Reasons to be cheerful

Reasons to be cheerful

Ongoing uncertainty and periods of market volatility

As we move into 2024, the world seems to be facing more challenges and uncertainties than ever before. Ongoing conflicts in Europe and the Middle East; geopolitical tension between the US and China; uncertainty over the direction of central bank actions on rates; softening economic conditions in key markets; upcoming major elections, most notably the US; the lingering impact of inflation and higher interest costs on consumer and business demand.

While each and all of these issues contribute to a challenging market backdrop, we believe there are a number of reasons to be more optimistic about the UK equity markets, particularly smaller companies.

The attractions of investing in UK smaller companies

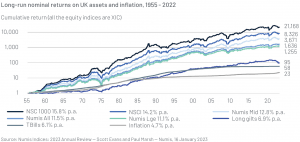

Over the longer-term academic studies show that smaller companies materially outperform their larger peers (see figure 1). Analysis of market corrections over many years indicate that when the smaller company segment emerges from a period of market drawdowns, the recovery can be stark and rapid, driven by improving risk appetite and the weight of money returning to the sector. We believe that period could now be in sight.

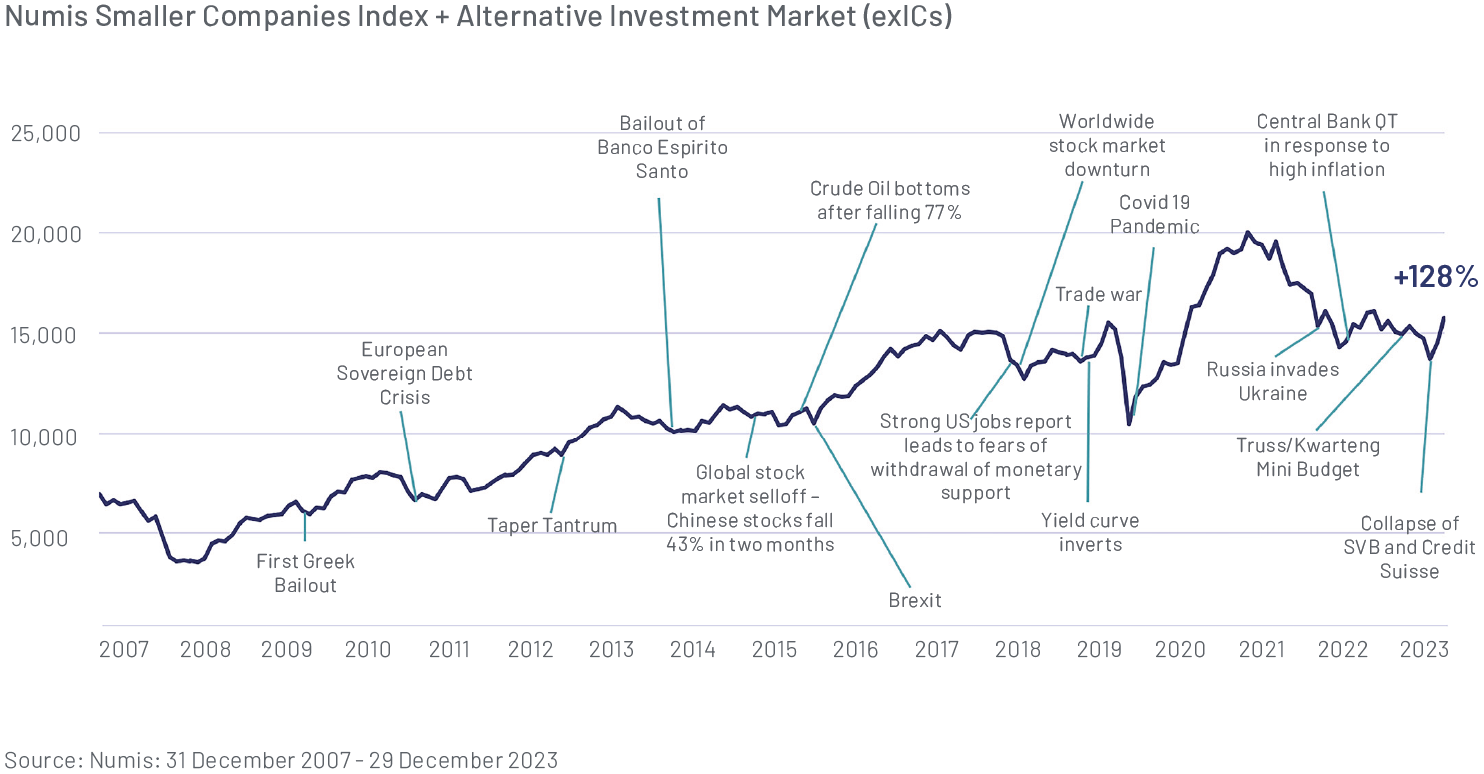

There are perpetual macroeconomic and geopolitical issues to be concerned about which periodically drive negative sentiment into markets. However, smaller company returns over the longer term can reward patient investors handsomely (see figure 2).

Increasing consensus for policy support

In 2023, a dearth of liquidity at the smaller end of the UK listed market kept valuations low and M&A activity high, further hollowing out quoted equities. High-growth UK smaller companies chose to list on overseas markets in pursuit of higher valuations; strong earnings performances were not reflected in UK smaller company valuations; and private equity increased its share of future UK value creation instead of domestic stakeholders, notably the growing millions of UK citizens saving for and living into retirement.

We think policy towards UK equity markets has a key role to play in unlocking the growth potential of the wider economy and we are not alone: research by Charles Hall at Peel Hunt found 92% of City professionals across a range of institutions and industries have called for incentives to increase investment in mid and small-cap companies. More broadly, 96% say we need to reinvigorate UK equity culture.

There is also increasing momentum and a building consensus behind the view that decades of government policy and regulation have contributed to pension funds and wealth managers reducing allocations to UK equities and that this trend must be reversed. The Mansion House compact, which calls for a British ISA and reforms to UK listing rules are just a few of the potential routes to attracting more capital to the UK market that could be material in time if executed effectively.

We strongly believe that listed markets are a critical component of the overall capital ecosystem that can stimulate economic growth in the UK. The UK venture capital market, underpinned by the VCT sector, has seen a dramatic revitalisation over the past decade, driving technological innovation and supporting knowledge and business hubs in London, Oxford, Cambridge and other regional centres of excellence. The junior AIM market of the London Stock Exchange has been a major global success story over the past 25 years supporting smaller companies with further growth capital as they expand and develop. The ability to use listed markets to provide capital is essential to be able to offer VCs an exit route, enabling them to recycle capital back into earlier stage businesses without selling British innovation to overseas buyers.

During the Covid-19 pandemic, listed markets provided rapid, flexible, and invaluable support to recapitalise British businesses impacted by lockdowns and a temporary reduction in activity, allowing them to recover and subsequently thrive. It is imperative that government policy helps to ensure this valuable ecosystem remains healthy to support the wider UK economy.

Elevated takeover activity will continue to drive selective re-ratings in UK smaller companies

At the beginning of 2023 we posed the question: “Are we set for a bumper year of corporate activity?” and pointed to depressed UK equity market valuations, large, uninvested commitments to private equity funds, and fewer private-to-private deals. Although subdued headline global M&A activity during 2023 would suggest the answer was firmly “no”, this was largely due to the absence of large- cap deals. Indeed, most deal activity focused on UK small and mid-cap public companies. Only ten of the 40 bids made at over £100mn equity value during 2023 had bid values over £500mn.

Depressed valuations within the UK equity market, particularly at the smaller end, resulted in the average takeover premium increasing to c.52% relative to a five-year average of 40%. If anything, during 2023, valuations for UK small-caps have become even more compelling relative to large-caps, global equities, and private market transaction benchmarks. For this reason, we believe the conditions remain favourable for takeover volumes to remain elevated, driving the potential for selective re-ratings across the market.

Increasing cash balances

Interest rate rises abating or reversing may stem the consistent net outflows experienced from UK equity funds over the past two years. In addition, takeover proceeds arriving into UK small-cap portfolios’ cash balances will be building into the year-end and will need to be deployed. Cash available to invest will create marginal buyers for UK small-cap stocks which could rapidly drive a more general re-rating across the sector and reduce the valuation discount.

|

|

| Ken Wotton Managing Director, Public Equity |

Brendan Gulston Director, Public Equity |

View this article as a PDF

Past performance is not necessarily a guide to future performance. Portfolio investments in smaller companies typically involve a higher degree of risk. Capital at risk. The views expressed by the investment team are correct at the time of writing but subject to change.

Key risks

- Interest rate rises abating or reversing may stem the consistent net outflows experienced from UK equity funds over the past two years.

- In addition, takeover proceeds arriving into UK small-cap portfolios’ cash balances will be building into the year-end and will need to be deployed.

- Cash available to invest will create marginal buyers for UK small-cap stocks which could rapidly drive a more general re-rating across the sector and reduce the valuation discount.

Important information

This document is a financial promotion issued by Gresham House Asset Management Limited (Gresham House) under Section 21 of the Financial Services and Markets Act 2000.

Gresham House is authorised and regulated by the Financial Conduct Authority (FCA) (FRN: 682776).

The information should not be construed as an invitation, offer or recommendation to buy or sell investments, shares, or securities or to form the basis of a contract to be relied on in any way. Gresham House provides no guarantees, representations, or warranties regarding the accuracy of this information.

This article is provided for the purpose of information only and before investing you should read the relevant Prospectus and the key investor information document (KIID) as they contain important information regarding the funds, including charges, tax and fund specific risk warnings and will form the basis of any investment. The prospectus, KIID and application forms are available from Waystone Management (UK) Limited, the Authorised Corporate Director of the funds (Tel: 0345 922 0044).

Gresham House

Specialist asset management

Gresham House

Specialist asset management