Francis Ireland - August 2022

Francis Ireland - August 2022

Why investors are turning to Forestry in difficult times

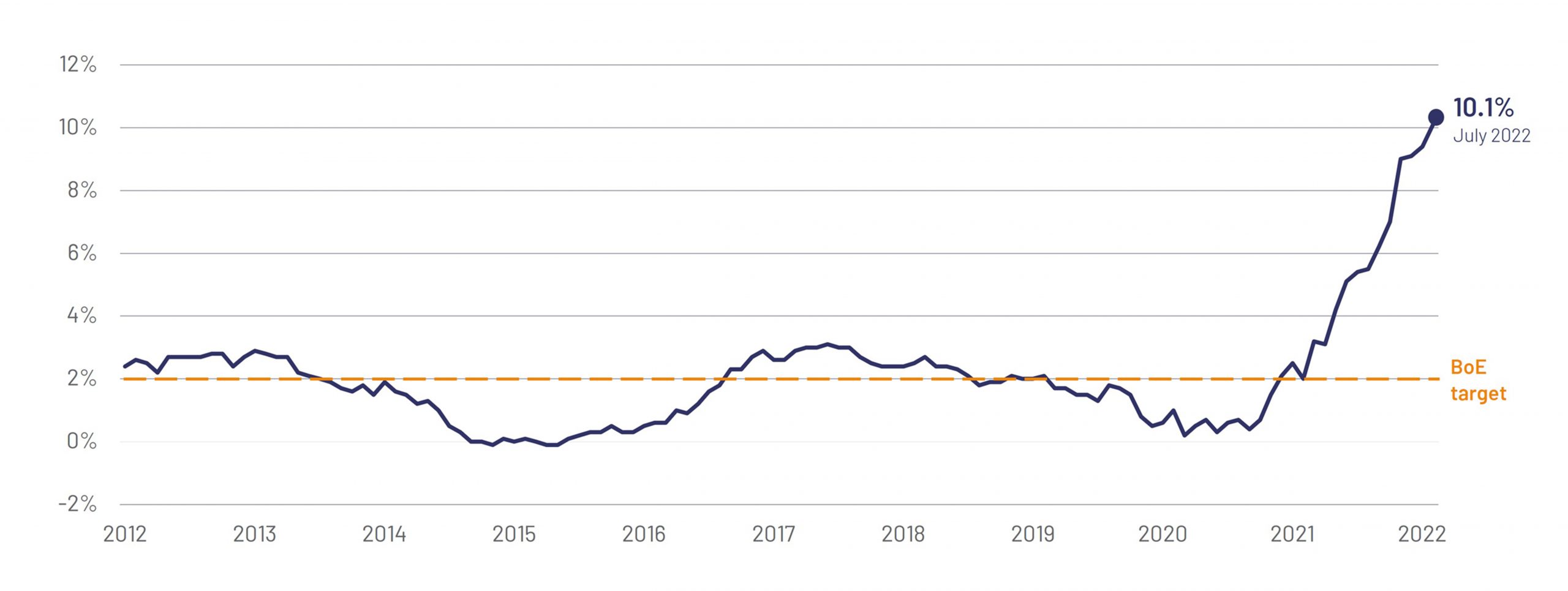

Inflation was long considered yesterday’s problem.

Double digit price growth in the UK last occurred more than 40 years ago, when Thatcher was in Downing Street, the Brixton riots took place and The Specials were in the top ten.

This morning saw the Office for National Statistics announce inflation had edged to 10.1% for the preceding 12 months.

Rising food and energy prices stemming from the Russian invasion of Ukraine have been the protagonists in a story of increasing price levels across the world.

Inflation over the last ten years

Source: ONS, July 2022

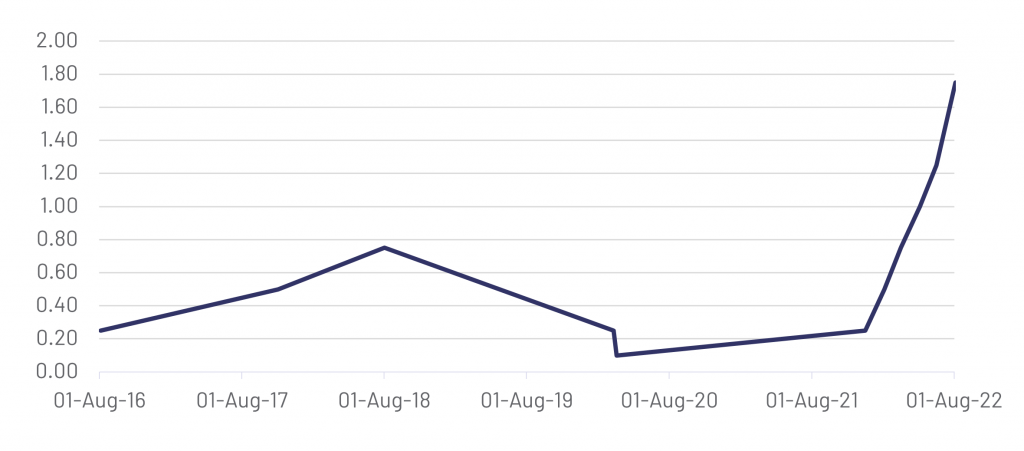

Central banks have responded by using the main tool at their disposal: hiking interest rates to the highest levels in a decade.

With debt more expensive and the supply of money tightening, growth prospects around the world look bleak.

Many will remember the period of stagflation in the 1970s, characterised by rising prices and low growth.

Public markets have responded to this economic outlook, with the FTSE 250 having fallen 18% at the time of writing for the year to date.

UK interest rate

Source: Bank of England data, August 2022

Despite consensus on the UK’s dim growth prospects over the next few years, views on the winners and losers are more disparate.

The preceding decade-long bull run saw capital moving away from fixed income into equity markets, based on an investment strategy predicated on capital growth.

What we are seeing now is a reversal of this trend, with investors looking to batten down the hatches.

Forestry as an asset class has provided a haven for investors in times of macroeconomic downturns, underpinned by the biological growth of trees, low correlation to mainstream asset classes, and timber acting as a strong inflation hedge.

The sector provides resilience to an investor landscape increasingly demanding protection against rising price levels and low growth.

Flexibility is crucial to the resilience of the sector.

Sitka Spruce, the most popular commercial conifer in the UK, has a harvesting window of 15 years.

This is significantly longer than the average business cycle length of seven years, permitting forest owners to time the harvest to capture opportune market conditions to maximise potential returns.

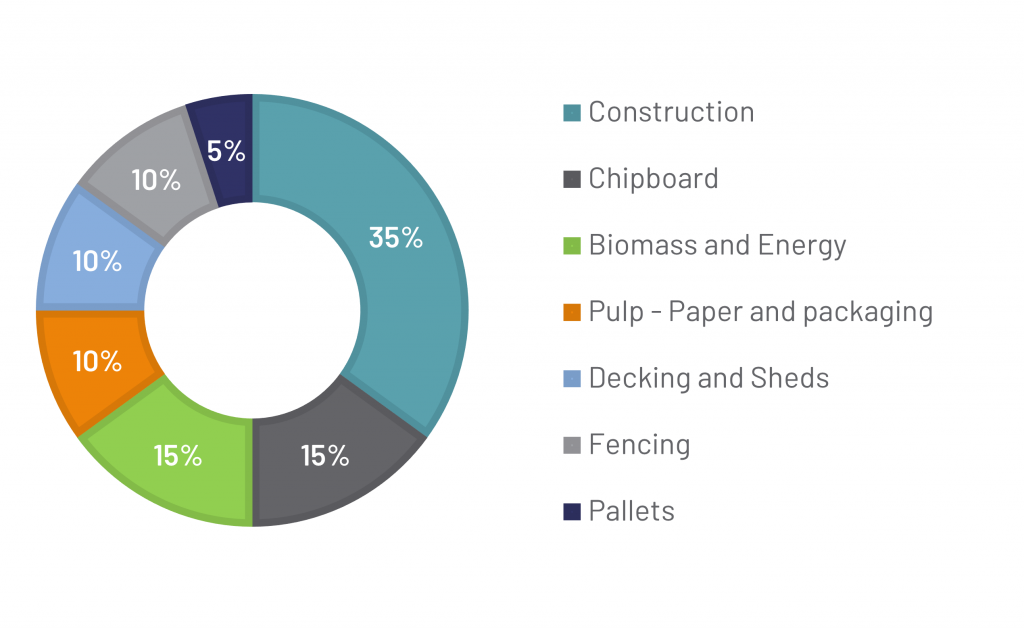

35% of UK timber is used in construction, a sector that has faltered in bear markets.

Rather than harvest and sell timber into a cold market, foresters can leave the crop on stump to grow volume while the timber markets recover.

The ability to navigate the business cycle through harvest timing lends a unique return profile to forestry as an asset class.

Timber uses in the UK. Source: Gresham House Global Timber Outlook, 2020.

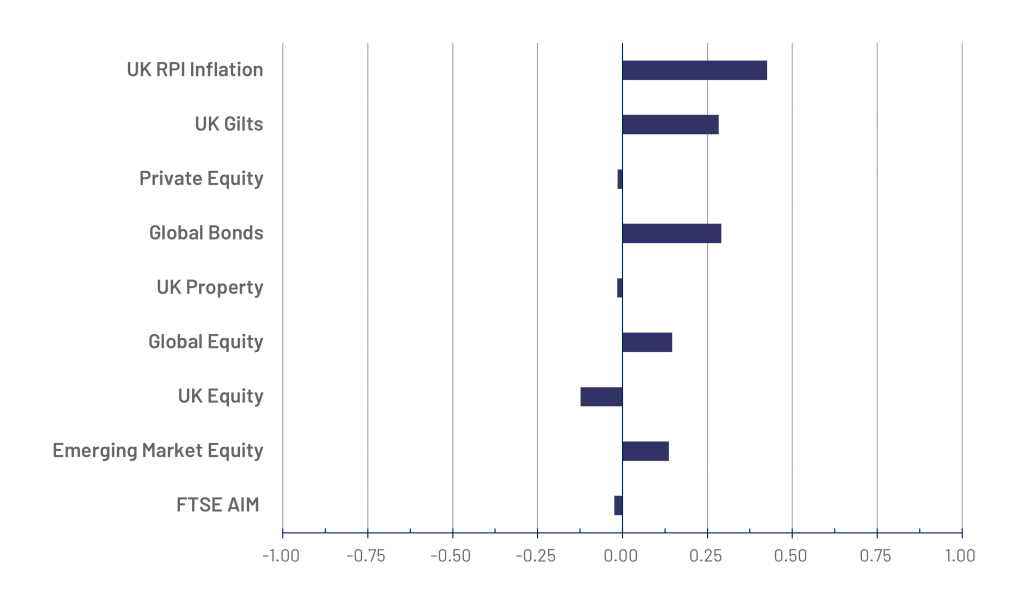

A return profile with low correlation to traditional asset classes

15-year UK forestry returns correlation coefficient

Source: Gresham House, May 2022

A key tenet of institutional portfolio construction lies in mitigating risk without compromising returns.

Allocation to a sector with little relationship to mainstream asset classes diversifies risk, reducing institutional exposure to the volatility surrounding financial markets.

Whilst inflation continues to rise, it is important to recognise that historically forestry has acted as an inflation hedge.

Forestry returns in the UK are correlated to inflation, where the asset class offers protection against rising price levels.

Outlined in our last article on the subject, the end use of timber is varied, with construction, food and battery energy storage all potential destinations for UK timber, amongst a multitude of others.

Given the CPI basket contains a number of timber-based products, the timber price naturally rises during periods of high inflation.

As investors scramble to protect themselves from a weak economic outlook coupled with inflationary pressure, forestry offers a tangible solution.

With its strong inflation correlation, low correlation to mainstream asset classes and the ability to navigate business cycles through the biological growth of trees, forestry is a compelling opportunity for investors as a refuge in uncertain times.

Francis Ireland

Francis Ireland is an Analyst within Gresham House’s Forestry investment team, having joined in February 2021. He regularly writes on the topic of forestry investment and markets, and holds a first-class degree in International Business, Finance & Economics and a Master’s in Finance from the University of Manchester.

Important information

Opinions expressed within this article are the author’s own and not necessarily those of Gresham House. This does not, and should not be construed to, constitute investment advice. Past performance is not a reliable indicator of future performance. Your capital is at risk.

Forestry investment is not for everyone. Please read more about the investment class and read up on the risks involved before considering investing.

Gresham House

Specialist asset management

Gresham House

Specialist asset management