The European Union’s Sustainable Finance Disclosure Regulation (SFDR) has come into force requiring, amongst other things, asset managers to make certain sustainability-related disclosures on their websites with respect to in-scope products.

Gresham House Asset Management Limited

Below are links to the website disclosures of all in-scope products under the management of Gresham House Asset Management Limited. Note that the website disclosures of one in-scope product will differ from those of another in-scope product.

Publication date: 23 December 2022

No consideration of adverse impacts of investment decisions on sustainability factors

Adverse impacts of investment decisions on sustainability factors are not considered by Gresham House (the Manager) and the Manager does not intend to consider adverse impacts for its investment strategies as it is not required to do so under the SFDR Article 4.

At product level, the Portfolio Manager has elected to exercise its discretion under Article 4(1)(b) of SFDR not to commit to considering the adverse impacts of investment decisions of the financial products on sustainability factors in the manner specifically contemplated by Article 4(1)(a) of the SFDR but will continue to consider and manage these impacts in line with its Sustainable Investment Policy.

Important notice

The website disclosures (the “Disclosures”) are being made pursuant to Articles 4(1) and 10(1) of Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector (as amended) (“SFDR”) in respect of the Irish Strategic Forestry Fund (the “Partnership”).

The Disclosures do not constitute (a) an offer of securities or interests, (b) an offer or invitation to the public, or (c) an invitation to apply for securities or interests. The Disclosures are being made to enable Gresham House Asset Management Limited, in its capacity as portfolio manager of the Partnership (the “Portfolio Manager”) to comply with its obligations under applicable law.

Sustainability-related disclosures

Publication date: 23 December 2022

Summary

The Partnership invests in a diversified portfolio of forestry assets which includes bare land for productive woodland creation, mid-rotation forestry and mature forestry plantations.

All planting land and existing forests acquired by the Partnership will be managed by Coillte and will either be: (i) land and/or forests that is/are certified under the FSC® (Forest Stewardship Council®) or PEFC® (Programme for the Endorsement of Forest Certification®) and will continue to be independently certified as 100% sustainable pursuant to the relevant certification during the period that the Partnership owns it/them; or (ii) newly acquired land and/or forests which is/are not yet certified under the FSC® or PEFC® but which will be managed with a view to ensuring that they will achieve such certification within a reasonable timeframe of being purchased by the Partnership.

This financial product promotes environmental or social characteristics but does not have as its objective a sustainable investment.

At least 97% of the Partnership’s NAV (including, for the avoidance of doubt, such development capital allocated to land and forestry investment as may temporarily be held from time to time) is aligned with the environmental and/or social characteristics of the Partnership.

The Partnership does not commit to making sustainable investments within the meaning of SFDR.

The sustainability indicators used to measure the attainment of the environmental or social characteristics promoted by the Partnership are:

(i) continued FSC® or PEFC® certification of planting land and/or existing forests which are already so-certified at the time of their acquisition by the Partnership; and

(ii) attainment of FSC® or PEFC® certification of such planting land and/or existing forests as are not at the time of being acquired by the Partnership so-certified, within a reasonable timeframe of being purchased by the Partnership.

Certification will be assessed by third party auditors on a regular basis as well as by the Portfolio Manager on an ad hoc basis. Both the FSC® and PEFC® have well-established and internationally recognised pre-defined criteria. The criteria and methodology can be found on the following websites:

- FSC® – fsc.org/en/fsc-standards

- PEFC® – pefc.ie

Data is collated by the Portfolio Manager from a variety of sources including woodland managers, third-party consultants, public databases. Data will be checked by various members of the Portfolio Manager’s Investment and Asset Management team.

A survey is sent to woodland managers annually for receipt of forest data include sustainability-related data. The data is dependent on the disclosure of accurate and relevant data and information by the woodland managers. The Portfolio Manager will work closely with woodland managers to monitor data received and to support in collation and measurement of required data.

Given the scale of forests under management as well as challenges in measuring certain data relevant to the attainment of FSC® or PEFC® certification (for example in relation to biodiversity and carbon sequestration), assumptions are made to ensure that data collation and measurement is done in a way that is appropriate to the Partnership’s mandate and objectives. All data is calculated using science-based and reputed approaches however these often apply estimates and assumptions to account for the scale of the forests in which the Partnership is invested.

In addition to internal audits and independent audits by relevant certification bodies, the Portfolio Manager has a dedicated Sustainable Investment Team that will also carry out annual auditing of ESG processes to ensure they meet the sustainability-related commitments of the Partnership.

The Partnership will engage with relevant stakeholders (including suppliers and local communities) as necessary, in order to ensure that FSC® or PEFC® certification of planting land and/or existing forests invested in by the Partnership is achieved and/or retained. The Portfolio Manager may also engage with relevant regulatory, industry or government entities with regard to certain aspects of sustainable forest management.

No sustainable investment objective

This financial product promotes environmental or social characteristics but does not have as its objective sustainable investment.

Environmental or social characteristics of the financial product

All planting land and existing forests acquired by the Partnership will be managed by Coillte and will either be:

(i) land and/or forests that is/are certified under the FSC® (Forest Stewardship Council®) or PEFC® (Programme for the Endorsement of Forest Certification®) and will continue to be independently certified as 100% sustainable pursuant to the relevant certification during the period that the Partnership owns it/them; or

(ii) newly acquired land and/or forests which is/are not yet certified under the FSC® or PEFC® but which will be managed with a view to ensuring that they will achieve such certification within a reasonable timeframe of being purchased by the Partnership.

Investment strategy

The Partnership invests in a diversified portfolio of forestry assets which includes bare land for productive woodland creation, mid-rotation forestry and mature forestry plantations.

All forests acquired or created will ultimately be certified and managed to international forestry management standards (FSC® or PEFC®) to ensure that the forests are managed in accordance with strict standards (incorporating prescribed social, economic and environmental criteria). All assets acquired by the Partnership require investment committee (“IC”) approval prior to acquisition.

An ESG report is provided to the IC for approval ahead of all investments. Once assets are acquired, they move into the asset management stage. At this point, assets will be managed to mitigate ESG-related risks and to meet (or continue to meet) the standards required in order to obtain (or retain) FSC® or PEFC® certification.

All forestry assets will be assessed at pre-investment stage and managed in line with the Charter unless any legal, regulatory, or natural obstacles outside the control of the Portfolio Manager prevent this.

The Charter sets out the Portfolio Manager’s commitments and targets in relation to sustainable forest management, based on international forestry standards, and the key performance indicators against which performance can be measured.

The Charter includes commitments and targets relating to the following categories. All commitments are at least aligned with forest certification standards:

- Forest Products & Services

- Climate Change

- Biodiversity & Woodland Ecology

- Forest Protection

- Income & Employment

- Communities & People

- Forest Certification and Standards

The Charter also reflects the Portfolio Manager’s commitment to apply the International Finance Corporation (IFC) exclusion policy as relevant to forestry assets(see ifc.org/exclusionlist) (the “Exclusion Policy“) to all forestry investments of the Partnership. This means that the Partnership will not be invested in:

- production or activities involving harmful or exploitative forms of forced labour/harmful child labour;

- commercial logging operations for use in primary tropical moist forest;

- production or trade in wood or other forestry products other than from sustainably managed forests; or

- production or activities that impinge on the lands owned, or claimed under adjudication, by Indigenous Peoples (as defined by the IFC for the purposes of its exclusion policy), without full documented consent of such people.

These exclusions are explicitly built into the Portfolio Manager’s proprietary ESG Decision Tool and require the Portfolio Manager to ensure that no new acquisition is in breach of the exclusions at due diligence stage.

All investments are screened using the Portfolio Manager’s Forestry ESG Decision Tool to ensure that ESG risks and opportunities are considered and the Exclusion Policy is applied, as part of sourcing, due diligence, acquisition, and ongoing management of assets. The ESG Decision Tool and KPIs set out in the Charter, as developed by the Portfolio Manager, will assist it to identify potential sustainability risks and opportunities pertaining to investments in a consistent manner, in line with the Portfolio Manager’s sustainability-related commitments. Further details relating to the ESG Decision Tool can be found in the section of the Information Memorandum entitled The Portfolio Manager’s ESG Decision Tool.

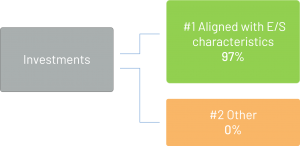

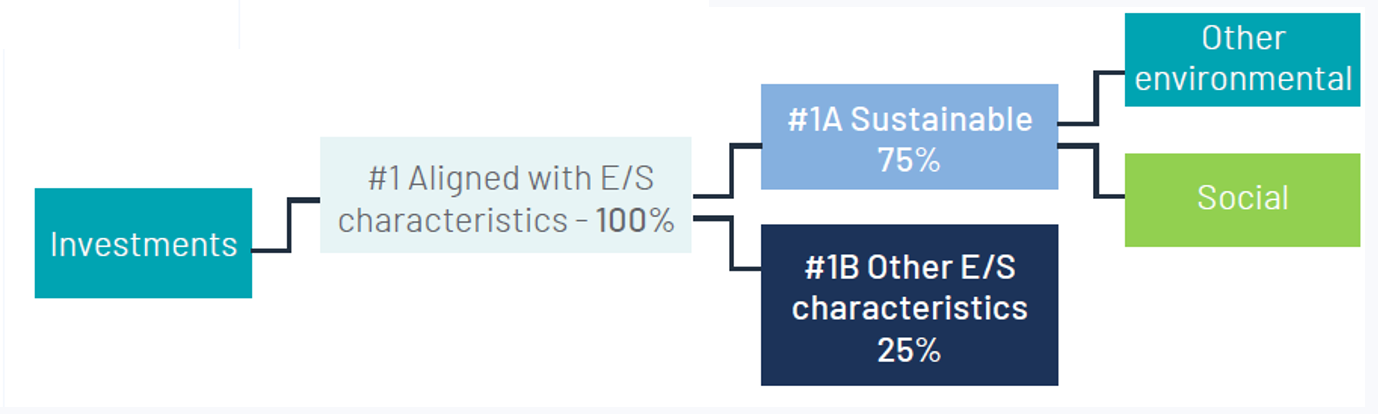

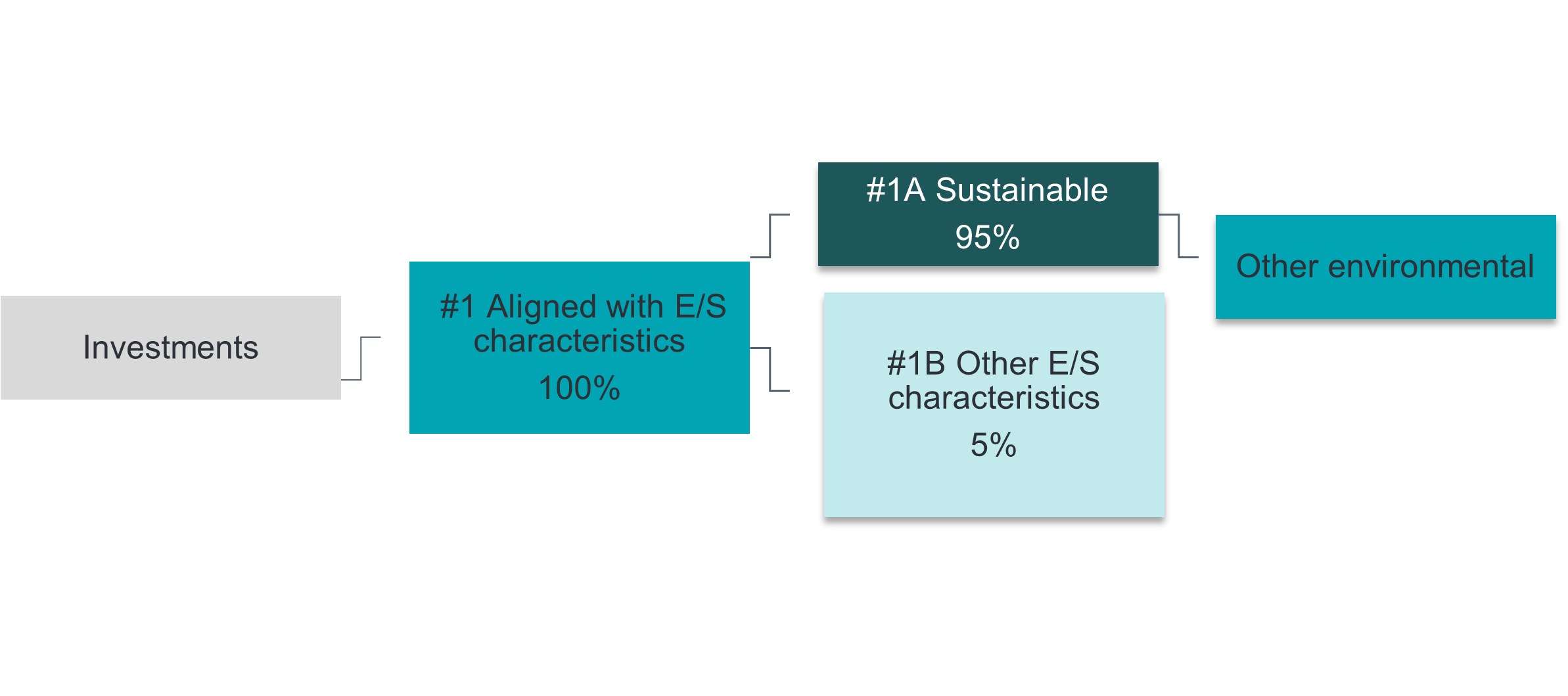

Proportion of investments

At least 97% of the Partnership’s NAV (including, for the avoidance of doubt, such development capital allocated to land and forestry investment as may temporarily be held from time to time) is aligned with the environmental and/or social characteristics of the Partnership. The Partnership does not commit to making sustainable investments within the meaning of SFDR.

Investments in the “#2 Other” category include investments and other instruments of the Partnership that cannot be aligned with the environmental and/or social characteristics of the Partnership. These can include, for example, portfolio management tools such as derivatives and cash (other than development capital allocated to land and forestry investment, as referred to above).

The Partnership does not make a minimum commitment to making investments that fall within the “#2 Other” category and therefore 0% is included for that category in the graphic below. This means that between 0% and 3% of the Partnership’s NAV might at any point in time qualify as “#2 Other” investments.

#1 Aligned with E/S characteristics includes the investments of the financial product used to attain the environmental or social characteristics promoted by the financial product.

#2 Other includes the remaining investments of the financial product which are neither aligned with the environmental or social characteristics, nor are qualified as sustainable investments.

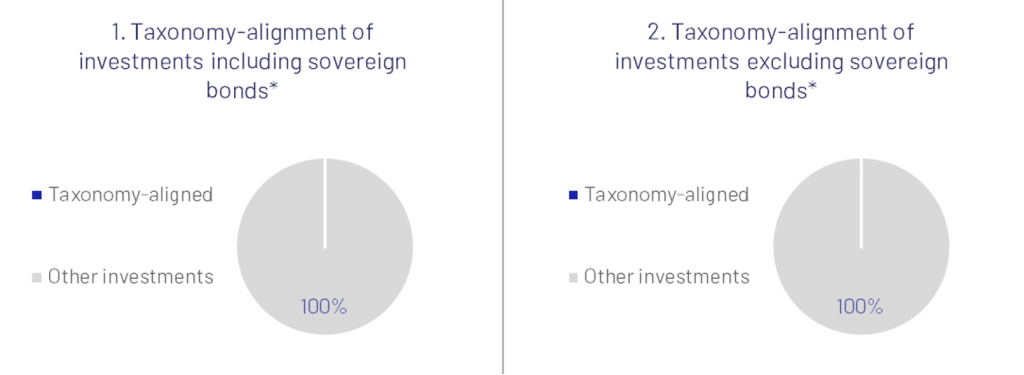

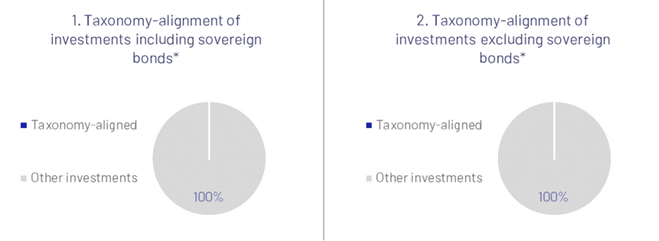

The two graphs below show the minimum percentage of investments that are aligned with the EU Taxonomy. As there is no appropriate methodology to determine the Taxonomy-alignment of sovereign bonds*, the first graph shows the Taxonomy alignment in relation to all the investments of the financial product including sovereign bonds, while the second graph shows the Taxonomy alignment only in relation to the investments of the financial product other than sovereign bonds.

*For the purpose of these graphs, ‘sovereign bonds’ consist of all sovereign exposures.

Monitoring of environmental or social characteristics

The sustainability indicators used to measure the attainment of the environmental or social characteristics promoted by the Partnership are:

- continued FSC® or PEFC® certification of planting land and/or existing forests which are already so-certified at the time of their acquisition by the Partnership; and

- attainment of FSC® or PEFC® certification of such planting land and/or existing forests as are not at the time of being acquired by the Partnership so-certified, within a reasonable timeframe of being purchased by the Partnership.

The certification status of said land and forests will be assessed by third party auditors on a regular basis as well as by the Portfolio Manager on an ad hoc basis.

Methodologies for environmental or social characteristics

Both the FSC® and PEFC® have well-established and internationally recognised pre-defined criteria which must be met in order to obtain FSC® or PEFC® certification. The relevant criteria and methodology can be found on the following websites:

- FSC® – fsc.org/en/fsc-standards

- PEFC® – pefc.ie

Data sources and processing

Data is collated by the Portfolio Manager from a variety of sources including woodland managers, third-party consultants, public databases in order to assess whether land and forests are being managed in line with FSC®/ PEFC® requirements. Data will be checked by various members of the Portfolio Manager’s Investment and Asset Management team.

A survey is sent to woodland managers annually for receipt of forest-related data including sustainability-related data. The data is dependent on the disclosure of accurate and relevant data and information by the woodland managers. The Portfolio Manager will work closely with woodland managers to monitor data received and to support in collation and measurement of required data.

Given the scale of forests under management as well as challenges in measuring certain data relevant to the attainment of FSC® or PEFC® certification (for example in relation to biodiversity and carbon sequestration), assumptions are made to ensure that data collation and measurement is done in a way that is appropriate to the Partnership’s mandate and objectives.

All data is calculated using science-based and reputed approaches however these often apply estimates (the proportion of which estimates will vary) and assumptions to account for the scale of the forests in which the Partnership is invested.

Limitations to methodologies and data

This section will be updated to include relevant limitations if and when these become apparent (on the basis of the understanding that this disclosure is required to include such limitations as relate to the scope of methodologies and data coverage, rather than limitations pertaining to the accuracy of data (which is addressed in the section immediately above).

Due diligence

All forests are inspected by the Portfolio Manager on a regular basis to ensure the requisite quality of woodland management. These internal audits will assess for adherence to the criteria relevant to achievement of the Partnership’s environmental and social characteristic, and associated forest management plans.

Forests will be independently audited by the relevant certification bodies (FSC® and/or PEFC®) to assess for compliance with their certification standards on a regular basis.

The Portfolio Manager also has a dedicated Sustainable Investment Team. This team will, inter alia, carry out annual auditing of the Portfolio Manager’s ESG-related due diligence processes to ensure they remain appropriate to attaining the environmental and social characteristic promoted by the Partnership.

The Portfolio Manager makes use of its proprietary ESG Tool to assist in evaluating the ESG impact of proposed investments as part of its due diligence process and to support the determination of the ESG KPIs as part of the initial investment process, which feeds into the ongoing monitoring of the Partnership’s incorporation of ESG considerations in its investment strategy. As part of this strategy, the Portfolio Manager conducts a detailed analysis of positive and negative factors affecting the investment, including any ESG event or condition that, if it occurs, could cause an actual or a potential material negative impact on the value of the investment (“ESG Risk”). The assessment of ESG Risks is conducted by the Portfolio Manager using data and information derived from a variety of sources and the Portfolio Manager’s own research, including the use of the ESG Tool.

Engagement policies

The Partnership (in line with the Charter) will engage with relevant stakeholders (including suppliers and local communities) as necessary, in order to ensure that FSC® or PEFC® certification of planting land and/or existing forests invested in by the Partnership is achieved and/or retained. The Portfolio Manager may also engage with relevant regulatory, industry or government entities with regard to certain aspects of sustainable forest management.

No consideration of adverse impacts of investment decisions on sustainability factors

The Manager has elected to exercise its discretion under Article 4(1)(b) of SFDR not to commit to considering the adverse impacts of investment decisions of the Company on sustainability factors in the manner specifically contemplated by Article 4(1)(a) of the SFDR but will continue to consider and manage these impacts in line with its Sustainable Investment Policy.

The manner in which sustainability risks are integrated into the investment decisions of Gresham House Asset Management Limited (the “Manager”) in relation to the Company

As detailed in the Energy Transition Sustainable Investment Policy, specific to the Manager’s investment division, the Manager integrates ESG (“sustainability”) risks and opportunities into the investment process.

The Manager integrates sustainability risks and opportunities through the completion of the ESG Decision Tool prior to investment. The Tool supports the identification of potential material ESG risks that need to be managed and mitigated during the investment period of the asset. The Tool also determines if there are any reasons why the asset may not be invested in at this stage for ESG reasons.

Post-investment, material sustainability risks identified through the ESG Decision Tool or as part of the division’s assessment of material sustainability risks to its assets, are monitored and managed on an ongoing basis. The Manager will also monitor ESG related data, where available, to support the ongoing management of sustainability risks for assets.

The likely impacts of sustainability risks on the returns of the Company

The Manager has determined that the sustainability risk (being the risk that the value of the Company could be materially negatively impacted by an environmental, social or governance event or condition) faced by the Company is low to medium.

The Manager has put in place processes and checks to minimise ESG-related risks associated with the manufacturing and sourcing of the components used in energy storage plants, as well as the construction and operation of these plants.

Sustainability-related disclosures

Publication date: 23 December 2022

Environmental and social characteristics

The Company is committed to investing in and increasing battery energy storage system (BESS) capacity to support the decarbonisation and electrification of energy systems. Battery energy storage systems (BESS) play an essential role in supporting the decarbonisation of energy systems and consequently the broader economy. The Company, in this way, aims to contribute positively to climate change mitigation and net zero strategies.

The Manager will assess adherence to the characteristic through measuring and monitoring:

- total operational battery energy storage capacity (megawatts (MW) and megawatt hours (MWh))

- total battery energy storage capacity under construction (megawatts (MW) and megawatt hours (MWh))

The Manager also intends to measure, monitor, and report on carbon emissions avoided (tCO2e) as a result of the operation of BESS and increase in BESS capacity. The Manager is in the process of finalising a robust methodology to estimate the carbon emissions avoided through the increased adoption of BESS in energy systems.

Summary

The Company is committed to investing in and increasing battery energy storage system (BESS) capacity to support the decarbonisation and electrification of energy systems. Battery energy storage systems (BESS) play an essential role in supporting the decarbonisation of energy systems and consequently the broader economy. The Company, in this way, aims to contribute positively to climate change mitigation and net zero policies.

The Company promotes environmental or social characteristics but does not have sustainable investment as its objective.

As detailed in the Gresham House Energy Transition Sustainable Investment Policy, the Manager integrates sustainability risks and opportunities into the pre-investment process for all assets through the completion of the ESG Decision Tool prior to investment. Post-investment, material sustainability risks identified through the ESG Decision Tool or as part of the division’s assessment of material sustainability risks are monitored and managed on an ongoing basis.

In line with the Company’s focus on supporting decarbonisation of the economy, the Manager will consider any climate-related risks and opportunities within the acquisition and construction phase and aim to mitigate or minimise risks.

At least 96% of the Company’s investments are aligned with the environmental and/or social characteristics of the Company. The Company does not commit to making sustainable investments as defined under the SFDR.

The Manager will measure and monitor the MWs and MWhs of operational BESS capacity and BESS capacity under construction on a regular basis. This is a central objective and outcome of the Company and remains core focus for the Manager.

MW and MWh operational and in-construction capacities are taken from the as built site diagrams and connection agreements, with in-construction assets driven from the site specifications as approved within the EPC agreement.

The parent entity of the Manager has a dedicated Sustainable Investment Team. This team provides support in relation to the evolution of processes around sustainable investing applied by the Manager. The Sustainable Investment Team carries out annual auditing of ESG processes to ensure they meet the sustainability-related commitments of the Manager. This includes an assessment of ESG metrics, ESG Decision Tools and investment processes.

As detailed in the Gresham House Energy Transition Sustainable Investment Policy, the Manager commits to engaging with relevant stakeholders as part of its ongoing investment and management of BESS assets. Engagement is focused to maximise the efficient operation of BESS that help balance the UK electricity grid, allowing it to make optimal use of intermittent renewable energy generation in the UK electricity generation system.

The fund does not designate a reference benchmark.

No sustainable investment objective

The Company promotes environmental or social characteristics but does not have sustainable investment as its objective.

Environmental or social characteristics promoted by the Company

The Company is committed to investing in and increasing battery energy storage system (BESS) capacity to support the decarbonisation and electrification of energy systems.

Battery energy storage systems (BESS) play an essential role in supporting the decarbonisation of energy systems and consequently the broader economy.

The Company, in this way, aims to contribute positively to climate change mitigation and net zero policies.

Investment strategy

The Company seeks to provide investors with an attractive and sustainable dividend over the long term by investing in a diversified portfolio of utility scale energy storage systems, which utilise batteries, located in Great Britain, and the Overseas Jurisdictions.

The Company aims to do this through the construction, development, acquisition, management, and operation of battery energy storage system (BESS). BESS assets are managed to provide several integral functions to energy systems that will enable the decarbonisation of the grid through increased renewable energy generation and generate varied revenue streams.

Functions include “Trading”, providing “Balancing Mechanisms” to the grid, and “Ancillary Services” (such as ” Frequency Response”, which maintains electrical stability by responding to deviation in frequency flowing through a network).

As detailed in the Gresham House Energy Transition Sustainable Investment Policy, the Manager integrates sustainability risks and opportunities into the pre-investment process for all assets through the completion of the ESG Decision Tool prior to investment. Post-investment, material sustainability risks identified through the ESG Decision Tool or as part of the division’s assessment of material sustainability risks are monitored and managed on an ongoing basis. In line with the Company’s focus on supporting decarbonisation of the economy, the Manager will consider any climate-related risks and opportunities within the acquisition and construction phase and aim to mitigate or minimise risks.

The Company invests in individual battery energy storage projects. All projects are companies that sit within special purpose vehicles invested in by the Company. Projects may either be operational or under construction at time of acquisition. Due diligence is carried out prior to acquisition for all projects. As noted above, this includes completion of the ESG Decision Tool to assess potential sustainability risks and opportunities. In addition, all projects will be assessed to ensure the project compliance to all relevant legal and regulatory requirements. The projects do not have management structures, employees, or tax policies in the way “investee companies”, as understood by the SFDR, might have.

Proportion of investments

At least 96% of the Company’s investments are aligned with the environmental and/or social characteristics of the Company. The Company does not commit to making sustainable investments as defined under the SFDR.

“Other” category investments include a legacy asset that uses mostly gas engine technology to provide power to the grid although does have a small amount of BESS (used as primary energy source before gas takes over) and a small amount Diesel generator capacity (primarily used as back up for Capacity Market Obligations). Under the investment policy, only energy storage systems (primarily BESS assets) will be invested in and as such the Company will not invest in equivalent assets going forward.

Monitoring of environmental or social characteristics

The Manager will measure and monitor the MWs and MWhs of operational BESS capacity and BESS capacity under construction on a regular basis. This is a central objective and outcome of the Company and remains core focus for the Manager.

The Manager is working to develop a credible carbon avoided methodology and will monitor this as a key metric to measure the attainment of the environmental characteristic to support climate change mitigation through the Company’s contribution to the decarbonisation of the energy system over time. The Manager is seeking input from a third-party carbon consultant to support the development of this methodology and the parent entity’s Sustainable Investment Team will also provide oversight.

Methodologies

MW and MWh operational and in-construction capacities are taken from the as built site diagrams and connection agreements, with in-construction assets driven from the site specifications as approved within the EPC agreement.

The methodology for carbon emissions avoided is currently under development and will be made available once ready.

Data sources and processing

MW and MWh operational and in-construction capacities are taken from the as built site diagrams and connection agreements, with in-construction assets driven from the site specifications as approved within the EPC agreement.

This disclosure will be updated when the Company adopts new metrics to assess carbon emissions avoided.

Limitations to methodologies and data

This disclosure will be updated when the Company adopts new metrics to assess carbon emissions avoided.

Due diligence

The Manager integrates sustainability risks and opportunities through the completion of the ESG Decision Tool prior to investment. The Tool supports the identification of potential, material ESG risks that need to be managed and mitigated during the investment period of the asset. The Tool also determines if there are any reasons why the asset may not be invested in at this stage for ESG reasons.

Post-investment, material sustainability risks identified through the ESG Decision Tool or as part of the division’s assessment of material sustainability risks to its wind, solar and battery energy storage system (BESS) assets, are monitored and managed on an ongoing basis. The Manager will also monitor ESG related data, where available, to support the ongoing management of sustainability risks for assets.

The parent entity of the Manager has a dedicated Sustainable Investment Team. This team provides support in relation to the evolution of processes around sustainable investing applied by the Manager. The Sustainable Investment Team carries out annual auditing of ESG processes to ensure they meet the sustainability-related commitments of the Manager. This includes an assessment of ESG metrics, ESG Decision Tools and investment processes.

Engagement policies

As detailed in the Gresham House Energy Transition Sustainable Investment Policy, the Manager commits to engaging with relevant stakeholders as part of its ongoing investment and management of BESS assets. Relevant stakeholders include developers, landowners, planning authorities, contractors and equipment suppliers during the development and contracting/procurement/construction process, as well as investors.

During the operational phase of the project, the Manager will engage with several stakeholders including local communities, insurers, operations & maintenance contractors, asset optimisers, the Environment Agency, and local fire services. Engagement is focused to maximise the efficient operation of BESS that help balance the UK electricity grid, allowing it to make optimal use of intermittent renewable energy generation in the UK electricity generation system.

Designated reference benchmark

The fund does not designate a reference benchmark.

Gresham House Asset Management Ireland Limited

Entity-level SFDR Disclosures

Under the EU Sustainable Finance Disclosure Regulation (SFDR), Financial Market Participants (FMPs) are required to make sustainability-related disclosures on their websites. This section provides disclosures required under the SFDR.

Publication date: 23 December 2022

No consideration of adverse impacts of investment decisions on sustainability factors

Adverse impacts of investment decisions on sustainability factors are not considered by Gresham House, Ireland (the Manager) and the Manager does not intend to consider adverse impacts for its investment strategies as it is not required to do so under the SFDR Article 4.

At a product level, it is our belief that the consideration of sustainability risks through ESG integration, as defined in the relevant Sustainable Investment Policy, is sufficient to demonstrate a consideration of sustainability risks and impacts for funds which do not have sustainable investment as their objective.

Sustainability risk policies

At Gresham House, we have developed a clear sustainable investment policy and are working hard to embed our approach consistently and effectively in line with our commitments, aiming to always be best in class.

Group Sustainable Investment Policy

The Gresham House Group Sustainable Investment Policy is applicable to Gresham House Asset Management Ireland Limited (Gresham House Ireland).

Across all our asset classes, we believe that understanding and, wherever possible, improving on environmental, social, economic and governance (ESG) performance drives long-term value, and we aim to work proactively with management teams and key stakeholders to make a positive change over time.

Our asset class policies

The Gresham House, Ireland Sustainable Investment Policy describes the sustainable investment commitments of the Manager1 for all unit trusts2.

1. The Manager refers to Gresham House Asset Management Ireland Limited (Gresham House Ireland), the Alternatives Investment Fund Manager (AIFM)

2. A Unit Trust is an arrangement made for the purpose of providing facilities for the participation by the public, as beneficiaries under a trust, in profits or income arising from the acquisition, holding, management or disposal of securities or any other property.

The Gresham House Commercial Real Estate Sustainable Investment Policy describes the sustainable investment commitments of the Manager1 for the Gresham House Commercial Property Fund.

1. The Manager refers to Gresham House Asset Management Ireland Limited (Gresham House, Ireland), the Alternatives Investment Fund Manager (AIFM)

Gresham House, Ireland Sustainable Investment Policy

Gresham House, Ireland Commercial Real Estate Sustainable Investment Policy

Sustainability risk integration

The Manager integrates sustainability risks as part of its investment decision-making process for all funds.3 The Manager believes that incorporating sustainability factors into investment decision making protects value and drives resilience of investments and can create compelling investment opportunities.

3. A sustainability risk integration model is currently being developed in respect of the Gresham House Commercial property fund.

A sustainability risk is an ESG event or condition that, if it occurs, could cause an actual or a potential material negative impact on the value of an investment. The likely impacts of sustainability risks on the returns of the fund will depend on the fund’s exposure to investments that are vulnerable to sustainability risks and the materiality of the sustainability risks.

The integration of sustainability risk throughout the investment lifecycle is key to the overall success of the funds under management. Sustainability risk assessment is part of the pre-investment due diligence process carried out by Investment Teams. Investment Teams are required to analyse how certain ESG factors may impact the investment case and the fund Net Asset Value. This is done through the application of the ESG Decision Tool (‘the Tool’).

The Tool is a key component of Gresham House’s approach to ESG integration and is applied by all investment divisions. The Tool aims to support the identification of a broad range of ESG risks which may materially impact on a proposed transaction. It does so by prompting a consideration of various aspects underlying ten core ESG themes laid out in the Sustainable Investment Framework. These themes include but are not limited to Governance & Ethics, Marketplace Responsibility, Climate Change and Pollution, Supply Chain Management and Employment, Health, Safety & Wellbeing.

The Tool will not tell the investment teams whether to invest or not, instead it aims to provide a rational and replicable assessment of key ESG risks which should be considered prior to investment, and to help rank the significance of each risk. The Tool also provides a way of summarising material ESG issues, which can then be tracked and monitored over time, and include actions that can be taken to mitigate those risks throughout the holding period.

The findings from the tool can be used to identify topics to engage investments , with the aim of increasing shareholder value over time and reducing downside risk. The findings may also drive voting decisions as a means of managing risk identified, if relevant to the investment strategy.

Remuneration policies

Sustainable investment-related objectives form part of employee variable remuneration review as detailed in Gresham House Asset Management Ireland Limited’s (Gresham House, Ireland) Remuneration Policy.

This extract is a carve out of the Gresham House, Ireland’s Remuneration Policy for the purpose of investor awareness and SFDR compliance.

Gresham House, Ireland is authorised by the Central Bank of Ireland as an Alternative Investment Fund Manager pursuant to the European Union (Alternative Investment Fund Managers) Regulations, 2013.

Variable remuneration

Performance management is measured by senior management on both a quantitative and qualitative basis with performance evaluations taking place on a mid-year and an annual basis. Employees may be eligible for a discretionary annual bonus payment. The level of bonus will depend on the performance of the individual, the Investment Team as a whole and the overall firm performance and takes into account financial as well as non-financial criteria. Gresham House, Ireland gives appropriate consideration to financial and non-financial criteria, including performance against sustainable investment-related objectives.

The annual bonus payment is at the total discretion of the firm. To reinforce the emphasis on sustainability, the firm not only considers what was achieved, but how the results were achieved when deciding on variable remuneration.

The Gresham House, Ireland remuneration principles are designed to attract a diverse and talented workforce, align reward with consideration of risk factors and support appropriate and controlled risk taking in line with fund objectives and strategies.

Product-level Sustainability-related disclosures

Under the SFDR, Financial Market Participants (FMPs) are required to make certain sustainability-related disclosures on their websites with respect to investment products. Below are links to the website disclosures of all in-scope products under the management of Gresham House, Ireland. Note that the website disclosures of one in-scope product will differ from those of another in-scope product.

Publication date: 4 December 2025

Important notice

The website disclosures (the “Disclosures”) are being made pursuant to Article 10(1) of Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector (as amended) (“SFDR”) in respect of Gresham House Sustainable International Forestry Fund LP (the “Fund”).

The Disclosures do not constitute (a) an offer of securities or interests, (b) an offer or invitation to the public, or (c) an invitation to apply for securities or interests. The Disclosures are being made to enable Gresham House Asset Management Ireland Limited (the “AIFM”) and Gresham House Asset Management Limited (the “Portfolio Manager”) to comply with their obligations under applicable law.

Summary

The Fund’s sustainable investment objective is to contribute to climate change mitigation, a sustainable investment objective contemplated within Article 9 and Article 2(17) of SFDR, whilst generating financial returns for investors. This objective is to be achieved through the following strategies of the Fund:

- To acquire, hold, and manage investments in sustainably managed productive core timberland and afforestation assets in Australia, New Zealand, the UK, Ireland, the rest of Europe and the USA. This may include any infrastructure, developments or higher business uses that may be incidental or supplementary to the timberland and afforestation assets acquired, held and managed.

- To target generating returns primarily from the capital growth of the timberland and afforestation assets and trees and income from the sale of timber and carbon credits and potentially from related infrastructure, development or higher business use opportunities that may be incidental or supplementary to timberland and afforestation assets.

- To support positive financial, environmental and/or social outcomes through the production of timber, a low carbon substitute resource, and the sequestration of carbon dioxide through forestry, supporting climate change mitigation and enabling the creation of carbon credits; and through any infrastructure, development or higher business uses incidental or supplementary to the timberland and afforestation assets.

The Fund applies the Do No Significant Harm (DNSH) criteria set out for forest management and afforestation under Regulation (EU) 2020/852 (the “EU Taxonomy”) for economic activities contributing substantially to Climate Change Mitigation.

All land and forests acquired by the Fund will be managed in line with the commitments and targets made in the Gresham House Forest Charter (the “Forest Charter”). In addition, investments are aligned with OECD Guidelines, UN Guiding Principles on Business and Human Rights, and international forestry standards.

The sustainability indicators used to measure progress against the sustainable investment objective are:

- Net carbon sequestration (tCO₂e),

- Carbon emissions (tCO₂e),

- Area certified to third-party forest management standards (%)

No significant harm to the sustainable investment objective

The Fund will not make investments that significantly harm its sustainable investment objective.

The Fund applies the Do No Significant Harm (DNSH) criteria set out for forest management and afforestation under the EU Taxonomy for economic activities contributing substantially to climate change mitigation to ensure no significant harm to the other environmental objectives of climate change adaptation, sustainable use and protection of water and marine resources, pollution prevention and control, transition to a circular economy and, protection and restoration of biodiversity and ecosystems.

All land and forests acquired by the Fund will be managed in line with the commitments and targets made in the Forest Charter. The Forest Charter sets out the Portfolio Manager’s commitments and targets in relation to sustainable forest management, based on international forestry standards, and the key performance indicators (KPIs) against which performance can be measured. The Forest Charter commitments and targets relate to the following categories: Forest Products & Services; Climate Change; Biodiversity & Ecology; Forest Protection; Income & Employment; Communities & People; and Forest Certification and Standards.

The Forest Charter also reflects the Portfolio Manager’s commitment to apply the International Finance Corporation (IFC) exclusion policy as relevant to forestry assets (the “Exclusion Policy”) to all forestry investments of the Fund. This means that the Fund will not be invested in:

- Production or activities involving harmful or exploitative forms of forced labour/harmful child labour;

- Commercial logging operations for use in primary tropical moist forest;

- Production or trade in wood or other forestry products other than from sustainably managed forests; or

- Production or activities that impinge on the lands owned, or claimed under adjudication, by Indigenous Peoples (as defined by the IFC for the purposes of its Exclusion Policy), without full documented consent of such people.

These exclusions are explicitly built into the Portfolio Manager’s ESG Decision Tool (the “ESG Tool”) and require the Portfolio Manager to ensure that no new acquisition is in breach of the exclusions at due diligence stage.

All investments are screened using the ESG Tool to ensure that ESG risks and impacts are considered prior to investment. This includes an assessment of the extent to which an asset might cause significant harm to environmental objectives climate change adaptation, sustainable use and protection of water and marine resources, pollution prevention and control, transition to a circular economy and, protection and restoration of biodiversity and ecosystems as well as social impact such as that on local communities and direct or indirect employees, and other commitments set out in the Forest Charter.

If an asset is considered to do significant harm to any environmental or social sustainable objective, this will be flagged in the ESG Tool. Any asset considered to do significant harm to environmental or social objectives will either not be acquired, or mitigation actions to prevent significant harm must be identified prior to investment, incorporated into the Forest Management Plan and approved by the Investment Committee.

The risks and impacts assessed through completion of the ESG Tool are aligned with the Do No Significant Harm (DNSH) approach of the EU Taxonomy. This ensures that the Fund’s investments do not significantly harm any of the objectives set out in Article 2(17) of SFDR.

In addition, the Portfolio Manager commits to all productive forestry assets being managed in accordance with recognised certification standards for sustainable forest management or working to achieve certification for forestry assets within a reasonable timeframe. The Portfolio Manager has determined that these certification standards are aligned with EU Taxonomy requirements for DNSH to environmental objectives with the exception of the Climate Change Mitigation requirements, for which the Manager will ensure use of additional climate risk analysis to mitigate any material physical climate risks identified.

Alignment with OECD Guidelines and UN Guiding Principles on Business and Human Rights is ensured through the application of the ESG Tool, as described above, and ongoing forest management in line with the commitments set out in the Forest Charter and forestry certification standards. ILO Fundamental Principles and Human Rights form the basis of the social principles set out by forestry certification standards and therefore the Forest Charter. Adherence to Minimum Safeguards is also determined by the inclusion of commitments relating to anti-bribery and corruption, tax compliance, competition law and human rights due diligence and protection in contract terms with key suppliers and contractors.

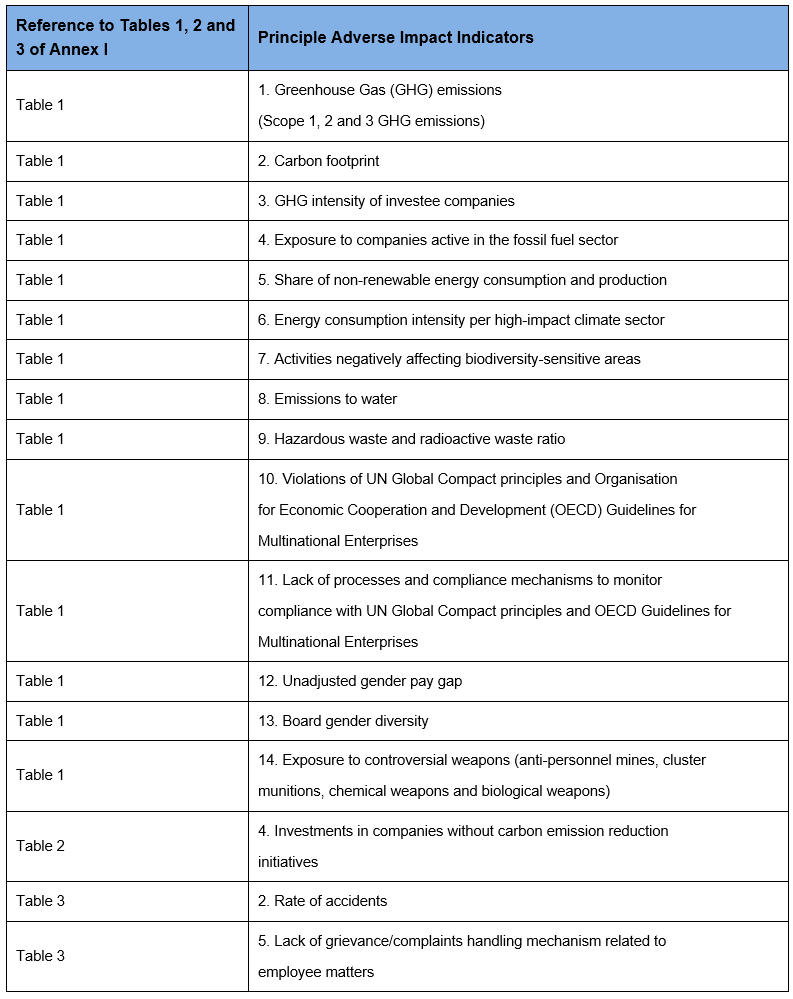

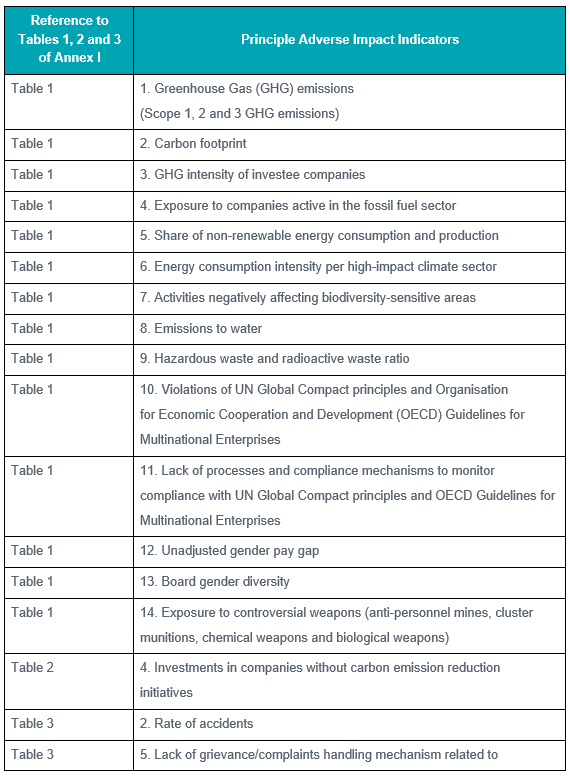

In relation to Tables 1, 2 and 3 of Annex I of Commission Delegated Regulation (EU) 2022/1288 of 6 April 2022, the Fund takes into account certain principal adverse impacts (“PAI”) – as set out in Annex III – and will calculate, monitor and report against these on an annual basis. The Portfolio Manager has not set any specific thresholds in relation to the PAIs but will use these indicators to contribute to ongoing fund and forest management decisions with a view to consistent improvement. Focused areas for portfolio management include:

- Intention to reduce Carbon Footprint

- Intention to keep the following at zero for the Portfolio: Activities negatively effecting biodiversity-sensitive areas, Emissions to water, Hazardous waste, Deforestation and Violations of UN Global Compact principles and Organisation for Economic Cooperation and Development (OECD) Guidelines for Multinational Enterprises

Sustainable investment objective of the financial product

The Fund’s investment objective is to contribute to climate change mitigation, a sustainable investment objective contemplated within Article 9 and Article 2(17) of SFDR, whilst generating financial returns for investors. This objective is to be achieved through the following strategies of the Fund:

- To acquire, hold, and manage investments in sustainably managed productive core timberland and afforestation assets in Australia, New Zealand, the UK, Ireland, the rest of Europe and the USA. This may include any infrastructure, developments or higher business uses that may be incidental or supplementary to the timberland and afforestation assets acquired, held and managed.

- To target generating returns primarily from the capital growth of the timberland and afforestation assets and trees and income from the sale of timber and carbon credits and potentially from related infrastructure, development or higher business use opportunities that may be incidental or supplementary to timberland and afforestation assets.

- To support positive financial, environmental and/or social outcomes through the production of timber, a low carbon substitute resource, and the sequestration of carbon dioxide through forestry, supporting climate change mitigation and enabling the creation of carbon credits; and through any infrastructure, development or higher business uses incidental or supplementary to the timberland and afforestation assets.

Investment strategy

The Fund’s sustainable investment objective is to contribute to climate change mitigation whilst generating financial returns for investors. This objective is to be achieved through the following strategies of the Fund:

- To acquire, hold, and manage investments in sustainably managed productive timberland and afforestation assets in the United Kingdom, Ireland, Australasia and other developed markets. This may include any infrastructure, developments or higher business uses that may be incidental or supplementary to the land and forests acquired, held and managed.

- To target generating returns primarily from the capital growth of the land and trees and income from the sale of timber and carbon credits and potentially from related infrastructure, development or higher business use opportunities that may be incidental or supplementary to the land and forests.

- To support positive financial, environmental and/or social outcomes through the production of timber, a low carbon substitute resource, and the sequestration of carbon dioxide through forestry, supporting climate change mitigation and enabling the creation of carbon credits; and through any infrastructure, development or higher business uses incidental or supplementary to the land and forests.

The integration of sustainability considerations, including ESG factors, into the investment decision making process followed in respect of the Fund is implemented by the application of the Forest Charter and ESG Tool (described above).

Any specific forest management approaches to meet the sustainable forest management or climate change mitigation objectives will be included in the Gresham House Forest Management Plan, be applied by the Portfolio Manager’s Asset Management Team, and regularly reviewed and updated over time.

The Portfolio Manager will review the performance of the sustainability indicators for the Fund on a regular basis. They will also assess the audit results for all assets to determine if any assets have significantly harmed any environmental or social objectives, including breach of minimum safeguards, and check adherence to the Forest Charter and certification criteria. If any asset is found not to meet requirements, a corrective action plan will be implemented. If, over time, this is considered not to be effective, the asset may be sold by the Fund.

The Fund will largely invest in forestry assets directly or through pooled investment vehicles managed by the Portfolio Manager. Any corporate entities in the structure are expected to be asset holding vehicles rather than business entities, and where the Fund does invest in a company it will follow the same procedure as it would for an asset acquisition to ensure compliance with good governance practices. As noted above, this includes assessment of alignment with forestry certification standards and the OECD Guidelines for Multinational Enterprises, the UN Guiding Principles on Business and Human Rights through completion of the ESG Tool and Minimum Safeguard clauses included in contract terms with primary suppliers and contractors.

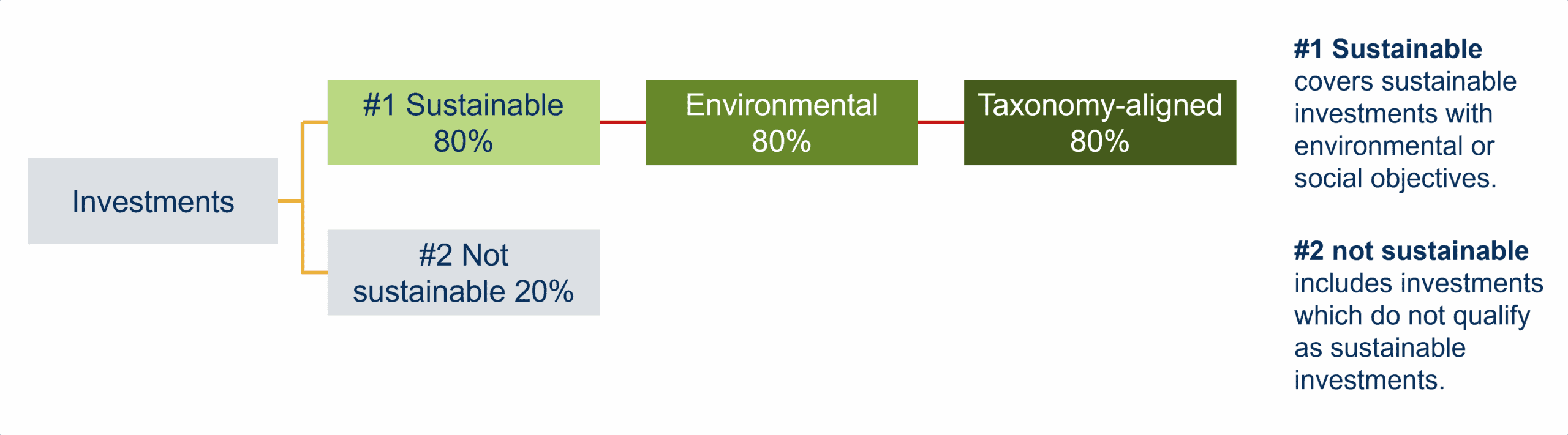

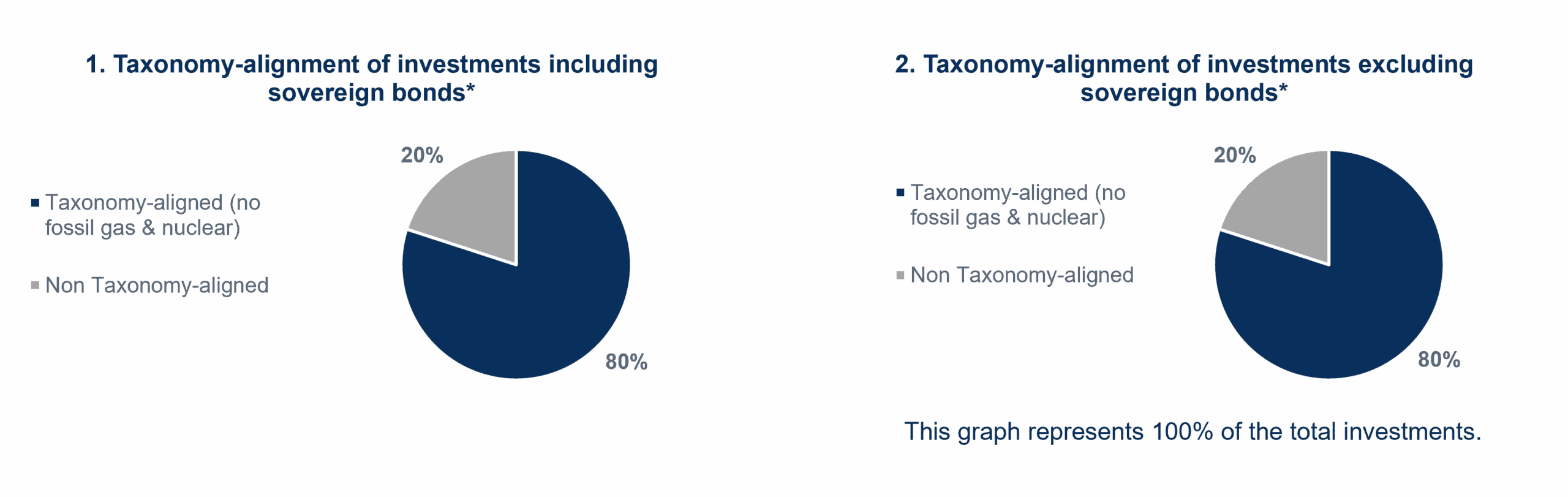

Proportion of investments

80% of the Fund’s investments are aligned with the Fund’s sustainable investment objective.

Investments in the “#2 Not Sustainable” category include investments and other instruments of the Fund that cannot be aligned with the environmental and/or social characteristics of the Fund. These can include, for example, portfolio management tools such as derivatives and cash.

The Fund may end up owning non-forestry related assets such as residential land and buildings where these are incidental parts of a forestry investment acquired by the Fund. It is expected that such assets will account less than 20% of the Fund’s investments. These assets are subject to the responsible management practices employed by the Fund across its portfolio and by proxy, environmental and social safeguarding is taken into consideration.

The two graphs below show the minimum percentage of investments that are aligned with the EU Taxonomy. As there is no appropriate methodology to determine the Taxonomy-alignment of sovereign bonds*, the first graph shows the Taxonomy alignment in relation to all the investments of the financial product including sovereign bonds, while the second graph shows the Taxonomy alignment only in relation to the investments of the financial product other than sovereign bonds.

*For the purpose of these graphs, ‘sovereign bonds’ consist of all sovereign exposures.

Monitoring of sustainable investment objective

The sustainability indicators used to measure the attainment of the sustainable investment objective of the financial product are:

- Net carbon sequestration (tCO2e),

- Carbon emissions (tCO2e), and

- Area certified to a third-party forest management standard (%).

The following processes are followed to monitor the Fund’s sustainable investment objective and sustainability indicators:

- The Portfolio Manager will ensure that ESG due diligence, through the completion of the ESG Tool, is completed for all assets and a summary of material findings is included in Investment Committee papers ahead of Investment Committee approval. The ESG Tool includes an assessment of the alignment of an asset with the EU Taxonomy criteria for climate change mitigation.

- The Portfolio Manager will review the performance of the Fund’s sustainability indicators, PAI Indicators and other indicators set out in the Forest Charter for the Fund on a regular basis. This will include a consideration of whether any change in forest management (including harvesting decisions), supplier relationships, or acquisition strategy is required to meet those objectives.

- The Portfolio Manager will assess internal and external audit results for assets and supplier questionnaire responses, as relevant during the latest investment period, to determine if any asset is considered to have significantly harmed environmental objectives or breached minimum safeguard criteria. If any asset is found not to meet requirements, a corrective action plan will be implemented. If, over time, this is considered not to be effective, the asset may be sold by the Fund.

Methodologies

The Portfolio Manager will aim to increase the “net carbon sequestration” over the lifetime of the Fund where “net carbon sequestration” is calculated by the additional carbon sequestration in the forestry assets, less carbon removals from harvesting, less operational emissions, plus carbon stored in wood products. This calculation is in line with the EU Taxonomy Technical Screening Criteria for Forest Management activities contributing substantially to climate change mitigation and IPCC guidelines. The carbon sequestered by the Fund cannot be claimed by individual investors unless carbon credits are retired by the investor.

The Portfolio Manager targets an increase in carbon removals (or decrease in carbon emissions) over the lifetime of the fund. “Carbon emissions” are calculated as the aggregate net balance of carbon dioxide emissions and removals of the forestry assets invested in by the fund, including carbon stored in harvested wood products, in line with 2006 IPCC guidelines.

The Portfolio Manager will also target all forest land to be managed sustainably without significantly harming other environmental objectives. This will be assured by certification under a third-party forest management standard. “Third-party forest management standards” refer to internationally recognised standards for sustainable forest management. These include the FSC® and PEFC™ and national equivalents.

Newly acquired land may not be certified at the time of purchase, but the Portfolio Manager will aim to ensure that 100% of forests thereon will be certified within a reasonable timeframe. The Manager will monitor the progress of all assets in terms of certification against the 100% of forest land target, measured by area of forest land (hectares).

Data sources and processing

Carbon removals and emissions associated with forest assets are based on the most recently available tree species yield class tables and country-specific carbon emissions factors. The carbon model applied by the Portfolio Manager has been reviewed by an independent specialist carbon consultant who has confirmed that the methodology applied in the carbon model is consistent with the 2019 Refinement to the 2006 IPCC Guidelines for National Greenhouse Gas Inventories to ensure data quality. The Portfolio Manager is responsible for reviewing carbon models and sense-checking the outputs.

Carbon emissions associated with forest management activities (operational carbon) estimated by applying a carbon factor to area of forest or volume of timber produced.

All other sustainability related data, including data contributing to PAI indicators and Forest Charter KPIs, are obtained from a variety of sources. This includes:

- A woodland manager survey sent annually to woodland managers for input and data relating specifically to forest assets under management, and

- Internal compartment schedules established by the Portfolio Manager which include information such as asset area, land types, tree species and standing timber inventory.

The data received from these sources is checked for completeness by the Portfolio Manager and will be corrected for anomalies and errors, as deemed appropriate, following receipt. The data is aggregated at Fund level for forest management and reporting purposes.

The level of estimation for data reported varies indicator by indicator however the scale of forestry assets means that certain metrics are dependent on methodologies and assumptions applied on a per hectare or per species basis. The data is also dependent on the accuracy of input by woodland managers, which is out of the control of the Portfolio Manager.

Limitations to methodologies and data

This section will be updated to include relevant limitations if and when these become apparent (on the basis of the understanding that this disclosure is required to include such limitations as relate to the scope of methodologies and data coverage, rather than limitations pertaining to the accuracy of data (which is addressed in the section immediately above).

Due diligence

Internal controls

All assets will be assessed prior to investment as part of pre-investment due diligence. This includes an assessment of all forest assets through completion of the ESG Tool, a tool which supports the Portfolio Manager in assessing and identifying sustainability risks, impacts and opportunities associated with all potential investments. Prior to acquisition or investment, the Portfolio Manager will assess the ability for all potential investments to adhere to the DNSH criteria. Any asset that is considered not to be able to meet these criteria will not be invested in.

The Portfolio Manager will monitor adherence to and application of policies by relevant persons involved in the management of forestry assets as set out in the above disclosure through regular Fund review.

The Sustainable Investment Team carries out annual audits of all investment divisions at Gresham House. As part of this audit process, the Sustainable Investment Team will review any sustainable investment commitments and processes applied by investment products with sustainable investment objectives, including this Fund. Any material findings following the audit will be shared with the Investment Manager and the Group’s Sustainability Executive Committee, which includes representatives from the Compliance Team.

External controls

All assets will be audited by an independent party to check the adherence of the asset to the EU Taxonomy criteria and certification standards. Audits will be carried out within two years of the beginning of the activity, and at least every 10 years thereafter.

Engagement policies

The Fund does not have an engagement policy. The Portfolio Manager commits to engagement policies and processes as set out in the Forest Charter and the Forestry Sustainable Investment Policy.

Under the Forest Charter, the Portfolio Manager commits to engaging with local communities both informally and as legally required as part of forest planning and ongoing forest management activities.

The Portfolio Manager also commits to not investing on the lands owned, or claimed under adjudication, by indigenous peoples, without full documented consent of such people, and will make all planning, felling or planting documentation available to the public.

Asset Management teams – who manage forest assets on behalf of the Portfolio Manager and Fund – will engage with woodland managers and other primary contractors or suppliers to gather relevant ESG-related information or data and, if relevant, to encourage enhancements to forest management activities in line with the sustainable investment objective.

The Portfolio Manager may engage other stakeholders including policymakers, regulators and industry associations to promote outcomes we believe to be in the interest of the sustainable investment objective and in the interest of our clients.

Attainment of the sustainable investment objective

The Fund seeks to support the objectives of the Paris Agreement adopted under the United Nations Framework Convention on Climate Change (the “Paris Agreement”) by pursuing a continuous reduction in carbon emissions through its investments.

The Fund’s sustainable investment objective is to contribute to climate change mitigation, a sustainable investment objective contemplated within Article 9 and Article 2(17) of SFDR, whilst generating financial returns for investors. The Fund aims to achieve its sustainable investment objective by investing in sustainable forest and afforestation activities that increase carbon sequestration, reduce net emissions and promote sustainable timber production.

Through its sustainability indicators of: (a) net carbon sequestration (b) carbon emissions and (c) the area certified to a third-party forest management standard, the Fund seeks to support the three objectives of the Paris Agreement.

By increasing net carbon sequestration and lowering carbon emissions in accordance with EU Taxonomy and IPCC methodologies, the Fund contributes to global efforts to limit temperature rise. Managing forest assets to internationally recognised sustainable forestry standards enhances ecosystem resilience and supports adaptation. By investing in carbon-reducing, climate-resilient forestry activities and through the creation of carbon credits, the Fund helps align financial flows with a pathway consistent with the Paris Agreement.

Publication date: 23 December 2022

Adverse sustainability impacts

Pursuant to Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector (“SFDR”), the Fund is not classified as an Article 8 or Article 9 fund, however, disclosure in accordance with the requirements of Article 6 of SFDR in relation to the integration of sustainability risks, which is applicable to the Fund, is set out in the Prospectus.

The Fund does not consider adverse impacts of investment decisions on sustainability factors, as defined under SFDR, as it is not required to do so under Article 4(3).

EU Taxonomy

The investments underlying this financial product do not take into account the EU criteria for environmentally sustainable economic activities.

Publication date: 23 December 2022

Adverse sustainability impacts

Pursuant to Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector (“SFDR”), the Fund is not classified as an Article 8 or Article 9 fund, however, disclosure in accordance with the requirements of Article 6 of SFDR in relation to the integration of sustainability risks, which is applicable to the Fund, is set out in the Prospectus. The Fund does not consider adverse impacts of investment decisions on sustainability factors, as defined under SFDR, as it is not required to do so under Article 4(3).

EU Taxonomy

The investments underlying this financial product do not take into account the EU criteria for environmentally sustainable economic activities.

Publication date: 23 December 2022

Adverse sustainability impacts

Pursuant to Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector (“SFDR”), the Fund is not classified as an Article 8 or Article 9 fund, however, disclosure in accordance with the requirements of Article 6 of SFDR in relation to the integration of sustainability risks, which is applicable to the Fund, is set out in the Prospectus. The Fund does not consider adverse impacts of investment decisions on sustainability factors, as defined under SFDR, as it is not required to do so under Article 4(3).

EU Taxonomy

The investments underlying this financial product do not take into account the EU criteria for environmentally sustainable economic activities.

Publication date: 23 December 2022

Adverse sustainability impacts

Pursuant to Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector (“SFDR”), the Fund is not classified as an Article 8 or Article 9 fund, however, disclosure in accordance with the requirements of Article 6 of SFDR in relation to the integration of sustainability risks, which is applicable to the Fund, is set out in the Prospectus. The Fund does not consider adverse impacts of investment decisions on sustainability factors, as defined under SFDR, as it is not required to do so under Article 4(3).

EU Taxonomy

The investments underlying this financial product do not take into account the EU criteria for environmentally sustainable economic activities.

Publication date: 23 December 2022

Sustainability-related disclosures

Summary

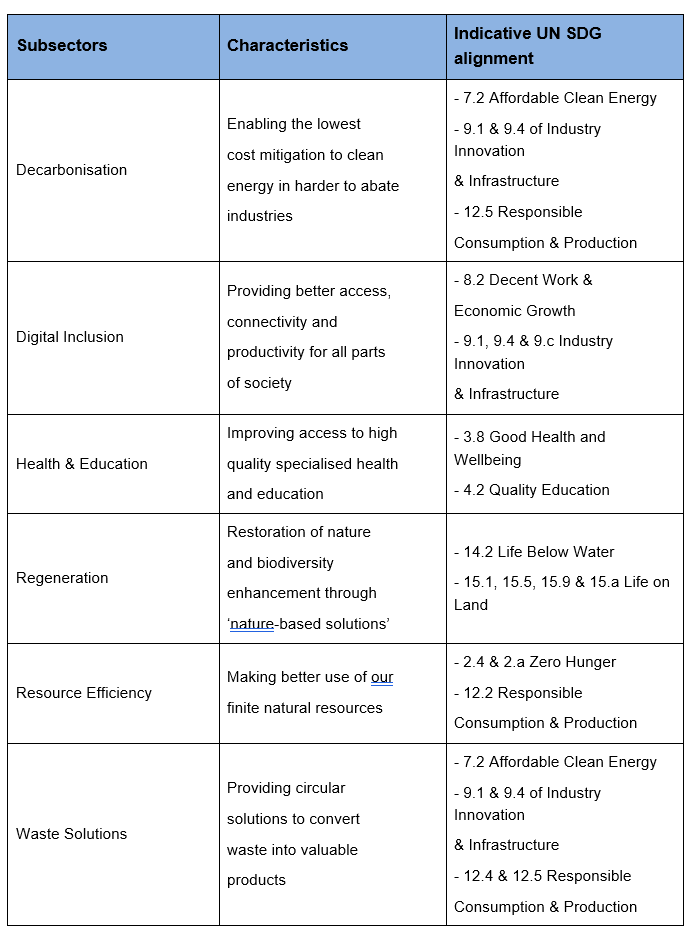

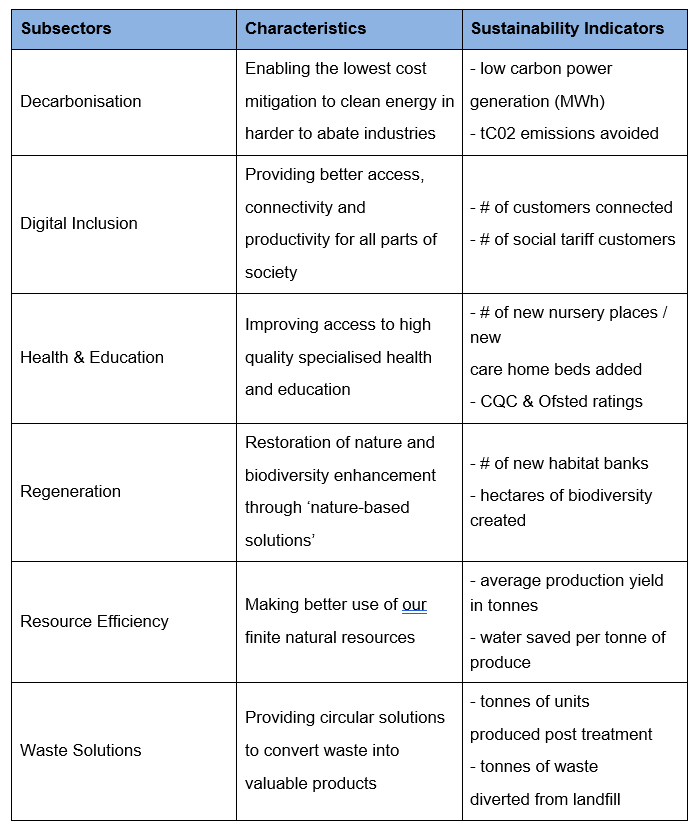

The Gresham House Thematic Multi Asset Fund is managed through a top-down asset allocation framework which involves the formation of a house view on financial markets that drives the asset allocation. Individual asset allocation decisions are based on bottom-up fundamental analysis and application of a sustainable investment process.

The fund promotes environmental and social characteristics by investing at least 70% of its value in “sustainable assets”, as well as not investing in companies which do not adhere to global norms on environmental protection, human rights, labour standards and anti-corruption, and excluding companies which have significant involvement in certain industries. “Sustainable assets” are defined as those which meet the fund’s sustainable thematic alignment and exclusion criteria. Thematic alignment will be determined by the percentage revenue, or equivalent metric relevant to the business model, which demonstrates contribution to a sustainable theme. Investments must demonstrate that more than 20% of revenue, or equivalent metric, contributes to a sustainable theme to be included in the fund. The fund will report on the percentage of holdings aligned to each theme on a periodic basis.

In order to ensure the securities in the fund adhere to global norms and do not invest in excluded industries, an external ESG data provider is employed to monitor the portfolio. The internal investment team is responsible for compiling a sustainable investment thesis for each asset. The thesis includes a summary of findings from the ESG Decision Tool, employed to assess material ESG risks and opportunities, and an assessment of the thematic alignment of the underlying security.

No sustainable investment objective

This financial product promotes environmental or social characteristics but does not have as its objective a sustainable investment.

Environmental or social characteristics

The fund promotes environmental and social characteristics by investing at least 70% of its value in sustainable assets. “Sustainable assets” are defined as those which align to sustainable themes, including but not limited to Climate & Energy, Waste, Circular Economy and Food & Agriculture, and meet the fund’s exclusion criteria restricting investment in certain activities. The fund will also not invest in companies which do not adhere to global norms on environmental protection, human rights, labour standards and anticorruption.

Investment strategy

The Gresham House Thematic Multi Asset Fund seeks to achieve long-term capital appreciation with moderate risk exposure by investing on a diversified basis in transferable securities, such as equity securities and debt securities, and in collective investment schemes. The Fund may invest across asset classes, sectors, geographies, and market capitalisations without limitation save in respect of the restriction on investment that do not meet the fund’s thematic and exclusion criteria described below.

The Gresham House Thematic Multi Asset Fund is managed through a top-down asset allocation framework which involves the formation of a house view on financial markets that drives the asset allocation. Individual asset selection decisions are based on bottom-up fundamental analysis, including a consideration of valuation and business quality, as well as alignment to sustainable themes and adherence to exclusion criteria.

Exclusion criteria

All investments must pass a screening process carried out by a third-party data provider to ensure they meet the fund’s exclusionary criteria. Exclusionary criteria are twofold:

First, the fund precludes investment in companies which do not adhere to global norms on environment protection, human rights, labour standards and anti-corruption. Global norms include:

- OECD Guidelines for Multinational Enterprises

- ILO Tripartite Declaration of Principles concerning Multinational Enterprises and Social Policy

- UN Global Compact

- Guiding Principles on Business and Human Rights

The third-party data provider will produce a red flag for investments considered to violate these Norms. Investments receiving a red flag cannot be invested in or will be sold within three months if already invested.

Secondly, the fund excludes investments with significant involvement in certain industries and activities. The industries or activities and exclusion thresholds are listed below:

- Military Equipment Services and Production >10% revenue

- Gambling >10% revenue

- Pornography > 5% revenue

- Tobacco > 10% revenue

- Nuclear Power >10% revenue

- Abortifacients – any involvement in Production, Distribution, Services

- Abortion Services/Planned Parenthood – any involvement

- Contraceptives – any involvement in Production, Distribution, Services

- Stem Cell Research – any involvement

- Alcohol Production – > 10% Revenue

- Fossil Fuels Production and/or Exploration >10% Revenue

Any investment that is determined by the third-party data provider to breach the thresholds will be sold from the portfolio within three months.

Thematic alignment

For all new investments made by the fund (except for cash or cash equivalents, or sovereign bonds), a company note including an investment and sustainability thesis must be produced prior to investment. This includes an analysis of the thematic alignment of the security and includes detail such as the theme targeted and a description of how the asset aligns to the theme.

All investments made by the fund must also be assessed using the ESG Decision Tool (“the Tool”) prior to investment. This tool is used to assess material sustainability risks and opportunities to the investment case and to identify any areas to be monitored and addressed through engagement and/or voting, as and when relevant, through the holding period. A summary of material findings from the Tool will be included in the company note.

Good governance

Good governance is assessed through application of the Tool which prompts an assessment of sustainability risks and opportunities to the investment case under the headings noted below:

- Board structure, composition and protocols

- Board skills and engagement, including in ESG risk

- Delivering change and success

- Anti-competitive behaviour

- Anti-bribery & corruption

- Ethical risk profiling and management

It is also considered that the exclusion of investments in breach of global norms contributes to the avoidance of investments that do not demonstrate good governance.

Sovereign bonds

Investment in sovereign bonds does not apply the fund’s exclusion or thematic alignment criteria. Investments in sovereign bonds that are intended to be held for more than 12 months (i.e. those that are not considered cash or cash equivalents) will be required to have a prime ESG rating (B- or above), as defined by a third party ESG data provider.

Proportion of investments

The fund invests across a variety of asset classes including equities, cash, bonds, property and alternative assets such as infrastructure and forestry. The fund will invest at least 70% of fund value in assets that promote environmental and social characteristics as determined by their alignment to sustainable themes and compliance with the fund’s exclusion criteria.

Up to 30% of the fund asset value is classified as “other”. This mainly consists of investments in cash and/or bonds. This allocation is necessary from an asset allocation perspective

The fund does not intend to make any sustainable investments.

Monitoring or environmental or social characteristics.

1. Continuous monitoring is carried by an external ESG data provider to ensure investments are not in breach of global norms in relation to environmental protection, human rights, labour standards and anti-corruption and to ensure that investments continue to meet exclusionary criteria.

2. Meetings with representatives of investments will be carried out regularly by the Gresham House Ireland Investment Team in order to:

- Assess the underlying investment thesis including alignment to sustainable themes

- Monitor any ESG specific risks identified

- Assess additional ESG risks

- Encourage improvements in ESG shortcomings

3. The Fund is overseen by the Gresham House Ireland Investment Committee on a regular basis who provide oversight of the fund’s adherence to the investment process detailed above.

Methodologies

To ensure an alignment of investments to sustainable themes, a sustainable investment thesis is compiled by the Investment Team which includes an analysis of thematic alignment as well as an assessment of ESG risks. The assessment of thematic alignment is based on bottom-up fundamental research.

An external provider is employed to ensure the global norms, exclusionary criteria and country ESG ratings of the fund are met. Please see here links to the:

- Methodology applied to assess adherence to global norms

- Methodology applied to determine revenue associated with exclusion criteria

- Methodology applied to assess country ESG rating

Data sources and processing

An external provider, currently ISS (Institutional Shareholder Services), is employed to provide data relating to compliance with global norms, breach of exclusion criteria, principal adverse impact indicators and country ESG ratings.

Internal analysis of all investments is conducted by the Gresham House Ireland Investment Team to determine thematic alignment. This is based on publicly available information and includes a review of documents including annual reports and sustainable investment reports, or equivalent.

Limitations to methodologies and data

Data relating to exclusions and global norms violations is provided by third party providers. The Manager is dependent on the external provider to provide accurate data. This data is also dependent on companies disclosing relevant data and accurate data.

The subjective nature of ESG data and sustainability topics means that third parties may not agree with the Investment Team or external provider in relation to thematic alignment or global norms violations.