Monthly Monitor | December 2025

2026 Outlook: An AI bubble – but still plenty to buy

The bad news: valuations are stretched

We believe there is a bubble forming in Artificial Intelligence AI -related equities. This is a problem due to significant weight of AI related equities in the S&P 500.

On a cyclically adjusted price-to-earnings basis, the S&P 500 is now trading at levels last seen during the dot-com bubble of the early 2000s. From those highs, the index fell by almost 50% over the subsequent three years. On price-to-sales and price-to-book measures, today’s valuations are even more extreme than those reached at the peak of that cycle.

Excess is particularly evident in the semiconductor sector. Valuations are at record highs on a price-to-sales basis, while earnings expectations for 2026 appear extraordinarily optimistic. The market is currently pricing in close to 50% earnings growth alongside profit margins approaching 40%, assumptions that leave little room for disappointment.

Some would argue that structurally higher margins and productivity gains justify these valuations. Similar arguments were widely used to defend internet-related stocks in the early 2000s. History suggests caution. If it looks like a duck and quacks like a duck… then it probably is a duck.

One of the few enduring truths of investing is simple: paying more for a given stream of cashflows results in lower future returns. Viewed through this lens, expected returns from AI-related equities are likely to be materially lower than those delivered recently.

For many investors, the obvious response would be to avoid the most expensive parts of the market. However, global equity benchmarks, which anchor many institutional portfolios, have become increasingly concentrated in U.S. mega-cap technology stocks. This has left portfolios exposed not only to a single investment theme, but also to heightened concentration risk across countries, sectors and individual stocks.

The not-so-bad news: bubbles can persist

Despite stretched valuations and optimistic earnings expectations, several factors reduce the likelihood of an imminent correction.

The macroeconomic backdrop remains supportive. Global growth is steady, policy settings are broadly accommodative, and forward earnings across regions continue to rise. These conditions typically provide a cushion that prevents abrupt reversals, even in highly valued segments of the market.

Market dynamics also remain favourable. Equity momentum is still strong, and previous overbought conditions have eased. In the absence of a clear catalyst, investors often remain committed to prevailing themes, even as excesses become more visible.

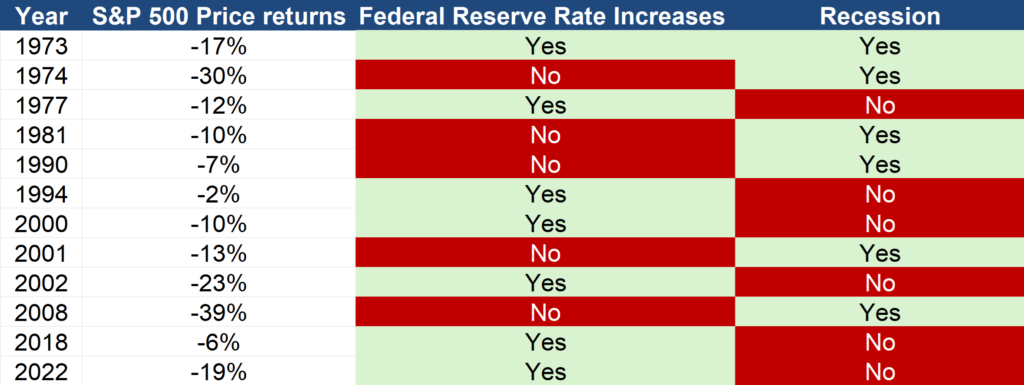

Historically, market cycles tend to end with either a recession or sustained monetary tightening. Neither appears imminent. Over the past six months, global money supply has expanded, and central banks have cut interest rates more often than they have raised them. For now, the conditions that normally trigger a sharp market downturn are simply not in place.

Source: Gresham House Ireland

The good news: This is not a market-wide bubble

Importantly, this is not an all-encompassing bubble.

While today’s environment echoes aspects of the dot-com era, it also presents a more flexible opportunity set. Avoiding the most overvalued assets, notably U.S. mega-cap AI beneficiaries, does not require abandoning risk altogether.

Our valuation framework continues to identify attractive opportunities in non-U.S. equities, deep value stocks and smaller-capitalisation companies. These areas offer more compelling expected returns and allow portfolios to remain invested without relying on overly optimistic assumptions.

History shows that different bubbles require different responses.

In 2000, wide valuation spreads allowed investors to rotate into attractively priced risk assets.

- In 2007-08, nearly all risk assets were expensive, forcing widespread de-risking

- In 2021, ultra-low real yields created a duration bubble across equities and bonds, leaving cash and short-duration assets as the only sensible alternatives

Today’s AI-driven episode is more forgiving. Investors can stay invested, remain diversified and avoid the most speculative parts of the market without sacrificing long-term return potential.

This approach is reflected in the valuation characteristics of our equity strategies and our current multi-asset positioning.

Conclusion: diversification will matter in 2026

2026 is likely to reward investors who resist the temptation to follow the herd.

Diversifying away from the AI bubble can be achieved without impairing expected returns. Deep value opportunities, non-U.S. markets and smaller companies provide a robust foundation for portfolios seeking both resilience and return potential.

Even if the AI rally continues, diversified portfolios have already kept pace with, or outperformed. For valuation driven investors, this is one of the more manageable bubbles of recent decades, offering ample scope to protect capital without resorting to extreme or impractical allocation shifts.

Derek Heffernan

Chief Investment Officer

Any views and opinions are those of the Fund Managers, this is not a personal recommendation and does not take into account whether any financial instrument referenced is suitable for any particular investor.

Capital at risk. If you invest in any Gresham House funds, you may lose some or all of the money you invest. The value of your investment may go down as well as up. This investment may be affected by changes in currency exchange rates. Past performance is not necessarily a guide to future performance.

The above disclaimer and limitations of liability are applicable to the fullest extent permitted by law, whether in Contract, Statute, Tort (including without limitation, negligence) or otherwise.

Want to keep up to date?

Subscribe using the form below to receive updates on our Monthly Monitor.

Gresham House

Specialist asset management

Gresham House

Specialist asset management