15 March 2021

15 March 2021

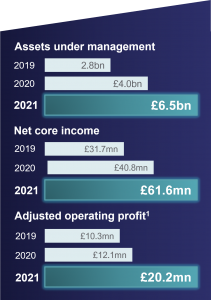

Gresham House Annual Results 202165% AUM increase to £6.5bn with strong organic growth.Gresham House plc is pleased to announce a year of significant growth, both organically and through acquisitions. Assets under management (AUM) rose 65% to £6.5 billion and this growth has led to material increases in revenue, operating margin and profit. The Group has made significant progress against our GH25 strategic objectives and therefore increased our AUM target in November 2021 to £8.0 billion. |

|

Highlights

|

|

Commenting on the results, Chief Executive, Tony Dalwood said:

“Throughout 2021 we made exceptional progress on the delivery of our GH25 five-year strategy and are reporting outstanding growth in AUM, profitability and revenue. We are focused on private assets which exhibit long-term superior investment returns alongside sustainability characteristics.

“We have demonstrated our ability to grow organically and to add value through acquisitions, providing an exciting future for our Group. Gresham House Ireland and the Mobeus VCT businesses enhance the strategic ambitions and potential for the Group.

“Momentum across the business continues to be buoyed by the structural shift driving fund inflows into alternative asset classes as we continue to diversify our client base. Our ESG-focused strategy and strong investment performance mean we are well placed to capture the rising demand for investments that deliver both financial returns and sustainable, climate-based solutions.

“In light of our excellent 2021 performance, we are well on track to achieve our GH25 objectives and have therefore upgraded our targets in accordance with our ambition and strategic goals. Despite the current macroeconomic environment and geo-political events, we are confident of further growth throughout 2022 as we continue to deliver value to all our stakeholders.”

Gresham House hosted an Annual Results webinar at 9:00am on Tuesday 15 March – please register here to watch >>

Get in touch

|

Media relations Houston PR Alexander Clelland Kay Larsen Joe Burgess

|

+44 (0)20 4529 0549 |

|

Canaccord Genuity Limited – Nominated Adviser and Joint Broker Bobbie Hilliam Georgina McCooke

|

+44 (0)20 7523 8000 |

|

Jefferies International Limited – Financial Adviser and Joint Broker Paul Nicholls Max Jones |

+44 (0)20 7029 8000 |

Past performance is not a reliable indicator of future performance. Capital at risk.

1. The net trading profit of the Group after charging interest, before depreciation, amortisation, share-based payments relating to acquisitions, profits and losses on disposal of tangible fixed assets, net performance fees, net development gains and exceptional items

Gresham House

Specialist asset management

Gresham House

Specialist asset management