Ken Wotton & Brendan Gulston - January 2023

Ken Wotton & Brendan Gulston - January 2023

Over the past 24 months, UK equities have seen a significant and sustained step up in corporate takeover activity. We see this continuing and becoming an even more prominent feature of UK public market activity during 2023 as corporate and private equity buyers seek to benefit from ongoing depressed UK equity valuations.

Highly attractive UK valuations lay the foundation

At Gresham House, we do not specifically target investments in companies we hope or expect to be takeover targets in the short term.

However, by focusing on businesses with attractive long-term fundamentals while also maintaining valuation discipline it is inevitable that some of our portfolio companies will attract interest.

Indeed, it is those strong fundamentals when combined with deep discounts to valuation multiples across large segments of the UK equity market that provides a compelling investment opportunity as we move into 2023.

Once-in-a-generation UK valuation discounts provide a large margin of safety for investors despite the macroeconomic challenges. If traditional equity market investors do not take the opportunity then we expect increasing numbers of corporate and private equity buyers to do so.

It is this simple observation that leads us to conclude that corporate activity will be elevated this year which in turn could be the catalyst for investors to turn attention back to the UK and drive a wider positive market re-rating.

The headline metrics are eye-catching.

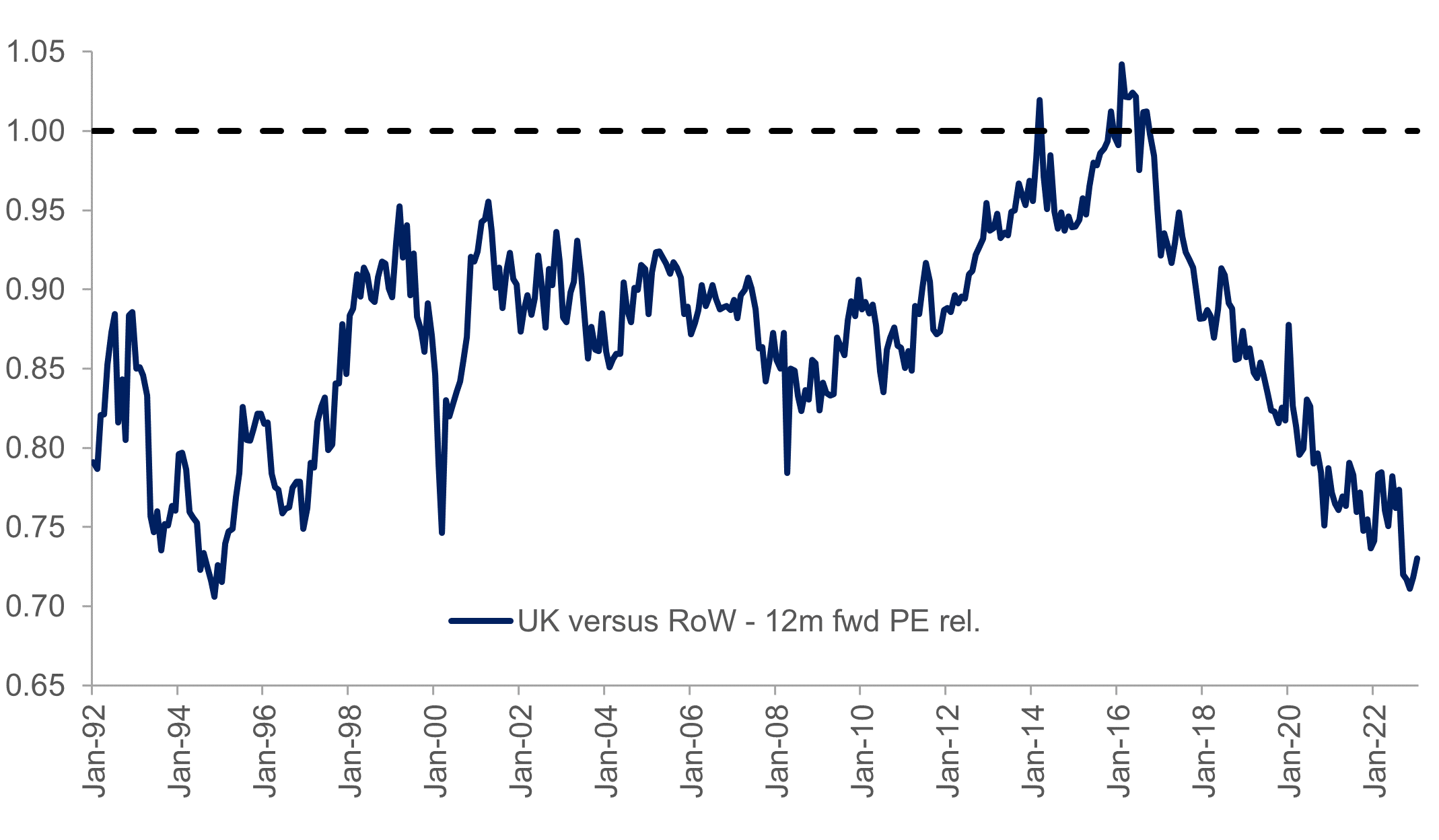

By the end of December 2022, UK equities were trading on a forward Price-to-Earnings ratio that valued the market almost a third more cheaply than global equities. After a seven-year slide in relative valuations – beginning in the wake of the Brexit referendum – UK equities have not looked so attractively priced compared to global markets at any time in the past 30 years.

UK equity markets showing a deep valuation discount – UK 12-month forward P/E multiple relative to global equities

Source: Berenberg

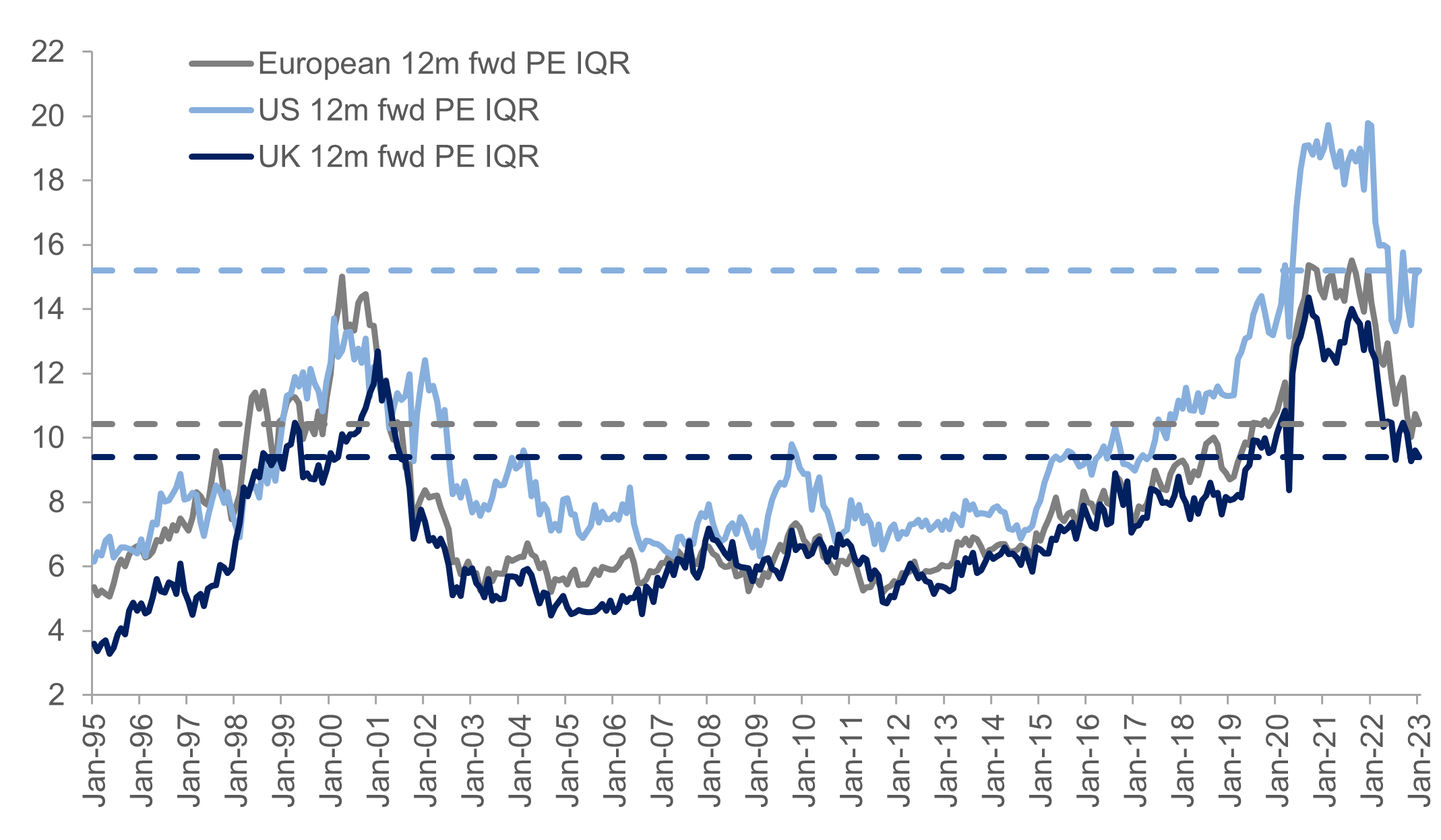

Moreover, those market-wide statistics mask a very wide dispersion of valuations at the individual stock level.

Rarely has there been so much disparity between the market value of ostensibly similar businesses – and therefore so much potential to exploit discrepancies and mis-pricing.

Wide dispersion of valuations – European, US and UK equity markets 12-month forward P/E inter-quartile range (IQR)

Source: Berenberg

The UK market is optically cheap, albeit there is still a wide range of valuations, meaning selectivity and discipline when it comes to stock selection are key. Furthermore, the smaller companies segment of the UK market continues to trade at a material discount to the mid and large cap segments.

However, there have been numerous occasions in history when UK equities have looked undervalued on both an absolute and relative basis, but many investors, including ourselves, have shied away from calling the bottom. Looking further afield at valuations across the private market we observe that multiples in this space have held up more stubbornly, precipitating a significant arbitrage gap between the two markets.

There are certain UK publicly listed companies, that we have identified and invested in, where we can point to almost mirror image private company comparables that are being bought at significant premia to where the public assets are trading. The current arbitrage gap and opportunity we see in UK equities is unsustainable and will close.

We believe that the critical catalyst to closing this valuation arbitrage gap between public and private markets will be discerning buyers of public assets.

We recognise that the current macroeconomic and geopolitical environment is uncertain at best. As 2023 commences, the UK faces strong economic headwinds: double-digit inflation, supply-chain disruption and the prospect of a recession that will last all year if the Bank of England’s forecasts prove accurate. These are among the factors that continue to weigh on market sentiment and contribute towards depressed share prices across the UK market.

But while macro-led investors may be daunted by that outlook, the macro-aware will continue to search for opportunity. The discerning investor will actively sift through to find those structurally well positioned companies, that are exposed to long-term secular dynamics and with sustainable competitive advantages, that will drive growth irrespective of wider macro-economic conditions. Within that opportunity set, those companies that are materially undervalued and where the investor can drive strong conviction will naturally form an area of focus.

The discerning buyer

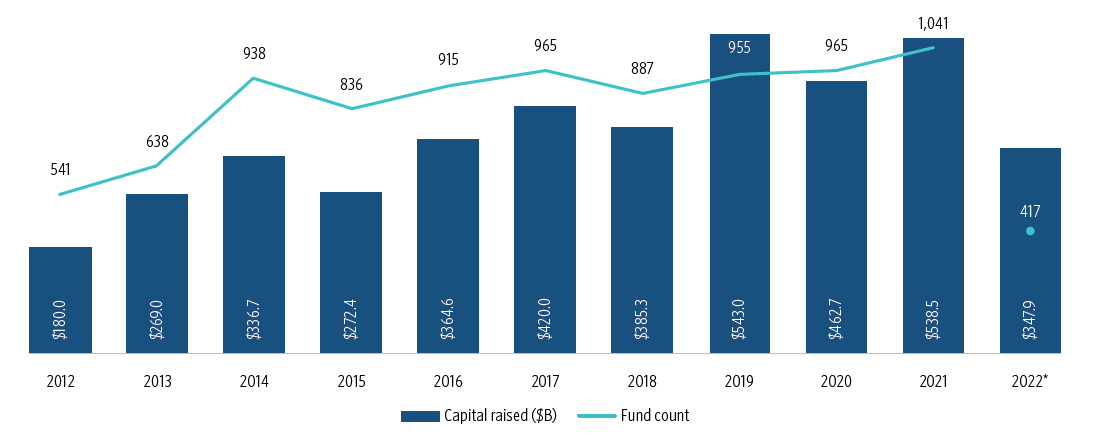

Over the past decade the global private equity industry has steadily raised more capital to deploy across a larger number funds (see below). The vast majority of this capital has been focused within North America and Europe.

Private capital fundraising activity

Source: PitchBook – Global Private Market Fundraising Report data to 30 September 2022

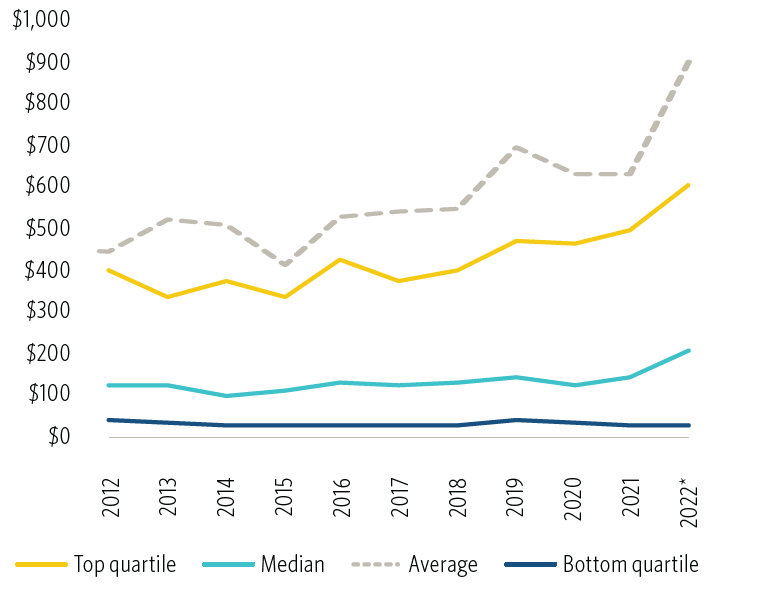

PE firms have been progressively launching funds with greater capacity to deploy the larger sums of capital being raised (see below).

PE fund sizes ($mn) by quartile

Source: PitchBook – Global Private Market Fundraising Report data to 30 September 2022*

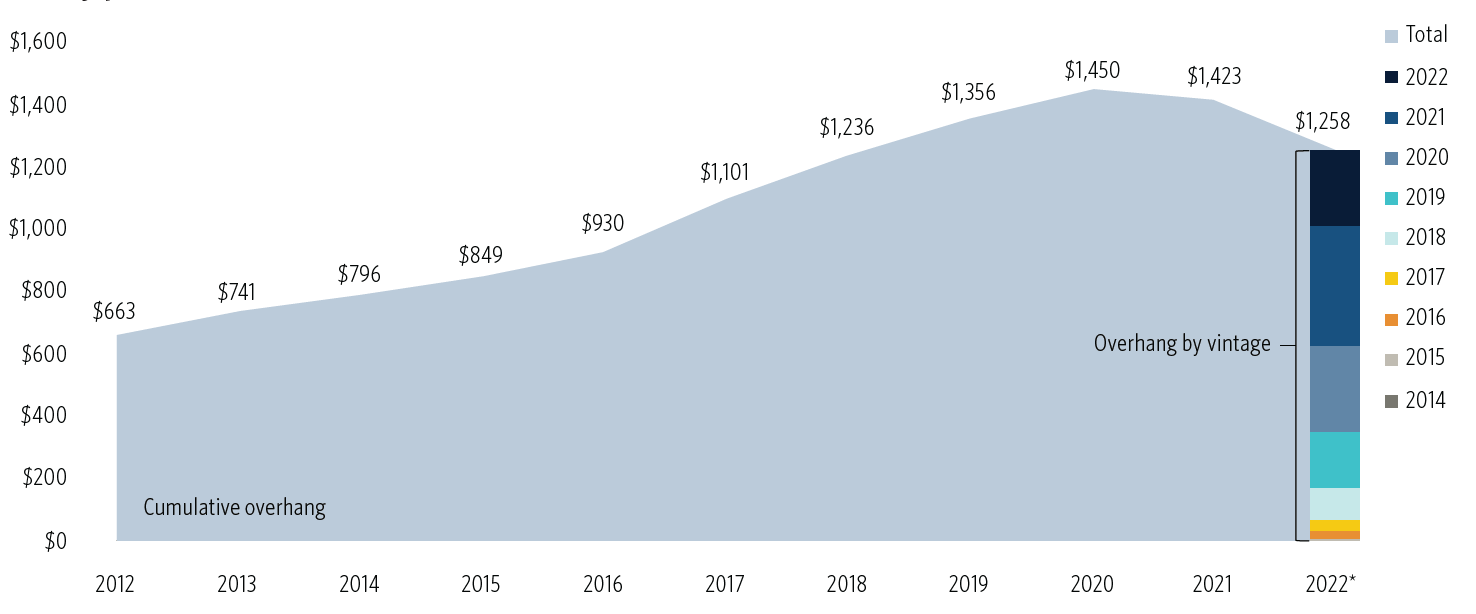

This has led to significant amounts of capital left to deploy (dry powder), estimated to be $1.3tn globally at the end of September 2022. The slowdown in fundraising activity in 2022 has driven a slight reduction in dry powder from its 2020 peak, however, the overall figure is more than twice the level it was a decade ago (see below).

PE dry powder ($bn)

Source: PitchBook – Global Private Market Fundraising Report data to 30 September 2022*

Taking a look at the dry powder overhang by vintage, we observe that the vast majority of this is capital that has been raised within the past three years. Even more notable is that the 2020 overhang remains greater than the capital raised just last year. This is of particular significance when you consider that the typical life of a private equity fund has a five-year investment period, indicating 2023 is a critical year for deployment.

Currency movements have also played their part. Recent US Dollar strength relative to Sterling provides an additional valuation discount to US private equity firms looking to the UK markets for asset purchases.

We believe this confluence of factors has created a perfect storm that could catalyse a flurry of UK public market takeover activity this year.

Over five years to the end of June, the UK stock market saw over 250 M&A transactions, with deals spread across a wide range of sectors. The average deal was agreed at a c. 44% premium to the price of the shares over the preceding 30 days, underlining the extent to which some businesses have become undervalued. The average EV /EBITDA multiple across these acquisitions of 13.6x compares very favourably to the corresponding multiple across our portfolios.

Takeover activity has not been limited to private equity buyers only. Corporate buyers, a number of which are ultimately backed by private equity, have also played a prominent role. Similarly to private equity firms, corporate buyers have been driven by the valuation arbitrage gap but are also looking for acquisitions with strong strategic rationale and synergy benefits. The high volume of corporate buyers across the UK equity markets validates our long-held view that the opportunity set for structurally growing companies that are building strategic value is plentiful. As we have seen from corporate buyers of UK public market assets, finding strategic value often equates to paying a material premium.

In some sectors or thematic areas the buying landscape is characterised by corporate buyers who are backed and controlled by private equity firms. For example, within healthcare services the long-term structural growth dynamics around the increase in outsourcing of pharmaceutical activities have driven private equity firms to seek to own platform assets which specialise in services to help the pharma industry navigate the regulatory landscape, liaise with reimbursement organisations, access key market participants and ultimately commercialise and sell drugs. Valuation multiples in the private sphere consequently rose as more capital went looking for these high-growth assets with quality earnings drivers and buy-and-build potential.

This inevitably spilled over to the UK public equity markets, particularly considering the gap in valuation multiples. Cello Health, UDG Healthcare, Clinigen and Vectura are some examples of public businesses within this thematic area that we saw acquired and taken private, two by private equity directly, one by trade and one by PE-backed trade.

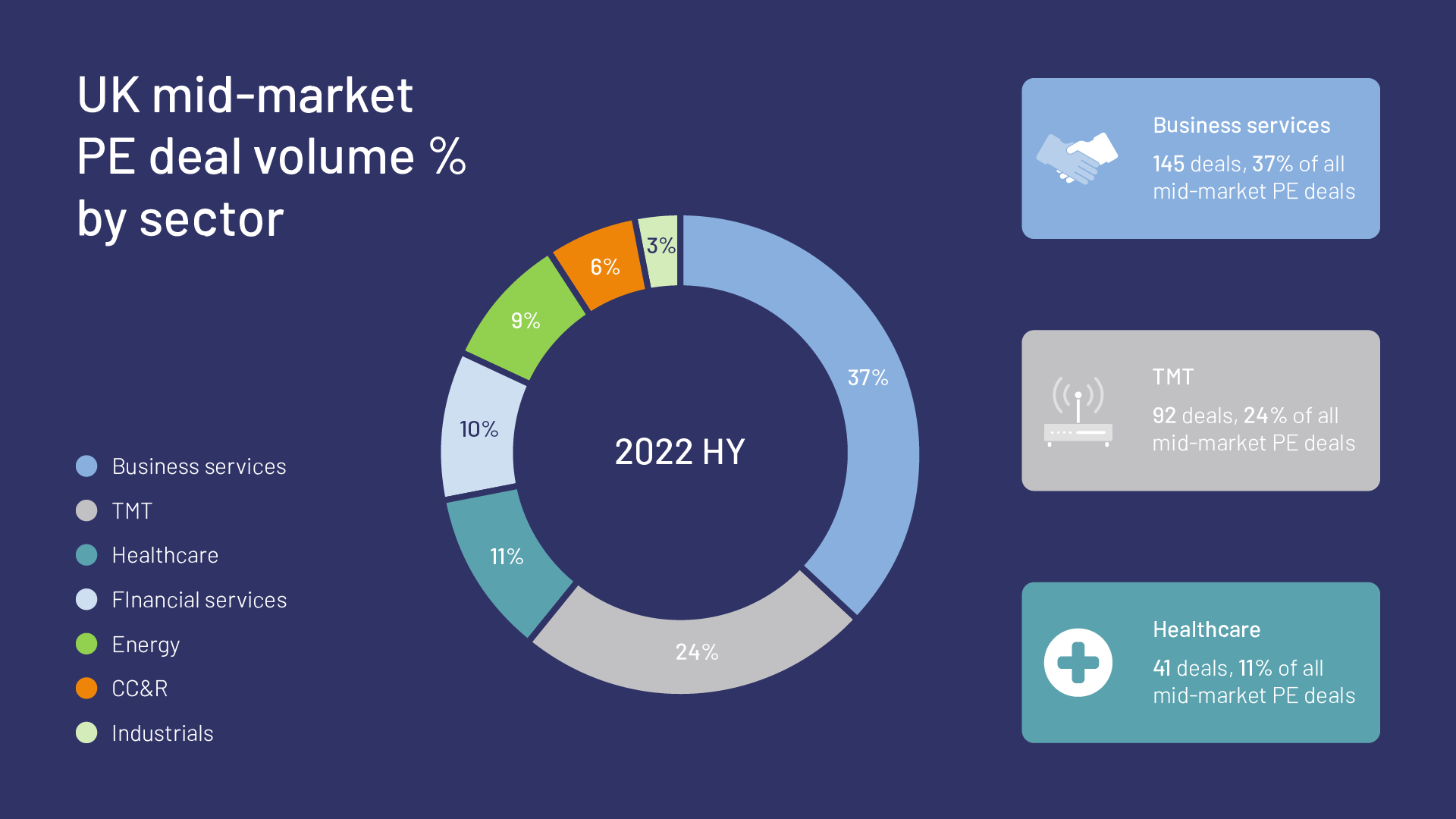

Over the course of the first half of 2022, Business Services, Healthcare and TMT were the three key sectors for private equity deal volume across the mid-market (£10-300mn enterprise value).

Source: KPMG – UK Mid-market PE review, August 2022

Our own analysis shows that these sectors have been three of the largest over the past five years across all UK public market takeover activity. Looking forward to 2023 we expect sectors such as Healthcare and TMT to be key target areas, particularly where valuations remain dislocated from the structurally attractive market dynamics and business critical recurring revenue profiles.

Additionally, we think that some other sectors have seen fairly indiscriminate selling pressure leaving a large pool of opportunities. Within both the Financial Services and Consumer and Retail sectors we would expect further takeover activity, although we would point to selectivity being a key factor.

Consumer and Retail businesses that are operating robust business models with customer value propositions that are fit for purpose, and taking market share in the current more challenged environment, are likely to be a key cohort. Resilient Financial Services businesses that aren’t necessarily correlated to asset class and market movements, and are capable of multi-year growth, are likely to stand out to potential acquirers.

Many of these have been caught up in the sector and market wide sell-off over the last 12-18 months and are therefore prime for takeover activity.

Gresham House positioning

As public market investors whose investment strategy and process are the product of our private equity heritage, we employ these principles and approaches to stock selection and risk management.

We understand first-hand what private equity buyers look for, how they implement thematic investment strategies, how they diligence assets and how they assess value and opportunity. Our extensive private equity network positions us well to identify strategically valuable assets that may potentially become acquisition targets in due course.

We do not explicitly seek to invest in companies we believe could be acquired in the short-term but we believe we are well placed to spot strategic value or the ability and potential to create it. It is no coincidence that many corporate and private equity buyers see the same characteristics across many of our portfolio companies.

Another key consideration is knowing how to deliver value creation within businesses.

Having direct experience of explicitly engaging with management teams to support strategy execution is critical to delivering the best outcome for equity investors. Across our investments we work to ensure the necessary building blocks around team, platform and operational scalability are in place in order to drive that value creation.

Our expectation for the year ahead is that the UK stock market could see further elevated levels of volatility as the economic uncertainty continues. Inflation, rising interest rates and deteriorating sentiment are all near-term headwinds; their impact will be significant.

However, we believe this is likely to contribute to more corporate activity across the UK market and that the scene is set for a significant year in this regard.

|

|

| Ken Wotton Managing Director, Public Equity |

Brendan Gulston Director, Public Equity |

All opinions expressed are their own and not necessarily those of Gresham House.

Key risks

- Past performance is not a reliable indicator of future performance

- Capital at risk

- Funds investing in smaller companies may carry a higher degree of risk than funds investing in larger companies. The shares of smaller companies may be less liquid than securities in larger companies

Important information

This document is a financial promotion issued by Gresham House Asset Management Limited (Gresham House) under Section 21 of the Financial Services and Markets Act 2000.

Gresham House is authorised and regulated by the Financial Conduct Authority.

The information should not be construed as an invitation, offer or recommendation to buy or sell investments, shares or securities or to form the basis of a contract to be relied on in any way. Gresham House provides no guarantees, representations or warranties regarding the accuracy of this information.

This article is provided for the purpose of information only and before investing you should read the Prospectus and the key investor information document (KIID) as they contain important information regarding the fund, including charges, tax and fund specific risk warnings and will form the basis of any investment. The prospectus, KIID and application forms are available from Link Fund Solutions, the Authorised Corporate Director of the Fund (Tel. No. 0345 922 0044).

Gresham House

Specialist asset management

Gresham House

Specialist asset management