Key risks; not an investment recommendation. Past performance is not a reliable indicator of future performance. Funds investing in smaller companies may carry a higher degree of risk than funds investing in larger companies. The shares of smaller companies may be less liquid than shares in larger companies. Views expressed are correct at the time of writing but are subject to change. Ascential plc, Capita plc and Ricardo plc are portfolio holdings in some of our equity funds.

Carve-outs are gaining momentum

Takeover activity has been a persistent theme over the last 18 months, a trend that is expected to continue as long as UK equities continue to trade at a stark discount to international markets, private companies, and history. However, there is an emerging nuance to this theme, with carve-outs – where a parent company sells a subsidiary company or business unit – which are gaining momentum across the listed landscape.

There have been more than 20 ‘meaningful’ carve-outs from UK-listed businesses so far this year, where divestments accounted for more than 50% of the group’s market capitalisation. The vast majority have been sold at a higher valuation multiple than the prevailing group multiple, with some selling for more than the entire market capitalisation. Recent notable carve-out examples include:

- Marlowe selling its Governance, Risk & Compliance (GRC) assets to UK mid-market Private Equity (PE) firm Inflexion for £430mn, which was more than the market capitalisation of the business on the day prior to the announcement, despite the assets only accounting for c.40% of group EBITDA.

- Capita selling its standalone, non-core software business to MRI Software in a deal that valued the subsidiary at c.£200mn versus a market capitalisation of £264mn on the day prior to the announcement, despite the business accounting for just c.14% of group EBITDA.

- GlobalData selling a 40% stake of its healthcare division, also to PE firm Inflexion, at a valuation of £1,115mn, GlobalData’s market capitalisation prior to the announcement was £1,352mn, despite the healthcare division only accounting for 50% of group EBITDA.

Benefits to shareholders

Carve-outs can provide an excellent opportunity to shine a light on the undervaluation of a business, unlocking value without having to sell the entire business. Whilst some of the takeovers over the past 18 months have been based on long-term strategic plans, it would be fair to say that a significant proportion have been opportunistic, with buyers capitalising on the discounted valuations of UK-listed businesses, with shareholders missing out on future upside.

Carve-outs, like takeovers, showcase the wider undervaluation of companies in the market but differ by allowing shareholders to keep a stake and benefit from future upside; providing some jam today, with potential for more jam tomorrow.

Carve-outs not only highlight the undervaluation of the remaining business, which can lead to a re-rating, but also provide cash that can be reinvested for growth, used to reduce debt, or returned to shareholders. They are especially useful for complex businesses with multiple units or brands that the market is failing to value properly. Selling off non-core parts can reduce complexity, simplify the business narrative, and refocus the company’s strategy.

Buyers also find carve-outs attractive

The UK market backdrop has been conducive to takeover activity over the last 18 months for many reasons, but perhaps most notably due to:

- Discounted valuations – many public companies have been markedly undervalued particularly versus private companies. This has meant that private equity firms with funds to deploy, and trade buyers have weighted their attention to UK-listed assets. Even against the backdrop of rising interest rates, the fact that some UK plcs have been trading at a 50%+ discount to private companies and international peers has meant that takeovers still make sense, even with the average premium increasing to above 50% vs. the longer-term average of 30-40%.

- Persistent outflows – the well-documented persistent outflows from UK equity markets have ultimately meant that shareholders have had a higher propensity to accept opportunistic bids, sometimes to fulfil redemptions.

Although there is still a valuation discount, in aggregate, selective re-ratings of UK equities has narrowed the gap to private precedent transactions in some instances, making it less appealing for buyers to purchase an entire business, particularly when accounting for the expected premium, against the backdrop of high interest rates. Instead, buying a portion of the business requires less cash, avoids the need for an arbitrary share price premium, and allows the buyer to focus on acquiring the part they truly want.

Any slowdown in the rate of negative flows, alongside the fact that fund managers have received significant funds from takeovers, will reduce the pressure to sell assets to meet redemptions. As a result, shareholders are now arguably less likely to accept opportunistic bids, which increases the risk of deal failure for buyers. Unlike takeovers, the majority of carve-outs do not need shareholder approval, making them a quicker and safer option for acquiring a business from a UK plc. However, for larger disposals (over 25% of profits/assets), shareholder approval is required. In such cases, shareholders are still more likely to agree, as they can benefit from near-term potential returns, alongside future gains.

Ascential – how a business can effectively unlock value

At the beginning of 2023, Ascential announced a strategic review of the business, with an intention to split the business through a series of interdependent transactions. The business consisted of three distinct business units: Digital Commerce, Product Design (WSGN) and a market-leading events business. Whilst each business is high-quality in its own right, there was limited crossover between each segment and a lack of a cohesive group strategy, which meant that the market failed to value the business properly on the sum of its parts. The management team recognised this and saw a break-up as the best way to unlock value for shareholders.

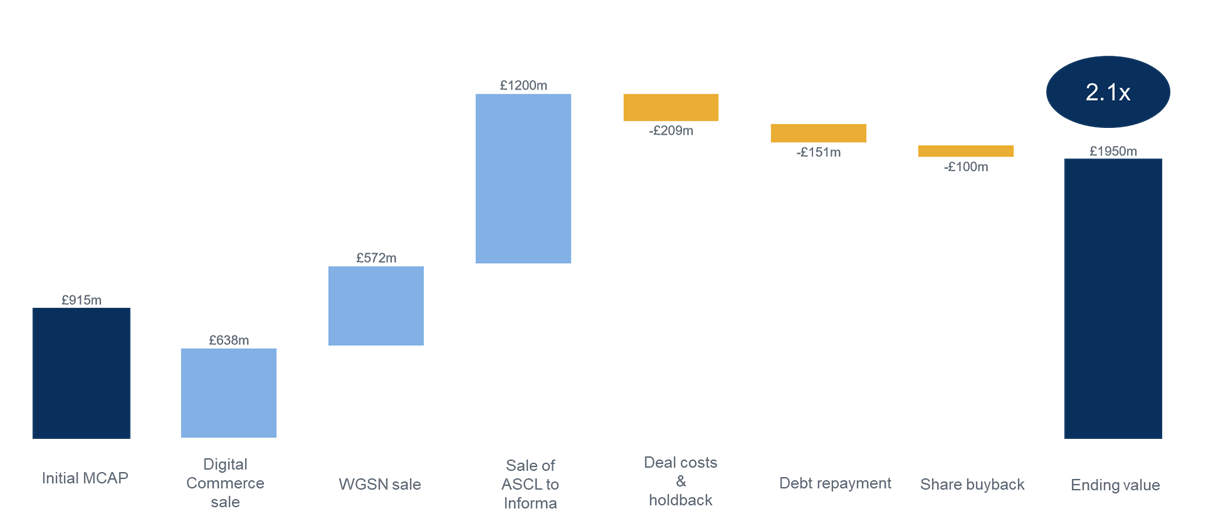

Fast forward 18 months and all three business units have been successfully sold, amounting to a total value of c.£1.9bn versus a market capitalisation of £915mn prior to the announcement of the review. Ascential has exemplified how a break-up can unlock value, with the ending value >2x that of the starting value.

Gresham House invested in Ascential at the end of 2023. We had followed the business closely since the announcement of a strategic review earlier that year and recognised that the business was undervalued on a sum-of-the-parts basis, however significant execution risk still existed at that point, particularly given an IPO was being considered as one of the exit routes.

After the sales of the Digital Commerce and WSGN business units at attractive valuations at the end of 2023, we initially thought we might have missed out on the upside. However, the remaining events business was left trading at a significantly discounted valuation compared to transaction multiples for similar businesses. After further research and discussions with industry experts, which validated the market-leading position of Ascential’s flagship events, we built conviction in the quality of the business and concluded that the discounted valuation was unjustified. Hence, we capitalised on the attractive entry point and invested in the business. In July this year, the business received a takeover offer from Informa at 16.6x FY25E EV/EBITDA, representing a premium versus prior transaction multiples of 13-14x EBITDA.

Opportunities to unlock value through carve-outs across our holdings

Ricardo is a global strategic, environmental and engineering consultancy with in-house production capability. Ricardo has been executing on a clearly defined strategy to reposition the business, by focusing on the higher margin, higher growth and lower capital intensity parts of the business with the objective of becoming a global leader in environmental consulting.

Despite clear progress being made in re-positioning the business, with significant growth across its Energy and Environmental division, the business continues to trade at a stark discount to precedent transaction multiples for similar businesses.

Part of the reason for the discounted valuation is the fact that the business is inherently complex across several geographies and five business units, two of which do not align with the re-defined strategy. From our perspective, Defence and Performance Products are non-core and present an opportunity to be divested. Carving-out these two business units has the potential to unlock value that could be reinvested in driving growth in core parts of the business, as well as helping to simplify the equity story, enabling the business to command a higher rating more closely aligned to other environmental consultancy firms.

Restore provides document management, secure recycling, and relocation services, operating through five business units. In our view, the Records Management division alone is worth more than the company’s current market value, offering option value on the other units. This division contributes around 46% of revenue and 80% of profit, with stable, recurring revenue, long-term loyal customers, and strong cash generation. These factors make it an appealing acquisition target, particularly for private equity. A catalyst for this could be the sale or closure of some of the smaller non-core components of the Group.

TP-ICAP, a global leader in inter-dealer broking, recently registered its data division, Parameta Solutions, as a stand-alone business following a strategic review. Recognising the significant potential of this high-growth, high-margin segment, management is exploring several ways to unlock its value. Even with conservative valuation estimates, Parameta could be worth more than the entire market capitalisation of TP-ICAP.

Opportunities may or may not materialise

Key takeaways

1. Carve-outs are gaining momentum: Carve-outs are being used as a strategic tool to unlock value by selling parts of a business, often at higher valuation multiples than the overall company.

2. Simplifying complex businesses: Carve-outs help streamline businesses with multiple units or brands that the market struggles to value properly. This simplification can lead to improved valuations for the remaining business.

3. Carve-outs benefit shareholders: Unlike full takeovers, carve-outs allow shareholders to retain ownership of the remaining business, offering the potential for future upside.

4. Buyers find carve-outs attractive: For buyers, carve-outs require less cash, avoid share price premiums, and provide access to the most valuable or relevant parts of a company without purchasing the entire business.

5. Carve-outs as a strategy to unlock value: Companies like Ascential have successfully used carve-outs to unlock significant shareholder value. There are other opportunities across our holdings to unlock value through carve-outs.

Source information for data is from Company RNS announcements.

Important information

This document is a financial promotion issued by Gresham House Asset Management Limited (Gresham House) under Section 21 of the Financial Services and Markets Act 2000. Gresham House is authorised and regulated by the Financial Conduct Authority (682776).

The information should not be construed as an invitation, offer or recommendation to buy investments or shares or to form the basis of a contract to be relied on in any way. Gresham House provides no guarantees, representations or warranties regarding the accuracy of this information. This article is provided for the purpose of information only.

Capital at risk. Past performance is not a guide to future returns. Funds investing in smaller companies may carry a higher degree of risk and the shares in smaller companies may be less liquid

|

| Cassie Herlihy Associate Director, Public Equity |

Gresham House

Specialist asset management

Gresham House

Specialist asset management