Francis Ireland, March 2022

Francis Ireland, March 2022

Looking at why we believe forestry could be a safe haven for investors in times of increasing inflation

As the threat of an inflationary future looms on the horizon, institutional investors are increasingly turning to real assets.

Real Assets can provide diversification benefits and have traditionally countered the effects of inflation through their exposure to tangible assets. The recent proliferation of real asset-focused funds has proved welcome in an institutional landscape demanding sustainability and protection from rising price levels.

Timberland is no different, with investors benefitting from the close relationship between forestry returns and inflation.

So, what is driving this relationship?

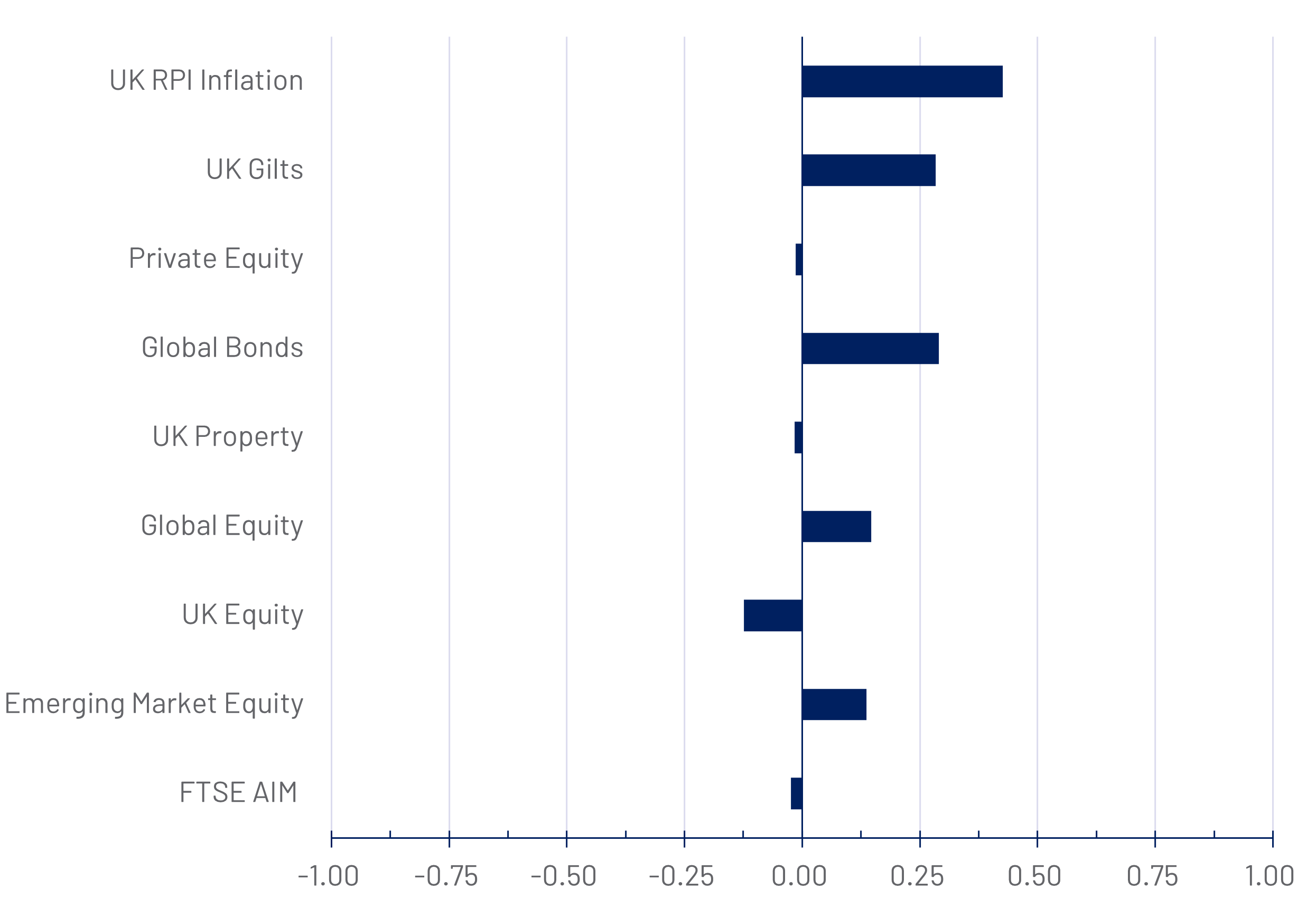

15-year UK forestry returns – Correlation coefficient

Source: Gresham House, 2022

Timber is used in everything from food production to battery storage

Timber is a super material. It is versatile, strong and sustainable. Wood is used in everything from food production to battery energy storage.

Where an investment in lithium may represent a bet on the electric car market, an investment into forestry reflects exposure to a broad range of industries.

What happens when price levels rise?

Wood-based products which permeate through the basket of goods on which inflation is calculated are captured in this rise. When inflation increases so do the prices of wood products.

Aside from the broad-based demand for wood products, inelastic supply is an integral component of the close relationship between inflation and forestry returns. For example, the most common productive species in the UK, Sitka Spruce, has a harvest length of circa 40 years.

As such, the ability of supply to react to timber prices is constrained. With inflation comes higher timber prices, suppliers are constrained in their ability to increase their output, price pressures persist.

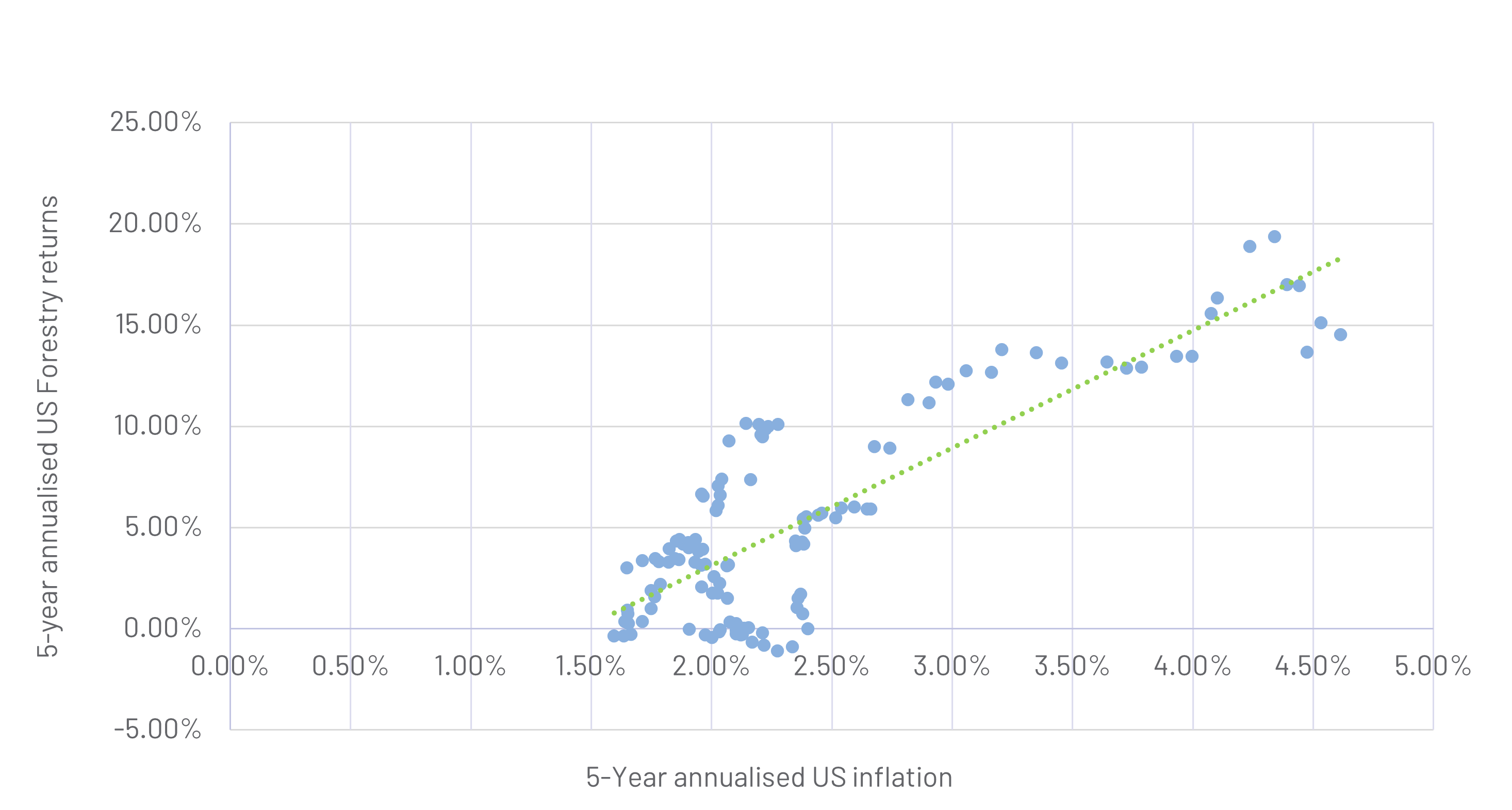

US Forestry returns vs. US inflation

Source: NCREIF/Fed, 2022

Forestry returns are intrinsically linked to inflation, with timber as the underlying driver.

However, US and UK timberland exhibit differences that affect their respective relationship to inflation. Timber consumption in the US is mainly serviced by domestic supply, with the US importing just 26% of their sawnwood, compared with 70% in the UK.

Exploring this through the broad-based demand logic, US forestry returns will more closely follow the domestic price level as more of the associated wood-based products are captured.

With the UK government committed to planting 30,000 hectares of trees a year by 2024, we believe forestry returns will follow inflation even more stringently as the UK consumes more domestic timber.

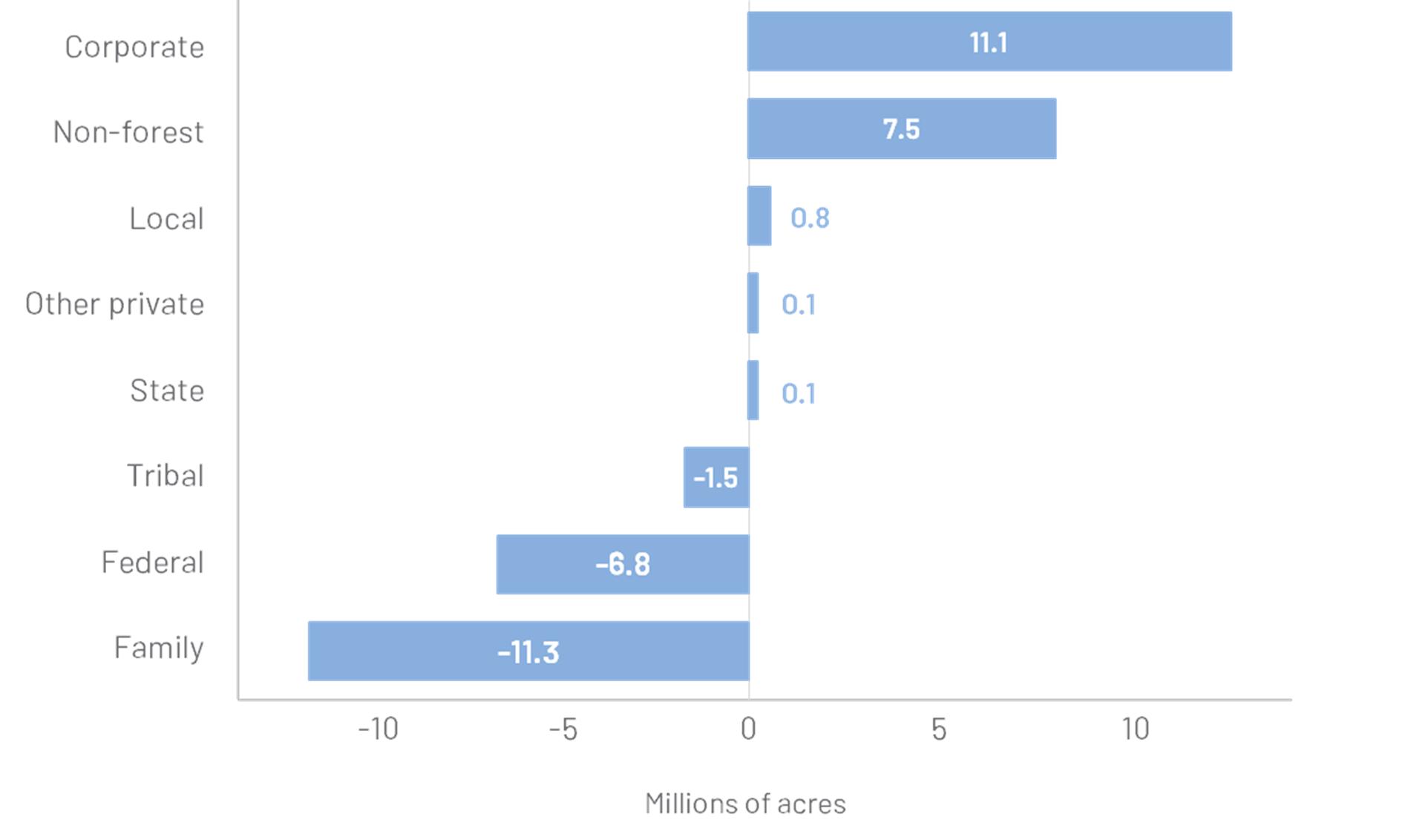

US Forestland Ownership Transition 2007-2017

Source: Journal of Forestry, 2021

UK Forestry returns are strongly correlated to inflation

Timberland in the US is the most mature market in the world when considering the institutional investor holdings.

In the UK, institutional investment in forestry is relatively new. In fact, Gresham House Asset Management Limited is the largest commercial Forestry Manager in the UK and our suite of discretionary forestry funds began in 2008.

Forestry values of late have benefited from this increasing institutional appetite. As values become more aligned to timber price movements, we believe the relationship between forestry returns and inflation will become even more prominent.

Traditionally, gold and other commodities have been the benefactor of institutional capital’s search for protection against rising price levels.

The development of UK forestry as an asset class offers an exciting alternative.

The sustainability credentials and diversification qualities provide an added benefit for any investor looking to counteract inflationary pressures on the horizon.

Francis Ireland

Analyst, Forestry

The views expressed here are the author’s own at the date of publication (March 2022) and do not necessarily reflect those of Gresham House.

Past performance is not a reliable indicator of future performance.

When investing in forestry, your capital is at risk. Please ensure you read more about the risks involved.

Gresham House

Specialist asset management

Gresham House

Specialist asset management