Monthly Monitor - February 2023

Monthly Monitor - February 2023

We have been ‘overweight’ in European equities versus US equities for a number of years, as our bottom-up process has consistently identified greater value in European markets.

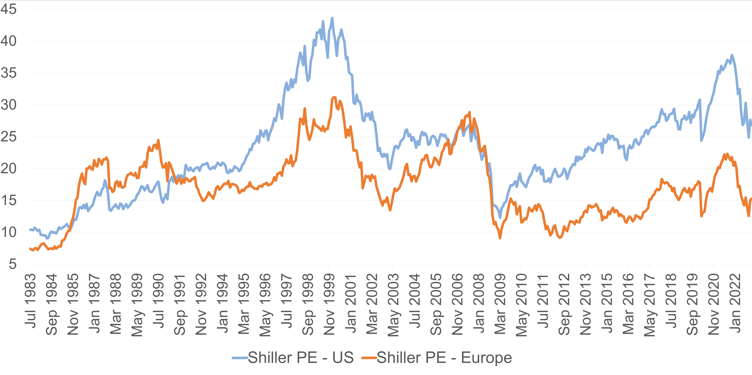

The discount between European equities and their US counterparts can be clearly seen at the Index level.

Looking at price to 10-year inflation adjusted earnings we can see that Europe is trading below its long run levels while the US is still in expensive territory.

Shiller PE ratios – US and Europe

Source: Gresham House, Ireland

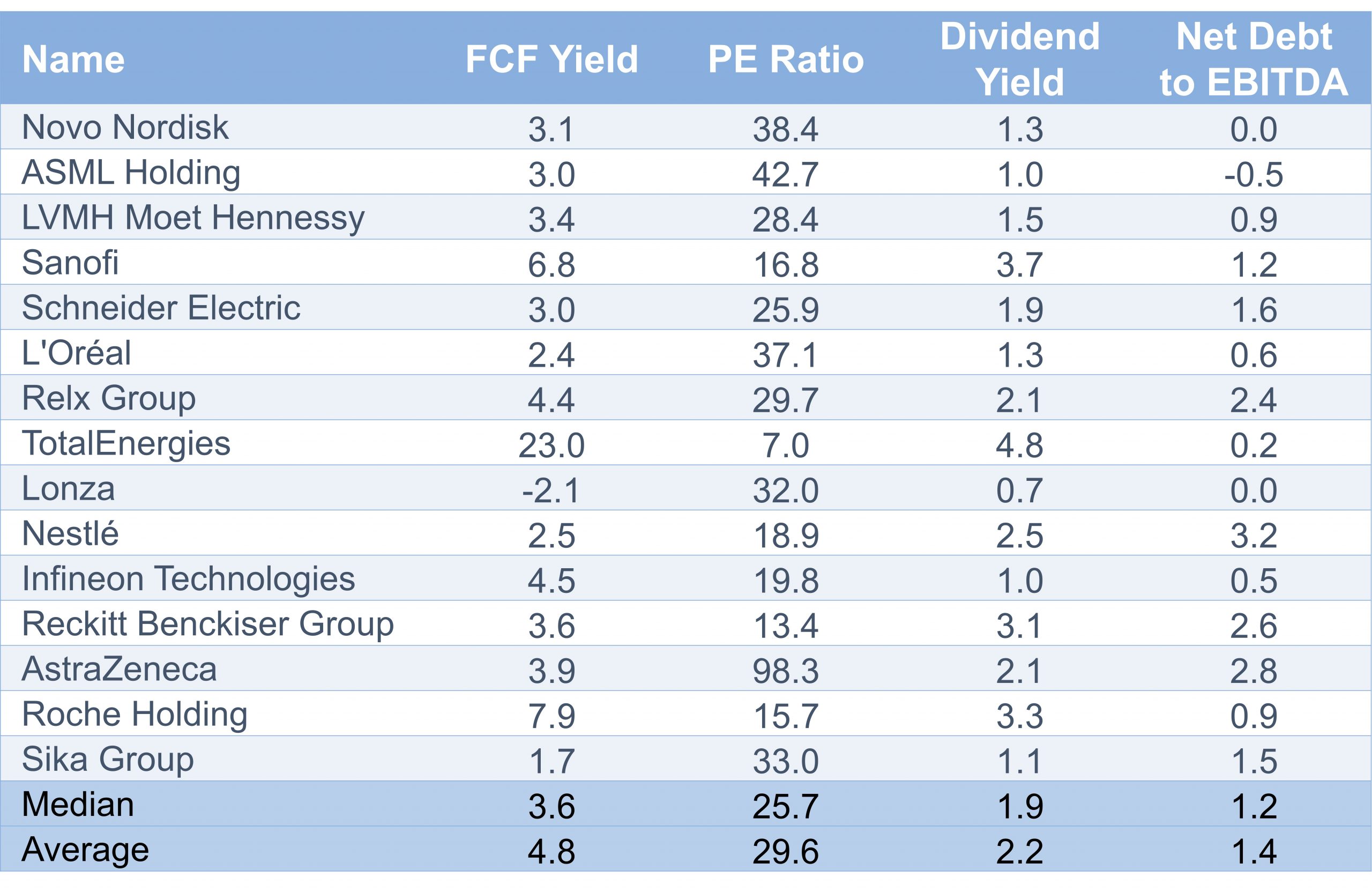

While Europe is cheap on an aggregate basis there are pockets of expensive stocks in Europe that we believe it is necessary to avoid.

French Bank BNP Paribas Exane undertakes a quarterly survey of European fund managers compiling the most popular stocks owned by European funds (most popular being the stocks with the largest overweight percent versus a benchmark).

A sample of names can be seen in the table below.

Source: BNP Paribas Exane survey

On a median basis the most popular stocks are trading on a Price to Earnings (P/E) ratio more than double that of the Index. This valuation premium exists even though a basket of the most loved stocks has underperformed the index for over two years at the time of writing.

To benefit from the convergence of European and US equity valuations, investors will need to own the correct basket of European stocks.

The popular names, which are perceived to be high quality and are owned in most funds will not provide this exposure.

We believe the Gresham House Global Equity Fund which trades on a P/E of 9.6X and a dividend yield of 4.3% will reward investors handsomely as European equities close the valuation gap with their US peers.

Any views and opinions are those of the Fund Managers, and coverage of any assets held must be taken in context of the constitution of the fund and in no way reflect an investment recommendation.

Capital at risk. If you invest in any Gresham House funds, you may lose some or all of the money you invest. The value of your investment may go down as well as up. This investment may be affected by changes in currency exchange rates. Past performance is not necessarily a guide to future performance.

The above disclaimer and limitations of liability are applicable to the fullest extent permitted by law, whether in Contract, Statute, Tort (including without limitation, negligence) or otherwise.

Gresham House

Specialist asset management

Gresham House

Specialist asset management