Private Equity and VCTs

Our Private Equity strategy offers investors access to fast growing, early-stage and lower mid-market private companies.

Our Private Equity strategy offers investors access to fast growing, early-stage and lower mid-market private companies.

Our team has backed high-growth businesses for more than a 20 years and has invested in more than 100 companies.

Through these investments we have built an extensive entrepreneurial network and sector expertise to support our portfolio companies as they deliver their growth plans.

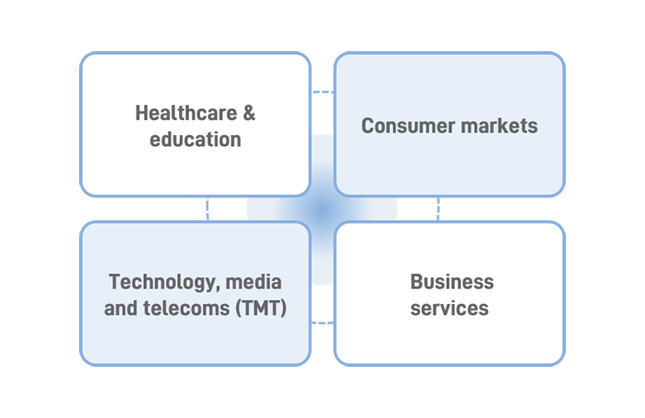

We are focused on scaling software and digitally-driven businesses in the healthcare, consumer and services sectors, aiming to deliver sustainable structural growth for our companies, alongside the potential for robust returns for investors.

Our key sectors

We have a consistent, repeatable approach for accelerating growth and realising shareholder value in the businesses we invest in.

We aim to invest in ambitious businesses who want to partner with an engaged and professional investor, who can provide capital and a range of specialist skills to support delivery of their growth plans.

Our VCT funds

Baronsmead Venture Trust plc

The Baronsmead VCTs invest in and support the UK & Ireland’s best and most innovative growth businesses.

Baronsmead Second Venture Trust plc

The Baronsmead funds invest in listed and unlisted UK & Ireland businesses with the potential to grow.

Gresham House Income & Growth VCT plc

Gresham House Income & Growth VCT plc invests in a diversified portfolio of unquoted UK companies, looking to drive growth.

Gresham House Income & Growth 2 VCT plc

Gresham House Income & Growth 2 VCT plc invests in a diversified portfolio of unquoted UK companies, looking to drive growth.

Seeking funding?

Gresham House Ventures

Our team works with exceptional entrepreneurs and has invested in high growth businesses for over twelve years, specialising in business models driven by tech, customer insight or service excellence.

What is Private Equity?

Private Equity is an alternative asset class that invests in, or acquires, private companies. Private equity invests in companies that have a high-growth prospects over the medium to long term.

At Gresham House our private equity investments are made via a range of venture capital trusts (VCTs) for which we are the investment manager or investment adviser.

Venture capital funds invest in companies at an early stage in their development. In contrast, private equity funds invest in more mature companies.

How Private Equity creates value?

Private equity businesses or investors buy companies or stakes in companies and then look to improve their value, at which point they will look to ‘exit’ or sell their stake either on the stockmarket to a corporate buyer or to another investor.

There are different ways that Private Equity seeks to create value. These are broadly through:

- Deal origination and transaction execution – this involves building and maintaining relationships with mergers and acquisitions (M&A) professionals including intermediaries and investment banks to find businesses looking for capital that are attractive investment opportunities. This is a competitive marketplace so an extensive network to highlight these opportunities and to ‘close deals’ is a major way of delivering value.

- Portfolio management – by actively engaging with and supporting the businesses they acquire, private equity investors can drive significant value. This can take many forms including providing strategic and financial planning, talent management and management incentives.

- Cost management – by managing the bottom-line as well as increasing the topline drives value. Cost management includes cost-cutting as well as selling non-core assets.

The are nine types of private equity funds:

- Venture Capital (VC)

Venture capital is a form of private equity and financing that deals with funding early-stage start-ups and new businesses. Venture capitalists invest in companies that they believe have high growth potential.

- Growth Equity

Companies raise capital through growth equity to boost expansion. Growth equity, also known as growth capital or expansion equity, works similarly to venture capital but it’s less speculative.

- Leveraged Buyout (LBO)

A leveraged buyout fund strategy combines investment funds with borrowed money.

It’s called leveraged buyout because the buying company leverages creditors’ and investors’ money to afford larger buyouts.

- Real Estate Private Equity (REPE)

Real estate private equity funds invest in properties using different strategies. Some funds are conservatively invested in low-risk rental properties offering stable, predictable income. Other funds invest in land or speculative development deals, which offer high return potential and greater risk.

- Infrastructure

Infrastructure private equity works similarly to real estate equity. The difference with infrastructure funds is that they invest in assets that provide essential utilities or services. This includes sectors like: utilities (e.g., gas, electricity, water), transportation (e.g., airports, roads, bridges, rail transit), social infrastructure (e.g., hospitals, schools), energy (e.g., power plants, pipelines), renewable energy (e.g., solar power plants, wind farms).

- Fund of Funds

A private equity fund of funds raises capital from investors but doesn’t invest in private companies or assets. Instead, it acts as an investor and buys into a portfolio of other private equity funds.

- Mezzanine Capital

The mezzanine floor of a building is halfway between one floor and another. Hence, this type of fund is aptly named because mezzanine capital is halfway between debt financing and raising equity capital. Companies typically use it to raise funds for specific projects.

- Distressed Private Equity

Distressed private equity funds, also known as special situations, specialise in lending to companies in financial crises. When the funds invest in companies, their purpose is to take control of the business during the bankruptcy or restructuring processes so they can buy the company at a lower purchase price. Then, they’ll work to turn the companies around and, eventually, sell them.

- Secondaries

Secondaries funds sometimes buy companies or assets and invest in other private equity funds portfolios, but that’s not the primary use. Instead, the secondary market exists to buy investments committed in a fund.

A typical private equity fund has an initial duration of 10 to 12 years. The first five years are called an investment period. The years after that are the harvesting period, during which investors can sell their investments.

If an investment hasn’t reached the harvesting period but an investor needs or wants to take their money out, the only way to do that is to sell through the secondary fund market.

Investment team

Trevor joined Gresham House in 2021 as part of the Mobeus VCTs acquisition. For over 25 years, he has invested in fast-growing businesses at the series A stage and beyond.

Prior roles include at Barclays, RBS, 3i and Beringea. Previous investments and Board positions include Paragon Software, Mondus.com, Cambridge Industries, Southnews plc, Achilles Group, MyOptique, Fjordnet, ILG Digital, Celebrus Technologies, Big Data Partnership, and Preservica.

Trevor holds an MBA from Exeter University, is an associate of the Chartered Institute of Bankers and a Member of the Chartered Institute of Marketing.

Rohit focusses on venture capital investments at late Seed / Series A stages and beyond with a specific focus on Fintech, SaaS, and AI-first technology companies. Previous investments include Adsum Technologies, Refyne Technologies, Honest Bank, WealthKernel, Penfold Pensions, and many others. He has a global network having worked / invested in the UK, EU, India, ME and SEA.

Before Gresham, Rohit was an Investment Partner at Digital Horizon VC and led their fintech investments globally, and before that spent 10+ years at Barclays Bank London in various roles including as the Lead for the Barclays VC unit. He has significant operational, commercial and leadership experience having worked with start-ups in Commercial roles and built and launched the wealth management and private banking mobile app for Barclays. He was a Management Consultant with EY and started his career as a Software Engineer with Infosys Technologies.

Rohit is passionate about diversity causes and has held various NED roles with start-ups and education institutions including being on the Global Alumni Board of Manchester Business School.

Rohit has an MBA (Director’s List and AT Kearney Scholar) from Manchester Business School, UK, and a B.Eng. (Honour’s) from Agra University, India.

Clive joined Gresham House in 2021 as part of the Mobeus VCTs acquisition. He is an investment management specialist with experience across a wide variety of sectors and stages of company development. He has worked in the private equity industry since 1995 making investments including TeleCity and Kerridge Commercial Systems. He has been working in the VCT industry since 2008 with previous experience including running his own business and as a Director of NVM Private Equity, Catapult Venture Managers and 3i plc.

Having specialised in portfolio management, Clive has acted as non-executive director and Chairman of a wide range of private equity backed businesses such as Virgin Wines, Entanet and Equip Outdoor Technologies. He now heads VCT portfolio management across the Gresham House VCT stable, sits on the Investment Committee and has responsibility for the portfolio valuations processes.

Clive holds a BSc (Hons) in Applied Physics & Electronics from Durham University, a DipM from the Chartered Institute of Marketing, and an MBA from the University of Warwick.

Greg joined the Mobeus VCT team in 2013. He sources and executes investments into fast-growing businesses and is our resident consumer expert. He combines a natural flair for understanding the drivers of brand value, insight into wider market dynamics and strong corporate finance experience. Previous investments and Board positions include Virgin Wines, MPB, Rotageek and Buster + Punch.

Greg joined Mobeus from Piper Private Equity and previously worked at PwC in Corporate Finance.

He holds a BA/ ACC in Business Studies & Accounting from the University of Edinburgh and is a Chartered Accountant (ICAS).

Graham works with our investment teams and portfolio companies providing the link between people strategy and investment strategy.

A Sport Science Graduate, majoring in psychology, he has 25 years’ experience leading HR & Talent functions and building high performing teams across a broad spectrum of organisations with diverse ownership structures.

These include HR leadership in a successful Private Equity backed SME, building pioneering approaches to Talent Management and Organisational Design, across over 150 transactions from within a leading Mid-Market Private Equity fund and an innovative executive search and advisory firm.

Graham latterly built his own consulting firm solely focussed on supporting investor backed, high growth SME’s with creative Talent Strategy.

With over 20 years in private equity, Hazel is an experienced investor and director, and has helped build numerous quality boards. Hazel qualified as a Chartered Accountant with Arthur Andersen before spending a few years in corporate finance with British Linen Bank advising public and private companies.

She joined 3i in 1993 and in 2000 opened a London private equity office for Bowman Capital, a $6bn hedge fund with $750m for private equity. She invested throughout Europe before gaining operational experience by heading up the UK for Cross Atlantic Capital Partners. Since 2000, Hazel has been sitting on boards for private equity and independently and since 2006, she has been formally helping companies build quality boards and management teams.

Hazel joined Gresham House in March 2019. She continues to help create and maintain quality teams and is a Non-Executive Director at Parsley Box, a food delivery firm.

Marieke joined Gresham House in February 2025 as Portfolio Director.

Marieke draws on over 15 years of industry experience. Prior to joining Gresham House Ventures, she was a senior investor and investment committee member at Forestay, a pan-European venture capital fund. She led a team focused on enterprise SaaS startups across the UK and Europe and served on the boards of four portfolio companies. Previously, she led the growth investment team at Octopus Ventures, serving on nine boards and managing new and follow-on investments as well as exits. She began her career in leveraged finance at NIBC (Frankfurt) and Credit Suisse (London).

Marieke has invested in and sat on the board of companies between £1m and £100m revenues and has deep experience supporting founders and management from first investment to exit.

She holds an MBA from Mannheim University. She is a mentor with Level20 and GAIN and serves as a Governor at West Wimbledon Primary School. Originally from Germany, she has lived in Spain and Mexico before moving to the UK in 2011.

Outside of work, Marieke enjoys time with her family, yoga, snowboarding and the theatre.

Tania joined Gresham House in November 2018 having been at Livingbridge for 13 years. She has worked on the Baronsmead VCTs since she joined, progressing from administration assistant to Finance Manager in 2011 and qualifying as a Chartered Management Accountant in 2012 while at Livingbridge.

Tania previously worked at a Chartered Accountancy practice in New Zealand for eight years where she began her accounting training. She holds a BBS in Accounting from the Open Polytechnic of New Zealand.

James joined Gresham House in December 2019 and works as part of our growth equity division, Gresham House Ventures.

Prior to this he spent five years at PwC, latterly working in the financial due diligence team.

James is a Chartered Accountant and read Economics and Accounting at Edinburgh University.

Bob joined the original Mobeus VCTs team in 1998 and was one of the Partners who set up Mobeus when they completed a management buyout from the Matrix Group in 2012. Bob is focused on new deal generation but also looks after a number of portfolio companies, specialising in construction, food manufacturing and sports.

Bob was previously at HSBC where he was Head of HSBC Ventures and prior to that spent time at County Bank.

He holds a BA (Hons) in Business Studies from London Guildhall University.

Francis joined Gresham House in the Forestry division in February 2021 and moved to the Private Equity team in January 2024.

Francis obtained a 1st class degree from the University of Manchester reading International Business, Finance & Economics. Following this he completed a Master’s in Finance, also at the University of Manchester, for which he was awarded a Distinction and the Alliance Manchester Business School Academic Scholarship.

Joe joined the Mobeus VCT team in 2021. He originates and leads growth capital investments in technology-led businesses. Joe has over 20 years’ experience helping to build, transform, and grow companies across North America and Europe. He is passionate about partnering with ambitious entrepreneurs to scale their businesses and deepen their impact, focusing on software, data & analytics, tech-enabled services, and online market places.

Joe joined Mobeus from Frog Capital, where he was a Partner, and previously held roles at Jefferies, 3i and EY. He was named one of the Financial News 40-Under-40 Rising Stars in Private Equity in 2015

He holds a BSc and MSc in Industrial Engineering from the University of Wisconsin – Madison and an MBA from London Business School.

Matt joined the Mobeus VCT team in 2019 as a Venture Partner working across their VCT investments. He has over 20 years’ experience in early stage and scale-up technology investing.

Previous roles include Corporate Finance at EY, a Partner in 3i’s technology investment business, and Chief Investment Officer roles at the National Endowment for Science Technology and the Arts (NESTA) and Mercia Technologies plc.

Zixin joined the Gresham House Ventures team in August 2022.

Prior to this, she spent over 8 years in the Energy industry, working at Royal Dutch Shell. At Shell, Zixin worked across various business lines including Trading, Retail, Renewable Energy Solutions and Shell Ventures.

During her time as a Senior Investment Associate with Shell Ventures, she focused on early-stage equity investments into fast growing start-ups in the Future of Mobility and CleanTech, across Europe, China and India.

Zixin is a qualified CIMA management accountant and holds a Master’s degree in Financial Engineering and Risk Management.

Hamza joined Gresham House as an Investment Manager within our Private Equity team in February 2023.

He has over three years of experience investing within the European and US venture ecosystem. Initially, as an Investment Associate at Columbia Lake Partners, a European growth capital fund focused on technology investments. He then worked within the venture capital arm of NJF Capital, a family office focused on early and growth stage investing across Europe and the US.

Hamza started his career in assurance at EY, where he completed his Chartered Accountancy (ACA) qualification.

He holds a BSc in Accounting and Finance from the University of Bristol.

Maria joined Gresham House as an Origination Analyst within our Private Equity team in November 2024, following a 3-month internship.

Prior to joining Gresham House, Maria interned at a mid-market UK private equity firm, where she was responsible for collating sector data and liaising with portfolio companies to generate performance reports.

Maria graduated from the University of Manchester with a BSc (Hons) degree in Biomedical Sciences and is currently pursuing a Masters degree in Finance and Big Data Analytics from Swansea University.

Joe joined Gresham House as an Investment Manager within our Private Equity team in September 2024.

Prior to joining, Joe spent 3 and a half years working at Clearwater Corporate Finance as an M&A advisor. He was primarily focused on raising first-round institutional investment for high-growth businesses based in the UK. He also hold a BSc in Mathematics and Economics.

Maya joined Gresham House in September 2019, having spent 4 years at Octopus Investments, investing in real estate-backed healthcare companies and entrepreneurs.

Prior to that she worked at KPMG for 7 years in audit and corporate finance.

She has a first class degree in Modern History from Oxford and is a Chartered Accountant.

Ed brings nearly 20 years’ experience of helping SMEs to create and realise shareholder value to his role. He has been working with Mobeus VCT management teams since 2017 to help them achieve their ambitions for growth and has overseen several notable exits in that time, including Automated Systems Group, Access-IS and Auction Technology Group. He also led the successful IPO of Virgin Wines in 2021.

Ed represents the Mobeus VCTs directly on the Board of several businesses, including Virgin Wines, RotaGeek and Vivacity Labs. His previous roles include CIO at Catapult Ventures in Assurance and Business Recovery Services at PwC. Ed was named one of Real Deals’ Future 40 Investment Leaders in April 2021.

He holds a BA (Hons) in Ancient History from the University of Nottingham and is a Chartered Accountant (ICAEW).

Jack joined the Private Equity team as an Investment Manager in November 2024.

Prior to joining, Jack spent 4 years investing in buyout and growth opportunities, primarily within the healthcare and energy sectors.

Before this, he worked at Baringa Partners as a management consultant where he supported private equity clients on strategy and due diligence projects.

Jack holds a first-class degree in Natural Sciences from UCL.

Ken is Managing Director, Public Equity, and leads the investment team managing public equity investments.

He is lead manager for LF Gresham House UK Micro Cap Fund, LF Gresham House UK Multi Cap Income Fund, Strategic Equity Capital plc and manages AIM listed portfolios on behalf of the Baronsmead VCTs.

Ken graduated from Brasenose College, Oxford, before qualifying as a Chartered Accountant with KPMG. He was an equity research analyst with Commerzbank and then Evolution Securities prior to spending the past 12 years as a Fund Manager at Livingbridge and now Gresham House specialising in smaller companies.

Investment Partner, Private Equity since April 2025

Alex focuses on originating and executing new investments in high growth technology businesses. He brings to the team over 14 years’ experience in growth equity, private equity and corporate finance across the European and Canadian markets. Prior to joining Gresham House, Alex was a General Partner at PROPELR Growth, a Toronto-based growth equity fund where he served on the boards of several privately traded as well as listed Canadian businesses including Field Effect Software and Tribe Property Technologies.

Previously, Alex was an Executive Director at Goldman Sachs in the Principal Investment Area, the private equity investing arm of GSAM, based in London, UK. He has also held private equity and corporate finance roles at Ontario Teachers’ Pension Plan and RBC Capital Markets.

Alex holds an MBA from INSEAD and an HBA from the Richard Ivey School of Business at the University of Western Ontario. In his free time he is an avid violinist, bass guitarist and ice hockey player.

Distribution team

Jamie joined Gresham House in October 2022 as a Client Services Associate within our Institutional Distribution team.

He previously spent five years at Cazenove, the wealth management arm of Schroders as a Client Services Executive within their Charities team. Prior to that, Jamie worked within the UK Retail Sales team at Schroders.

Jamie holds the CFA Institute Investment Foundations Certificate and Unit 1 of the IMC.

Keisha-Ann joined Gresham House in November 2020 as part of the Institutional Sales team and is responsible for institutional business development and consultant relations, fundraising across Gresham House’s Real Assets strategies.

Prior to Gresham House, she spent five years at quantitative investment manager, Winton, where she was responsible for investor relations coverage of investment consultants and Winton’s global institutional and wholesale clients including pension funds, sovereign wealth funds, investment banks, family offices and endowments.

Keisha-Ann holds a BA (Hons) in Geography from the University of Leeds.

Heather is Managing Director, Institutional Business and a member of the GHAM Board.

Prior to joining Gresham House, Heather spent seven years at Fidelity International, latterly as Head of Institutional Distribution for UK & Ireland. She also previously held business development and client relationship positions at BankInvest, Capital International and Gartmore where she focussed on U.K & Ireland and Nordic institutional investors.

Heather has over 25 years of financial experience and holds a BA (Hons) in Politics from Durham University and the Investment Management Certificate from the CFA Society of the UK.

Claire joined Gresham House in August 2023 as Head of Business Development in the UK and Irish Institutional market.

Prior to Gresham House, Claire worked at Schroders for ten years and held positions as Head of Sustainability UK and Co-Head of the UK Institutional Business.

Claire started her career at M&G Investments, before moving to Baring Asset Management where she spent 11 years with the last six years in a UK Institutional Business Development role.

Claire is IMC qualified and has obtained the CFA ESG certificate.

Ben is Head of Institutional Business, and joined Gresham House in May 2024.

Prior to joining the firm Ben was the EMEA Commercial Officer at Cambridge Associates, where he was responsible for Business Development & Marketing focussing on Institutional investors, Endowment & Foundations and Family Offices. Before, joining Cambridge Associates, Ben spent 18 years at Mercer Investments in several leadership roles including European Head of Mercer Sentinel and the UK Head of Fiduciary Management. In his previous roles Ben has been responsible for developing propositions across Europe, Asia and the Middle East, including spending time as the Head of Mercer’s Middle East business based in Dubai.

Ben holds a MSc in Accounting and Finance from DeMonfort University and a BSc (Econ) in Accounting and Financial Management from the University of Buckingham. He is also a qualified Actuary, has passed the Investment Management Certificate and has over 20 years-experience in the financial industry.

Harry joined Gresham House in December 2023 as an Analyst in the Institutional Sales team.

Prior to this he completed a 3-month internship with the team.

He holds a First Class BA (Hons) in Geography from Durham University having graduated in 2022.

Susanna joined Gresham House in January 2025 as part of the Institutional Sales team.

Prior to joining Gresham House, she spent close to 6 years at Aksia, a specialist research and portfolio advisory firm providing alternative investment solutions to institutional investors, where she held roles in the client advisory and RFP teams.

She holds a First Class MA (Hons) in Spanish and English Literature from the University of Edinburgh.

Liz joined Gresham House from Legal & General Investment Management, where she was an Investment Reporting Analyst working with Institutional clients.

Prior to Legal & General, Liz held roles as a Client Service Analyst at Wellington Management, covering the Global Wealth channel in Europe and Asia, and as an Investor Relations Specialist at NewSmith Asset Management.

Liz holds the Investment Management Certificate and has a BA in French & Spanish from University College London.

Jenny joined Gresham House in January 2025 as an Analyst in the Institutional Sales team.

Prior to joining, Jenny spent a year at Allianz Global Investors and was part of the private infrastructure debt investing team. She also completed an internship at Goldman Sachs Asset Management in 2022.

She holds a BSc (Hons) degree in Economics from The University of Warwick having graduated in 2023.

Distribution team

Anthony’s background is in investment banking, having previously worked for international firms in London, New York and South America, including Macquarie and Merrill Lynch. At Gresham House, he is responsible for business development, marketing and sales for our forestry and energy transition assets, also managing one of the funds.

Anthony has a BA (Hons) in History from Newcastle University and is an Investment Management Certificate holder. He is also a registered adviser with the Financial Conduct Authority.

Distribution team

Chris is a Managing Director in the Wholesale Distribution team and joined Gresham House in July 2021.

Prior to this he was Head of Strategic Partnerships at LGBR Capital where he focused on developing key strategic relationships in the UK discretionary market. He was one of the founding members of LGBR Capital, helping to grow the business from launch in 2012 into one of the largest outsourced distributors in the UK.

Chris previously held business development and client relationship positions at Matrix Asset Management and Goldman Sachs.

Chris has 14 years’ industry experience and holds a BSc (Hons) in Economics from Queen Mary, University of London. He is a CAIA Charterholder and has passed both the Certificate in ESG Investing and the Investment Management Certificate from the CFA Society of the UK.

Andy has over 20 years’ industry experience and joined Gresham House in October 2019 after spending two years at BNP Paribas. Prior to this he spent six years as investment sales director at BNY Mellon, focusing on family offices and the London discretionary market.

He has also worked in the business development team at Skandia Investment Management, helping launch the Spectrum range of funds. He holds a BA (Hons) in Economics, the CFA Certificate in Investment Management, the CFA Certificate in ESG Investing, the CII Certificate In Discretionary Investment Management, the CII Certificate in Investment Operations and the CII Diploma in Financial Planning.

Rees joined the Wholesale Distribution team in July 2022.

Prior to joining Gresham House, Rees worked within the UK Investor Relations team at Comgest Asset Management and within the Asset Management team at Willis Towers Watson.

Rees is currently studying for his Investment Management Certificate.

Where are you based?

-

UK

-

IE

-

AUS

-

ROW

-

DE

Which of these best describes you?

-

Institutional investor or investment consultant

-

Financial adviser

-

Family office

-

Individual investor

-

Seeking funding

-

Selling assets

-

Charity or religious order

-

Real estate owner or developer

-

Seeking funding or selling assets

-

Familienbüro

-

Finanzberater

-

Institutionelle

Disclaimer

Location:

Size:

Type:

Your choice regarding cookies on this site

This website uses cookies to help us provide the best experience for you. Please select 'Allow all' to consent to the use of cookies on your device or select 'Manage cookies' for more options. You can find out more in our online privacy and cookie policy.

We use cookies on our site

Gresham House asks you to consent to the use of cookies, to store and access basic, first-party data about your website usage. Some of these cookies are essential to our site working properly and others help us improve the site by providing insight into how the site is being used. To allow us to provide the best website experience, we recommend that you accept the use of all cookies. Please note that some data processing may not require your consent but you have the right to object to such processing. Please read our online privacy and cookie policy which is available on our website.

Strictly necessary

Data collected in this category is essential to provide our services to you. The data is necessary for the website to operate and to maintain your security and privacy while using the website. These cookies are always on as they are critical to the website functioning correctly. This data is not used for marketing purposes or the purposes covered by the two categories below.

Performance

Data collected in this category is used to inform us about how the website is used, to improve functionality on our website and to help us to identify issues you may have when accessing our website. This data is not used to target you with advertising.

Targeting

Data collected in this category is used to help make our messages more relevant to you. The data may be shared with our media partners and platforms we may use to deliver personalised advertisements and messages.

Gresham House

Specialist asset management

Gresham House

Specialist asset management