WS Gresham House UK Multi Cap Income Fund - 2025 outlook

WS Gresham House UK Multi Cap Income Fund - 2025 outlook

Key risks

Not an investment recommendation. Past performance is not a reliable indicator of future performance. Fund investing in smaller companies may carry a higher degree of risk than funds investing in larger companies. The shares of smaller companies may be less liquid than securities in larger companies.

Key takeaways

- Relative underperformance in 2024 was primarily driven by transitory external headwinds including government policy and sentiment-based valuation de-rating (from 10x EV/EBITDA to c.8x)

- Our high-quality portfolio companies continue to deliver strong operational performance and their valuations have become increasingly dislocated from business fundamentals

- Potential outperformance in 2025 underpinned by stock-specific catalysts and ongoing M&A activity

- Visible pathway to exceeding our high-single digit annual total return target through selective portfolio company re-ratings and a strong forecast dividend yield

Download pdf version >>

2024 overview

The WS Gresham House UK Multi Cap Income Fund (Fund) delivered a 2.1% total return in 2024, underperforming the IA UK Equity Income and IA UK Smaller Companies Sectors which rose by 9.0% and 6.9% respectively. The Fund also underperformed the FTSE All Share ex Investment Trusts Index which grew by 9.5%, the FTSE Smaller Companies ex Investment Trusts Index which grew by 13.7%, but outperformed the FTSE AIM All Share which fell by 3.6%.

The principal drivers of relative underperformance were:

- Size bias – large cap stock outperformance, where the Fund was relatively underweight vs the FTSE All Share, averaging 19% NAV in FTSE 100 companies

- AIM exposure – the Fund averaged 25% of NAV in AIM stocks during the year, which experienced a market sell-off precipitated by the Autumn budget which catalysed negative market sentiment around rising corporate costs and potential tax implications (e.g. IHT relief)

- Portfolio company valuation de-rating – material dislocation between the operating fundamentals of our investee companies and their share prices saw valuation multiples decline during 2024. 92% of portfolio company updates during the year were positive or in-line compared to market expectations and, on average, the Fund’s investee companies grew revenue and EBITDA by 6.4% and 7.1% respectively

- Stock specific detractors as detailed below

As fundamentals focused, high conviction long-term investors we view the 2024 drivers of relative underperformance as transitory and sentiment driven. We are confident in the underlying operating drivers of the Fund’s investee companies, many of which have de-rated significantly to highly attractive valuation levels. With our private equity approach to public market investing, the backdrop of heightened corporate activity and our rigorous investment process, we believe the potential to deliver highly attractive multi-year total returns going forward is compelling.

2024 performance

Top 3 detractors

The largest detractors from performance during the period were: Impax Asset Management (-1.0% CTR), a new investment in the Fund from July 2024, which lost c.£6bn of AUM in December as ongoing St James’s Place restructuring prompted mandate withdrawals, driving a 7% downgrade to the FY25 profit before tax forecast and de-rating to 5.5x EV/EBITDA (c.23% intra-day share price decline) which we view as materially overdone relative to the fundamental impact; Gresham House Energy Storage Fund (GRID; -1.0% CTR) which de-rated significantly as a result of subdued trading revenues and technical issues in the national grid balancing mechanism driving under-utilisation of battery energy storage systems (BESS). However, following a full stock review and recent trading update we have conviction in a meaningful earnings recovery and dividend reinstatement during 2025; and Mony Group (-1.0% CTR) which de-rated sharply from c.11x EV/EBITDA to c.7x in 2024 on the back of lower reported Q3 revenue growth against a tough prior-year comparator, despite the business expecting to deliver 6% EBITDA growth in FY24. We retain our view that this is a compelling long-term investment leveraging its strong competitive position in diversified and attractive end markets to drive high margins (30%+ EBITDA), growth and cash generation underpinned by a strong balance sheet and high dividend yield of c. 7%.

Top 3 contributors

The largest contributors to performance during the period were: XPS Pensions Group (1.8% CTR), our top holding at the start of 2024 which entered an earnings upgrade cycle, benefitting from structural demand tailwinds around regulatory change in the core pensions business and inflation-linked contracts, delivering double-digit top-line growth across all divisions and 29% EBITDA growth in FY24, prompting us to take some profits during the year; 3i Group (1.1% CTR), a private equity firm whose key portfolio asset, Action (c.66% NAV), continued on an earnings upgrade cycle which catalysed a re-rating of the wider Group, leading us to fully exit the position in November 2024 and recycle profits into similar sector opportunities at more compelling entry valuations, in particular B&M and Sainsbury’s; and TP ICAP (1.1% CTR) which traded strongly during the period, particularly in multi-asset and equities broking, with management now progressing strategic options for its market-leading, high recurring revenue data business, Parameta Solutions, with a focus on unlocking shareholder value, potentially via a separate US IPO of the division.

2025 outlook

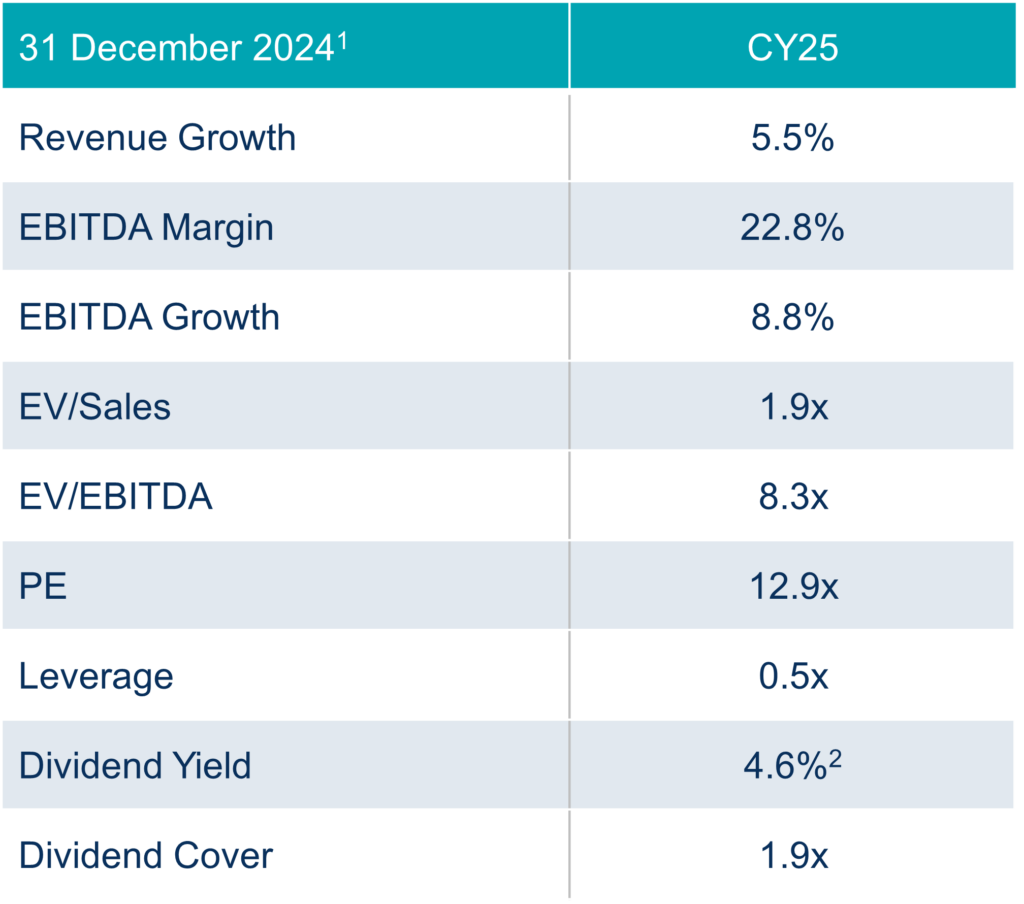

Looking ahead to this year, we see a number of short-to-medium term catalysts for a compelling performance recovery for the Fund and believe our companies remain well positioned to offset external headwinds such as high interest rates, low economic growth, and UK government-driven cost inflation. On the latter issue, in Q4 we undertook targeted engagements with portfolio companies perceived to have material exposure to changing UK national minimum wage and national insurance legislation, especially in the consumer sector. Following conversations with management teams, we have built conviction in company-specific measures to offset the budget impact across the majority of portfolio companies, underpinning confidence in our aggregate portfolio 2025 forecast of 5.5% and 8.8% revenue and EBITDA growth respectively.

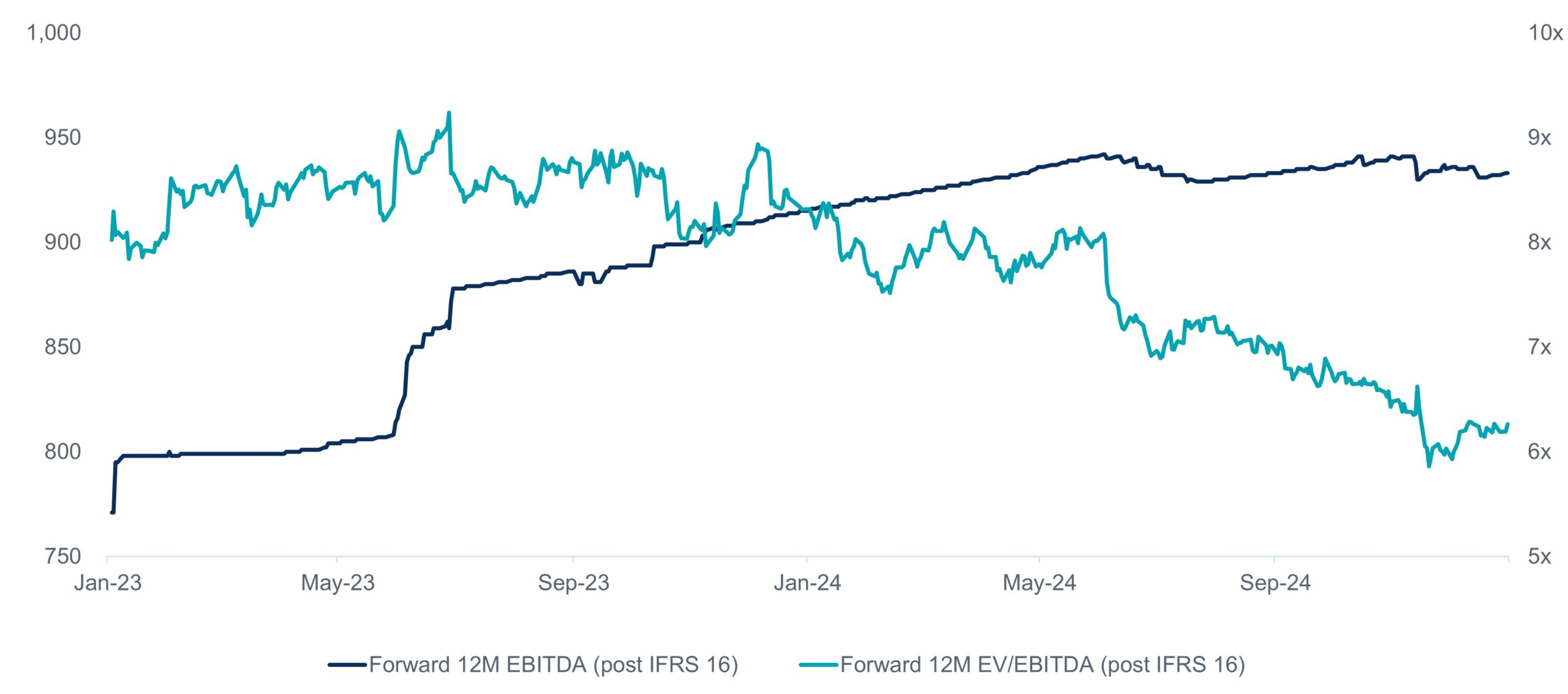

On the theme of UK consumer, we retain high conviction in portfolio companies which acutely de-rated during 2024. Foremost among these is B&M European Value Retail (-1.0% CTR) whose shares have de-rated from c.8.5x EV/EBITDA (pre-IFRS 16) to 5.8x despite positive growth. In our view the market has misinterpreted negative UK like-for-like growth (‘LFL’) rates as receding price competitiveness when, in fact, B&M had purposefully grown its relative price advantage in general merchandise to take volume share, supporting expectations of a return to strong positive LFL growth over the medium term. We also note its highly productive store rollout programme that is delivering a one-year total payback per store and remains central to our returns thesis. B&M now trades on FY26 valuation metrics of 5.8x EV/EBITDA (pre-IFRS 16), a 12% free cash flow yield, and is forecast to return £1.3 billion to shareholders over the next three years.1 For comparison, another value retailer, Action, is valued by 3i at 18.5x trailing EV/EBITDA, with the shares trading at a c.40% premium to net asset value.

B&M’s consistent EBITDA growth offset by sharp de-rating2

Similarly, we anticipate a strong recovery from Domino’s Pizza Group (-0.4% CTR), which de-rated in the second half of 2024 given the one-off cost impacts of the Autumn budget and a new five-year franchisee framework agreement, with the valuation now sitting at a depressed c.10.5x EV/EBITDA . This is despite expected positive growth in FY24 and the underlying business delivering accelerated LFL growth momentum, underpinned by a leading UK consumer value proposition combined with strong digital marketing capabilities. These positive trading dynamics have been masked by recent adverse newsflow on costs. Moreover, the new multi-year franchisee agreement increases visibility of further attractive store rollout, which should support attractive shareholder returns.

We also retain conviction that last year’s top performers can sustain momentum into 2025. XPS Pensions Group and TP ICAP continue to benefit from structural growth tailwinds, leading market positions, and upside catalysts from M&A or divisional ‘carve-outs’ (e.g. TP ICAP’s Parameta Solutions business); the latter being an emerging nuance to corporate transaction activity in UK equity markets which may help crystallise shareholder value this year3. Equally, we believe Quilter (1.0% CTR) – a new investment from 2024 – is well positioned to double-down on strong prior-year returns given consistent market share gains in the UK investment platform market and accelerating net inflows in its IFA distribution channel. From conversations with management, we understand this has been achieved without excess cash held in UK savings accounts (due to high interest rates or under-investment as a result of lacking financial advice)4 entering the investment ecosystem, presenting potential upside to market expectations in 2025.

Conclusion

Despite disappointing performance in 2024, we take confidence from the resilient fundamentals of a healthily growing portfolio which in aggregate was subjected to harsh, sentiment-based de-rating, contrary to the underlying performances and future expectations for the majority of our portfolio companies. We believe that continued mitigation of current headwinds combined with another year of resilient portfolio earnings growth, cash generation and progressive dividends can lead to a correction of prior-year de-ratings, driving Fund outperformance in 2025. While this Fund targets a high single-digit annualised total return, with an attractive income yield of c.4%, the current valuation dynamics and re-rating prospects of our portfolio companies presents meaningful capital upside beyond these targets. The expected dividend yield for 2025 has also grown to 4.6% as the Fund annualises seven new investments made during 2024 and we forecast 15% dividend per unit growth year-on-year.

Two key strands of our investment approach support our ability to actively manage the Fund towards outperformance in 2025. Firstly, our portfolio construction is focused on defensive characteristics including structural growth trends, non-cyclical markets, and high-quality financials (including over 20% average EBITDA margins, strong cash generation, and very low financial leverage), affording greater earnings resilience than the wider UK economy to external shocks.

WS Gresham House UK Multi Cap Income Fund – key fundamentals of the portfolio

- Premium earnings growth rates relative to the market, supported by structural growth drivers and self-help initiatives

- Premium EBITDA margins indicate the underlying quality, pricing power and resilience

- Undemanding valuation multiples for high-quality financial characteristics

- Very low aggregate financial leverage

- Underpinned, well-covered dividend with an aggregate 4.6% yield

Secondly, our consistent and repeatable private equity approach to UK public market investing, leveraging a high-quality expert network to independently validate key investment judgements, provides a sustainable ‘edge’ over the wider market in terms of investment appraisal and portfolio monitoring.

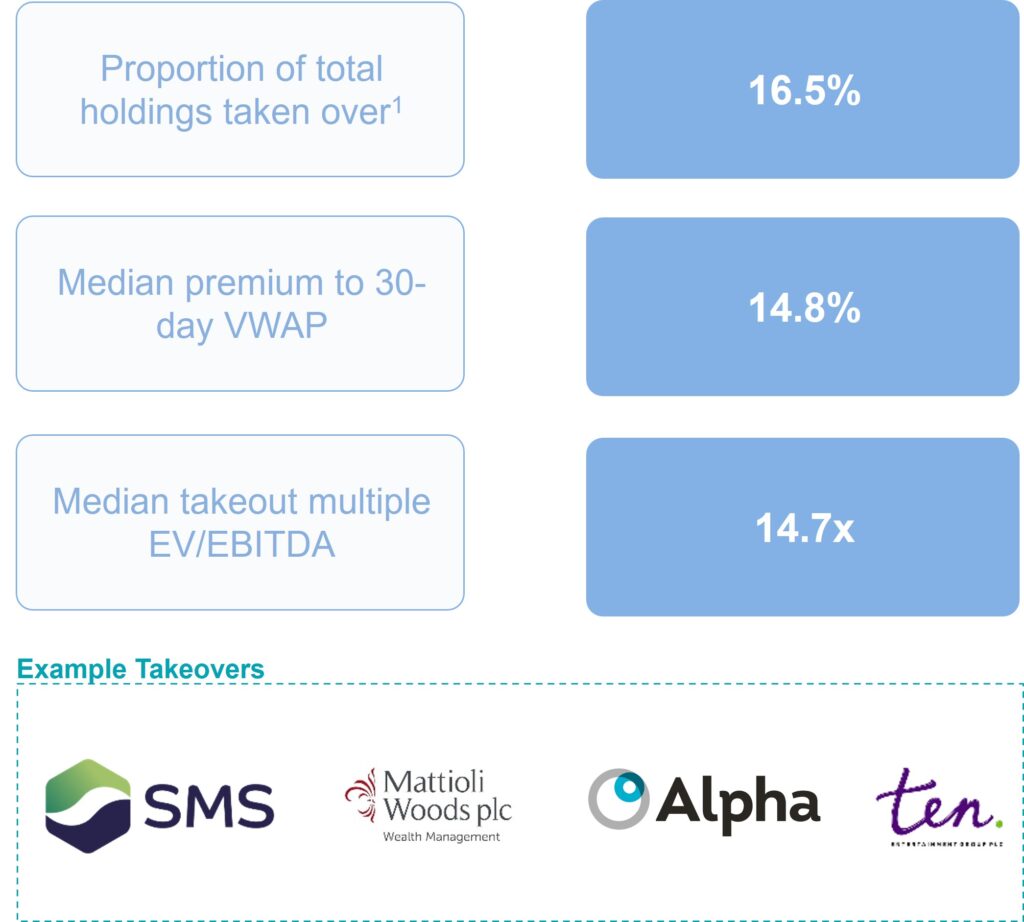

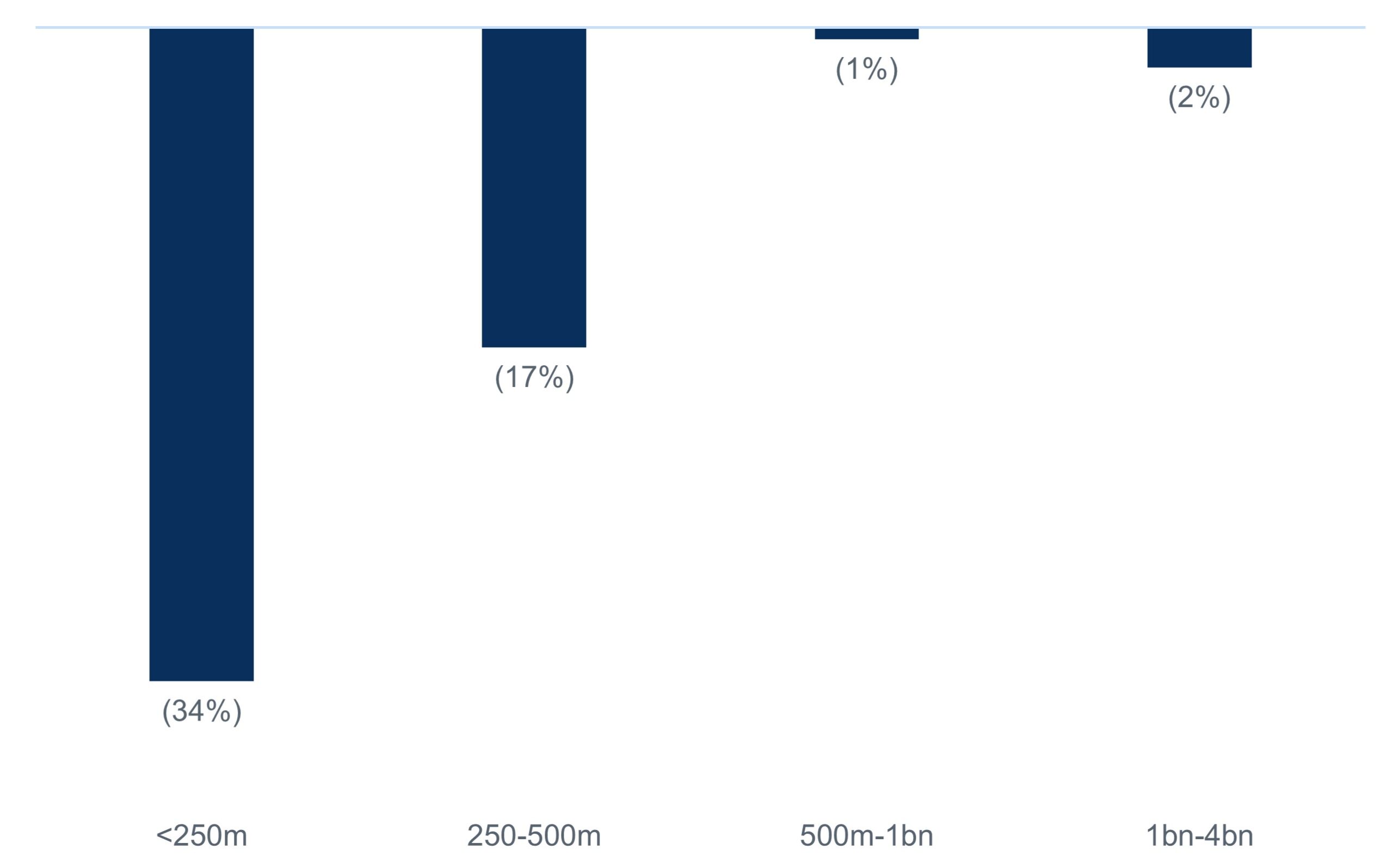

We also see upside potential to Fund performance from elevated takeover activity across UK equity markets heading into 2025. While the uncertainty around the Autumn budget led to an M&A slowdown in Q3, we observed an uptick in activity during Q4 and anticipate deal momentum continuing into this year. During 2024, buyers paid on average a 44% premium for UK companies, greater than the five-year average despite elevated deal funding costs amidst higher interest rates5. From conversations with our private equity network, we understand that private buyers continue to assess the UK market for deal-flow opportunities given the attractive valuations on offer and the relative shortage of investment opportunities in a subdued private M&A market. With c.$4 trillion of ‘dry powder’ yet to be deployed6, we expect that takeover activity, alongside divisional carveouts, will offer attractive returns for the Fund in 2025.

Takeovers in the Fund7

- Global acquirers across trade and private equity

- Takeover activity focused on UK smaller companies where valuations discounts are greatest

- Rising premia despite higher deal funding costs, reflecting record-low valuations

- Fund trades at a steep discount to average transaction multiples (8.3x EV/EBITDA)

More broadly, we welcome calls for government reforms in 2025 to encourage UK pension fund participation in domestic equity markets, where they are materially under-penetrated today at defined contribution, defined benefits, and local government levels compared to other developed western nations.8 Having inflected to a small net inflow in November (£317 million) – the first in 42 months – UK-focused equity funds shed a further £221 million in December 2024, taking the annual total outflow to £9.6 billion.9

UK net outflows during 2024 (£bn)10

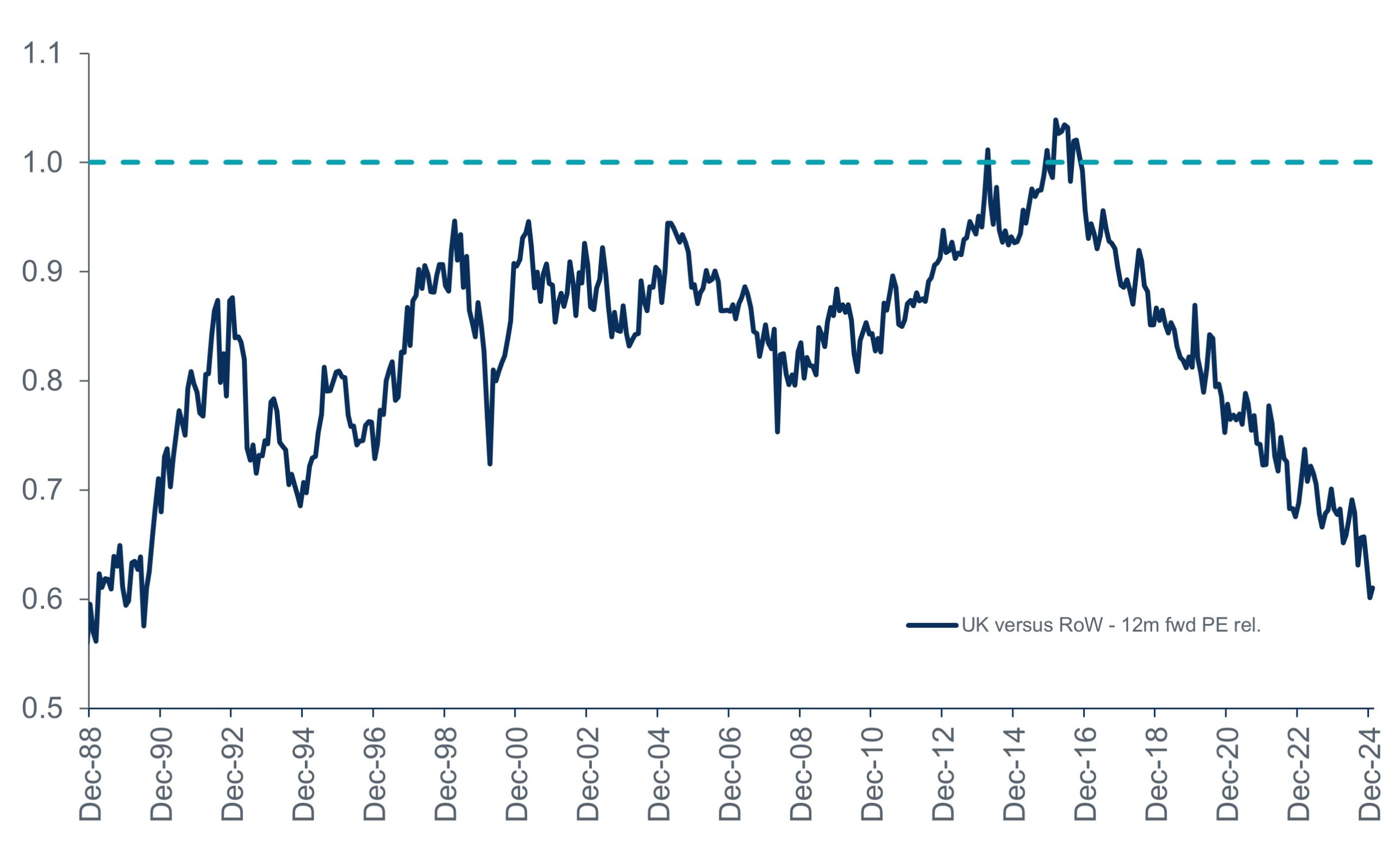

Much of the outflows from the UK market over the year were recycled into global and US equity funds or passive trackers, driving positive valuation momentum in non-domestic equity markets and leaving UK equities trading at a stark discount to international peers heading into 2025; a discount even more pronounced among UK smaller companies, which are now 28%, 57% and 69% cheaper than UK large caps, US large caps and US smaller companies respectively.11 Any incremental liquidity as a result of supportive government policies would aid marginal buying of UK shares and in turn offers the potential to bridge the stark valuation arbitrage to other developed equity markets and precedent M&A transactions.

UK valuations at a 30-year low relative to global equities,12

Median PE discount of UK smaller companies versus large caps

Key takeaways

- Relative underperformance in 2024 was primarily driven by transitory external headwinds including government policy and sentiment-based valuation de-rating (from 10x EV/EBITDA to c.8x)

- Our high-quality portfolio companies continue to deliver strong operational performance and their valuations have become increasingly dislocated from business fundamentals

- Potential outperformance in 2025 underpinned by stock-specific catalysts and ongoing M&A activity

- Visible pathway to exceeding our high-single digit annual total return target through selective portfolio company re-ratings and a strong forecast dividend yield

1. B&M FY26 is the period between 01/04/2025 and 31/03/2026.

2. Bloomberg data – B&M 12M blended forward 12M EBITDA vs 12M blended forward EV/EBITDA.

3. Gresham House, ‘Unlocking value through carve-outs’

4. Barclays, ‘The UK investment gap: £430 billion in cash savings not invested by UK adults’, 11 Sep 24.

5. Bloomberg data.

6. Charles Hall, ‘Strategy’, Peel Hunt Research, 2 Oct 2024.

7. Factset, Bloomberg as of 31 December 2024.

8. Department for Work & Pensions, ‘Pension fund investment and the UK economy.’

9. Calastone UK equity fund flow data, 7 Jan 25.

10. Calastone UK equity fund flow data, 7 Jan 25.

11. Bloomberg 12M forward price-to-earnings data as at 12 Jan 25 (Deutsche Numis Smaller Companies ex Investment Trusts plus AIM index versus FTSE 100, S&P 500, and Russell 2000 indices).

12. UK 12-month forward P/E relative to global equities, Berenberg, 31 December 2024.

Get in touch

For more information on our products and services, please contact our Wholesale team.

|

|

|

| Chris Elliott Managing Director, Wholesale |

Andy Gibb Sales Director |

Rees Whiteley Sales Manager, Wholesale |

| M: +44(0) 7827 920 066 E: c.elliott@greshamhouse.com |

M: +44(0) 7849 088 033 E: a.gibb@greshamhouse.com |

M: +44(0) 7597 579 438 E: r.whiteley@greshamhouse.com |

Important information

This document is a financial promotion issued by Gresham House Asset Management Limited (Gresham House) under Section 21 of the Financial Services and Markets Act 2000. Gresham House is authorised and regulated by the Financial Conduct Authority (682776).

The information should not be construed as an invitation, offer or recommendation to buy investments or shares or to form the basis of a contract to be relied on in any way. Gresham House provides no guarantees, representations or warranties regarding the accuracy of this information. This article is provided for the purpose of information only.

Capital at risk. Past performance is not a guide to future returns. Funds investing in smaller companies may carry a higher degree of risk and the shares in smaller companies may be less liquid.

Restricted content

This content is for professional investors only. Please click below to return to the news page.

Gresham House

Specialist asset management

Gresham House

Specialist asset management