May 2025

May 2025

Monthly Monitor | May 2025

The consensus trade for 2025 is clear – stay short the US Dollar. On most purchasing-power-parity models the currency still screens as expensive.

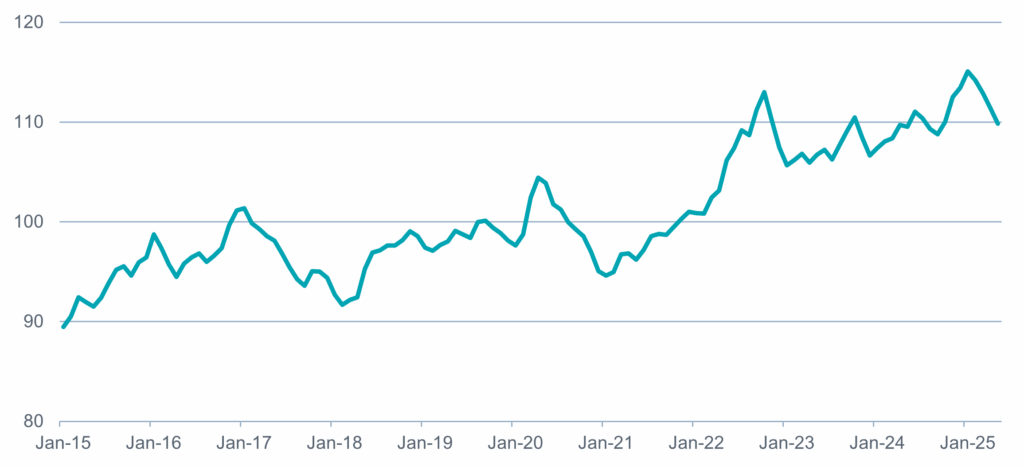

US real effective exchange rate vs. main trading partners

Source: Bloomberg, 23 June 2025

Washington’s policy mix (the publicised conflict between the fiscal and monetary arms, tariff wars creating a difficult decision making environment for companies, ‘revenge taxes’ on foreign shareholders and ideas regarding taxing US immigrant remittances) undermines the predictability that underpins reserve-currency status. Add a fiscal deficit of 6% of GDP and a persistent current-account gap, and it is no surprise that the market has turned bearish on the greenback.

The long-run bearish narrative is coherent although history shows that the US Dollar’s longest declines have been sprinkled with sharp rallies sparked by shifts in growth, liquidity, or policy perception. However, we evaluate several ingredients that could be a catalyst for US Dollar outperformance in the short-term.

Growth differentials may re-open interest:

Early-cycle US indicators (payrolls, productivity) are firming. Should incoming numbers push US real-GDP expectations clearly above those of its G-10 peers, capital may gravitate back to US Dollar assets even if nominal rate spreads narrow.

Liquidity could tighten suddenly:

While the debt ceiling has been frozen, the Treasury has financed outlays by running down its Treasury account (TGA), effectively injecting reserves into banks. Once the ceiling lifts, heavy bill issuance will pull those reserves back out, shrinking US Dollar liquidity at a moment when leveraged funds are short. Juxtaposed to this, two years of balance-sheet run-off have already drained reserves at large banks at a margin just above their own comfort thresholds. Layering the two could result in what policymakers call sub-ample territory, the zone where overnight funding rates jump, as seen in the 2019 repurchase agreement market episode. Scarcer dollars usually mean a stronger US Dollar.

A hawkish surprise at the Fed:

Market chatter assumes the White House will opt for a dovish, compliant Fed chair. Yet a visibly independent nominee could serve political ends, providing a scapegoat if growth slows while reassuring bond investors. A credible inflation hawk at the helm would upend the current policy drift narrative.

Valuation is a poor timing tool:

Purchasing-power-parity gaps highlight long-run misalignments, but they do not dictate timing. The US has been overvalued for years as productivity differentials favoured it. A similar continuance is conceivable if US productivity continues to outpace its key rivals.

The structural bear case for the US Dollar remains persuasive over the long run, but several catalysts could deliver a short-term squeeze as currencies rarely move in an obedient straight line.

We remain structurally short the US Dollar in our portfolios due to our long-term conviction in its trajectory and the value bias in our portfolios.

Kudakwashe Damba

Senior Investment Analyst

Any views and opinions are those of the Fund Managers, this is not a personal recommendation and does not take into account whether any financial instrument referenced is suitable for any particular investor.

Capital at risk. If you invest in any Gresham House funds, you may lose some or all of the money you invest. The value of your investment may go down as well as up. This investment may be affected by changes in currency exchange rates. Past performance is not necessarily a guide to future performance.

The above disclaimer and limitations of liability are applicable to the fullest extent permitted by law, whether in Contract, Statute, Tort (including without limitation, negligence) or otherwise.

Want to keep up to date?

Subscribe using the form below to receive updates on our Monthly Monitor.

Gresham House

Specialist asset management

Gresham House

Specialist asset management