Our Private Equity strategy offers investors access to fast growing, early-stage and lower mid-market private companies.

Our Private Equity strategy offers investors access to fast growing, early-stage and lower mid-market private companies.

Our team has backed high-growth businesses for more than a 20 years and has invested in more than 100 companies.

Through these investments we have built an extensive entrepreneurial network and sector expertise to support our portfolio companies as they deliver their growth plans.

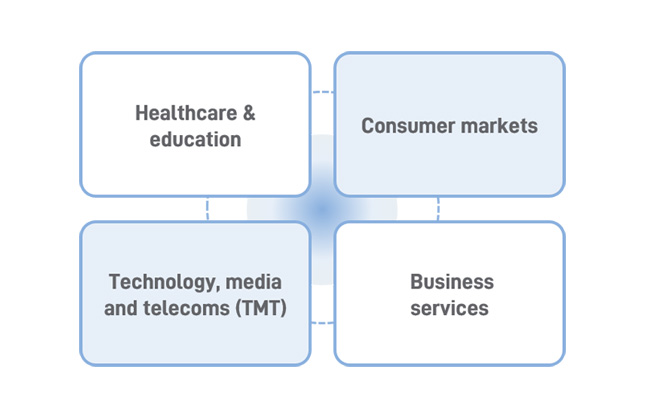

We are focused on scaling software and digitally-driven businesses in the healthcare, consumer and services sectors, aiming to deliver sustainable structural growth for our companies, alongside the potential for robust returns for investors.

Our key sectors

Key documents

We have a consistent, repeatable approach for accelerating growth and realising shareholder value in the businesses we invest in.

We aim to invest in ambitious businesses who want to partner with an engaged and professional investor, who can provide capital and a range of specialist skills to support delivery of their growth plans.

Gresham House

Specialist asset management

Gresham House

Specialist asset management