Introduction

As we enter 2026 with greater optimism than we have for several years, we reflect on a challenging, volatile and sometimes surprising market environment during 2025.

Over 2025, there were strong gains for UK large caps as the US diversification trade saw material international money flow into the top end of the UK market. A sharp market drawdown driven by extreme uncertainty about US tariffs in Q1 turned into a brief UK domestic rally in Q2 which in turn gave way to budget-related uncertainty and deteriorating domestic sentiment throughout most of the second half of the year.

Domestic UK equity fund flows remained persistently negative throughout the year despite international investors starting to take a different view, catching up with private equity and corporate buyers – who continue to find compelling value amongst UK small and mid-cap companies.

Net outflows create marginal sellers, and marginal sellers drive valuation de-rating. We continue to believe money flows are likely to be the key to a more general re-rating of UK small and mid-caps. This may not immediately come from domestic sources, despite positive noises from government around pension fund and ISA reforms to stimulate demand. However, it is starting to come from international investors, in particular from the US where even a modest reallocation could have a significant impact on the UK market.

We believe many of the conditions are now in place for a meaningful small and mid-cap recovery in the UK market. Whilst timing will always be uncertain and we do not expect one large decisive catalyst, we do see a number of reasons to be more optimistic for 2026 after a tough four years for UK small and mid-cap investors.

Key takeaways for 2026

There are a number of reasons to be more cheerful about the outlook for 2026:

- The material outperformance of the FTSE100 against not just other domestic indices but also the S&P500, particularly in US dollar terms, during 2025 has put the UK market back on the global map after several years of underperformance

- Valuation dispersion between large and smaller companies remains historically wide, incentivising a relative value trade and a positive trickle-down effect

- Expected UK interest rate cuts should improve liquidity conditions and provide valuation support for smaller companies

- A reopening IPO market and elevated corporate activity provide tangible catalysts for re-ratings

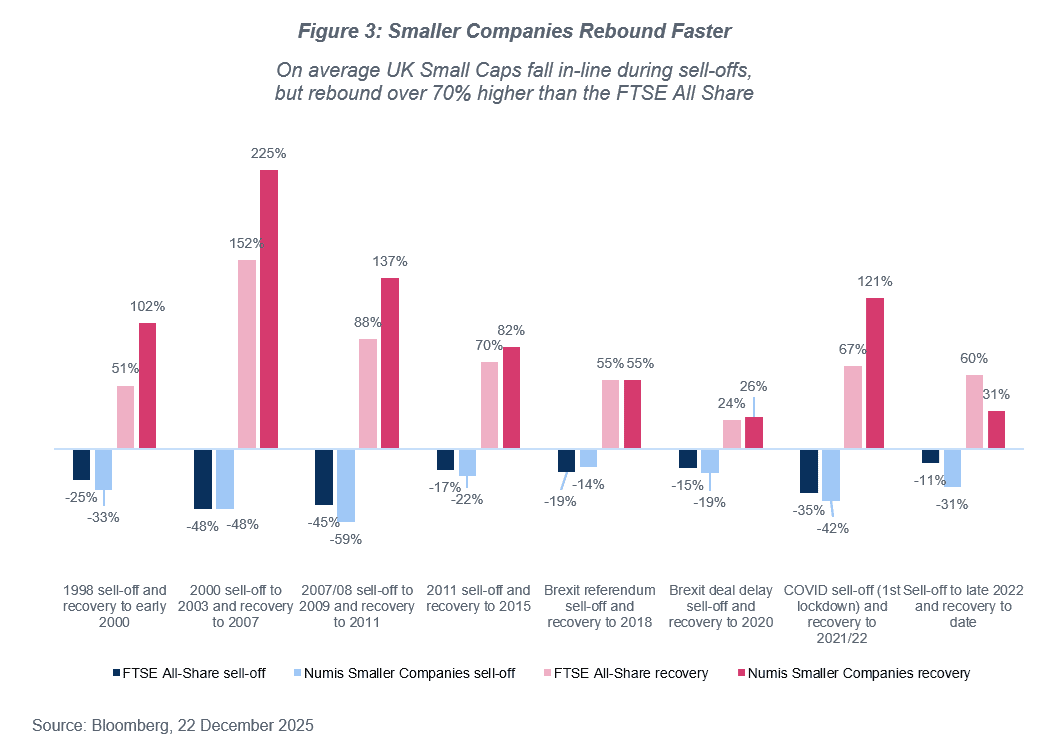

- History suggests that although small caps typically lag in a market recovery, when they do recover they can do so rapidly and very sharply contributing substantially to their long-term outperformance over the wider market

- If 2026 is to be the year of the small and mid-cap recovery then patient investors do not want to capitulate and miss out on this potential source of outsized returns

1. Deutsche Numis / London Business School (Dimson & Marsh) index history

2025 in review

The UK equity market delivered strong headline returns during 2025, although performance was driven by a relatively narrow set of sectors. While the FTSE100 returned c.26%, the FTSE 250 and FTSE Small Cap indices lagged with returns of approximately 13% and 14% respectively (2025 calendar year return including dividends). While 82 of the total 106 names that were in the FTSE 100 index last year performed positively, contribution to return remained highly concentrated. Just three stocks (HSBC, Rolls Royce, AstraZeneca) accounted for 35% of returns, rising to 48% when looking at the top five.

Multicap and small-cap active funds lagged the headline market returns, reflecting concentration of index returns in a small number of large-cap stocks, particularly banks and defence.

US markets again hit all-time highs during 2025 but lagged the FTSE100 over the year, particularly in US dollar terms (given the depreciation of the Dollar against Sterling). US institutional capital has perhaps started to lose some faith in US exceptionalism with $10s of billions flowing into the UK market over the course of 20252. US sector and stock concentration, historically high valuation multiples and concerns about an AI-led bubble have all contributed to a major diversification trade gaining momentum. To a US-based value investor the entire UK market now screens well for relative value globally.

Historical context

The UK equity market in aggregate has underperformed other global markets since the Brexit referendum result in 2016. However, as the world has evolved the UK is no longer a negative outlier for government debt, economic growth, inflation or political instability. Indeed, the UK now looks like a relative safe haven with interest rates falling and fiscal buffer improved – conditions set for a domestic recovery. But it is the FTSE250 which is likely to be the leading indicator for this now that the FTSE100 outperformed so substantially last year.

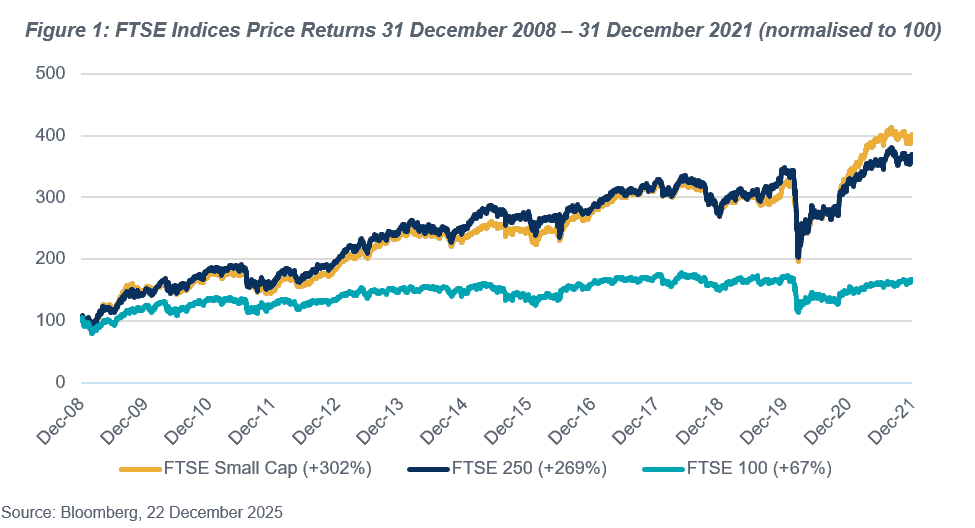

It is notable that despite the UK’s struggles over the past decade, since the end of 2008 and the Global Financial Crisis during the period to the end of the 2021 the more domestically oriented FTSE250 (dark blue line) and FTSE Small Cap (gold line) are both up almost four-fold (price return, excluding dividends), while the more international FTSE100 (teal line) only returned a relatively modest +66.5%.

Past performance is not a reliable indicator of future performance. Forecasts are not guaranteed.

2. Association of Investment Companies, US investors pump $15bn into cheap UK shares, 18 August 2025

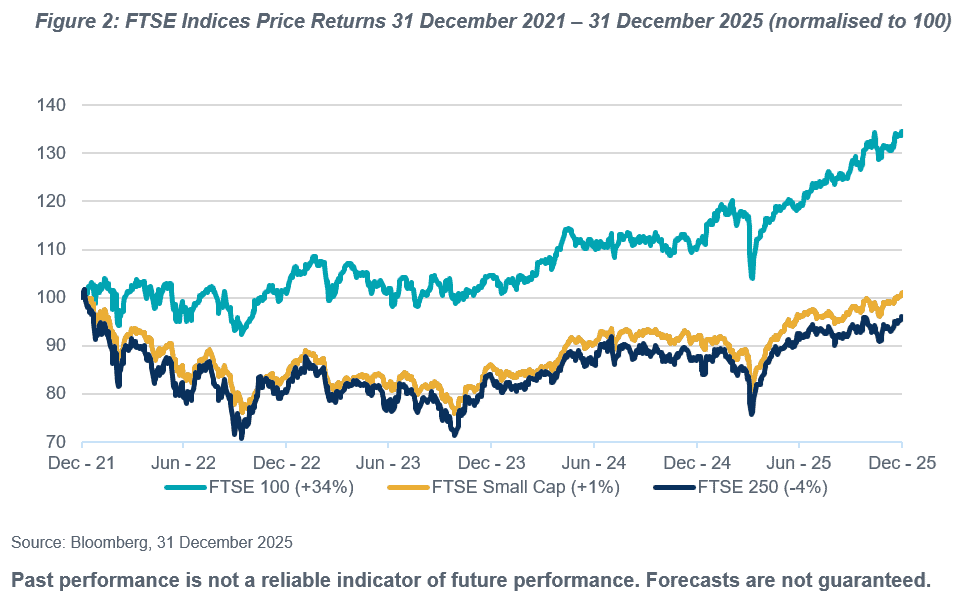

However, since the end of 2021 both the FTSE Small Cap (+1.0%) and FTSE250 (-4.3%), have significantly underperformed the large cap FTSE100 which has returned +34.5% (with a standout c.22% in 2025).

We believe the conditions are now in place for a reversion to the longer-term trend of small and mid cap stocks outperforming their larger peers. Indeed, an analysis of the UK market sell-offs and subsequent recoveries suggests that although small caps typically underperform large caps on the way down and also lag in a recovery when they finally do recover they typically do so rapidly and more significantly than their large cap peers. We believe 2026 could be the year of this recovery which in the past has sometimes led to small cap indices increasing 30-50%. The relative valuation discount to large caps, as well as international and private market comparables supports this sort of move if valuation multiples start to converge.

Past performance is not a reliable indicator of future performance. Forecasts are not guaranteed.

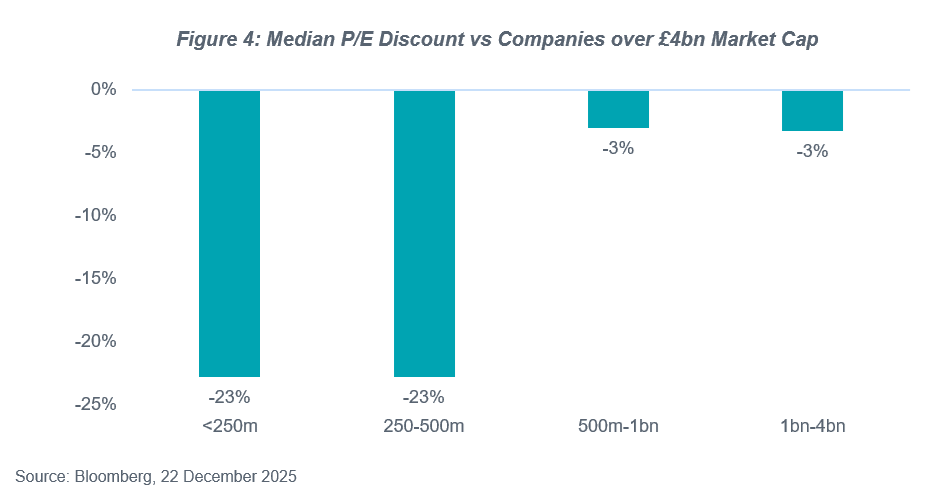

Within UK equities there remains a wide dispersion of valuation ranges across the market cap spectrum, with small and micro cap stocks trading at, on average, a c. 23% discount to larger cap companies (over £4bn market cap).

Past performance is not a reliable indicator of future performance. Forecasts are not guaranteed.

Over the year this phenomenon played out for our Gresham House Multi Cap Income Fund, which underperformed its large-cap-dominated FTSE All-Share benchmark and the wider IA UK Equity Income sector. The majority of the relative underperformance versus the All-Share (c.-17%) was attributable to the Fund’s structural lack of exposure to banks and mining companies. These sectors, in which the Fund does not invest, benefited from strong macroeconomic tailwinds: a supportive interest-rate environment for banks and elevated commodity prices, with gold reaching record highs, for miners. Over 2025, the Banks GICS Industry Group has returned +69%, creating an 8% relative headwind to Fund performance (driven primarily by HSBC 3.5%, Barclays 1.4% and Lloyds 1.3%). In addition, the Materials GICS Industry Group detracted a further 2% in relative terms, largely due to the absence of Rio Tinto (0.7%). Some consumer holdings within the portfolio also faced a challenging trading environment during the year, which weighed on returns. Following a comprehensive set of stock reviews and re-appraisals the portfolio was re-positioned, on a stock-by-stock basis, during 2025. This resulted in a lower overall weighting towards consumer, focused on a smaller number of higher conviction holdings and with a cohort of compelling new investments that are resilient, good quality recurring earnings businesses with strong margins and cash flows. The Fund took advantage of specific mispricing opportunities to initiate these new stock positions at undemanding valuations, some of which were validated by private equity interest shortly thereafter (JTC and Big Yellow Group). Despite some headwinds in 2025, the Fund’s fundamental characteristics remain robust with exciting long-term growth and income prospects, trading at around the lowest valuations since the inception of the Fund in 2017.

Past performance is not a reliable indicator of future performance. Forecasts are not guaranteed.

Over the year this phenomenon played out for our Gresham House Multi Cap Income Fund, which underperformed its large-cap-dominated FTSE All-Share benchmark and the wider IA UK Equity Income sector. The majority of the relative underperformance versus the All-Share (c.-17%) was attributable to the Fund’s structural lack of exposure to banks and mining companies. These sectors, in which the Fund does not invest, benefited from strong macroeconomic tailwinds: a supportive interest-rate environment for banks and elevated commodity prices, with gold reaching record highs, for miners. Over 2025, the Banks GICS Industry Group has returned +69%, creating an 8% relative headwind to Fund performance (driven primarily by HSBC 3.5%, Barclays 1.4% and Lloyds 1.3%). In addition, the Materials GICS Industry Group detracted a further 2% in relative terms, largely due to the absence of Rio Tinto (0.7%). Some consumer holdings within the portfolio also faced a challenging trading environment during the year, which weighed on returns. Following a comprehensive set of stock reviews and re-appraisals the portfolio was re-positioned, on a stock-by-stock basis, during 2025. This resulted in a lower overall weighting towards consumer, focused on a smaller number of higher conviction holdings and with a cohort of compelling new investments that are resilient, good quality recurring earnings businesses with strong margins and cash flows. The Fund took advantage of specific mispricing opportunities to initiate these new stock positions at undemanding valuations, some of which were validated by private equity interest shortly thereafter (JTC and Big Yellow Group). Despite some headwinds in 2025, the Fund’s fundamental characteristics remain robust with exciting long-term growth and income prospects, trading at around the lowest valuations since the inception of the Fund in 2017.

Past performance is not a reliable indicator of future performance. Forecasts are not guaranteed.

Why the opportunity in 2026 looks compelling

Market leadership broadening

Sustained large-cap outperformance often precedes a rotation into smaller companies as confidence improves and risk appetite broadens.

Lower interest rates

Consensus expectations for declining interest rates should ease financial conditions, reduce discount rates applied to future earnings, and support renewed investor appetite for smaller companies.

IPO market reopening

A reopening IPO market typically benefits mid and small-cap equities through increased deal flow, valuation benchmarking and renewed institutional engagement. The first wave of IPOs in a new cycle also typically generate superior returns due to more attractive pricing.

Buybacks and takeovers

Elevated levels of share buybacks and takeover activity continue to provide direct support for equity valuations, with UK assets remaining attractive relative to global peers and private market benchmarks.

Valuation reallocation

The valuation gap between large and smaller companies remains wide by historical standards, creating a strong incentive for capital to reallocate back into small and mid-cap equities.

Portfolio positioning and case studies

Entering 2026, the Gresham House Public Equity portfolios are well positioned for a small and mid cap recovery. We have a high-quality portfolio of companies with quality long-term fundamental characteristics: earnings growth with high visibility of revenues in less cyclical segments of the economy; high margins reflecting strong market positions; low or no financial leverage providing resilience in an uncertain macro environment; good cash generation underpinning financial returns; high quality and agile management teams aligned with creating long-term shareholder value.

These are companies that should command premium ratings on the public markets. Instead, many trade at historically low valuations. If the market fails to rate these businesses appropriately then it is likely we will continue to see an elevated level of takeover approaches for businesses where private equity and strategic buyers appreciate the value on offer.

Case studies:

Case studies selected for illustrative purposes only and do not constitute an investment recommendation. Past performance is not a reliable indicator of future performance.

![]()

JTC is a global administrator to funds, corporates and private clients, with highly recurring, inflation-linked revenues and a repeatable M&A-led value-creation playbook. Our investment in JTC in mid-2025 is a good example of how a private-equity lens can uncover mispriced platforms in public markets.

- From late 2024 into mid-2025 the shares materially de-rated on concerns about private-capital fundraising, even as the business delivered 11% net organic revenue growth in H1 2025 and continued to execute on its strategy

- We initiated our position when the market was effectively valuing JTC at c.11x 2026E EBITDA (the first full year of Citi Trust)

- In H2 2025 a Recommended Cash Offer from Permira at c.18x 2026E EBITDA helped crystallise this public-to-private valuation gap

Brooks Macdonald is a UK wealth manager providing discretionary portfolios and platform-based managed portfolio services and is a good example of the self-help inflections we look for in listed financials; a high-quality wealth-management franchise where the market has been anchored on historic outflows while the underlying business has been repositioned for growth.

- 2025 was a year of deliberate repositioning, with the sale of its international business, a move from AIM to the Main Market and targeted financial-planning acquisitions under the “Reignite Growth” strategy

- While group net flows are still slightly negative, the mix has shifted: strong platform MPS inflows are now largely offsetting outflows from the legacy bespoke service, with net outflows materially improved year on year

We see an increasingly focused, capital-light, recurring-fee platform that is close to an inflection to positive net flows in a sector where recent take-privates of peers such as Charles Stanley, Brewin Dolphin and Mattioli Woods demonstrate the multiples strategic and private-equity buyers are prepared to pay for scaled advice-led platforms once growth is demonstrably improving

Case studies selected for illustrative purposes only and do not constitute an investment recommendation. Past performance is not a reliable indicator of future performance.

Everplay is an outsourced video game developer and publisher focused on the high growth ‘indie’ segment.

- Following an oversupply of video games during Covid, the market has now reverted to a more normalised state underpinned by healthy demand drivers

- Everplay has a well-diversified back book of video games, which provide high visibility of future earnings and started to deliver forecast upgrades in 2025 against a recovering market backdrop

- There remain M&A opportunities within the sector that could accelerate Everplay’s growth trajectory and unlock strategic value as a platform in the indie games sector, an attractive segment for larger trade buyers seeking growth and diversification

MHA is a UK accounting services business that listed on AIM in April 2025, where we made a cornerstone investment.

- MHA is a high recurring revenue (85%+), high margin and cash generative business with attractive long term structural growth drivers underpinned by pricing, regulatory change and cross-selling initiatives

- We leveraged our private equity network to thoroughly diligence the asset, market structure and growth drivers. Pulling together high conviction conversations across our proprietary network of experts gave us confidence in strongly supporting the IPO at a compelling valuation

- MHA has had a strong start to public life with the shares up over 60% since April

![]()

Elixirr is a challenger specialist consultancy business operating in a huge global market and leveraging long-term structural growth trends such as digital transformation and AI adoption to deliver market leading growth, both organically and through acquisitions.

- The business benefits from high profit margins with attractive operational leverage and a strong balance sheet

- It has delivered compelling returns since IPO, yet still trades at a material discount to sector M&A. A close competitor (Alpha FMC) was recently acquired by private equity at a material premium to Elixirr’s current rating

Conclusion

Whilst the past two years have tested investor patience, the underlying conditions for UK small and mid caps appear increasingly supportive heading into 2026. A combination of improving monetary conditions, elevated corporate activity and compelling valuations provides a credible foundation for improved returns, particularly within small and mid-cap companies where inefficiencies remain most pronounced and where relatively modest flows of capital can drive outsized re-ratings from currently depressed levels.

If the small and mid cap recovery comes in 2026 investors who have remained patient do not want to miss it.

Key risks

- Views and opinions expressed by the investment team are correct at the time of writing but are subject to change

- Not to be construed as investment advice

- Case studies selected for illustrative purposes only

- Not an investment recommendation

- Past performance is not a reliable indicator of future performance

- Funds investing in smaller companies may carry a higher degree of risk than funds investing in larger companies.

- The shares of smaller companies may be less liquid than securities in larger companies.

Important information

This document is a financial promotion issued by Gresham House Asset Management Limited (Gresham House) under Section 21 of the Financial Services and Markets Act 2000. Gresham House is authorised and regulated by the Financial Conduct Authority (682776).

The information should not be construed as an invitation, offer or recommendation to buy investments or shares or to form the basis of a contract to be relied on in any way. Gresham House provides no guarantees, representations or warranties regarding the accuracy of this information. This article is provided for the purpose of information only.

Gresham House

Specialist asset management

Gresham House

Specialist asset management