We are pleased to announce a transformational year in 2023, delivering strong financial returns for clients and a growing... Read more 4d

Why we created our Forest Charter - November 2022

Why we created our Forest Charter - November 2022

Gresham House is a commercial forestry investor and manager.

We aim to meet our clients’ investment objectives through the planting and sustainable long-term management of forests that produce a key natural resource: timber.

We primarily invest in softwood forests in the United Kingdom, Ireland, Australia, and New Zealand, but we are increasingly expanding our activities to other geographies and focusing on planting a greater diversity of species.

Our forestry strategy is committed to sustainable investment and forest management. To underline this commitment, we launched the Gresham House Forest Charter in 2022.

The Charter is a policy document that provides a clear and comprehensive summary of our commitments and targets regarding sustainable forest management.

Our approach to sustainable forest management is to manage forests to meet our clients’ financial and wider investment objectives while also managing the social and environmental impact and dependencies of the assets.

Our Charter commitments are aligned – and in some instances we believe go beyond – national and international standards, whose criteria and principles underpin these commitments, such as the Forest Stewardship Council or Programme for the Endorsement of Forest Certification.

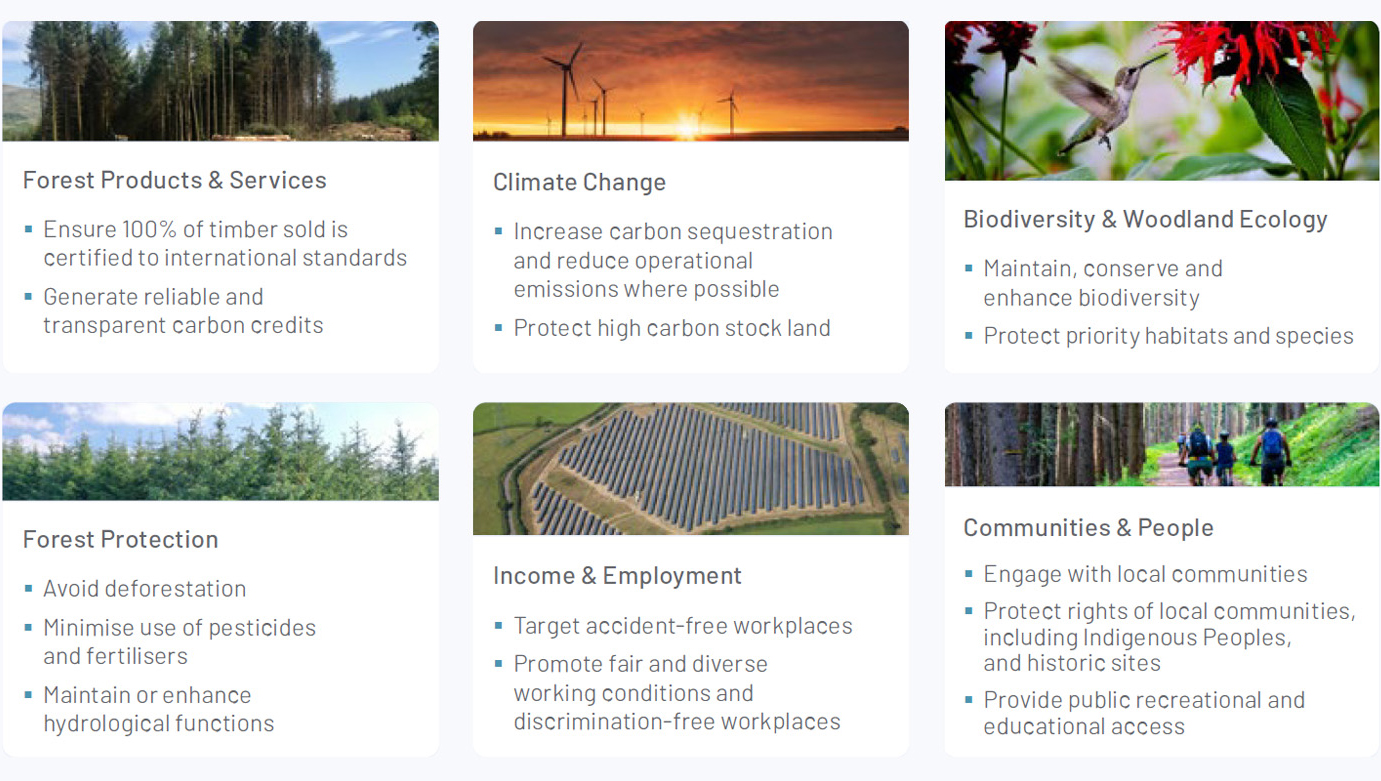

Our Charter includes details about how we will invest in and manage forests in relation to a range of environmental, social and governance (ESG) factors that we have identified as most material to forest ecosystems and services.

These include climate change, forest protection, biodiversity and ecology, communities and people, income and employment as well as forest products. It also includes metrics that we will measure to monitor the performance of our forestry investments against these commitments over time. We apply the charter to all forests managed in our discretionary portfolios.

The key principles of our Charter

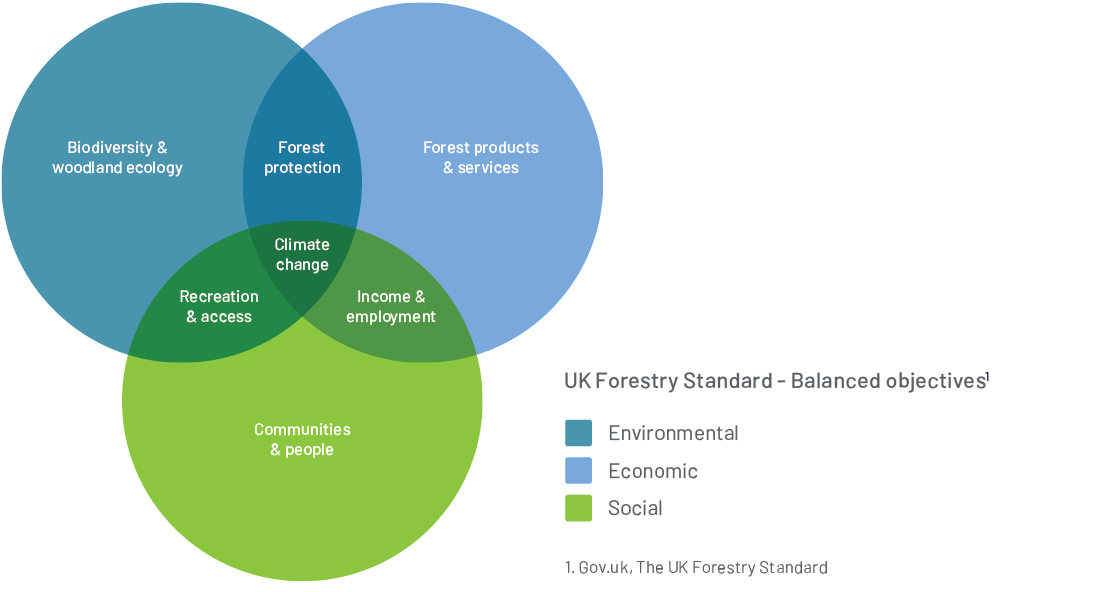

The Charter’s structure is based on the UK Forestry Standard’s concept of balanced objectives.

This recognises that forests have environmental, social and economic functions and that these must all be considered and managed in tandem to ensure sustainable forest management.

By doing so, we believe that the many forest benefits can be maintained over the long term.

We have laid out clear commitments in our Charter, across six key areas:

These commitments and targets apply across all the forests we manage and frame the types of activities we will invest in.

Being unable to meet these commitments would prevent us from investing in a forest, as illustrated in the example below.

For this Charter to be effective, we have to be able to gather meaningful data and monitor progress against key performance indicators. We do this through our:

- investment managers, who are responsible for fund-level strategy and forest investments;

- asset managers, who are responsible for managing the forests; and

- woodland managers, who work on the ground and in close collaboration with our asset managers.

The collation of certain ESG data points is new for us and for the industry.

We are working hard with our teams to collate data.

For example, we recently issued a questionnaire to woodland managers requesting data and information relating to many of the core commitments in our Charter to enhance the data we have available to monitor the performance of our forestry assets.

Aspects that we will measure and report on include carbon stock, carbon sequestration and biodiversity, where we are trialling technologies such as environmental DNA and satellite data to improve the accuracy of our reporting. This will be complemented by on-the-ground work such as surveys of flora and fauna by woodland managers.

Our clients will receive at least annual updates in fund reporting, and we will provide a broader divisional Forestry update for other stakeholders in our Sustainable Investment Report.

Case study: How the Charter affects our investments

| Commitments | KPIs | |

| Carbon in forests | We will not convert any high-carbon stock areas (peatlands, wetlands and grasslands) of land purchased for afforestation, unless within local regulatory guidelines. For example, no planting will take place in the UK where the depth of peat exceeds 50cm (or relevant guidelines) and, where peat is present but shallower than 50cm, steps will be taken to minimise soil disturbance during ground preparation and will only be enough to ensure successful establishment of the trees. | ▪ Carbon stock (tCO2e) ▪ Total carbon emissions sequestered (tCO2e) ▪ Operational emissions (tCO2e) ▪ Area of peatland present (ha) |

| Water management | We will ensure that measures are planned and implemented to maintain and/or enhance long term hydrological functions, such as the maintenance of drains, streams, rivers and ponds. | N/A |

| Habitats & priority species | We will take appropriate measures as part of our planning and management processes to protect identified priority habitats and species, within the area of forest under management and beyond the boundary where relevant to priority species, in accordance with plans agreed with nature conservation agencies. | ▪ Area of forest land with protected conservation status (ha) ▪ Number of threatened species present on forest land |

We recently declined making an investment in Scotland after our assessment revealed that doing so would breach three of our Charter commitments, relating to biodiversity, water management and carbon stocks (see table above).

One-third of the property consisted of low-quality agricultural land; the remainder consisted of unimproved deep peatland.

Our investment managers were considering the investment on the basis that we could have planted the agricultural land with conifers for timber production, to ultimately generate income through the sale of the wood harvested. This would have realised additional potential environmental, social and economic benefits, such as carbon sequestration, new habitat creation and public access.

We did not consider the deep peatland for planting as part of the potential investment case because this would have contravened our commitment to carbon stocks.

As part of our pre-investment work, we appointed an ecologist to assist with our appraisal of the site.

The ecologist’s review found that planting the agricultural land posed two key risks:

1. Planting could negatively affect the hydrology of the adjacent peat area and consequently impact our commitment to water management, which sets out to “maintain and/or enhance the long-term hydrological functions”

2. Planting could result in trees “seeding” onto to the peatland and colonising it. This could result in disturbing the peatland – particularly significant, given the negative climate change impact this can have through the disturbance of carbon in the soil – and would contravene our commitment regarding high carbon stock land, highlighted above.

The site’s deep peatland was deemed to be in good condition, as well as adjoining two Sites of Special Scientific Interest (SSSI). As such, if seeding of the peatland was to occur, this would have been a breach of a further commitment made in our charter: to protect priority habitats (including SSSI) and species.

Although this investment opportunity would have created several environmental, social and economic benefits, these would not have outweighed the environmental risks to the peatland posed by planting the agricultural land.

Consequently, we determined that this would not have been a sustainable forest investment and declined to proceed.

Get in touch for more information

|

| Heather Fleming Managing Director, Institutional Business +44 (0) 7872 685 532 h.fleming@greshamhouse.com |

More views from Gresham House

The Baronsmead VCTs have raised a further £50mn, bringing their total net asset value to c.£450mn. Read more 3w

Why we think sustainable productive forestry should form the basis of a natural capital portfolio. Read more 1mo

Gresham House has celebrated the topping out of a landmark affordable housing development in Henley-on-Thames, South... Read more 1mo

Gresham House

Specialist asset management

Gresham House

Specialist asset management