Key highlights and achievements

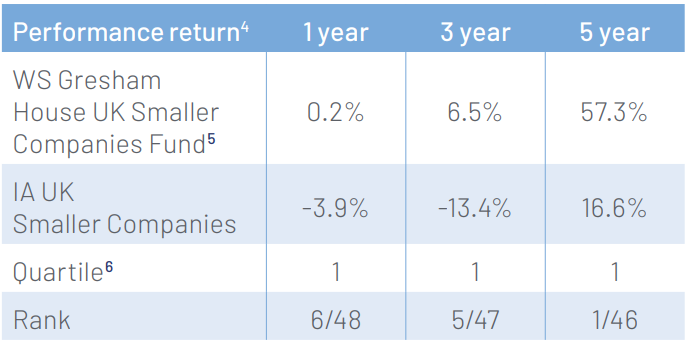

- Number one performing fund over five years in the IA UK Smaller Companies sector, outperforming the sector in each calendar year since launch1

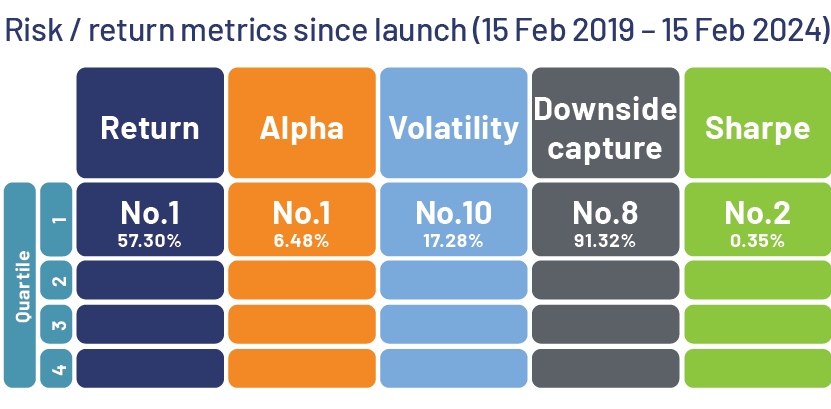

- Top quartile since launch across a range of risk adjusted metrics relative to the IA UK Smaller Companies Sector1

- Focus on high-quality companies with a strong valuation discipline

- Targeting a diversified portfolio of 40-50 holdings

- Managed by an award winning, experienced, and specialist UK small cap equities team

Background and approach

Looking back to February 2019, when we launched the WS Gresham House UK Smaller Companies Fund, little did we realise that the next five years would see a series of globally unprecedented events in modern times. The UK leaving the European Union, the outbreak of a global pandemic, wars in Europe and the Middle East, a rapid resurgence of inflation across most countries and rising interest rates.

The Fund has navigated these challenges with remarkable resilience, and we are cautiously optimistic about the future and the medium-term outlook for the Fund as we seek to continue to deliver market leading risk adjusted returns within UK equity markets.

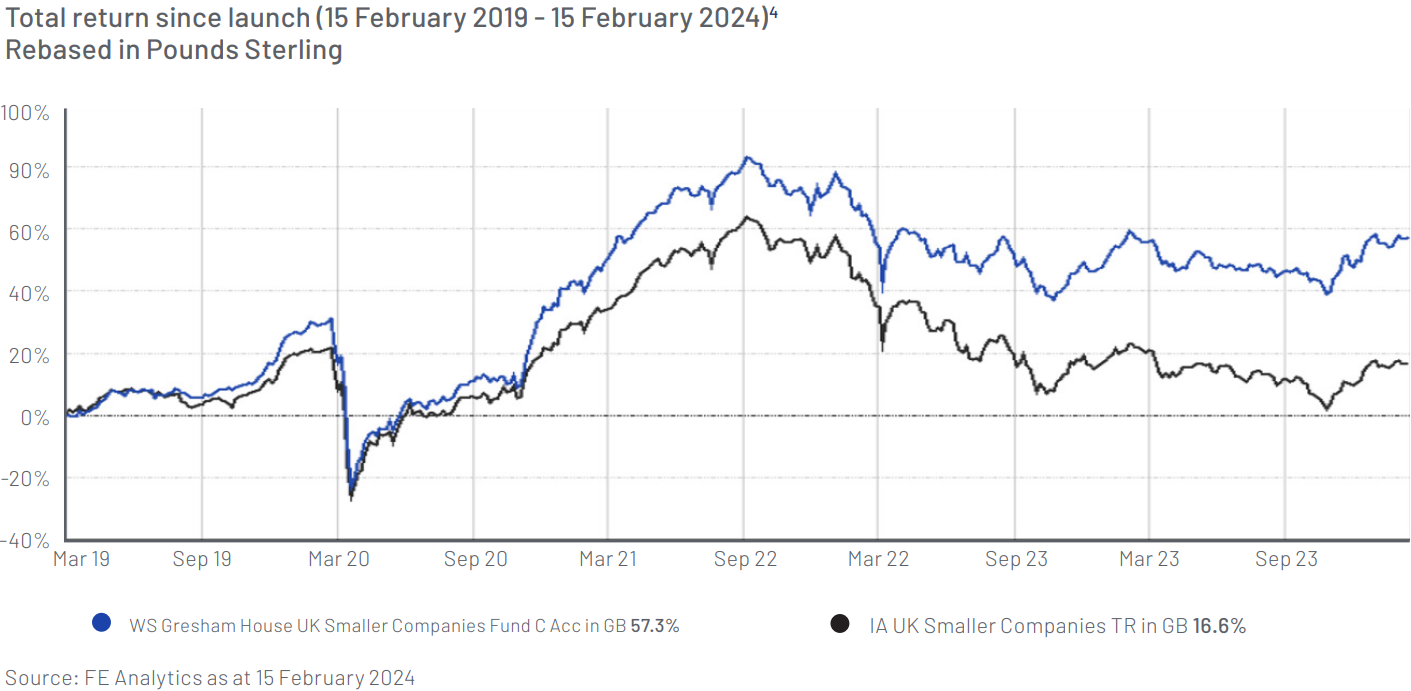

The WS Gresham House UK Smaller Companies Fund marked its five-year anniversary (15 February 2024) as the top performing fund over this time, and one of the most consistent performing funds within the IA UK Smaller Companies sector since launch. Since launch the Fund has returned 57.3% compared to the sector average of 16.6%.1

Driving this performance is our investment philosophy and mindset – backing high-quality, resilient companies with structurally attractive fundamentals that deliver value creation through economic cycles and challenging external conditions. We launched this fund with that philosophy front and centre, to find quality and resilience at a reasonable price to provide attractive capital growth to our investors over the long term.

As specialist smaller companies investors, we wanted to build on the long-standing success of our WS Gresham House UK Micro Cap Fund and apply our private equity approach to public markets to a wider range of UK small-cap listed companies.

Our ambition was to back the best UK smaller companies as they scale and mature. With well over a thousand possible companies to invest into, our objective was to create a highly differentiated set of holdings in the form of a relatively concentrated portfolio that offered investors access to a differentiated portfolio of structurally growing businesses with the potential for attractive long-term capital growth.

The last five years have seen market turbulence, diverging sector performance and changing sentiment towards investment styles. We have deliberately been consistent in focusing on the long-term investment horizon and have avoided short-term rotations in or out of sectors or styles. Often our selectivity and discipline in not subscribing to shorter term trends has been rewarding and a major contributor to our risk-adjusted returns.

We believe our long-term focus and willingness to back high-quality businesses and teams through periods of uncertainty and volatility have contributed to the consistency of the Fund’s returns. At the five-year anniversary, 14.9% of the Fund was in stocks that were invested in at launch.2

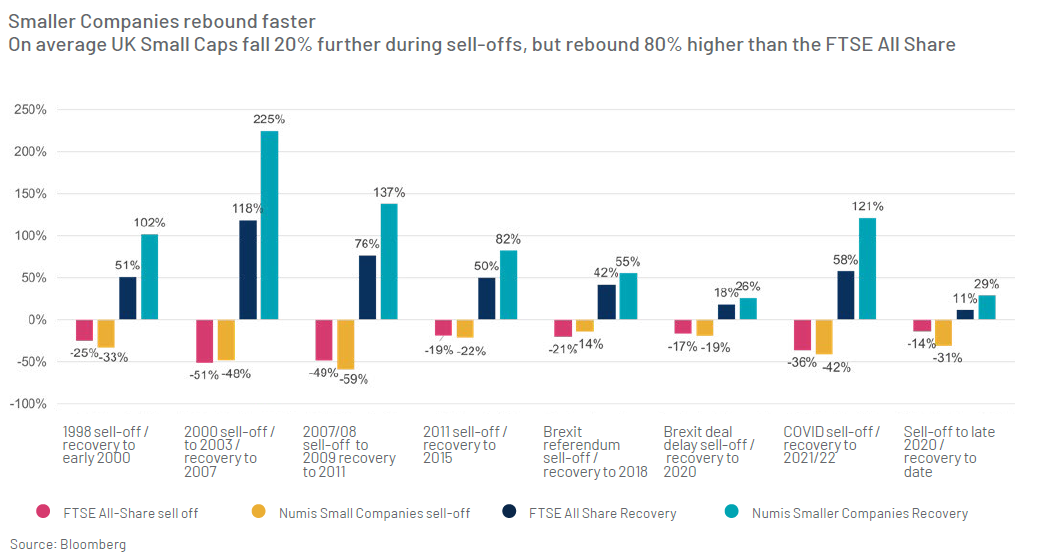

Amid market fluctuations, the psychological frameworks through which investors perceive risk and reward often shift in kind. Allocation weightings towards larger-cap companies generally increase in periods of economic weakness, as lower betas and relatively stable earnings appeal to a larger pool of investors in depressed market conditions.

Risk-off market sentiment has prevented investors from capitalising on the attractive fundamental opportunities available in the small-cap space. Our historical review of UK equity performance illustrates how under-allocation to small-cap stocks has resulted in UK investors foregoing superior returns in the aftermath of market turmoil.

Today, we see near-term catalysts for a small-cap revival and encourage investors not to miss the opportunity.

Investment philosophy

Our core investment philosophy was directly borne out of our time spent investing as part of a private equity firm. Applying this private equity mindset and these techniques to public markets is central to our approach to deploying capital and managing risk.

Our starting point is capital preservation. First and foremost we are looking to defend our investors’ capital value. We have an absolute return focus, seeking to deliver a return on every investment we make, with a suitable risk return profile that reflects our style and approach to risk mitigation. We do not seek to outperform benchmarks or make investment decisions predicated on being over or under weight sectors or styles, as we believe these can lead to a sub-optimal allocation of capital.

As high-conviction investors the Fund is constructed on a bottom-up basis, comprising a relatively concentrated set of differentiated holdings (c.40-50 stocks) that we believe are uncorrelated to the wider market.

We are fundamental focused investors who look for quality and resilience with a keen eye on valuation. We only invest in sectors and companies that we really understand and where we believe we can build proprietary objective investment insight to underpin compelling investment cases. We have always and will continue to focus on sectors and areas of the economy where success or failure is principally within the control of the management team and less influenced by external factors, such as the macroeconomic environment.

Investment process

Our thorough approach to diligence involves using our independent network of specialists to validate or invalidate our critical investment judgements.

As true long-term investors we seek to identify structural growth trends, transforming market dynamics and changing ecosystems that unlock multi-year growth opportunities. We target businesses benefitting from these structural growth trends since these provide a tailwind that can provide resilience and visibility in an uncertain macro-economic environment.

From pharmaceutical outsourcing to digital transformation we are thoughtful about matching capital deployment with areas of long-term growth and structurally positive business dynamics. We are selective about how we view sectors and sub-sectors and are focused on business models that match our philosophy of profit scalability, cash generation and attractive unit economics. The collective insight we leverage across both public and private equity is used to build high conviction in our investments.

Investment case studies

|

Keyword Studios

|

Keywords is the global market leader in videogame outsourcing, providing services to large videogame developers and publishers, including functional testing, language translation, game development and marketing.

Videogaming is a sector that we know well, through previous investment activity over several years. We have built a strong network within the sector that we leveraged in our due diligence process prior to investing in Keywords.

We had tracked the business for a number of years before investing, given its strong fundamentals and high-quality financial characteristics. However, the share price had historically traded at a premium rating and did not fit our strict valuation criteria. During 2023 the shares de-rated significantly as part of a broader sector sell-off and unfounded fears surrounding the threat of AI. This enabled us to buy in at an attractive entry point at a valuation multiple that represented a material discount to history, international sector peers and relevant sector M&A transactions.

Keywords is a high-quality business that has built a strong track record of growing earnings and cash consistently since its IPO in 2013, through effective execution on its clear organic and inorganic growth strategy. Its outsourcing proposition plays into the large and expanding videogames market, whilst avoiding the risk and lumpiness of relying on the success of individual game releases to drive returns.

Ultimately, we believe its longer-term growth is underpinned by structural tailwinds, as the increased race for the highest quality content, in the most cost-effective way, pushes capacity constrained developers and publishers to outsource key elements of game development and life-cycle management.

Keywords is the market leader globally, three-times as large as its closest competitor in a fragmented market, providing a platform to continue to take market share organically as well as growing through M&A.

Ricardo

|

Ricardo is a global strategic, environmental and engineering consultancy with in-house production capability. The business operates across 27 countries, with more than 2,900 employees worldwide and over 2,500 live projects, across its five business units.3

Ricardo has a long-heritage as a listed business in the UK. With a new CEO joining the business over two years ago he has set out to implement a clearly defined strategy to reposition the business, by focusing on the higher margin, higher growth and lower capital intensity parts of the business with the objective of becoming a global leader in environmental consulting.

This strategic shift aligns the business to longer-term structural tailwinds, as well as improving cash generation and earnings quality. This should underpin the Group’s target of doubling operating profit by 2027. We have engaged closely with the management team on their strategic plan, backing a high-quality team to drive the strategic repositioning of the group to deliver a compelling value creation opportunity.

Despite clear progress being made in re-positioning the business, with significant growth across its Energy and Environmental division, this business continues to trade at a stark discount to precedent transaction multiples for similar businesses. If the UK stock market continues to fail to appreciate the progress made by Ricardo, this business is likely to become an attractive target for either a strategic or private equity buyer.

Our objective

Given the private equity investment platform from which we launched this Fund and the philosophy and mindset of the investment team, our expectations were to deliver

market-leading risk-adjusted returns over the long term.

Since launch in 2019, we have seen periods of great stress from a domestic and global economic perspective as well as significant market volatility.

Through this period the underlying resilience of our investments has been proven. We have consistently backed high quality management teams with clear strategies that align with shareholder value creation.

We have leveraged our deep investment team resource and unique insights across public and private equity to find companies with robust business models operating in structurally attractive markets that are benefitting from secular growth drivers and which have a strong competitive advantage that endures over the long term.

One of the key differentiators we have used to drive a competitive edge is using our network of independent experts to validate critical judgements and understand key risks.

We are able to draw on the insight and expertise of experienced individuals with deep sector insights to provide critical insight relevant to our investment decision making process.

Performance

Capital at risk. Past performance is not a guide to future returns. Funds investing in smaller companies may carry a higher degree of risk and the shares in smaller companies may be less liquid.

Quality and resilient financial metrics at sensible valuations

We target businesses with attractive high quality financial characteristics. We look for attractive and sustainable revenue and earnings growth; strong business visibility and quality of revenue; high operating margins providing profit resilience; low or no financial leverage providing a robust balance sheet to withstand unexpected market turbulence and reducing the risk of permanent capital loss.

We are focused on valuations, seeking to find companies with high quality financial characteristics at valuation levels where we can rationalise how we can achieve our target long-term returns with an appropriate margin of safety.

We assess this not just by benchmarking valuation metrics against UK-listed peers and history but also with reference to international peers and in particular relative to precedent transaction multiples for relevant businesses in private markets where we can leverage our private equity network to provide insight.

This table sets out the aggregate financial and valuation characteristics for the Fund. The portfolio exhibits attractive revenue and profit growth, high margins and low financial leverage. On a comparative basis it is interesting to note is the portfolio valuation stands at a material discount to historic UK equity valuation levels and to typical M&A transaction multiples in recent years.

| 31 January 20247 | CY23 | |

| Revenue growth | 10.3% | |

| EBITDA margin | 22.6% | |

| Net Income Growth | 12.1% | |

| EV/sales | 2.0% | |

| EV/EBITDA | 8.6% | |

| PE | 14.9% | |

| Leverage8 | 0.3 |

Outlook

While global markets price in expectations of easing inflation and falling interest rates in 2024, we do not expect market volatility to abate given the ongoing macroeconomic and geopolitical uncertainty. We believe that present conditions will continue to generate mispricing opportunities across the UK market, particularly across the smaller companies segment, yet we are conscious to retain a sharp focus on resilient businesses with high-quality fundamentals.

The UK markets de-rated through 2023, with many companies continuing to trade at a stark discount to history, as well as versus international and private peers. As market valuations remain low it is worth considering that in some cases de-ratings may be warranted. Through 2023 we saw elevated profit warnings across the UK market, a trend which we expect to continue into 2024, therefore some companies may not be as attractively valued as they initially seem and hence, we view this as a stock-pickers market.

We continue to leverage our network to glean unique expertise and analytical insights, helping us validate and build conviction across discrete components of our investment theses. Using this advantage in tough market conditions navigates us away from ‘value traps’ which tend to appear in a ‘cheap’ market, allowing us to focus our deployment into high quality businesses, trading at attractive valuations.

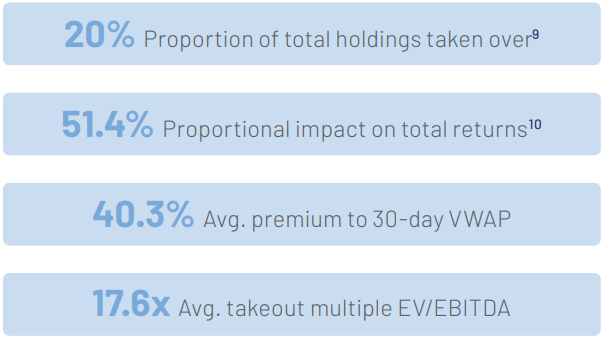

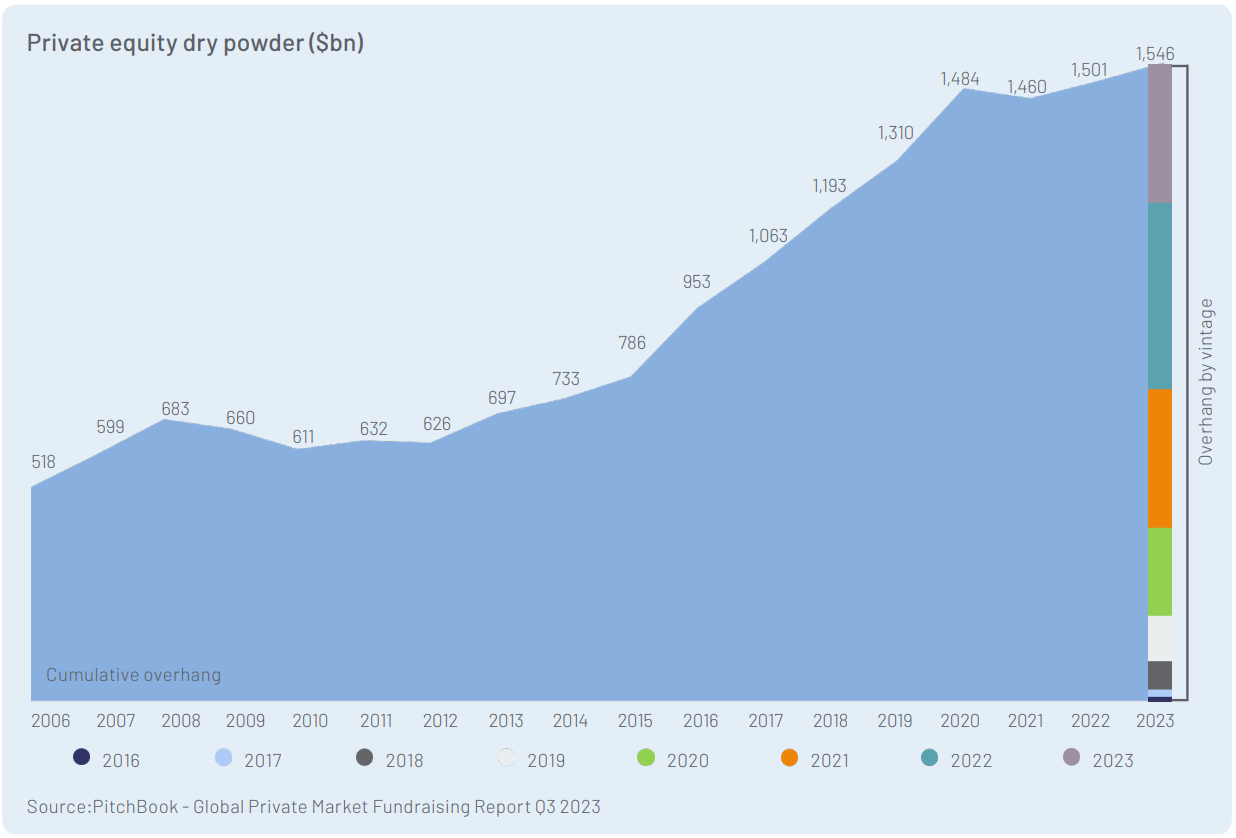

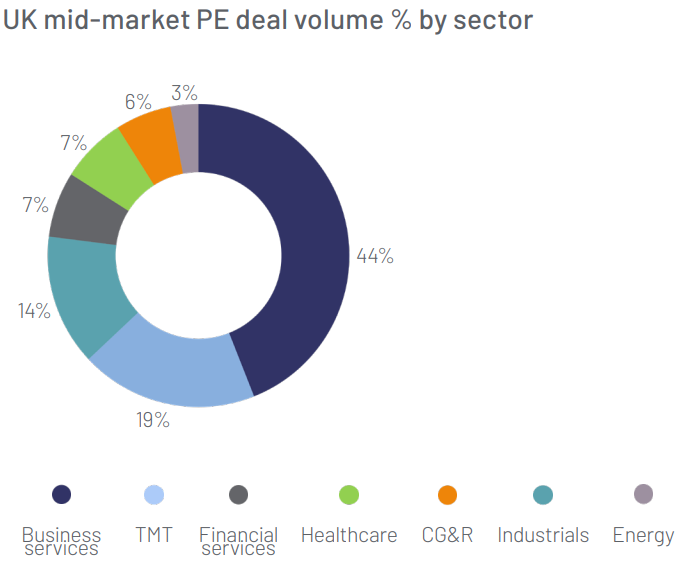

We also expect M&A activity to persist into early 2024 as UK equities remain heavily discounted relative to comparable M&A transactions. In the US and Europe, mid-to-large leveraged buyout firms are looking to offset the higher cost of debt by purchasing UK-listed businesses at steep discounts to intrinsic value.

As evidenced by the takeover activity, the private equity gaze is firmly fixed on UK smaller companies, where the discrepancy between trading multiples and company fundamentals appears most prevalently. As the M&A activity continues, we cautiously expect investors to bridge the gap between stock market valuations and UK company fundamentals.

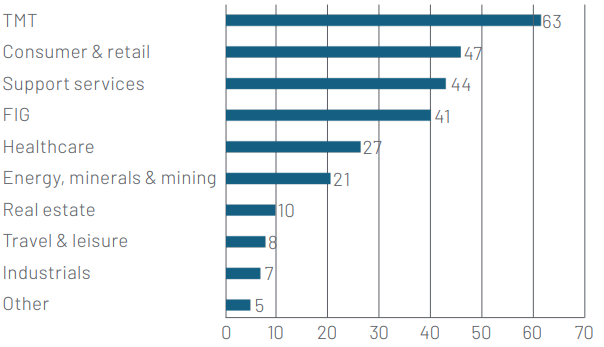

UK takeovers in past five years – Gresham House UK Smaller Companies

Recent takeover announcements

Private equity activity in UK public markets

Source: Pitchbook – Global Private Market Fundraising Report Q3 2023

1. FE Analytics as at 15 February 2024

2. Source: Gresham House

3. Ricardo plc

4. Based on the returns of the C share class, net of charges, since launch to 15 February 2024

5. Fund launch: 1 February 2019 (First NAV 15 February 2019)

6. Peer group of 48 funds in IA UK Smaller Companies by FE fund info as at 15 February 2024

7. Please contact Gresham House for detail on all exclusions

8. Net Debt/EBITDA

9. Includes holdings held prior to the point of takeover

10. Returns data only available over L3Y

Key risks

- The value of the Fund and income is not gauranteed and may fall as well as rise. As your capital is at risk you may get back less than you originally invested

- Past performance is not a reliable indicator of future performance

- Fund investing in smaller companies may carry a higher degree of risk than funds investing in larger companies. The shares of smaller companies may be less liquid than securities in larger companies

Important information

This document is a financial promotion issued by Gresham House Asset Management Limited (Gresham House) under Section 21 of the Financial Services and Markets Act 2000. Gresham House is authorised and regulated by the Financial Conduct Authority. The information should not be construed as an invitation, offer or recommendation to buy or sell investments, shares or securities or to form the basis of a contract to be relied on in any way.

Gresham House provides no guarantees, representations or warranties regarding the accuracy of this information. This article is provided for the purpose of information only and before investing you should read the Prospectus and the key investor information document (KIID) as they contain important information regarding the fund, including charges, tax and fund specific risk warnings and will form the basis of any investment. The prospectus, KIID and application forms are available from Link Fund Solutions, the Authorised Corporate Director of the Fund (Tel. No. 0345 922 0044).

Capital at risk. Past performance is not a guide to future returns. Funds investing in smaller companies may carry a higher degree of risk and the shares in smaller companies may be less liquid.

Gresham House

Specialist asset management

Gresham House

Specialist asset management