Monthly Monitor - July 2023

Monthly Monitor - July 2023

Why we still love dividends.

There are various ways to dissect historical equity returns but we believe using dividend metrics makes the most sense.

Investors derive a return from equities from three sources:

Equity return = dividend yield + growth in dividend + change in valuation multiple

Over the long-term, dividends provide the majority of returns. The starting dividend yield is the most consistent contributor to equity returns.

Between 1970 to 2022, the real annual return from UK equities was 4.7%, of which 4% came from the dividend yield with the remaining 0.7% from dividend growth.

While the market obsesses over changes in valuation multiples, sticking to the fundamentals of buying companies that can sustain and grow their dividend throughout time seems a rewarding strategy.

The challenge we face as active investors is to distinguish between companies that have a high dividend yield for a particular reason e.g. ‘value traps’ – companies that are in trouble with an unsustainable dividend yield, and those that have solid business prospects where the high-yield does not reflect their long-term potential. This is where we focus our time.

Rather than agonising if a stock should trade on 10x price-to-earnings or 11x price-to-earnings or if Earnings Per Share for the quarter will be 0.41 cents or 0.42 cents, we focus on the sustainability of the dividend stream and the ability of that dividend stream to grow.

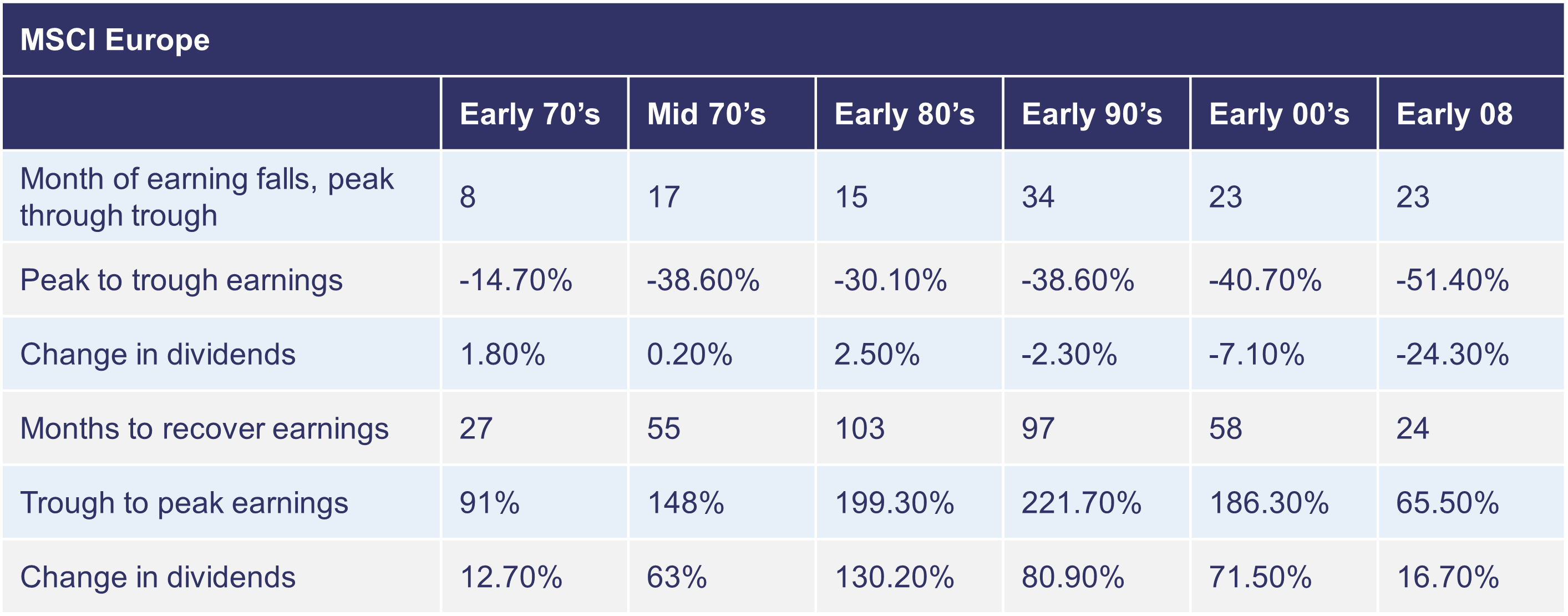

Dividend investing performs well during recessionary times, which is a real possibility for the remainder of 2023 and into 2024.

Historically, it has taken a larger than 50% fall in earnings to lead to a double-digit decline in dividends.

So why do we love dividends?

They provide the majority of returns over time, they are more stable than earnings and dividend strategies work when we need them most (e.g. in a difficult economic environment).

What more could you want?

Our Funds are well positioned to take advantage of the dividend opportunity.

We expect the high dividend yields, attractive valuations and dividend growth to deliver strong returns for our investors.

Any views and opinions are those of the Fund Managers, this is not a personal recommendation and does not take into account whether any financial instrument referenced is suitable for any particular investor.

Capital at risk. If you invest in any Gresham House funds, you may lose some or all of the money you invest. The value of your investment may go down as well as up. This investment may be affected by changes in currency exchange rates. Past performance is not necessarily a guide to future performance.

The above disclaimer and limitations of liability are applicable to the fullest extent permitted by law, whether in Contract, Statute, Tort (including without limitation, negligence) or otherwise.

Gresham House

Specialist asset management

Gresham House

Specialist asset management