Energy Transition investment

Supporting the shift from finite resources by investing in transformative technologies

Supporting the shift from finite resources by investing in transformative technologies

Investing in the Energy Transition with Gresham House

We focus on sustainable, transformative technologies that we believe offer the potential for strong financial returns, while supporting the transition to a more sustainable world.

We deploy capital into utility-scale battery energy storage – including two-hour and longer-duration systems, solar and wind assets, energy efficiency and electrification.

As global energy systems evolve, the transition to renewables and the technologies enabling it are reshaping power markets.

Want to keep up to date?

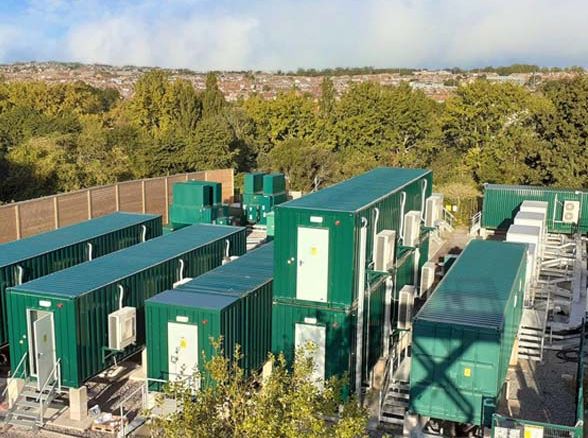

Gresham House is a top ten energy transition infrastructure platform and the largest operator of battery energy storage systems (BESS) in Europe1.

Through the January 2026 acquisition of SUSI Partners, Gresham House’s Energy Transition division has become one of Europe’s leading platforms dedicated to mid-market energy transition investments1. Anchored in Europe, with offices in London and Zurich, and supported by a growing platform in Asia based in Singapore, the team brings deep expertise and a longstanding track record across energy transition themes and risk-return profiles, investing across the capital stack from senior-secured credit to value-add equity.

1. Indefi, June 2025 based on 10-year fundraising in European-focused renewables funds by European GPs (excluding industrial-affiliated players) as of year-ending 2024.

Why invest in renewables and battery energy storage?

Our assets support the move to decarbonise electricity and to ‘electrify’ public infrastructure. Benefits can include:

- Material positive social and environmental impact

- Potential downside protection from substantial asset-backing

- Opportunity for attractive inflation-linked long-term cash flow yields

- Capital growth and returns with low correlation to the broader economy

The dynamics of the global energy market are changing rapidly

The transition to low-carbon energy is accelerating worldwide. Electricity demand is expected to more than double by 2050, while renewable generation must increase eight-fold to achieve net-zero ambitions. To balance this growth in intermittent supply, global battery energy storage capacity will need to expand sixty-fold.1

Europe is at the forefront of the energy transition, supported by ambitious decarbonisation targets, grid modernisation and the rapid electrification of transport and industry. Falling battery costs and accelerating deployment are driving energy storage growth. As renewables become a larger share of generation, energy storage has a vital role to play in stabilising markets, improving system flexibility and enhancing the resilience of evolving energy infrastructure.

1. IEA 2024; BloombergNEF 2024

Asia Energy Transition strategy

In the Far East, our Asia Energy Transition strategy is designed with the aim to capture Southeast Asia’s accelerating shift toward a lower-carbon economy, driven by digitalisation, urbanisation and supportive regulation. Concentrated on Malaysia, Indonesia, Vietnam, the Philippines and Thailand, the strategy aims to build on longstanding regional experience to invest across renewable generation, storage and emerging demand-side solutions, including electrification and energy services. The approach is underpinned by active ownership and robust environmental, social and compliance risk management from due diligence through to delivery.

In tandem with the growing penetration of renewables, we expect to see a significant increase in demand and need for battery energy storage.

Globally, battery storage capacity will need to expand around sixty-fold by 2050 to support the transition to net zero – equivalent to a 17% compound annual growth rate in installed capacity from 2023 to 2050.1

In the UK we currently have c.4.7GW installed battery energy storage capacity.2 In the next 2-3 years, to avoid significant imbalances on the electricity grid, this capacity needs to increase tenfold.

1. IEA 2024; BloombergNEF 2024

2. Modo Energy, 2024

Solar energy has become one of the world’s most established and rapidly deployed renewable technologies.

Globally, solar has grown from the smallest to the largest source of new electricity capacity in just 15 years, and now delivers some of the cheapest power ever recorded1. This remarkable growth underscores solar’s critical role in the global transition to low-carbon energy systems.

Solar assets are the most established renewable energy technology in the UK, based on capacity installed. Solar generation amounts to around 5.2% of electricity supply on an annual basis2 but during the summer months output meets over a third of our electricity demand.

Technical innovation has made solar among the most cost-competitive forms of generation, meaning new projects can now be economically attractive without reliance on government subsidies.

1. IRENA 2024; Bloomberg NEF 2024

2. Department for Energy Security & Net Zero, 2024

Worldwide, installed wind capacity has grown more than twenty-fold since 2000, making it a central pillar of clean electricity generation and a key driver of decarbonisation1.

In the UK, wind assets are the most established renewable energy technology based on the amount of power generated, accounting for around 29.5% of electricity supply on an annual basis.2 Given the UK’s plentiful wind resource, projects are economically attractive without a need for Government subsidy.

Internationally, wind remains one of the most compelling areas for renewable infrastructure investment – supported by proven technology, falling costs, and strong policy frameworks across Europe, North America, and other mature markets.

1. IRENA 2024; Bloomberg NEF 2024

2. Department for Energy Security & Net Zero, 2024

Key risks

- The value of an investment and the income from it is not guaranteed and may fall as well as rise. As your capital is at risk you may get back less than you originally invested

- Past performance is not a reliable indicator of future performance

How to invest in the Energy Transition

Investors can access Gresham House’s Energy Transition investment opportunities through Listed vehicles, Unregulated Collective Investment Schemes (UCIS) or co-investment. For more information, please contact:

| Institutions and investment consultants | Private investors |

Heather Fleming

|

Anthony Crosbie Dawson Director, Private Clients +44 (0)1451 843 096 a.crosbiedawson@greshamhouse.com |

In addition to our listed funds, the Gresham House Energy Transition investment team manages investment vehicles classed as unregulated collective investment schemes (UCIS). These are subject to restrictions on promotions to investors.

In order to receive information on these funds you must:

- Be an investment professional authorised to advise on UCIS; or

- Have completed a sustainability assessment (CFIF)* and been deemed by Gresham House as suitable and appropriate to invest in these funds due to being either a Certified High Net Worth Investor or a Self-Certified Sophisticated Investor; or

- Be a Certified Sophisticated Investor; or

- Be an Eligible Counterparty or Professional Client, as set out in the FCA Handbook.

* Client Financial Information Form

Direct investments

Gresham House offers investors access to direct investments in renewable energy assets, which are subject to restrictions on promotions to investors.

For more details, please contact: Anthony Crosbie Dawson +44 (0)1451 843 096 | a.crosbiedawson@greshamhouse.com

Please download our Terms of Business. By completing this form you grant Gresham House permission to act on your behalf in the acquisition of renewable energy assets.

Co-investments

For information on Sustainable Infrastructure co-investment opportunities with Gresham House, please contact:

Heather Fleming, Managing Director, Institutional Business +44 (0)20 3873 5908 | h.fleming@greshamhouse.com

Gresham House Energy Transition funds

Gresham House Energy Storage Fund plc (GRID)

Gresham House Energy Storage Fund plc owns a growing portfolio of utility-scale operational battery energy storage systems (BESS) located in Great Britain.

Gresham House Renewable Energy VCT 1 plc

Seeks to invest in a portfolio of unquoted companies that specialise in long-term renewable energy projects.

Gresham House Renewable Energy VCT 2 plc

As with VCT 1, seeks to invest in unquoted companies specialising in long-term renewable energy projects.

Investment team

Marco leads Gresham House’s Energy Transition division, spanning Equity, Credit, Asia, and Global BESS strategies. He joined Gresham House in January 2026 following its acquisition of SUSI Partners, where he served as CEO.

Marco had joined SUSI Partners in 2017 as Chief Investment Officer, directing global investment and asset management activities. He became Co-CEO in 2020 and assumed full leadership as CEO in 2023.

Before joining SUSI, Marco was a Senior Vice President at Brookfield Asset Management, where he was responsible for the European renewable energy investments team and led the strategy formulation, origination, and execution activities in this segment. Prior to that, he was a Principal in the Infrastructure and Private Equity team at Arcapita, a global alternative assets firm, after starting his career in M&A at Dresdner Kleinwort Wasserstein.

Energy Transition

Ben has been Managing Director and Head of the Gresham House Energy Transition division since November 2017.

He is the Fund Manager of Gresham House Energy Storage Fund plc and was, through 2020, also Fund Manager for the British Strategic Investment Fund (BSIF) strategy which grew AUM to £350mn under his leadership.

Ben started his fund management career at Lazard Asset Management in 1994 and worked there for nine years. He later founded Hazel Capital in April 2007, serving as Managing Partner and CIO and which became Gresham House Energy Transition on the acquisition of Hazel Capital’s business activities in November 2017.

Prior to founding Hazel Capital, he was a co-founder of Cantillon Capital, where he managed a US$1bn equity hedge fund focused on global technology, media and telecom.

Ben currently serves as a director of over 50, mostly project, companies.

He has 27 years of investment experience and holds a BEng in Mechanical Engineering from Imperial College.

Wymen leads Gresham House’s Asia strategy within the firm’s Energy Transition division. He joined Gresham House in January 2026 following its acquisition of SUSI Partners, where he served as Head of Asia.

Wymen had joined SUSI Partners in 2018 to develop and execute the firm’s Southeast Asia investment strategy across utility-scale renewables, distributed solar PV and energy-efficiency platforms, and other climate-aligned infrastructure solutions. In this role, he led the origination, structuring, and execution of multiple clean-energy platforms across Asia, spanning development, asset-management and exit execution.

Before joining SUSI, Wymen held senior roles in Asian infrastructure-focused funds including at Armstrong Asset Management and Maybank MEACP and previously worked in mid-market buyouts in the US. He brings more than 20 years of investment experience across private-equity, real assets, and cross-border transactions.

Richard leads Gresham House’s international equity strategy within the firm’s Energy Transition division. He joined Gresham House in January 2026 following its acquisition of SUSI Partners, where he served as Co-CIO.

Richard had joined SUSI Partners in 2020 to lead the firm’s dedicated energy storage strategy, took over management of the broader equity business in 2021, and in late 2023 was appointed Co-CIO. In this role, he was responsible for overall investment strategy formulation and execution as well as portfolio management of the firms’ Equity strategy.

Before joining SUSI, Richard was the Chief Financial Officer at Pivot Power and Senior Vice President, Distributed Energy & Onshore Renewables, at Macquarie Green Investment Group. Prior to that, he worked at the UK Department of Energy and Climate Change as well as JPMorgan.

Alexander leads Gresham House’s credit strategy within the firm’s Energy Transition division. He joined Gresham House in January 2026 following its acquisition of SUSI Partners, where he served as Co-CIO.

Alexander had joined SUSI in 2015 to further develop the firm’s asset-backed credit financing solutions, was responsible for SUSI’s Credit business from 2017 onwards, and in late 2023 was promoted to Co-CIO. In this role, he was responsible for overall investment strategy formulation and execution as well as portfolio management of SUSI Partners’ credit strategy.

Before joining SUSI, Alexander worked for private equity fund manager Perseus L.L.C. and in the utility/public sector department of the investment bank at Sal. Oppenheim Jr. & Cie.

Filinto is Managing Director of Gresham House’s Energy Transition division since April 2025. He is also the Fund Manager for Gresham House Global Energy Storage Fund.

Prior to Gresham House, Filinto was the Managing Director of Sonnet, iCON Infrastructure’s Iberian investment platform, which focused on energy and infrastructure. Before, Filinto was Managing Director and Head of NextPower III, a global renewables investment fund, at NextEnergy Capital.

With almost 20 years of experience in energy transition, Filinto held several senior management, business development, asset management, and investment positions with cross-sector and international exposure in markets such as Europe, North America, Latam, and India.

Filinto holds a Master in Finance degree (Catolica-Lisbon School of Business and Economics) and a Bachelor’s in Management (Moderna University).

Lefteris joined Gresham House in March 2023 and is responsible for sourcing and executing energy storage investment opportunities.

Lefteris has over 15 years of experience in infrastructure and energy transition investments. He has held principal investment and advisory roles with large institutions such as Columbia Threadneedle Investments, National Pension Service of South Korea (NPS), Macquarie, and Société Générale, as well as corporate and business development roles with Libra Group and Maple Power.

He is a seasoned investor who has worked across a range of sectors including solar PV, onshore and offshore wind, anaerobic digestion, and hydroelectric power.

Lefteris holds a MSc in Finance from Imperial College London and a BSc in Management Science from Athens University of Economics and Business.

Rupert has been the Managing Director of Gresham House Asset Management Ltd since September 2015. He is a member of the Group Management and Investment Committees.

Rupert has a proven track record of delivering significant value to shareholders and has over 32 years’ experience in asset management, private banking and wealth management, focusing on product innovation, investment management, business development, banking and wealth structuring.

Before joining Gresham House, Rupert was CEO and CIO of Schroders (UK) Private Bank for 11 years, and spent 17 years at Rothschild, where latterly he was Head of Private Clients for Rothschild Asset Management.

Wayne is an Investment Director in our Energy Transition division and has 29 years of technical, commercial, stakeholder and general management experience in the energy sector.

Before joining Gresham House, Wayne served as COO at FIM Services Ltd, and prior to that Wayne was an Onshore Wind Development and Construction Director for RWE Innogy.

He has overseen the construction of 17 wind farms (~400MW) and the sale of 12 wind farms (~200MW) over the past 12 years. He has also represented the industry on aviation matters as a director and vice chair of the Aviation Investment Fund Company Ltd.

Wayne is a Chartered Engineer and has a PhD in Engineering from the University of Sheffield. Wayne is also a registered adviser with the Financial Conduct Authority.

Matt joined Gresham House in September 2025 as a Project Manager in the Energy Transition team, working on the construction of the Carno III Wind Farm.

Prior to joining Gresham House, Matt worked in the wind sector from December 2023, acting as an Owner’s Engineer and consulting on a range of onshore wind projects through development, construction and repowering.

Matt holds a Master’s degree in Mechanical Engineering from the University of Bristol and is a CFA Level I holder.

Associate Director with responsibility for the fund management of Gresham House Solar Distribution LLP and Gresham House Secure Income Renewable Energy & Storage LP. In this role, he oversees renewable energy and storage investment strategies, including capital raising, structuring, origination, portfolio performance, asset management coordination, and investor reporting. James has been with Gresham House since August 2017.

He progressed from Analyst to Associate Director during his tenure at the firm, developing extensive experience across renewable energy investment analysis, portfolio management, and fund operations.

Prior to joining Gresham House, he held roles at Computershare, RWE and J.P. Morgan, gaining experience across the energy and equities sectors, with a focus on financial analysis, capital markets and energy market dynamics.

He has 13 years of experience in financial services and holds a degree in Business Administration and has completed the Investment Management Certificate (IMC) and CFA Level I.

His career has focused on renewable energy and infrastructure investment, with specialist expertise in the structuring, management and oversight of income-generating energy assets.

Stephanie joined Gresham House’s Energy Transition division as part of the Commercial Asset Management team in August 2025, having previously completed an internship.

Prior to joining Gresham House, Stephanie worked at LCP Delta, writing market reports and advising leading industry players on commercial strategy across various energy transition sectors, including EV charging infrastructure, solar and battery storage. She also gained experience at Circulor, a cleantech start-up, as part of the Product team, where she focused on developing the SaaS platform providing a supply chain traceability solution for materials in renewable energy technologies.

Stephanie holds a Master’s degree in Climate Change, Management and Finance from Imperial College Business School and a Bachelor’s degree in Philosophy, Politics and Economics from King’s College London.

Based in our Oxford office, Suzy works in the asset management team for our renewables portfolio. Suzy has been involved in the construction, financing and operational management of over 100 MW of onshore wind and solar assets on behalf of investors.

Previously, Suzy worked as a Senior Investment Analyst for Sun Life Financial of Canada and Lincoln Financial Group.

Suzy holds a first-class BSc (Hons) in Mathematics and Statistics from the University of Bath.

Marcello Balasini is the Commercial Director within the Energy Transition division’s Portfolio Services team. He manages a large portfolio of utility-scale wind, solar and storage assets and is responsible for financial performance, capital investment planning and the delivery of contractual obligations under PPAs, financing arrangements and key service contracts. He became part of Gresham House in January 2026 following its acquisition of SUSI Partners, which he had joined in early 2019.

Prior to this, Marcello worked as an Asset Manager at TerraForm Power / SunEdison in San Francisco, overseeing a 550MW portfolio of utility-scale wind assets across the United States. Earlier in his career, he held senior roles at First Climate in Zurich and Beijing and at Ernst & Young in Rome, focusing on renewable energy, carbon markets and climate change strategy for energy and industrial clients.

Marcello has over 20 years of experience in renewable energy, carbon markets and infrastructure asset management and holds a Master of Advanced Studies in Management, Technology and Economics from ETH Zürich and a Master of Science in Environmental Engineering from Politecnico di Milano.

Lorenzo is a Technical Manager within the Energy Transition’s Portfolio Services team. He works with portfolio companies and local teams to support asset performance, operational effectiveness, and consistent technical delivery. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2017.

He began his career through General Electric’s graduate programme and later joined Engie, where he contributed to the development of solar PV and battery energy storage projects in Italy across commercial and utility scale segments. His focus included project execution, asset optimisation, and support to emerging business activities.

Lorenzo has over six years of experience in renewable energy across engineering, project management, and asset operations. He holds a BSc in Industrial Engineering and an MSc in Renewable Energy Engineering from Politecnico di Milanonand completed a research exchange at KTH Royal Institute of Technology in Stockholm.

In his free time, he enjoys alpinism and played semi-professional basketball for more than ten years.

Pedro is an ESG and sustainability specialist at Gresham House with a focus on the firm’s Energy Transition division. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2024.

Prior to this, Pedro worked at Zurich Insurance in the responsible investment team as a working student. He supported impact investing, ESG integration and climate action investment work. His work focused on impact measurement and reporting for fixed income, infrastructure and private market assets, as well as ESG analysis of internal and external asset managers. He also led projects to digitalise impact measurement processes and helped develop internal responsible investment training.

Pedro has over three years of experience in sustainable investing. He holds a Master of Science in Business Administration from the Lucerne University of Applied Sciences and a Bachelor of Arts in Business Administration from Karel de Grote University of Applied Sciences. He also holds the CFA Certificate in ESG Investing and is a Certified Expert in Climate and Renewable Energy Finance from the Frankfurt School of Finance and Management.

In addition, Pedro is fluent in four languages and has an entrepreneurial background from running his own personal training business.

Didzis is an Investment Vice President within Gresham House’s Energy Transition division, focusing on origination and managing investments for the division’s credit strategy. He joined Gresham House in January 2026 following its acquisition of SUSI Partners.

Didzis had joined SUSI Partners in 2025 and played a key role in the firm’s take-over of portfolio management duties on behalf of the European Energy Efficiency Fund. His prior experience includes investment management roles at DWS, a boutique AIFM and a family office, as well as audit and transaction services roles at PwC.

Didzis holds an Executive MBA from London Business School, is a Fellow of the ACCA, and holds bachelor’s degrees from Oxford Brookes University and the BA School of Business and Finance.

Javier is an Investment Associate within Gresham House’s Energy Transition division, where he supports the origination and execution of energy and infrastructure investment opportunities for the division’s international equity strategy. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2021.

Prior to this, Javier worked as an Investment Analyst at Everwood Capital. He has around six years’ experience in private equity, M&A and project finance for energy transition assets across Europe and Latin America. His transaction experience spans battery storage, onshore wind, solar PV and EV-charging infrastructure, covering acquisitions, financings and portfolio exits.

Javier holds MSc and BSc degrees in Industrial Engineering and a Bachelor in Business Administration from Universidad Pontificia de Comillas (ICAI-ICADE). Upon graduating, he also received scholarships to study at TU Delft in the Netherlands and Universiti Teknologi PETRONAS in Malaysia

Francesco is an Investment Associate within Gresham House’s Energy Transition division, where he supports deal origination and execution for the division’s credit strategy. He focuses on financial modelling, due diligence, and execution of new investments in the energy transition and energy efficiency sectors. His experience includes investments in renewables, high-efficiency industrial cogeneration, deep energy retrofits, and EV charging projects. He joined Gresham House in 2025 following its acquisition of SUSI Partners, which he had joined in 2021.

Previously, he worked at Alantra as part of a pan-European team advising on structured finance and distressed debt transactions. Earlier in his career, he held roles at other international financial institutions in equity capital markets and equity research. Overall, he has more than eight years of experience in the financial industry.

Francesco holds an MSc in Business Administration and Law, and a BSc in Business Administration and Management from Bocconi University.

Roberto is an Investment Associate within Gresham House’s Energy Transition division, focusing investment origination, execution and portfolio value creation for the division’s international equity strategy. He joined Gresham House in January 2026 following its acquisition of SUSI Partners.

Roberto had joined SUSI Partners in January 2021 and held roles across the firm’s Portfolio Services and Equity Investment teams. After nearly three years as an Engineering Analyst within Portfolio Services, he completed an MBA at INSEAD before returning to SUSI Partners in September 2024 as part of the Equity Investment team. Prior to joining the firm, he worked in the UAE as a PV and BESS project engineer and in Switzerland as an energy efficiency and acoustics engineer.

He brings six years of experience in the energy transition sector, including four years in the financial industry. Roberto holds a BSc in Energy Engineering from the Polytechnic University of Turin, an MSc in Energy Management and Sustainability from EPFL and an MBA from INSEAD. He is also a CFA charter holder.

During his Master’s studies, Roberto spent one year at the Wind Engineering and Renewable Energy Laboratory at EPFL, and six months at the Wind and Energy Systems Laboratory at DTU Denmark, where he completed his thesis. He is the first author of a scientific publication on wind farm optimisation in complex terrain, published in Applied Energy.

James is an Associate Director at Gresham House. James moved to the Energy Transition team in 2019 after joining Gresham House in 2018 as part of Gresham House Ventures, having previously been at Livingbridge since 2016.

James is the Assistant Fund Manager for Gresham House Energy Storage Fund plc.

He is an experienced financial modeller and investment professional and his current role covers a broad range of work across fund management and new investments, primarily focused on energy storage and renewables. Prior to joining the Energy Transition team, he worked as an Analyst covering mostly early-stage companies in the Venture Capital and Equity Fund vehicles as part of Gresham House Ventures. This role provided experience with investment decisions across a variety of markets as well as exposure to growth companies and management of quoted investment vehicles.

His career started in TMT audit at EY where he spent three years and qualified as a chartered accountant.

James holds a first-class Master’s degree in Mathematics from Durham University.

Tommaso is an Investment Director within Gresham House’s Energy Transition division, where he is contributing to the development and execution of the firm’s credit investment strategy. He serves as Chairman of the Board in four portfolio companies of the European Energy Efficiency Fund, an investment vehicle funded by the European Union. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2016.

Prior to joining SUSI Partners, Tommaso was part of the M&A team of Edison SpA (EDF Group). Tommaso has 12 years of relevant experience in the energy industry and holds a Bachelor’s Degree in environmental engineering from Politecnico di Milano and a Master Degree in Green Management, Energy and Corporate Social Responsibility from Bocconi University.

Fernando joined Gresham House in May 2021 and is focused on the design, development and deployment of processes and procedures that allow the Energy Transition team to increase MW under management each year.

Fernando has 15 years’ experience in the Renewable Energy sector, specifically in the Solar PV industry. Prior to Gresham House, he was Global Head of Technical for a 2.2GW Solar PV portfolio at WiseEnergy (Next Energy Group company), focused on the operation of their Solar PV assets and increasing overall revenues.

Fernando holds a BEng in Industrial Engineering from the University of Castilla-La Mancha and an MSc in Energy and Sustainability with Electrical Power Engineering from the University of Southampton. He also holds a Global Executive MBA from IESE Business School, Barcelona.

Paul heads asset management efforts for the Energy Transition division’s Asia business. He is responsible for overseeing the technical and commercial performance of renewable energy investments across Asia, including solar, wind, hydro, battery storage and energy efficiency assets. He leads project execution, asset optimisation, contractor and partner oversight, ESG compliance, and provides governance support through board roles within platform companies. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2021.

Paul brings over 20 years of experience in the renewable energy and power sectors. Prior to joining SUSI Partners, he held senior roles at PETRONAS New Energy, Armstrong Asset Management, SunEdison, juwi Renewable Energies, and Vestas, where he managed development, EPC execution, technical due diligence, operations, and large-scale grid and power plant projects across Southeast Asia and the broader Asia Pacific.

He holds a Master of Science in Management of Technology from the National University of Singapore, a Bachelor of Electrical & Electronic Engineering (Hons) from Nanyang Technological University, with an Accredited Diploma of Directorship from SID-SMU Singapore.

Hugo joined Gresham House’s Energy Transition Investment team following several years working in renewable energy development.

Hugo is pursuing a CFA accreditation and has passed his level 1 exam, scoring above the 90th percentile of candidates.

Hugo holds a first in Civil Engineering from the University of Exeter.

Siaw Fun is the ESG Manager for Gresham House’s Asia business. She joined Gresham House in January 2026 following its acquisition of SUSI Partners.

Siaw Fund had joined SUSI Partners in 2024 to lead ESG efforts for the firm’s Southeast Asia-focused strategy. She is an ESG professional with more than 13 years of practical experience in the conduct of environmental and social due diligence, impact assessments, implementation and monitoring of environmental and social management systems focused on the energy sector in Asia.

Prior to joining SUSI, Siaw Fun was E&S Manager at EDF HQ Singapore, a leading global electric utility company where she was responsible for developing ESG governance procedures, screening for E&S risks, and implementing E&S policies across projects in Asia. She has also previously worked at Ramboll Environ where she gained regional power development ESG consulting experience.

Letizia is an Investment Director within Gresham House’s Energy Transition division, where she is contributing to the development and execution of the firm’s credit investment strategy. She serves as Chairman of the Board in a portfolio company of the European Energy Efficiency Fund, an investment vehicle funded by the European Union. She became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which she had joined in 2018.

Prior to joining SUSI Partners AG, Letizia worked in the M&A division of the investment bank Nomura. She has 11 years of investment experience and holds a MSc in Accounting, Financial Management and Control from Bocconi University.

François is an Investment Associate within Gresham House’s Energy Transition division, where he supports deal origination and execution for the division’s credit strategy. He joined Gresham House in 2025 following its acquisition of SUSI Partners, which he had joined in 2021.

Prior to joining SUSI Partners, François completed internships in the Valuation & Business Modelling team at Rocket Internet and in the Corporate Clients Advisory division of UBS, gaining strong experience in credit risk analysis and financial modelling.

François has five years’ experience in the financial industry. He holds a Master’s degree in Banking and Finance and a Bachelor’s degree in Economics from the University of St. Gallen (HSG), both awarded with great distinction.

Gianfranco is a Senior Finance Manager within the Energy Transition division’s Portfolio Services team. He focuses on financial management, reporting, and valuation of portfolio companies across the division’s international equity funds. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2019.

Prior to this, he worked as a Financial Manager at DITH. Gianfranco holds a Master’s degree in Accounting, Financial Management and Control from Bocconi University and a Bachelor’s degree in Economics from LUISS University.

Xavier is an Investment Vice President within Gresham House’s Energy Transition division, where he is responsible for sourcing, executing and managing private infrastructure investments for the division’s international equity strategy. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2021.

He brings close to ten years of experience across private equity investing, debt financing and M&A, with a strong track record in infrastructure and energy transition. At SUSI Partners, he led full-cycle investments in majority-owned platforms, including due diligence, structuring, capital raising, M&A execution and operational value creation initiatives. Xavier previously held investment and advisory roles at BNP Paribas CIB, LFPI (former private equity arm of Lazard) and Edmond de Rothschild, working in the UK, Switzerland and France.

Xavier is an alumnus of IMD Business School, and holds an MSc in Management (Grande École) from Grenoble École de Management. He speaks English, French and German.

Ben Fletcher

Associate Technical Asset Manager

Ellen joined Gresham House in January 2025 and supports the execution of energy storage investment opportunities.

Ellen has four years experience in M&A, structured finance, and project finance advisory for renewable energy assets and companies in both North America and Europe. Ellen’s c.$500M of transaction experience spans residential and utility scale solar, co-located and standalone storage, as well as wind.

Ellen holds a Bachelor of Science in Education and Social Policy from Northwestern University, with dual majors in Environmental Science and Human Development. Upon graduating, Ellen received a Fulbright research fellowship to study stakeholder engagement with renewable energy systems on the islands of Tilos and Sifnos in Greece.

Gelasius is an Asset Management Analyst for the Energy Transition division’s Asia business. He supports projects in Southeast Asia from both technical and commercial perspectives and ensuring deployments are effectively used to advance project outcomes. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2025.

Gelasius has four years of experience in renewable energy and construction. Gelasius began his career at Sinotech Engineering Consultants in Taiwan as an Engineer, working on substation design and supporting hydro project management. He later joined K2 Management Taiwan as a Project Manager, and after its acquisition by Ramboll, continued as a Senior Consultant. In this period, he managed onshore wind project development, built an internal project finance tool, conducted due diligence, acted as owner’s engineer, and led technical and commercial proposal preparation.

Gelasius holds a Bachelor of Science in Civil Engineering from Bandung Institute Technology, and Master of Science in Structural Engineering from National Taiwan University. He also holds the FMVA certification from CFI and has completed project finance modelling training with Pivotal180.

Marina is responsible for commercial portfolio management aspects within the Energy Transition division’s Portfolio Services team. She oversees the performance and operational excellence of the firm’s energy-transition assets and portfolio companies and works closely with the local technical, operational and commercial teams to ensure strong performance optimisation, robust risk management, and long-term value creation across the portfolio. She became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2022.

Prior to this, Marina served as Project Manager for Carbon Assets Management at First Climate, where she led the development, monitoring, and optimisation of international carbon reduction and climate-impact projects. Earlier in her career, Marina spent more than six years at Gas Natural Fenosa in various senior roles and held several roles in the energy industry, building expertise in gas supply.

With over 20 years of experience in the energy sector – including natural gas operations, renewable energy markets, asset management, and operational excellence – Marina brings extensive expertise in market analysis, portfolio strategy, and asset performance improvement. She holds an Bachelor in Industrial Engineering degree and a MSc. in Energy from the Universidad Politécnica of Madrid, followed by an additional MSc. in Energy Engineering from the same institution.

Carole oversees Gresham House’s renewable assets portfolio and acts as Fund Manager for one of the wind funds.

Carole joined Gresham House as part of the FIM Services Ltd integration, and has been involved in the origination, financing, construction and management of all of the previously FIM-branded renewable assets.

Prior to joining FIM, Carole worked across several sectors including technology, software and travel as a Finance and Operations Director following qualification as a Chartered Management Accountant.

Harry is an Investment Manager in Gresham House’s Energy Transition team. He joined the firm in April 2023 as an Analyst and has progressed to Investment Manager as his responsibility across investment execution has grown.

Harry works within the fund management team for GRID plc, focusing on investment origination and transaction execution for battery storage assets. He has played key roles in deploying capital through fund investments, as well as helping deliver both equity raise activity and debt financing workstreams.

Alongside transactions, Harry assists with quarterly fund valuations and the preparation of Investment Committee and Board materials. He also engages with market and policy developments, helping shape the firm’s response to relevant industry developments and public consultations.

Prior to joining Gresham House, Harry spent three years at Grant Thornton specialising in TMT audit, qualifying as an ICAEW ACA chartered accountant with first-time passes. He holds a First-Class degree in Chemistry from New College, Oxford, where he was an Academic Scholar, and the CFA UK Investment Management Certificate (IMC).

Chloe joined Gresham House in July 2019, having spent over three years in infrastructure operations at Oxford Capital.

Prior to Oxford Capital, she was Acquisitions Manager at Inazin and a Project Officer at TRW, a ZF Group company.

She holds a BSc (Hons) in Zoology from the University of Nottingham and an MBA from RAC, Cirencester.

Fabian co-leads investment activities and acts as a member of the investment committee for Gresham House’s credit strategies within the firm’s Energy Transition division. He joined Gresham House in January 2026 following its acquisition of SUSI Partners.

Fabian worked at SUSI Partners from 2015 to 2025 where he was responsible for executing infrastructure credit investments and significantly contributed to growing the firm’s credit platform. Prior to joining SUSI Partners, he held several M&A roles with UniCredit`s investment banking division and the corporate finance advisory firm Oaklins with a focus on energy and infrastructure transactions.

He has more than 16 years of experience in the investment industry and holds a MSc in International Finance from Leeds University Business School.

Nicolas is a Finance Manager within the Energy Transition division’s Portfolio Services team, focusing on portfolio companies across the division’s international equity funds. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2021.

Prior to this, he worked for Ludwig & Co. GmbH, focusing on M&A and financial restructuring. He started his career with several internships in finance-related jobs at PRETTL group automotive, Alantra / N+1 and Banco Santander CIB.

Nicolas has 8 years of experience in finance-related jobs and Bachelor of Science (double degree) in International Management at ESB Reutlingen, Germany and Universidad Pontificia Comillas (ICADE) in Madrid, Spain. He is fluent in 5 languages and finisher of several long-distance triathlons and marathons.

Wesley is a Vice President within Gresham House’s Energy Transition division. He is involved across origination, assessment and execution of investment opportunities in the energy transition space focused on the Southeast Asia region. He works closely with platform partners and supports various portfolio management activities across invested platforms. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2022.

His previous experience includes roles in project finance and advisory, leveraged finance and infrastructure private equity at Sumitomo Mitsui Banking Corporation.

Wesley has more than 6 years of experience in the financial industry and holds a double honours degree in Bachelor of Accountancy and Business (Banking and Finance) from Nanyang Technological University, Singapore.

Ismael is an Investment Vice President within Gresham House’s Energy Transition division, where he is focused on the division’s international equity strategy. In addition to his core investment responsibilities, Ismael serves as a director on the boards of several portfolio companies in Chile and the United States. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2021.

Prior to this, Ismael worked in the corporate development team at Siemens Gamesa, where he structured and executed strategic investments, divestments, and partnerships across global business units. He began his career in investment banking at DC Advisory, supporting M&A transactions in the Iberian market.

He has over eight years of experience in the financial industry. Ismael holds an MSc in Finance from Carlos III University of Madrid and a BSc in Aerospace Engineering from Universidad Politécnica de Madrid. He is also a CFA charter holder.

Jacopo is a Financial and Data Analyst at Gresham House with a focus on the firm’s Energy Transition division. He supports transaction evaluation, financial modelling and portfolio analytics. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2025.

Prior to this, Jacopo gained experience through internships in private markets at LGT Bank and in strategy consulting at SprintlyWorks. He holds a MA in Banking and Finance from the University of St. Gallen, a MSc in Finance from Esade Business School, and a BSc in Economics and Finance from Bocconi University. He was also recognised as a global finalist in the Kellogg-Morgan Stanley Sustainable Investing Challenge for work on an innovative blue-carbon investment structure.

Arnaud manages credit investments within Gresham House’s Energy Transition division, focusing on financial analysis and portfolio monitoring. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2022.

Prior to this, Arnaud worked in the structured finance and syndicated loans department of Bank of China in Luxembourg, carrying out credit analysis of leveraged debt financing transactions in the utilities and energy sector. He started his career in wealth management and private banking through various internships in Shanghai and Brussels.

Arnaud has more than 5 years of experience in the finance industry and holds a BBA in Financial Management from the Fudan University in Shanghai. He is fluent in French, English and Mandarin, having completed his BBA in a Chinese-taught program.

William is an Investment Associate within Gresham House’s Energy Transition division, focusing investment origination, execution and portfolio value creation for the division’s international equity strategy. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2023.

Prior to this, William worked at Energy Infrastructure Partners in Zurich, the European Bank for Reconstruction and Development in London, and Kommunalkredit in Vienna, gaining exposure to both equity and debt investments across energy and broader infrastructure sectors. He holds a BSc in International Business from the University of Groningen and a double degree MSc in Finance from Bocconi University and the Rotterdam School of Management.

Maxime heads the finance function within the Energy Transition division’s Portfolio Services team, focusing on portfolio companies across the division’s international equity funds. He joined Gresham House in January 2026 following the acquisition of SUSI Partners, which he had joined in early 2025.

Prior to this, he held a range of senior finance and investment roles, including deputy CFO of a UK-based metering company and investment team positions at ICG and EDF Invest infrastructure funds. He started his career as a banker at Natixis CIB. Maxime is a graduate of HEC Montréal and holds both the CFA and FRM designations.

Luke is a Vice President within Gresham House’s Energy Transition division. He is managing the full lifecycle of energy transition infrastructure investments in Asia, from origination, structuring, execution, portfolio management, to exit planning. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2021.

His responsibilities build on a solid foundation in project finance, cross-border mergers and acquisitions, and structured finance gained at DBS Bank, Singapore-based boutique advisory firm Pickering Pacific, and global energy trader Trafigura.

He has 10 years of experience in the financial industry and holds a double degree in Bachelor of Accountancy and Bachelor of Business Management from the Singapore Management University, graduating Summa Cum Laude.

Owen joined Gresham House in October 2024 as a Project Development Manager. He is responsible for ensuring our portfolio of storage and renewable projects in development are at an excellent standard, ready for investment and construction.

Prior to Gresham House, Owen worked as a Project Manager at EDF Renewables where he was responsible for the development of standalone BESS and PV/BESS hybrid projects in GB. Before this, he worked as an Energy Storage Analyst at ib Vogt GmbH developing an origination pipeline of BESS projects across 7 global markets. With over three years of experience in the energy storage sector, Owen has a strong understanding of end-to-end project development and what it takes to produce high-quality renewable infrastructure investments.

Owen holds a BEng in Mechanical Engineering from the University of Birmingham and an MSc in Sustainable Energy Futures from Imperial College London.

Russell is an Investment Vice President within Gresham House’s Energy Transition division. He is managing the full lifecycle of energy transition infrastructure investments in Asia, from origination, structuring, execution, portfolio management, to exit planning. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2018.

His responsibilities build on fundraising and strategic management at a high growth tech start up, and prior to that, a solid foundation in cross border financial advisory and mergers and acquisitions gained at Evercore.

He has 9 years of experience in the financial sector and holds a degree in Bachelor of Business Management from the Singapore Management University.

Matias is an Investment Director within Gresham House’s Energy Transition division, where he is involved in the execution, management, and divestment of investments for the division’s international equity strategy. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2023.

Prior to this, he worked in BlackRock’s infrastructure group. Matias holds a Master’s degree in Finance from Nova School of Business and Economics.

Gergely leads credit asset management efforts within Gresham House’s Energy Transition division. He is responsible for post-closing management of energy-transition credit investments, portfolio performance monitoring, covenant and contractual oversight, investor reporting, valuation and supporting intensive-care situations in close coordination with the investment team. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2022.

Prior to this, Gergely worked in corporate finance advisory at Deloitte Luxembourg, focusing on infrastructure clients and private equity investors. His experience includes valuation and valuation review work, transaction support, and advising on complex infrastructure assets across energy transition and essential services sectors.

Overall, Gergely brings over 15 years of experience across various corporate finance areas – including valuation, M&A and financial due diligence – gained through both consulting roles and in-house M&A functions. More than a decade of his career has been dedicated to specialised work in energy infrastructure, covering mainly renewables, energy-efficiency and transition projects. He holds a Master’s degree in Corporate Finance from Corvinus University of Budapest (Hungary).

Antoine is an Investment Associate within Gresham House’s Energy Transition division, where he executes transactions and supports the management of portfolio companies for the division’s international equity strategy. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2023.

Prior to this, Antoine was a Senior Financial Consultant at H3P Financial Advisory, advising on project finance transactions in the infrastructure, energy and telecom sectors. He began his career at Mantu as a Corporate Financial Analyst after gaining infrastructure investment experience at Ardian.

Antoine has eight years of experience in equity investments, project finance and infrastructure M&A across Europe and the US. He holds a Master’s degree in Administrative Studies in Financial Economics from Boston University and a Master’s degree in Corporate Finance from Audencia Business School. He is fluent in English, French and Spanish.

Leah joined the Energy Transition team in September 2025 as a Technical Asset Manager.

She brings over seven years of experience in the operations and maintenance of renewable energy assets, with a particular focus on solar PV. Leah has successfully managed portfolios exceeding 1.2 GW, ensuring efficient performance and long-term value creation.

She holds a BA (Hons) in Geography from the University of Brighton.

Raphaela leads Gresham House’s sustainability agenda across its equity and credit strategies, partnering closely with investment and asset management teams to embed ESG considerations throughout the investment lifecycle. She aligns sustainability priorities with financial performance, translating ESG commitments into practical investment decisions that strengthen risk management and long-term value creation. She joined Gresham House in January 2026 following its acquisition of SUSI Partners.

Raphaela had joined SUSI Partners’ investment team in 2017 and later took on the responsibility of establishing and systematically integrating the ESG and Sustainability function at the firm. Earlier in her career, she built a foundation in renewable energy and infrastructure through roles in M&A and corporate finance at D.CT Deutsche Cleantech and structured finance at Deutsche Bank, and began her career at PwC.

She has additional postgraduate training in Finance, including a CAS in Sustainable Finance, and holds a BA in International Management.

Ana joined Gresham House in September 2022 and is responsible for implementing the EPCM structure and delivering the Energy Transition team’s project pipeline.

Ana is a multi-skilled professional with 12 years of experience delivering innovative, award-winning renewable energy projects in the UK.

Previously, Ana helped to establish quality management, project delivery, and commercial project functions at GRIDSERVE Sustainable Energy. She also successfully delivered the UK’s first Electric Forecourt and subsidy-free solar and battery storage hybrid projects with bi-facial panels and tracking technology. Before joining GRIDSERVE, Ana was part of the BELECTRIC projects team building utility-scale solar farms.

Lambis is an Investment Analyst within Gresham House’s Energy Transition division, focusing on the execution of bespoke financing solutions for energy transition and efficiency projects across Europe for the division’s credit strategy. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2024.

Prior to this, Lambis was an Analyst in corporate strategy and M&A at DWS Group, where he worked on multiple M&A transactions and various strategic initiatives for the group across the organisation. Earlier experience includes roles with DC Advisory (Infrastructure Investment Banking) and Ardian (Private Equity Secondaries & Primaries).

Lambis holds an MSc in International Finance from HEC Paris and a BSc in Business Administration from the Free University of Berlin.

Kentaro is an Analyst within Gresham House’s Energy Transition division. He is involved in origination, assessment and execution of energy transition infrastructure investments with a focus on renewable energy, energy efficiency and energy storage solutions across Southeast Asia. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2024.

Prior to this, Kentaro worked in PricewaterhouseCoopers’ deals advisory team where he focused on valuations and infrastructure advisory transactions across the infrastructure and renewable energy sector.

He has over 4 years of experience in financial services and holds a Bachelor of Accountancy (Hons) from Nanyang Technological University.

Carles leads the risk management function for Europe. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2020.

With 30 years of experience, Carles has performed different underwriting and risk management roles within the financial services industry at companies such as ABB Financial Services or Intrum Justitia Debt Finance.

Carles holds a BBA & MBA from ESADE business school in Barcelona and has obtained CFA and CAIA charter holder designations.

Marco is the Technical Director within the Energy Transition division’s Portfolio Services team. He oversees portfolio management, construction monitoring, technical risk control, and portfolio-wide procurement strategies. He became part of the Gresham House team in January 2026 following its acquisition of SUSI Partners, which he had joined in 2017.

Prior to this, he was Head of Engineering and Construction Italy at EDP Renewables (2009–2017), Business Development Manager at Co-Ver Energy Holding (2006–2009), and began his career as Engine Specialist at AgustaWestland Helicopters (2002–2006).

Marco has a proven track record in managing complex projects, with over 20 years of professional experience in the energy and aerospace sectors. He holds a Master of Science in Aerospace Engineering from the Politecnico di Milano, complemented by the Finmeccanica Master in General Management.

Hans heads the Energy Transition division’s Portfolio Services team. He leads a team of experts covering technical, commercial, strategic and financial operations for the division’s international equity funds. He also contributes to strategic direction and value creation through board roles in assets and portfolio companies. He joined Gresham House in January 2026 following its acquisition of SUSI Partners.

Hans had joined SUSI Partners in 2015 and served in investment and portfolio management roles across the firm’s energy transition infrastructure equity products. He has over 18 years of experience in M&A work with a proven track record across the full investment lifecycle including acquisitions, operations and exits primarily in energy infrastructure assets and companies across global OECD markets. Prior to his investment career, he worked as an M&A and finance lawyer with business law firm Baker McKenzie in Switzerland.

Hans holds an MBA from the University of Chicago’s Booth School of Business and a Master in Laws from the University of Fribourg in Switzerland, and has completed the CAIA program.

Charlie is an Investment Director in the Gresham House Energy Transition team. His current role began in February 2021, following a year in the team as a contractor. He is responsible for executing investments in infrastructure projects such as energy storage systems, whether acquired before construction or when already operational.

Charlie has extensive experience in the development, funding and asset management of distributed energy infrastructure projects assisting both investment managers and project developers at every stage of bringing their projects to fruition. He has worked on projects in a wide range of technologies including solar PV, hydroelectric power, anaerobic digestion, combined heat and power, thermal heat networks, gas peaking and grid-scale battery storage.

He started his career over 20 years ago as a commercial solicitor before transitioning to renewable energy, working with investment management firms for the last nine years.

Charlie studied science of materials at Trinity College Dublin and has an MBA from INSEAD, France.

Victor is an Investment Director within Gresham House’s Energy Transition division, where he focuses on originating, executing and managing energy-transition infrastructure investments for the division’s international equity strategy. He joined Gresham House in January 2026 following its acquisition of SUSI Partners.

Victor had initially joined SUSI Partners during the firm’s early growth phase, and after temporarily working for Nuveen Infrastructure as an Investment Director, rejoined the company in 2022. He played a key role in the development of the firm’s international equity platform and was actively involved in the evaluation and execution of transactions across multiple OECD geographies and technologies.

He brings broad experience in infrastructure and growth investing, having completed numerous acquisitions, divestments, and debt financings across a wide range of markets and sectors. His expertise spans the full investment lifecycle, from deal sourcing, commercial analysis, and structuring to negotiation, portfolio management, and board representation. He holds a Bachelor of Science from the University of California, Los Angeles (UCLA) and an MBA from INSEAD.

Distribution Team

Heather is Managing Director, Institutional Business and a member of the GHAM Board.

Prior to joining Gresham House, Heather spent seven years at Fidelity International, latterly as Head of Institutional Distribution for UK & Ireland. She also previously held business development and client relationship positions at BankInvest, Capital International and Gartmore where she focussed on U.K & Ireland and Nordic institutional investors.

Heather has over 25 years of financial experience and holds a BA (Hons) in Politics from Durham University and the Investment Management Certificate from the CFA Society of the UK.

Jamie joined Gresham House in October 2022 as a Client Services Associate within our Institutional Distribution team.

He previously spent five years at Cazenove, the wealth management arm of Schroders as a Client Services Executive within their Charities team. Prior to that, Jamie worked within the UK Retail Sales team at Schroders.

Jamie holds the CFA Institute Investment Foundations Certificate and Unit 1 of the IMC.

Keisha-Ann joined Gresham House in November 2020 as part of the Institutional Sales team and is responsible for institutional business development and consultant relations, fundraising across Gresham House’s Real Assets strategies.

Prior to Gresham House, she spent five years at quantitative investment manager, Winton, where she was responsible for investor relations coverage of investment consultants and Winton’s global institutional and wholesale clients including pension funds, sovereign wealth funds, investment banks, family offices and endowments.

Keisha-Ann holds a BA (Hons) in Geography from the University of Leeds.

Emily joined Gresham House in October 2025 as an Analyst in the Institutional Sales team.

Prior to this she completed a one-month internship at GIB Asset Management.

She holds a First Class BA (Hons) in Geography from Durham University having graduated in July 2025.

Claire joined Gresham House in August 2023 as Head of Business Development in the UK and Irish Institutional market.

Prior to Gresham House, Claire worked at Schroders for ten years and held positions as Head of Sustainability UK and Co-Head of the UK Institutional Business.

Claire started her career at M&G Investments, before moving to Baring Asset Management where she spent 11 years with the last six years in a UK Institutional Business Development role.

Claire is IMC qualified and has obtained the CFA ESG certificate.

Harry joined Gresham House in December 2023 as an Analyst in the Institutional Sales team.

Prior to this he completed a 3-month internship with the team.

He holds a First Class BA (Hons) in Geography from Durham University having graduated in 2022.

Susanna joined Gresham House in January 2025 as part of the Institutional Sales team.

Prior to joining Gresham House, she spent close to 6 years at Aksia, a specialist research and portfolio advisory firm providing alternative investment solutions to institutional investors, where she held roles in the client advisory and RFP teams.

She holds a First Class MA (Hons) in Spanish and English Literature from the University of Edinburgh.

Liz joined Gresham House from Legal & General Investment Management, where she was an Investment Reporting Analyst working with Institutional clients.

Prior to Legal & General, Liz held roles as a Client Service Analyst at Wellington Management, covering the Global Wealth channel in Europe and Asia, and as an Investor Relations Specialist at NewSmith Asset Management.

Liz holds the Investment Management Certificate and has a BA in French & Spanish from University College London.

Distribution Team

Anthony’s background is in investment banking, having previously worked for international firms in London, New York and South America, including Macquarie and Merrill Lynch. At Gresham House, he is responsible for business development, marketing and sales for our forestry and energy transition assets, also managing one of the funds.

Anthony has a BA (Hons) in History from Newcastle University and is an Investment Management Certificate holder. He is also a registered adviser with the Financial Conduct Authority.

Distribution Team

Chris is a Managing Director in the Wholesale Distribution team and joined Gresham House in July 2021.

Prior to this he was Head of Strategic Partnerships at LGBR Capital where he focused on developing key strategic relationships in the UK discretionary market. He was one of the founding members of LGBR Capital, helping to grow the business from launch in 2012 into one of the largest outsourced distributors in the UK.

Chris previously held business development and client relationship positions at Matrix Asset Management and Goldman Sachs.

Chris has 14 years’ industry experience and holds a BSc (Hons) in Economics from Queen Mary, University of London. He is a CAIA Charterholder and has passed both the Certificate in ESG Investing and the Investment Management Certificate from the CFA Society of the UK.

Andy has over 20 years’ industry experience and joined Gresham House in October 2019 after spending two years at BNP Paribas. Prior to this he spent six years as investment sales director at BNY Mellon, focusing on family offices and the London discretionary market.

He has also worked in the business development team at Skandia Investment Management, helping launch the Spectrum range of funds. He holds a BA (Hons) in Economics, the CFA Certificate in Investment Management, the CFA Certificate in ESG Investing, the CII Certificate In Discretionary Investment Management, the CII Certificate in Investment Operations and the CII Diploma in Financial Planning.

Distribution team

Anthony’s background is in investment banking, having previously worked for international firms in London, New York and South America, including Macquarie and Merrill Lynch. At Gresham House, he is responsible for business development, marketing and sales for our forestry and energy transition assets, also managing one of the funds.

Anthony has a BA (Hons) in History from Newcastle University and is an Investment Management Certificate holder. He is also a registered adviser with the Financial Conduct Authority.

Heather is Managing Director, Institutional Business and a member of the GHAM Board.

Prior to joining Gresham House, Heather spent seven years at Fidelity International, latterly as Head of Institutional Distribution for UK & Ireland. She also previously held business development and client relationship positions at BankInvest, Capital International and Gartmore where she focussed on U.K & Ireland and Nordic institutional investors.

Heather has over 25 years of financial experience and holds a BA (Hons) in Politics from Durham University and the Investment Management Certificate from the CFA Society of the UK.

Jamie joined Gresham House in October 2022 as a Client Services Associate within our Institutional Distribution team.

He previously spent five years at Cazenove, the wealth management arm of Schroders as a Client Services Executive within their Charities team. Prior to that, Jamie worked within the UK Retail Sales team at Schroders.

Jamie holds the CFA Institute Investment Foundations Certificate and Unit 1 of the IMC.

Keisha-Ann joined Gresham House in November 2020 as part of the Institutional Sales team and is responsible for institutional business development and consultant relations, fundraising across Gresham House’s Real Assets strategies.

Prior to Gresham House, she spent five years at quantitative investment manager, Winton, where she was responsible for investor relations coverage of investment consultants and Winton’s global institutional and wholesale clients including pension funds, sovereign wealth funds, investment banks, family offices and endowments.

Keisha-Ann holds a BA (Hons) in Geography from the University of Leeds.

Emily joined Gresham House in October 2025 as an Analyst in the Institutional Sales team.

Prior to this she completed a one-month internship at GIB Asset Management.

She holds a First Class BA (Hons) in Geography from Durham University having graduated in July 2025.

Claire joined Gresham House in August 2023 as Head of Business Development in the UK and Irish Institutional market.

Prior to Gresham House, Claire worked at Schroders for ten years and held positions as Head of Sustainability UK and Co-Head of the UK Institutional Business.

Claire started her career at M&G Investments, before moving to Baring Asset Management where she spent 11 years with the last six years in a UK Institutional Business Development role.

Claire is IMC qualified and has obtained the CFA ESG certificate.

Harry joined Gresham House in December 2023 as an Analyst in the Institutional Sales team.

Prior to this he completed a 3-month internship with the team.

He holds a First Class BA (Hons) in Geography from Durham University having graduated in 2022.

Susanna joined Gresham House in January 2025 as part of the Institutional Sales team.

Prior to joining Gresham House, she spent close to 6 years at Aksia, a specialist research and portfolio advisory firm providing alternative investment solutions to institutional investors, where she held roles in the client advisory and RFP teams.

She holds a First Class MA (Hons) in Spanish and English Literature from the University of Edinburgh.

Liz joined Gresham House from Legal & General Investment Management, where she was an Investment Reporting Analyst working with Institutional clients.

Prior to Legal & General, Liz held roles as a Client Service Analyst at Wellington Management, covering the Global Wealth channel in Europe and Asia, and as an Investor Relations Specialist at NewSmith Asset Management.

Liz holds the Investment Management Certificate and has a BA in French & Spanish from University College London.

Where are you based?

-

UK

-

IE

-

ROW

-

AUS

-

DE

-

JP

Which of these best describes you?

-

Institutional investor or investment consultant

-

Intermediary

-

Financial adviser

-

Family office

-

Individual investor

-

Seeking funding

-

Selling assets

-

Real estate owner or developer

-

Charity or religious order

-

Seeking funding or selling assets

-

Familienbüro

-

Finanzberater

-

Institutionelle

-

機関投資家 ホーム

-

ファミリーオフィス ホーム

-

ファイナンシャルアドバイザー ホーム

Disclaimer

Location:

Size:

Type:

Your choice regarding cookies on this site

This website uses cookies to help us provide the best experience for you. Please select 'Allow all' to consent to the use of cookies on your device or select 'Manage cookies' for more options. You can find out more in our online privacy and cookie policy.

We use cookies on our site

Gresham House asks you to consent to the use of cookies, to store and access basic, first-party data about your website usage. Some of these cookies are essential to our site working properly and others help us improve the site by providing insight into how the site is being used. To allow us to provide the best website experience, we recommend that you accept the use of all cookies. Please note that some data processing may not require your consent but you have the right to object to such processing. Please read our online privacy and cookie policy which is available on our website.

Strictly necessary

Data collected in this category is essential to provide our services to you. The data is necessary for the website to operate and to maintain your security and privacy while using the website. These cookies are always on as they are critical to the website functioning correctly. This data is not used for marketing purposes or the purposes covered by the two categories below.

Performance

Data collected in this category is used to inform us about how the website is used, to improve functionality on our website and to help us to identify issues you may have when accessing our website. This data is not used to target you with advertising.

Targeting

Data collected in this category is used to help make our messages more relevant to you. The data may be shared with our media partners and platforms we may use to deliver personalised advertisements and messages.

Gresham House

Specialist asset management

Gresham House

Specialist asset management