June 2025

June 2025

Key risks

- Views and opinions expressed by the investment team are correct at the time of writing but are subject to change. Not to be construed as investment advice.

- Case study presented for illustrative purposes only. Not to be construed as investment advice. Extracted portfolio performance may or may not be representative of the portfolio as a whole.

- Past performance is not a reliable indicator of future performance. Fund investing in smaller companies may carry a higher degree of risk than funds investing in larger companies. The shares of smaller companies may be less liquid than securities in larger companies. Capital at risk.

The Alternative Investment Market (AIM) stands at a pivotal crossroads. For nearly three decades, AIM has been a powerful driver of UK innovation, employment, and economic expansion. Yet today, it faces unprecedented headwinds from declining capital flows and liquidity challenges to adverse tax policy shifts. At a time when the UK is in urgent need of growth, AIM must not be overlooked. Instead, it should be championed as a critical pillar in the nation’s economic architecture.

AIM: A proven engine of SME growth

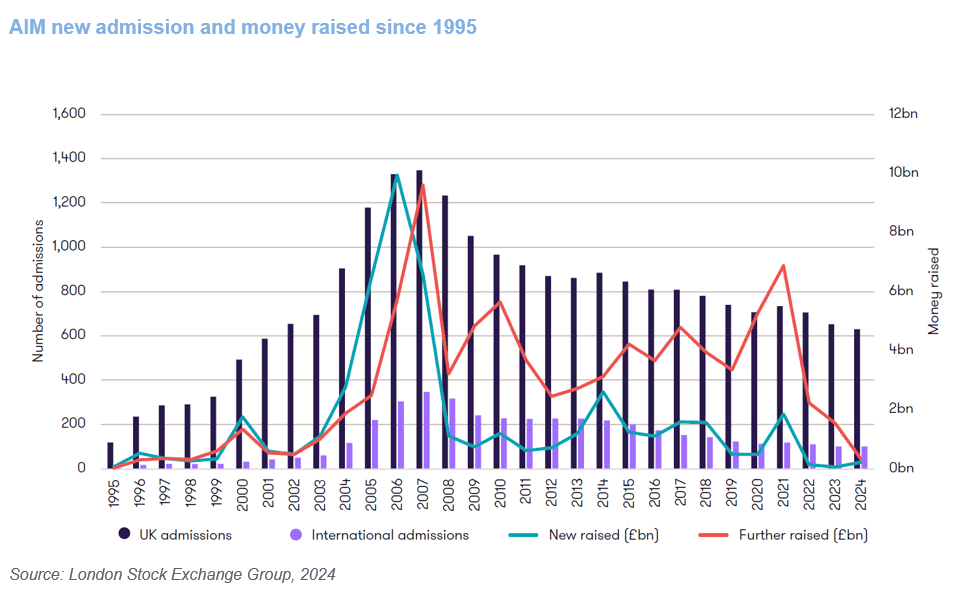

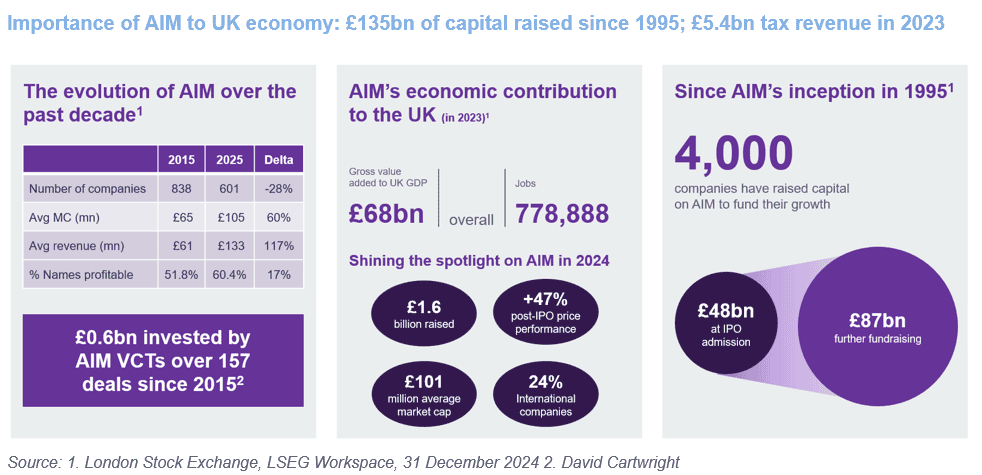

Since its inception in 1995, AIM has supported over 4,000 growth companies and facilitated over £135 billion in capital raising through IPOs and follow-on fundraising. Even amid recent macroeconomic challenges, 83% of AIM IPOs since 2015 have involved UK-incorporated companies contributing directly to the domestic tax base and wider economy.

With UK venture capital funding down 60% from its Q1 2022 peak, AIM could play an essential role in bridging the country’s ‘growth funding gap.’ However, a dramatic reduction in capital raised on AIM and a steady stream of companies leaving the market through takeovers and de-listings in recent years is undermining this potential. For many scale-up businesses, public markets can offer a fundamental step in their development and expansion. The market is currently struggling to fulfill this role.

A strategic asset in the UK’s growth ecosystem

AIM is not just a financing vehicle it is a growth ecosystem. In 2023 alone, AIM companies contributed £35.7 billion in gross value added (GVA) to the UK economy, supported 410,000 jobs directly, and generated £5.4 billion in tax revenues. When factoring in supply-chain impacts and multiplier effects, AIM’s total contribution rises to £68 billion in GVA and 778,000 jobs.

AIM-listed companies are also significantly more productive than the national average, contributing £87,000 per employee in GVA compared to £58,000 for the UK overall*. They are globally competitive too 22% of AIM company revenue came from international markets in 2023, bolstering the UK’s global standing and export economy.

* Source: Grant Thornton, ‘Economic impact of AIM’, 16 September 2024

Attractive investment opportunities

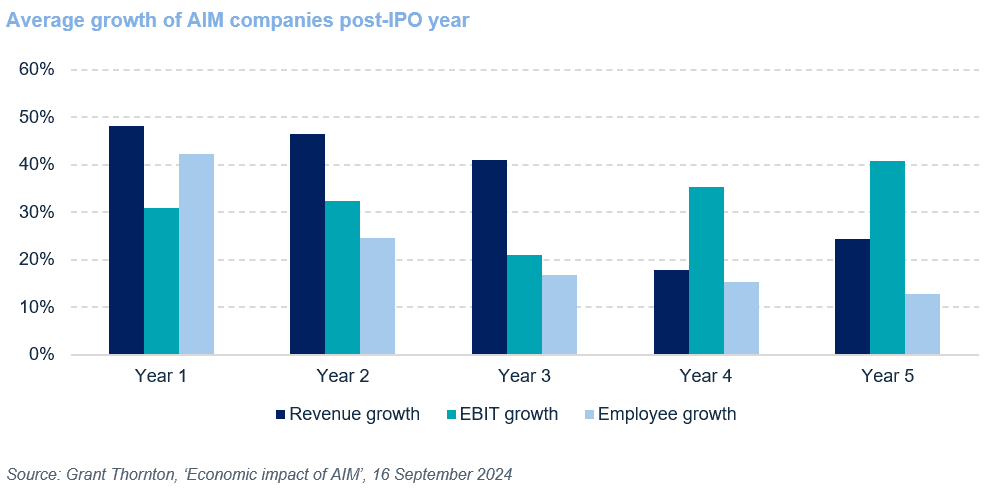

Despite recent market volatility, AIM remains home to a diverse array of growth companies trading at historically attractive valuations. This presents a compelling entry point for long-term investors seeking exposure to innovation-driven businesses across multiple sectors.

AIM’s companies have demonstrated robust earnings growth post-listing, with strong performance across a range of market capitalisations and industries. The potential for meaningful investment returns, coupled with the economic impact of these firms, makes AIM a highly investable segment of the UK market.

Case study 1: Netcall plc – A testament to long-term growth on AIM

Netcall plc, a provider of intelligent automation and customer engagement software, exemplifies the growth trajectory possible for companies listed on AIM. In 2010, Gresham House, through its Baronsmead VCTs, invested in Netcall, supporting the company through new capital and secondary market purchases to build a significant stake.

At the time of investment, Netcall had just acquired Telephonetics and was generating annual revenues of approximately £5 million, profits of £0.5 million, and employed 27 staff. By June 2024, these figures had grown to £39.1 million in revenue, £5.85 million in profit, and 283 employees, reflecting the company’s successful expansion.

From a financial perspective, Netcall’s share price has increased from 19 pence at the time of the 2010 fundraising to 104 pence in 2025. Alongside cumulative dividends of approximately 12.66 pence per share, this represents an annualised total return of around 13% over the past 15 years an example of the long-term return potential from smaller AIM-listed companies.

An interview with Netcall plc

Case study 2: MHA plc – Demonstrating AIM’s vitality in 2025

In April 2025, MHA plc, a leading UK accountancy firm and the UK member of Baker Tilly International, successfully listed on AIM, raising £98 million and achieving a market capitalisation of approximately £271 million. Gresham House acted as a cornerstone investor in this IPO, reflecting confidence in MHA’s growth prospects and the opportunities presented by new AIM listings.

MHA’s decision to list on AIM was driven by the desire to access growth capital, enhance its public profile, and provide some liquidity for existing shareholders. The successful IPO, despite prevailing market volatility, demonstrates that AIM remains open for business and continues to be an attractive platform for companies seeking to raise capital and expand their operations.

A call for Government action

The UK government has a stated mission to kickstart economic growth and we believe they have an opportunity to support the innovation and growth that the AIM market is capable of driving.

The government should explicitly acknowledge that AIM companies are included within the recently expanded Mansion House Accord. Chancellor Rachel Reeves should affirm that the commitment to directing pension and institutional capital towards UK assets applies to productive growth companies listed on AIM as well. These companies should be seen as a desirable home for pension fund capital, offering both the opportunity to generate long-term investment returns and to support economic growth. Stating this clearly would signal a strong vote of confidence in the market and help reverse the trend of de-equitisation currently plaguing UK equity markets.

Furthermore, they should act decisively to restore confidence and liquidity in AIM. This starts with maintaining existing tax incentives such as Business Property Relief which have been essential in attracting long-term patient capital. The recent halving of IHT exemptions has had a material adverse impact on liquidity and sentiment towards AIM as a market. Clear confirmation from government that there will be no further changes for the life of this parliament would go a long way to rebuilding confidence.

Unlocking liquidity through VCT reform

The AIM VCT industry, managing over £1 billion in capital, represents a significant untapped lever to enhance secondary market liquidity. Current EU-aligned rules prohibit VCTs from investing in secondary AIM shares – a restriction that could be sensibly reversed. By allowing VCTs to trade in the secondary market of VCT-eligible AIM companies, the government could inject much-needed liquidity without any new fiscal expenditure, while simultaneously supporting a vibrant investment industry that already benefits from targeted tax relief. Making upwards revisions to other restrictions such as the gross assets limit, age limits and amounts of VCT capital that can be received by an individual company would benefit qualifying AIM and private companies alike by supporting the best businesses with more capital for longer to help them to scale.

A time for decisive action

In a global economy, increasingly driven by innovation and entrepreneurship, the UK cannot afford to neglect one of its most effective tools for fostering business growth. AIM is more than a junior market it is a vital engine of national prosperity, job creation, and tax generation. It deserves not just protection, but proactive promotion. The future of AIM should be a central plank in any credible strategy for sustainable UK growth. With the right policy support and renewed investor confidence, AIM can reclaim its role as a cornerstone of Britain’s capital markets – and a beacon for growth companies at home and abroad.

Authors |

||

|

|

|

| Ken Wotton Managing Director, Public Equity |

George Karidis Investment Associate, Public Equity |

Important information

This document is a financial promotion issued by Gresham House Asset Management Limited (Gresham House) under Section 21 of the Financial Services and Markets Act 2000. Gresham House is authorised and regulated by the Financial Conduct Authority (682776).

The information should not be construed as an invitation, offer or recommendation to buy or investments, shares or securities or to form the basis of a contract to be relied on in any way. Gresham House provides no guarantees, representations or warranties regarding the accuracy of this information. This article is provided for the purpose of information only.

Capital at risk. Past performance is not a guide to future returns. Funds investing in smaller companies may carry a higher degree of risk and the shares in smaller companies may be less liquid.

Restricted content

This content is for professional investors only. Please click below to return to the news page.

Gresham House

Specialist asset management

Gresham House

Specialist asset management