Monthly Monitor - June 2023

Monthly Monitor - June 2023

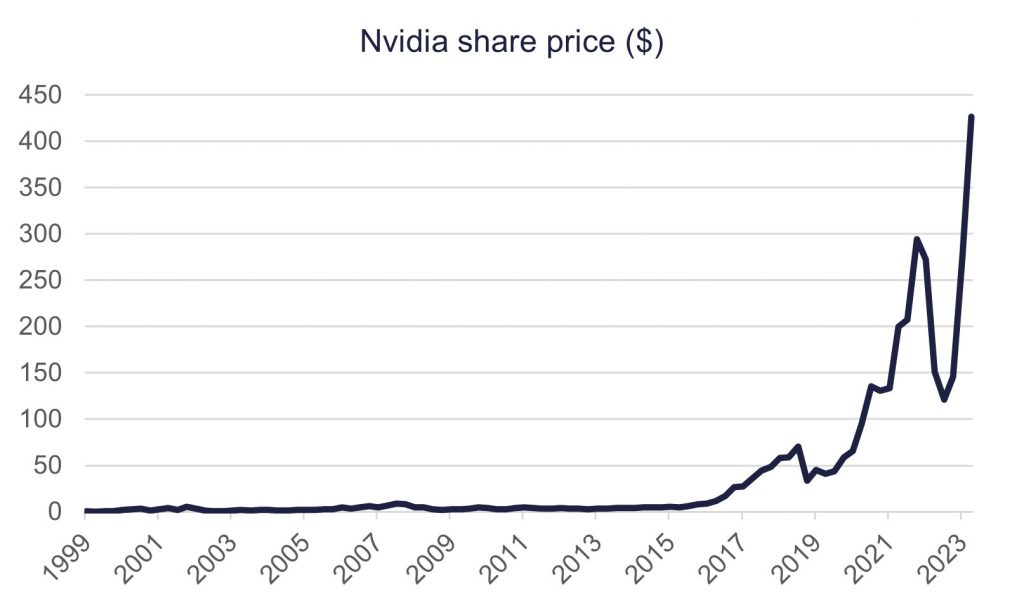

The share price of Nvidia Corporation, the US multinational technology company has dramatically increased recently.

Last month, after reporting solid earnings and a sales forecast that was 50% higher than consensus expectations, the shares gained 26% in after-hours trading.

That was an almost $300 billion increase in market capitalisation.

The optimism around Nvidia is mostly driven by the company’s leading position in the market for artificial intelligence chips.

The market believes that Nvidia’s market opportunity is like selling pickaxes in the ‘California Gold Rush.’

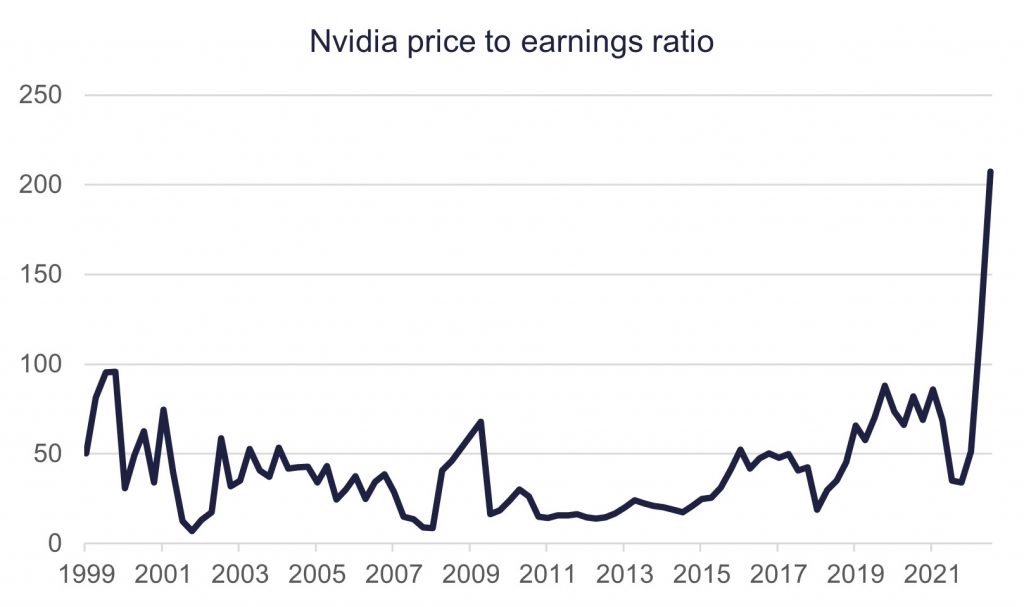

The recent rally has driven valuations to extreme levels.

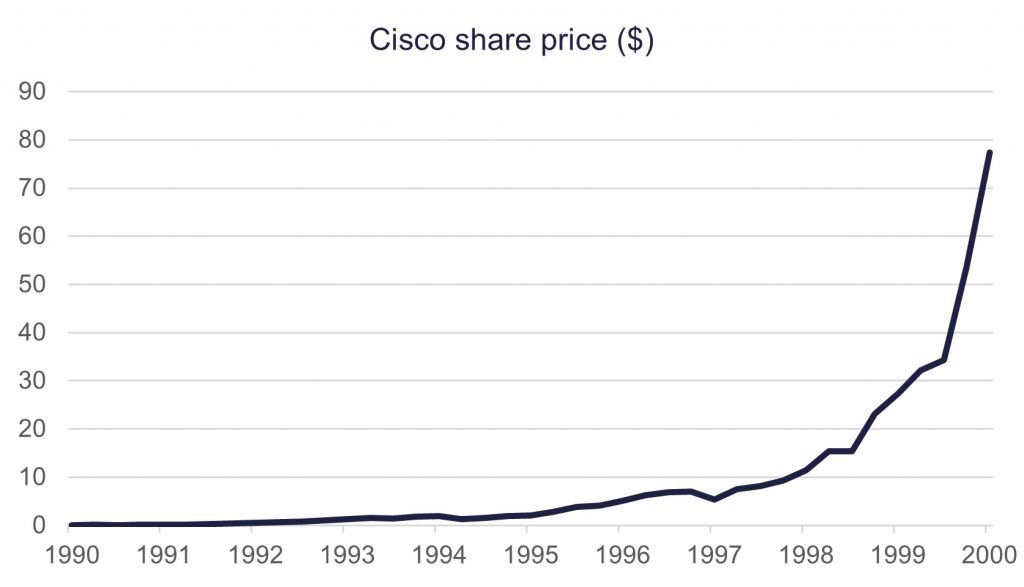

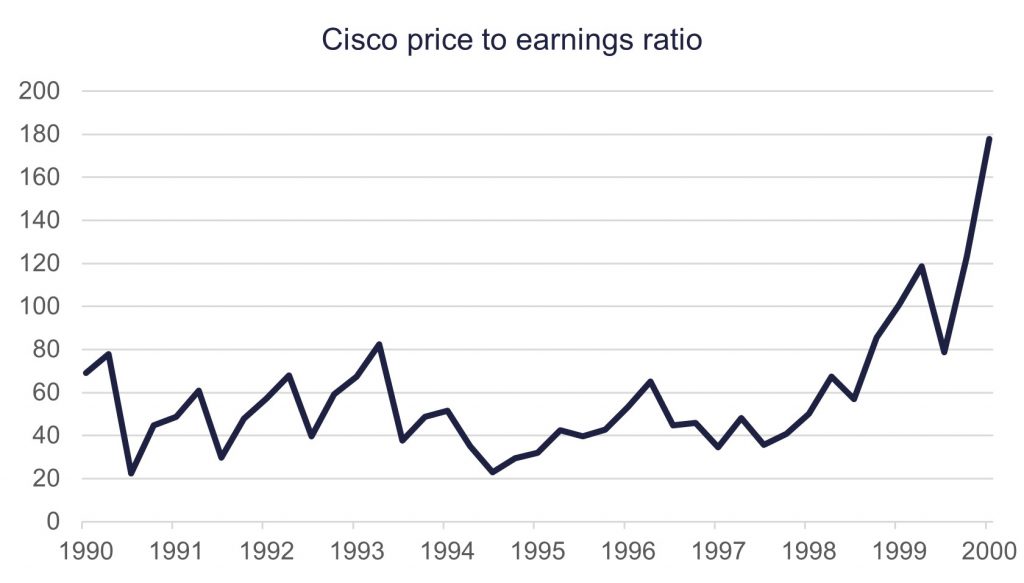

This episode rhymes with history.

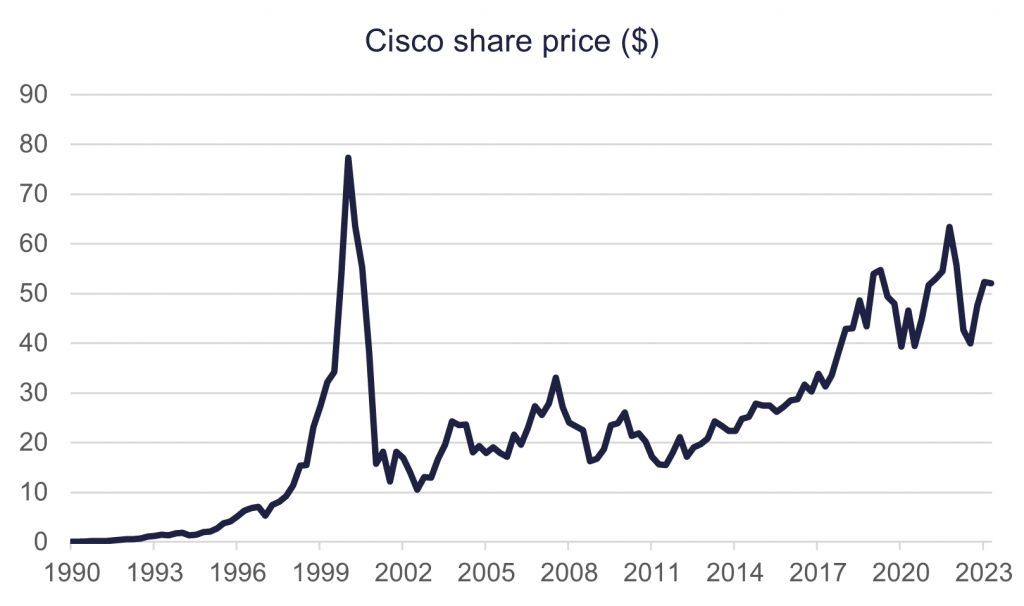

During the dotcom/TMT bubble Cisco played the part that Nvidia is currently playing, as the pickaxe seller to the internet revolution.

Cisco’s share price enjoyed a similarly dramatic rally with the share price peaking at $77.46.

The valuation ran up to almost 180 times price to earnings.

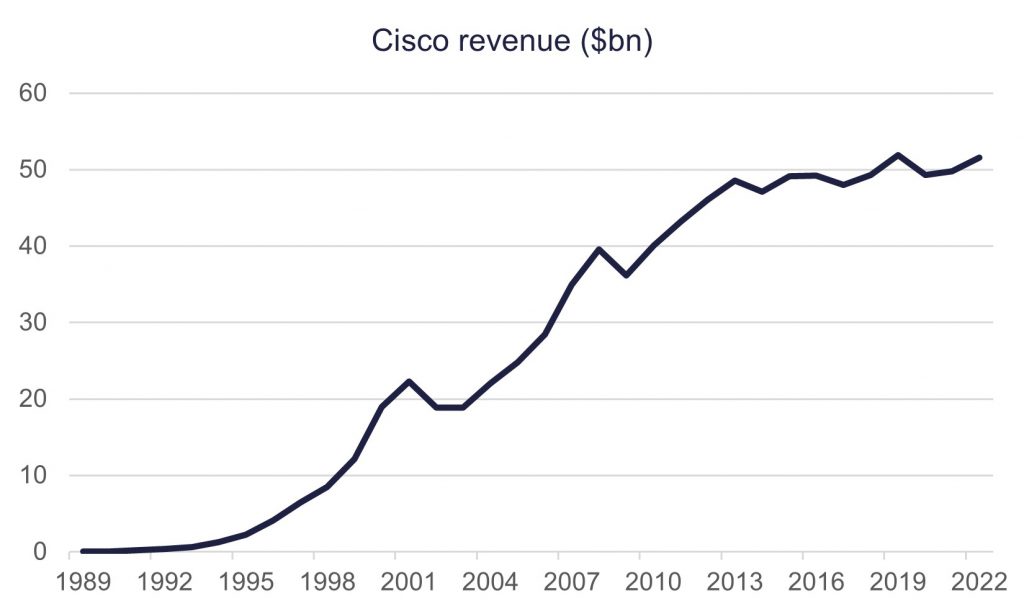

In the subsequent 23 years, the thesis for holding Cisco largely played out.

The internet changed the world and Cisco benefitted from selling the hardware that allowed the internet revolution to happen.

Revenues have more than trebled since and the company has expanded margins.

However, the fact that the thesis played out will be of little consolation for Cisco shareholders.

The share price remains 32% below the peak reached in 2000, an annualised loss of 1.69% for 23 years.

Why didn’t the share price follow the business fundamentals? The valuation was simply too high.

We think the same of Nvidia today.

Buying a large market capitalisation company at a multiple of over 200 times price to earnings rarely ends well.

Expensive glamour stocks, like Nvidia, that are adored by the analyst community (of the 58 analysts covering Nvidia only one has a ‘Sell’ rating) are rarely good investments.

Like the Cisco situation post the dotcom bubble, we believe buying quality cash generating companies at attractive (and less inflated) multiples may serve investors much better than buying the new glamour story.

All data sourced from Bloomberg 2023.

Any views and opinions are those of the Fund Managers, this is not a personal recommendation and does not take into account whether any financial instrument referenced is suitable for any particular investor.

Capital at risk. If you invest in any Gresham House funds, you may lose some or all of the money you invest. The value of your investment may go down as well as up. This investment may be affected by changes in currency exchange rates. Past performance is not necessarily a guide to future performance.

The above disclaimer and limitations of liability are applicable to the fullest extent permitted by law, whether in Contract, Statute, Tort (including without limitation, negligence) or otherwise.

Gresham House

Specialist asset management

Gresham House

Specialist asset management