Francis Ireland, November 2021

Francis Ireland, November 2021

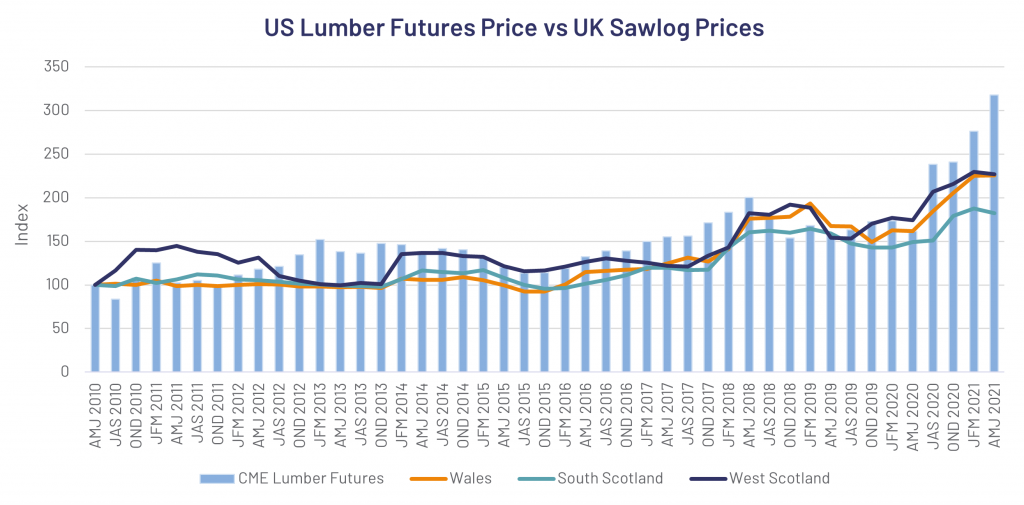

Lumber, or in the UK, sawnwood, has never been a regularly covered topic in the mainstream financial press until earlier this year; when Chicago Mercantile Exchange (CME) lumber futures rocketed to unprecedented highs (figure 1).

For a commodity with strong liquidity in an established trading venue, this meteoric rise dominated water-cooler talk for months. Specifically, what were the drivers of this spike, and, on this side of the pond, what would the implications be for UK sawnwood (post-sawmill) and sawlog prices.

Figure 1. Source: Investing.com. Basis: 04.01.2010 to 30.06.2021

The drivers are threefold:

⚠ Demand

???? Supply

???? Speculation

At the beginning of the pandemic, many US sawmills predicted a significant drop in wood demand and reacted accordingly by ceasing production.

Paradoxically, the pandemic only served to fuel demand for wood-based DIY projects and housebuilding for space-conscious Americans.

This expectation of a drop in demand by the saw mills, reflected not only the historic relationship between the economy and lumber demand, but also the structural supply issues dominating the American market.

mills, reflected not only the historic relationship between the economy and lumber demand, but also the structural supply issues dominating the American market.

For example, the fallout of the financial crisis was particularly relevant for the lumber industry, with industry output in 2009 down 43.6% from its pre-crisis peak.

More recently the unexpected peaking of demand was coupled with constrained supply, with climate change driven problems including pests and wildfires having a long-term effect in British Columbia, the largest supplier to US sawmills.

All of this means that long-term lumber capacity failed to keep up with demand and the result – a massive hike in pricing.

Much like any heightened period of market stress, speculation plays a large role. This role has increased even further in recent years through the emergence of retail trading-fuelled volatility in public markets.

The extent of the pullback in lumber futures prices since the peak earlier this year, considering the persisting structural supply problems and relatively small drop off in demand, serves to highlight the significant role that speculators played in this market volatility.

The UK imports 81% of its wood requirements

Whilst the plight of lumber futures is now mainstream news, much less transparent is the relationship between US lumber futures and UK sawnwood prices.

Given Gresham House’s status as the largest commercial forestry manager in the UK, we have access to a considerable wealth of live pricing data. Over the last 10 years we have harvested well over 7.5 million tonnes of timber, highlighting the unique window in which to examine this relationship.

Over the last ten years, Gresham House has harvested over 7.5m tonnes of timber

The graph in figure 2 details the price of US lumber futures on the right-hand side against green sawlog (recently cut) prices, on the left-hand side, in the most significant timber growing regions of the UK: South Scotland, the West Coast of Scotland, and Wales respectively.

At first glance, there appears to be an underlying trend between logs and lumber, with all three regions’ log prices following the ebbs and flows of US lumber futures prices. However, closer analysis of the correlations reveals differences. In fact, when analysing this correlation across varying time lags, it never exceeds 0.5, highlighting at the most, there is a relatively strong correlation, while at the least, there is little to no correlation between log prices and US lumber futures.

Interestingly, by lagging lumber futures to capture the idea that US lumber futures are leading indicators of UK log prices, correlation decreases, revealing that it is not a time lag that explains the low initial correlation.

Figure 2. Source: Gresham House. Basis: Q2 2010 to Q2 2021.

There is always a relationship between any raw material and its end-use products, where a deviation of this relationship should arm arbitrage players with significant incentives, which should balance any market. In this sense there is an elastic band effect, where end-use product prices will naturally fluctuate, but fluctuate within a price band against the raw material.

Despite this inherent underlying relationship, different factors will affect these separate markets, the extent to which is ultimately reflected in the correlation coefficient.

US lumber output was down 43.6% from pre-crisis peak to 2009

An understanding of the UK sawlog market and its underlying drivers helps to explain why these markets are more fractured than it may at first appear. Central to this is, the fact that the UK imports 81% of its wood requirements, highlighting the role global markets play in UK sawlog pricing.

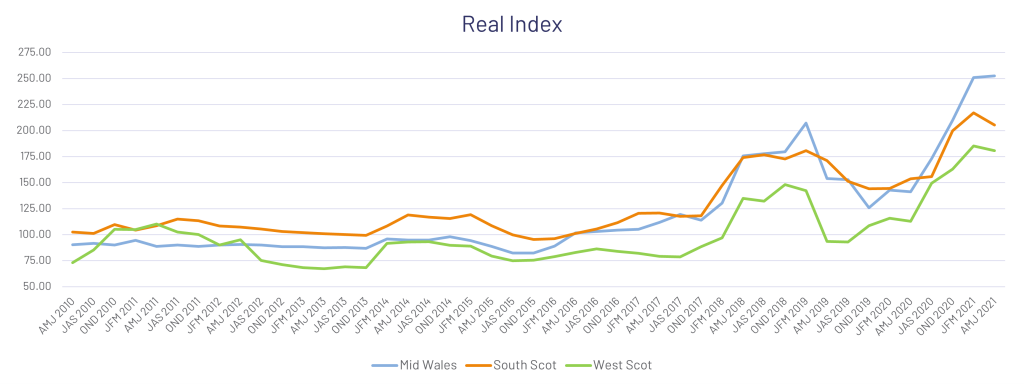

The strength of the pound plays a pivotal role in homegrown log prices. After the Brexit vote in 2016, sawlog prices increased as it became more expensive to purchase foreign logs, with sawmills increasingly turning to home grown logs (see figure 3). This also explains how forestry can act as a hedge against UK sterling, reflecting its attractiveness to UK investors seeking real asset protection against the UK business cycle.

A good example would be Sweden where the value of the Krona, or more accurately the price of Swedish sawnwood, has historically affected the UK sawlog market.

The US, on the other hand, is not traditionally a large importer of wood, and so currency but more specifically, established UK trade flows, will not affect US sawnwood prices.

Figure 3. Source: Gresham House. Basis: Q1 2010 to Q2 2021.

Finally, log supply to the UK and US markets are asymmetric because of climate, geography and trade.

The US market relies heavily on home grown timber as well as that from British Columbia, whilst the UK market relies on homegrown timber as well as timber from the EU. As such the structural supply dynamics are completely different between the two markets.

Gresham House manages over 136,000 hectares of UK Forests

Despite structural differences in the US and UK markets, both are likely to benefit from the underlying trends shaping timber demand.

Over the next 30 years, we expect global timber consumption to rise by an average of 3.1% per annum, driven by urbanisation, decarbonisation and housebuilding.

Globally, most countries have set targets to reduce carbon emissions to reach net zero by 2050. Timber will play a critical role in this transformation. Urbanisation and decarbonisation will lead to more new homes as well as cleaner low carbon intensity buildings built from timber. Wood will increasingly replace high carbon intensive steel and concrete.

The rising demand for timber is set against a constrained supply, due to the long rotation of the crop. This imbalance will likely see timber price increases over the medium to long term. Commercial forestry remains an excellent diversifying investment, uncorrelated to other asset classes, offering inflation protection.

Overall, while similar trends affect each market, namely, shifting attitudes towards sustainability driving demand, and climate change constraining supply, the UK sawlog market and the US lumber market are structurally different and relatively uncorrelated.

The swings and lows of the recent lumber futures frenzy should be treated with a healthy pinch of salt, the reality is that UK log prices are driven by real market participants buying and selling wood, not by retail traders in their newly erected wooden sheds!

Francis Ireland

Analyst, Forestry

The views expressed here are the author’s own at the date of publication (October 2021) and do not necessarily reflect those of Gresham House.

Past performance is not a reliable indicator of future performance.

When investing in forestry, your capital is at risk. Please ensure you read more about the risks involved.

Gresham House

Specialist asset management

Gresham House

Specialist asset management