May 2024

May 2024

Key risks

Not an investment recommendation. Past performance is not a reliable indicator of future performance. Survey respondents may give a good indication but may not be a representation of the market as a whole. Fund investing in smaller companies may carry a higher degree of risk than funds investing in larger companies. The shares of smaller companies may be less liquid than securities in larger companies.

De-equitisation of the UK equity market

For the past 18 months UK equities have experienced heightened takeover activity at a time when the IPO market has effectively been closed.

39 takeovers were announced in 2023, with a further 12 transactions announced in Q1 2024, with a lack of IPOs to refill the hopper. Financial sponsors and trade buyers have been drawn to the UK market from the UK, US, Europe and further afield – there is a huge appetite for UK listed businesses. UK equities continue to trade at a stark discount versus international markets, private companies, and history – as long as the valuation dislocation continues, so too will opportunistic bids.

The vast majority of takeovers have targeted the small cap segment, where the valuation discount is particularly severe. This has led to the inference that at the current rate of de-equitisation, the small cap segment of the main market will cease to exist by 20281. Whilst not the only antidote, a resurgence in IPOs would undoubtedly help to reverse this trend.

Current state of the UK IPO market

There has been minimal IPO activity during the past two years, with less than 20 UK IPOs through 2022 and 2023, versus a longer-term average of c.40 per year2. There have been some green shoots of activity in 2024, with five IPOs in London so far this year, however we have yet to see any meaningful resurgence. The pick-up in IPO activity in Europe, with seven IPOs valued at more than £100mn this year, can be viewed as a lead indicator for the UK IPO market. Perhaps even more relevant is the meaningful increase in broader UK plc capital raising activity in Q1 2024, with volumes up 105% in the year to date3 compared with the same period last year. Increasing equity capital markets (ECM) activity is an indicator of improved investor sentiment.

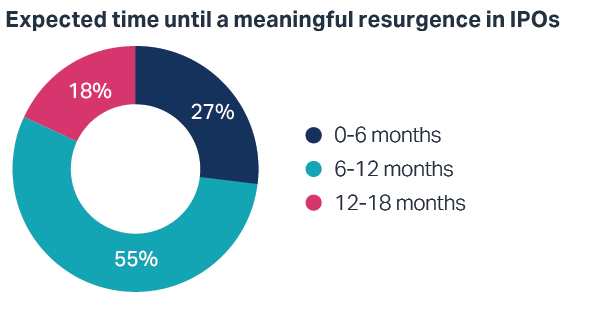

The Gresham House Public Equity team (herein referred to as ‘we’, ‘our’, ‘us’) has seen an uplift in the volume of “early look” meetings so far this year, with some high-quality businesses considering an IPO, which we view as an indicator that the window to the IPO market is beginning to open. To get a better sense of the current state of the UK IPO market from a bottom-up perspective, we have surveyed participants across UK Small Cap corporate broking firms. The majority of participants indicated that whilst their IPO pipelines remained subdued for much of 2022 and 2023, they have now started to build once again, with 82% of respondents expecting to see IPOs returning in a meaningful way within the next 12 months. Whilst this is a positive signal, the key nuance emerging from participants was that the conditions need to be ‘right’ to ensure these businesses progress from within their pipelines to ultimately listing on the UK market.

What are the right conditions for IPOs to return in a meaningful way?

The most cited factors from our survey participants were improvements in the macroeconomic backdrop, valuations, investor sentiment, UK equity flows and regulation.

1. Macroeconomic backdrop – without intending to be overly bullish, the backdrop is improving across a number of datapoints including weakening inflationary pressures, stabilising interest rates, and sterling stability against the dollar. The macroeconomic environment needs to be stable enough for businesses to be able to make longer-term decisions about their future i.e. whether to press play on a time consuming and costly IPO process.

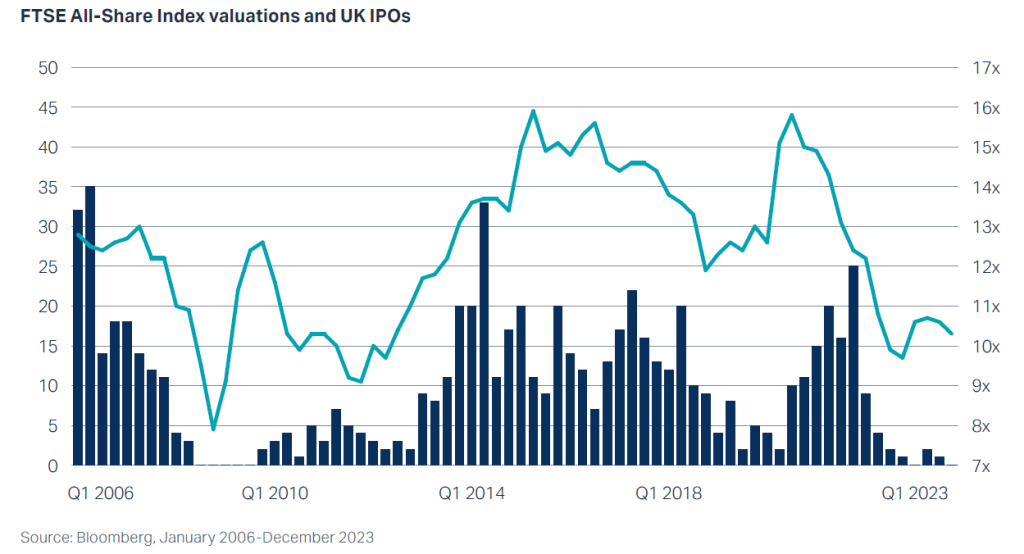

2. Valuations – perhaps the most important factor from perspective. The IPO market is inherently cyclical, with a close correlation between valuations and the volume of IPOs, as shown below. Interestingly, this chart also reminds us that it was only a few years ago when we saw a bumper number of IPOs in 2021, with 75 businesses listing, many at lofty valuations. UK equities now trade at a record 45% discount to global counterparts, with the discount for small caps even more marked. Any market improvement from here would help to underpin a reopening of the IPO market.

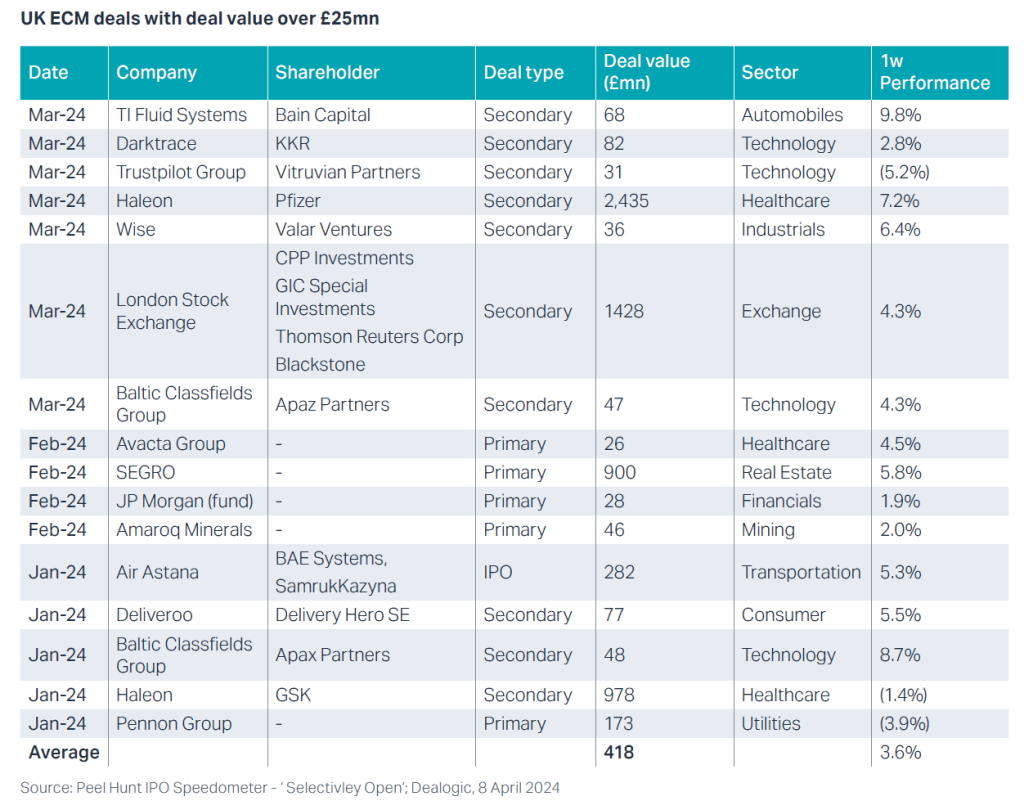

3. Investor sentiment – our survey respondents had mixed views on investor sentiment, with several indicating that it had improved noticeably in 2024, while others indicated it remains downbeat. It is, therefore, more useful to rely on quantitative data. The meaningful increase in UK ECM activity YTD is a positive signal that investors are willing to support high quality businesses with their funding needs, with 16 deals valued at £25mn or more. The increase in activity has primarily focused on secondary sell downs and primary capital raises of meaningful size (average deal value £418mn), rather than IPOs at this stage. Helpfully, the majority of companies have seen a strengthening share price post-deal, which helps build investor confidence further. When deals do well and investors make money, investors feel more confident to participate more broadly, hence we view the increase in ECM activity as a lead indicator for an IPO resurgence.

4. UK equity flows – The overarching picture remains bleak, with March 2024 the 34th consecutive month of outflows from UK equity funds4, which would suggest that firepower is limited for domestic IPOs. However, the significant increase in UK ECM activity in Q1 this year indicates that UK fund managers are still willing to deploy capital for high quality deals. Heightened takeover activity means UK fund managers have received cash primed to redeploy, and whilst this may not completely counteract persistent outflows, investors will continue to selectively redeploy, some of which could come in the form of supporting new listings. Any incremental stabilisation in the rate of outflows from here would underpin an improvement in UK PLC valuations, which in turn underpins the cyclical return of IPOs highlighted earlier.

5. Regulation – several of our survey respondents cited an easing of regulation as a key mechanism to unlock the IPO market, noting that management teams looking to list want the least arduous and most cost-efficient process possible, which from the brokers’ perspective is not always feasible in the UK. The FCA has proposed new rules to encourage companies to list in the UK, focused on making the UK’s listing regime more accessible, effective, and competitive. Whilst this makes sense, and is a necessary step in the right direction, it is unlikely that the changes will go far enough. From our perspective the attractiveness of the UK IPO market will ultimately be underpinned by post-IPO performance and levels of liquidity. Both of which could be helped by regulation focused on driving further flows into the UK market, rather than regulation surrounding the listing rules themselves. Initiatives such as the British ISA are a good first step in encouraging investment flows into UK-listed businesses, but more is needed to really move the needle.

The UK market ought to be positioned as the go-to market for smaller companies

Recently, there have been several high-profile examples of businesses listing in the US rather than the UK. The argument being that US-listed companies enjoy higher levels of liquidity, making it easier for them to grow quickly, and at least theoretically trade at a higher valuation.

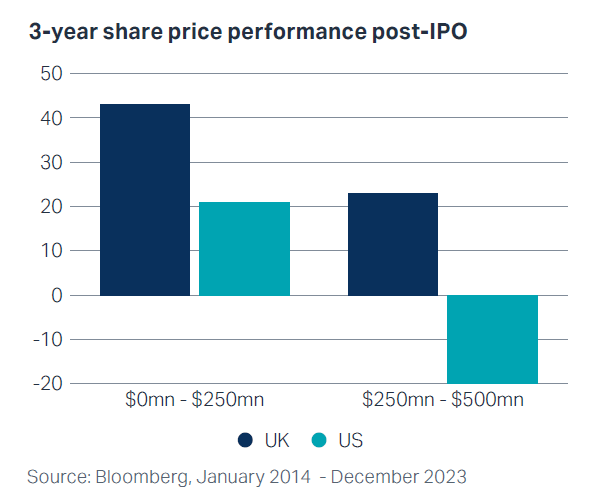

This argument may make sense for a large UK company with US exposure, to benefit from the valuation uplift and liquidity benefits of a US listing. However, the market is crowded, with limited interest for truly small cap businesses. In the US, anything smaller than $0.5bn market cap is essentially deemed nano-cap, and hence some of the perceived benefits are not necessarily experienced by all – the grass is not always greener. In fact, analysis of IPOs in the UK versus the US show that small cap businesses listed in the UK have tended to trade better post-IPO than in the US.

One of the key areas flagged by our surveyed brokers was that market participants need to be more vocal about the benefits of smaller businesses listing in the UK, particularly versus international markets. There is an opportunity to position the UK market as an incubator for smaller companies, with engaged investors who are willing to spend the time doing the work to fully understand and appreciate high quality smaller companies, that could otherwise go under the radar in crowded overseas markets. As small cap specialists, we have an appetite to support smaller companies through their value creation journey, with a preference for businesses with strong fundamentals and attractive financial characteristics.

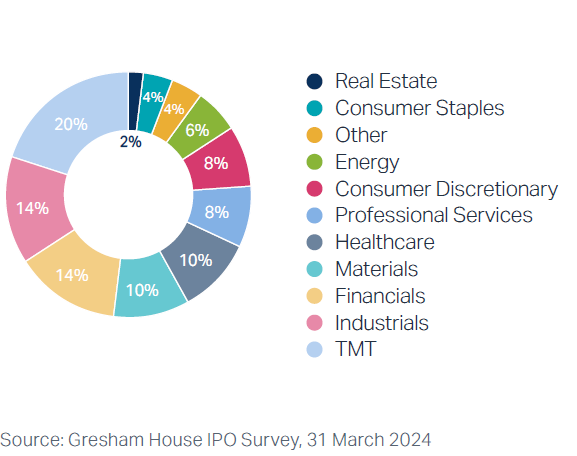

Newsflow has been particularly negative surrounding the loss of home-grown technology businesses, notably with Arm choosing to list in the US, despite overt lobbying to encourage a UK listing. However, this trend is not as apocalyptic as mainstream media suggest. Promisingly the most cited sector across our broker pipelines is TMT, accounting for one in five businesses considering a UK IPO. The sheer diversity of sectors across the pipelines suggests that when IPOs do return, they will do so in a way that appeals to a broad range of investors, underpinning the quality and breadth of the UK equity market.

While we wait for the IPO resurgence, the small cap opportunity set remains plentiful

As the de-equitisation theme continues, and we await the resurgence in IPOs, we continue to see a highly attractive opportunity set across UK small caps. An emerging theme of ‘fallen angels’ has dominated our new investments since the second half of 2023, where we have seen high quality businesses, in terms of financial and strategic characteristics, that have been de-rated due to broader market sentiment and sector malaise, despite continuing to perform well operationally. Hence even if there are fewer businesses within the small cap segment following heightened takeovers and a lack of IPOs, there is currently a higher proportion of businesses that fit both our quality and valuation criteria.

For example, Keywords Studios, the global market leader in video game outsourcing, is a business that we had tracked for a number of years before investing, however the share price had historically traded at a premium rating and did not fit our strict valuation criteria. During 2023 the shares de-rated significantly as part of a broader sector sell-off and unfounded fears surrounding the threat of AI. This enabled us to buy in at an at a valuation multiple that represented a material discount to history, international sector peers and relevant sector M&A transactions. It is our view that Keywords is a high-quality business with a dominant market position, with longer-term growth underpinned by structural tailwinds.

Another example is Moonpig, which was part of the 2021 IPO cohort. Whilst we were aware of the business and its strong fundamentals at that point, it did not meet our valuation criteria at the time of listing. Moonpig’s shares have de-rated significantly since IPO, as broader e-commerce fell out of favour following covid, We feel that Moonpig is differentiated versus broader e-commerce, with best-in-class financial characteristics, and where the organic growth levers are primarily within management’s control. The structural shift towards online purchasing also remains more nascent for card and gifting segment versus broader retail, hence as penetration increases, Moonpig will benefit as the UK’s leading player.

Key takeaways

- There are reasons to feel optimistic about the UK IPO market re-opening, with green shoots of activity despite negative headlines

- It is a question of when not if the IPO market will fully re-open – the current lack of IPOs is cyclical rather than structural; as valuations improve, IPOs will return

- There is an opportunity to position the UK market as the go-to-market for smaller companies, who would not necessarily benefit from the perceived advantages of international markets

- Market participants need to be more vocal about the benefits of smaller companies listing in London – it is time to exit the doom loop and start focusing on the positives

- An IPO resurgence is not necessarily needed to ‘rescue’ the UK small cap market, given the opportunity set remains plentiful, but when the IPO market does re-open, which it will, high quality businesses will certainly be welcomed with open arms by the investor community

|

| Cassie Herlihy Associate Director, Public Equity |

View this article as a PDF

1. Peel Hunt – UK M&A – Feeding Frenzy

2. Bloomberg – UK IPO data

3. Dealogic

4. Calastone Data

Important information

This document is a financial promotion issued by Gresham House Asset Management Limited (Gresham House) under Section 21 of the Financial Services and Markets Act 2000. Gresham House is authorised and regulated by the Financial Conduct Authority (682776).

The information should not be construed as an invitation, offer or recommendation to buy or investments, shares or securities or to form the basis of a contract to be relied on in any way. Gresham House provides no guarantees, representations or warranties regarding the accuracy of this information. This article is provided for the purpose of information only.

Capital at risk. Past performance is not a guide to future returns. Funds investing in smaller companies may carry a higher degree of risk and the shares in smaller companies may be less liquid.

Restricted content

This content is for professional investors only. Please click below to return to the news page.

Gresham House

Specialist asset management

Gresham House

Specialist asset management