A concentrated portfolio of select UK smaller companies

A concentrated portfolio of select UK smaller companies

Strategic Equity Capital plc (SEC)

Strategic Equity Capital plc is a specialist alternative equity trust.

Actively managed, it maintains a highly-concentrated portfolio of 15-25 high-quality, dynamic, UK smaller companies, each operating in a niche market offering structural growth opportunities.

SEC aims to achieve investment growth over a medium-term period, principally through capital growth. The team looks to find companies with the potential to double shareholder value every five years.

SEC listed on the London Stock Exchange on 19 July 2005, having raised funds from a range of investors including institutions, pension funds and private banks. The Board consists of five Non-Executive Directors, all independent of the Investment Manager.

At a glance

Key documents

Performance

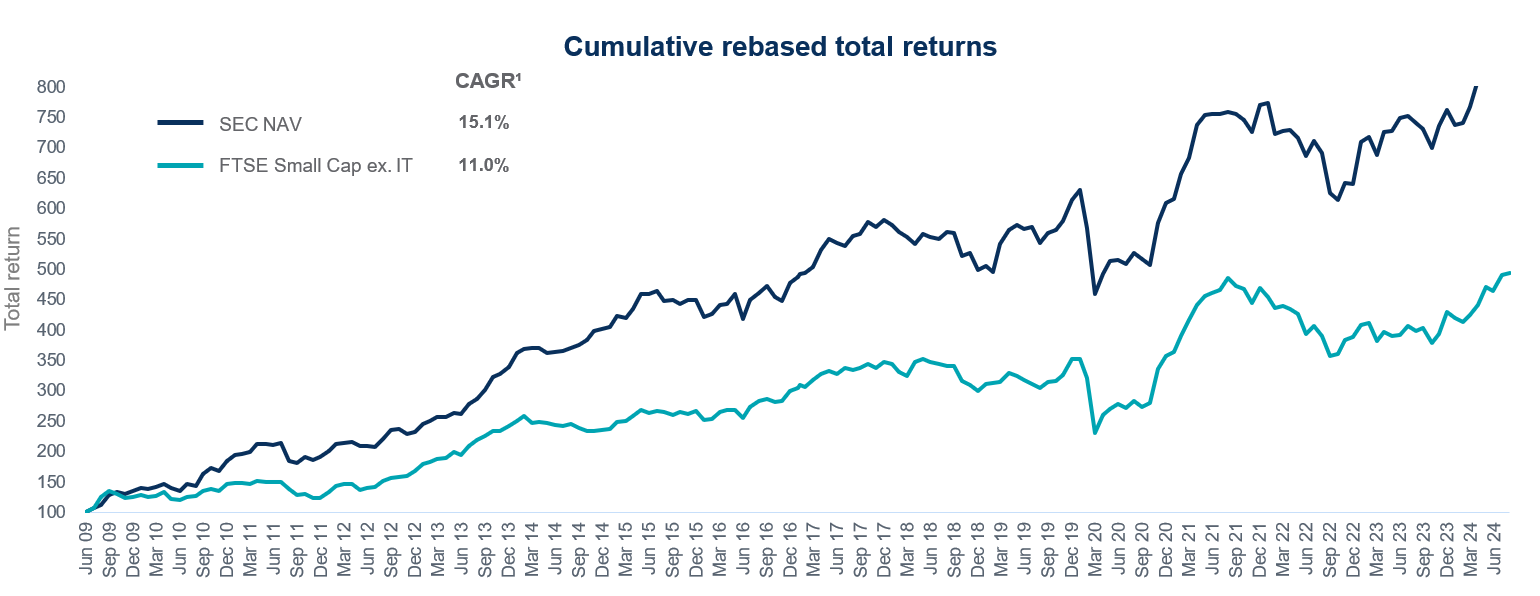

Chart source: Bloomberg, Juniper Partners as at 31 August 2024, net of charges. Notes: Data rebased to SEC start NAV June 2009

1. CAGR: Compound Annual Growth Rate

| Discrete annual returns | Q2 2024 | 2023 | 2022 | 2021 | 2020 | 2019 |

| Strategic Equity Capital plc NAV TR | 13.8% | 19.0% | -17.0% | 26.6% | -0.9% | 23.0% |

| Strategic Equity Capital plc Share Price TR | 13.7% | 17.5% | -12.6% | 37.4% | -4.7% | 25.9% |

| FTSE Small Cap x IT Total Return2 | 9.3% | 10.4% | -17.3% | 31.3% | 1.7% | 17.7% |

Performance net of charges and chart Data at 31 August 2024 – all data from Gresham House, Juniper, Bloomberg, FE fundinfo

2. Not official benchmark, used for comparative purposes only

Past performance is not necessarily a guide to future performance. Portfolio investments in smaller companies typically involve a higher degree of risk. Capital at risk.

Why Strategic Equity Capital?

Expertise and track record: fund manager Ken Wotton and his team are specialists in identifying great investment opportunities in smaller UK equities, and have a proven, long-term performance track record.

Distinctive: our UK equity team’s investment process employs a ‘private-equity approach to public markets’, a rigorous and repeatable methodology based on private equity investing techniques to deliver value and returns on investment.

A powerful network: our network of advisers and connections provides challenge, validation and insight to the investment team which in turn drives better decision-making, stock-selection and ultimately, value to shareholders. The network and advisers can also be connected to portfolio companies to support their growth.

Active and engaged: we invest in a highly-concentrated portfolio of between 15–25 companies. The investment team is actively engaged with investee companies working closely to build superior shareholder value.

Focus within an investment trust structure: the structure of the investment vehicle allows the investment team to be truly long term and to run a more concentrated portfolio of stocks with a high degree of conviction.

Investment approach

The SEC team applies Gresham House’s highly disciplined private equityapproach to public markets, with constructive corporate engagement and thorough due diligence.

The investment team’s experience in this area has shown the potential for strong returns.

The team can invest in a number of ways to help companies achieve their goals, including:

- Providing primary capital

- Supporting changes in strategic focus or operational performance

- Pre-IPO funding

- Providing a catalyst for M&A

Our portfolio

SEC has a concentrated portfolio of 15-25 high-conviction holdings with prospects for attractive absolute returns over our investment holding period.

Portfolio value is likely to be concentrated in the top 10-15 holdings, with other positions representing potential “springboard” investments where we are still undertaking due diligence or awaiting a catalyst to increase our stake to an influential, strategic level.

At acquisition, no holding can represent more than 10% of the portfolio but a successful investment could grow over time to reach c.15% of net assets before ongoing trimming or a sale of the holding would occur.

Bottom-up stock picking determines SEC’s sector weightings, which are not explicitly managed relative to a target benchmark weighting.

The absence of certain sectors – such as Oil & Gas, Mining, Banks and Insurers – as well as limited exposure to overtly cyclical parts of the market, typically result in a portfolio heavily weighted towards Software, Healthcare and Business Services.

Top 10 holdings

| Holding | % of NAV |

| XPS Pensions Group | 22.9% |

| Brooks Macdonald | 9.9% |

| Iomart | 9.6% |

| Fintel | 9.1% |

| Ricardo | 7.8% |

| Property Franchise Group | 6.6% |

| Team 17 | 5.7% |

| Tribal Group | 4.8% |

| Alpha Financial Markets | 4.1% |

| Inspired plc | 3.9% |

Source: Gresham House Asset Management Limited (portfolio at 30 June 2024)

Past performance is not necessarily a guide to future performance. Portfolio investments in smaller companies typically involve a higher degree of risk. Capital at risk.

Gresham House aims to have a considerably higher level of engagement with investee company stakeholders, in order to exploit market inefficiencies and support a clear plan to create value over the long term.

How to invest

The Company’s shares are traded openly on the London Stock Exchange and can be purchased through a stock broker or other financial intermediary.

The shares are available through savings plans (including Investment Dealing Accounts, ISAs, Junior ISAs and SIPPs) which facilitate both regular monthly investments and lump sum investments in the Company’s shares. There are a number of investment platforms that offer these facilities.

Computershare – Share Dealing Service

A quick and easy share dealing service is available to existing shareholders through the Company’s Registrar, Computershare Investor Services, to either buy or sell shares. An online and telephone dealing facility provides an easy to access and simple to use service.

For further information on this service please visit www.computershare.trade or call 0370 703 0084 (calls are charged at a standard geographic rate and will vary by provider. Calls outside the United Kingdom are charged at the applicable international rate). Lines are open from 8.00am to 4.30pm Monday to Friday (excluding public holidays in England and Wales).

Before you can trade you will need to register for the service. Shareholders should have their Shareholder Reference Number (‘SRN’) available. The SRN appears on share certificates and it will be required as part of the registration process.

Key risks

- The value of the Fund and the income from it is not guaranteed and may fall as well as rise. As your capital is at risk you may get back less than you originally invested

- Past performance is not a reliable indicator of future performance

- Funds investing in smaller companies may carry a higher degree of risk than funds investing in larger companies. The shares of smaller companies may be less liquid than securities in larger companies

Investment team

Want to keep up to date?

Subscribe using the form below to receive regular updates on Strategic Equity Capital plc.

Gresham House

Specialist asset management

Gresham House

Specialist asset management