Monthly Monitor - December 2022

Monthly Monitor - December 2022

What is value investing?

We define value stocks as those that are cheap relative to their long-run Free Cash Flow (FCF) generation. Their business models are usually relatively stable, capital allocation is disciplined, and they are conservatively financed.

Value investing is focused on buying these stocks when their market expectations are lower than justified, and they are trading below their fundamental value.

On the other end of the investing spectrum is glamour investing. Glamour investing involves buying the stocks of companies that are expected to grow faster than the rest of the market. These companies usually reinvest any cash flow back into the business to expand quickly, often at the cost of delaying profitability.

The attractiveness of following a value strategy is that we have significant evidence on our side. Over the 42 years to December 2020 (even before the latest value rally began) the cheapest quintile of the S&P 500 delivered 15.7% per annum while the S&P 500 delivered 12.1%. The most expensive quintile delivered less than half the return of the S&P 500.

Why do value stocks outperform glamour stocks and the market?

Numerous studies1 have shown that there is no persistence in growth. This means that even amongst those companies that have grown their earnings the strongest historically, future persistence in the growth of earnings before tax is indistinguishable from coin flips over the long term.

Despite this evidence, analysts and investors persevere in assigning higher multiples to those companies that have grown at high rates historically, despite there being no evidence that past growth correlates with long-term growth.

Value investors are focused on the current earnings power of the company. While growth is expected from value stocks, value investors refuse to pay up for growth. Therefore, even if the growth does not materialise as expected, value investors can still generate attractive returns.

Is the value rally over?

The 12 months to the end of September 2022 were the best for value performance relative to the performance of glamour companies since the autumn of 2001, after the dotcom bubble burst. This has led to investors being concerned that they may have missed the value rally.

We believe we are in the very early stages of the current value rally.

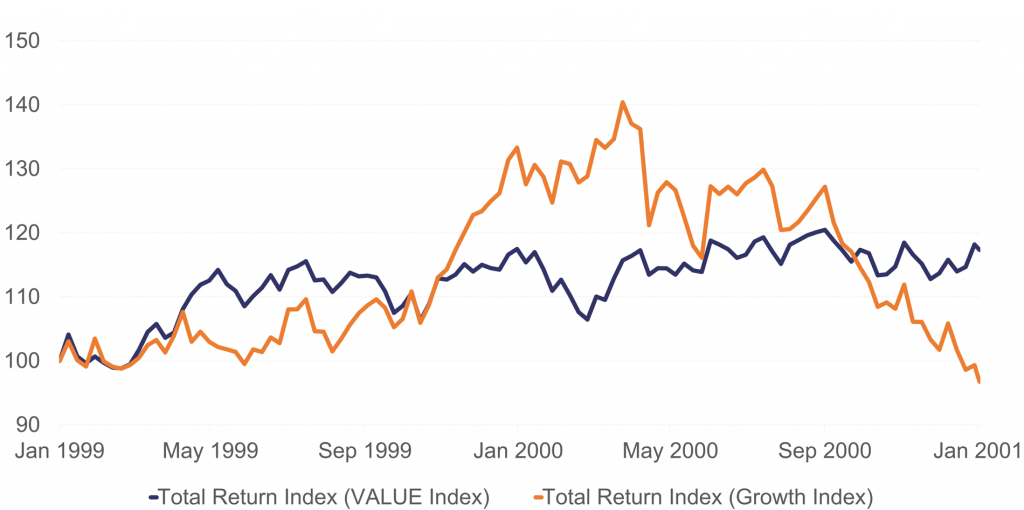

Value rallies tend to last years and to be persistent in nature. Post the bursting of the dotcom bubble in the late 1990’s, not only did growth stocks decline sharply during the bust, but they failed to outperform for another five years.

The outperformance of value stocks was driven by the market realising that the so-called ‘Secular Growth’ stocks were in fact deeply cyclical companies whose growth looked structural due to a massive investment cycle.

Value stocks also outperformed in the economic slowdown that followed.

We see a similar situation emerging today.

The Global Central Bank inspired ‘Duration Bubble’ has burst. When bubbles burst, owning assets that did not participate in the bubble is a good idea. Value stocks did not participate in this bubble. We believe that like the early 2000s value will outperform in the economic slowdown.

Value stocks held up during the 2000 sell off

Source: Gresham House Ireland, Bloomberg

When do value stocks perform best?

(In situations like today)

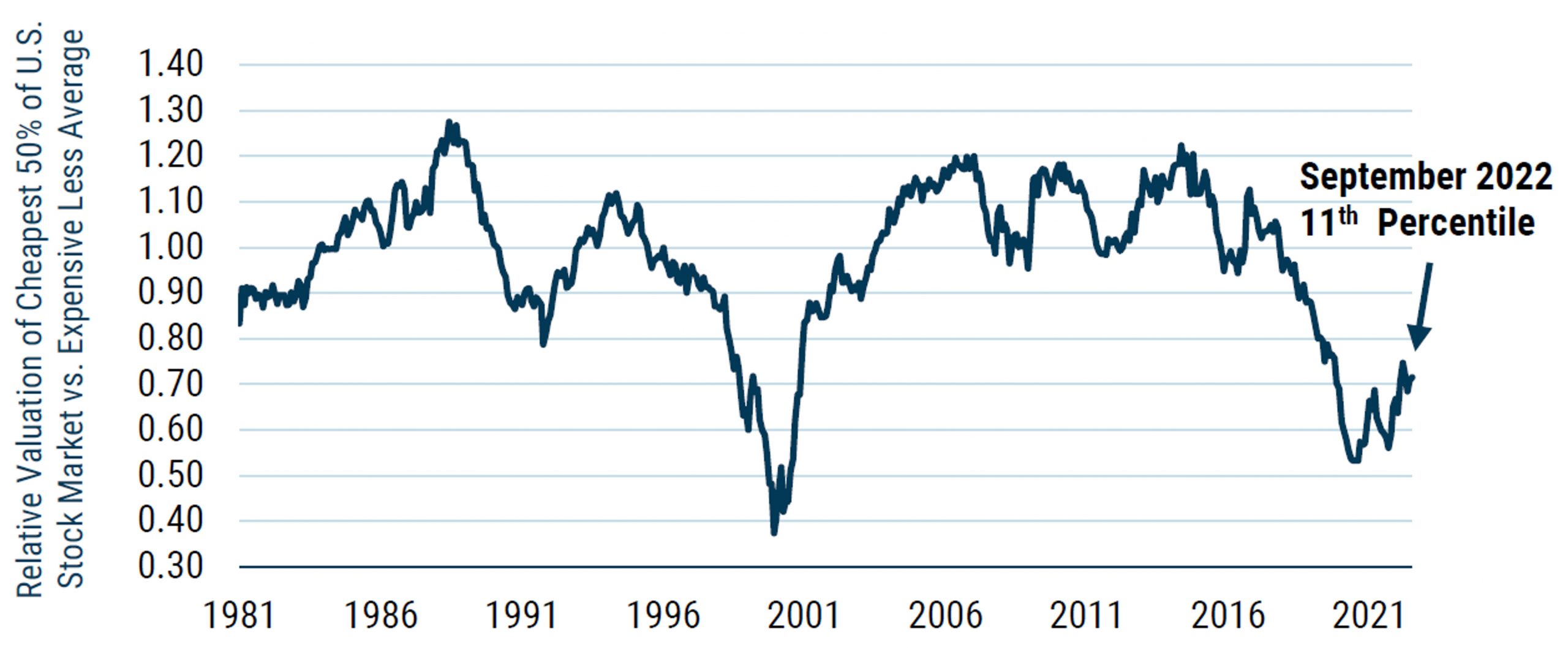

1. Value stocks are most attractive when their valuation is at a significant discount to growth stocks. This is the case today. Despite the strong relative performance of value stocks vs. growth stocks since the announcement of the vaccine efficacy in November 2020 the valuation discount has barely narrowed. The outperformance of value stocks has come from the stability and moderate growth in their cash flows. This is the opposite of the growth stocks which enjoyed a one-off event that made their cyclical earnings look like they were destined for structural growth.

Source: GMO LLC, 30 September 2022

2. Value performs well after poor five-year periods. The five-year period to December 2020 was a very weak period for value. The cheapest quintile of S&P 500 stocks by P/E delivered 7.80% per year for that period. The good news is that with value investing it’s always darkest before the dawn.

- From 1969 to 1973 the cheapest quintile only delivered -0.9% per annum; the next five years delivered 21.1% per annum

- From 2004 to 2008 the cheapest quintile only delivered 0.2% per annum; the next five years delivered 25.3% per annum

- From 2007 to 2011 the cheapest quintile only delivered 4.8% per annum; the next five years delivered 17.7% per annum

3. Value performs well when the macro environment is supportive. Value strategies outperform in both bear-flattening regimes and bear-steepening regimes.2

4. Value can be the beneficiary when investment moves from intangibles to tangibles. A recession may bring rates back down but the era of lower lows in interest rates is over. We have moved from a world where the fear was that inflation would drop too low to one where the fear is that inflation breaks out on the upside. This environment will alter monetary policy and the valuation of numerous assets. Permanently zero rates favoured fixed income, equities which behaved like fixed income, intangible assets such as US technology and internet stocks, cryptocurrencies, and other speculative investments. Now that the days of zero rates are gone those names with exposure to the real economy will benefit. Commodities, energy, value stocks and real assets (including housing) should all perform well as we move to an era of real investment and investment in the energy transition.

Where is the value?

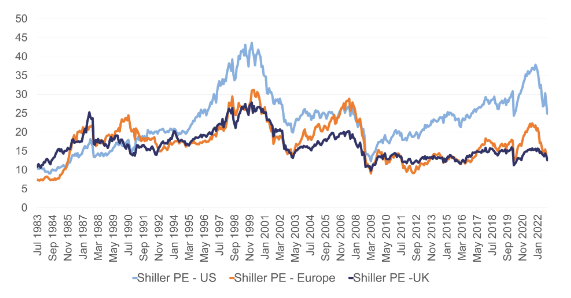

Europe, including the UK, is the epicentre of the value opportunity.

Shiller PE’s of US, Europe and the UK

Source: Gresham House, Ireland, December 2022

Despite the war in Ukraine and the economic weakness that will stem from the gas crisis, the prospects to make supernormal returns from European equities has rarely been this attractive. The combined PE ratio (average of the forward PE, trailing PE, and PE 10 ratios) has dropped to extreme cheap levels. It is almost on par with levels seen at the bottom of the dotcom bubble burst, and the 2020 bear market. It has yet to plummet to the absolute lows seen during the global financial crisis and subsequent European sovereign debt crisis, but we are not far off. The situation today is nowhere near as dire.

According to Bloomberg the region also looks like a bright spot from an earnings standpoint. The next 12-month bottom-up earnings estimates for European equities just hit a 10-year high.

Sentiment is also improving off a low base. European institutional investors are becoming slightly less pessimistic.

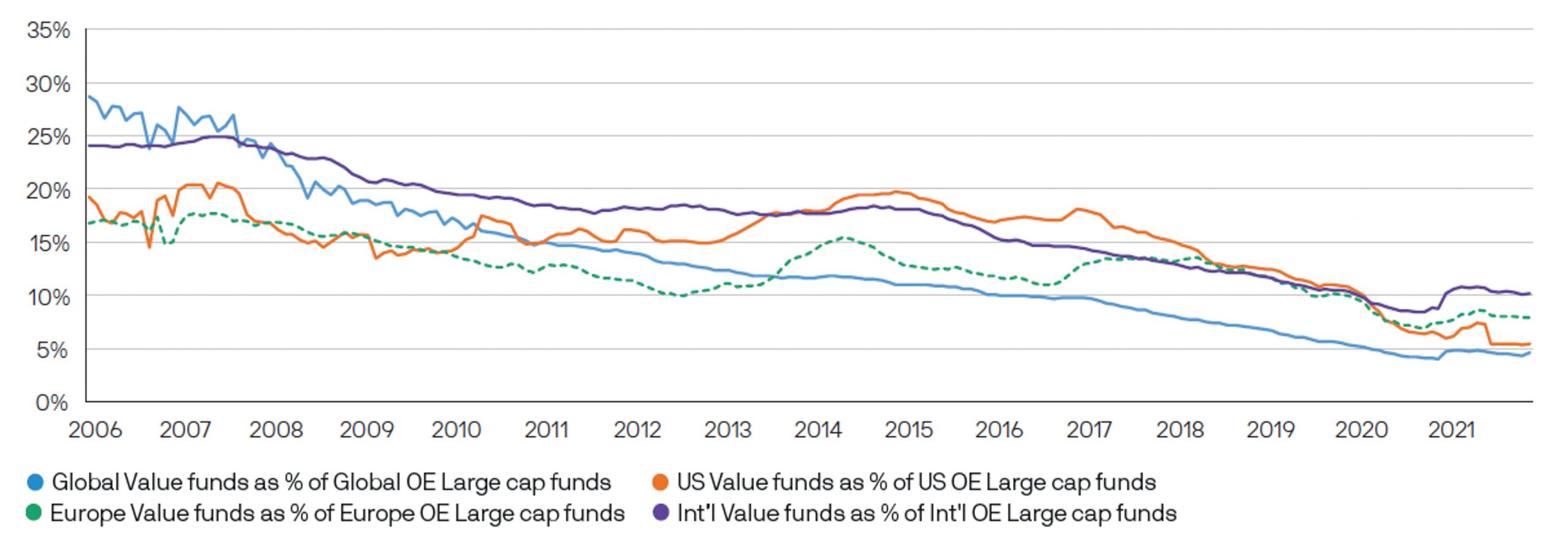

The lack of value investors creates an opportunity

Value investors are a dying breed, this creates an opportunity. During the speculative mania that we have witnessed value investors have struggled to stay afloat. Some capitulated and bought in to the speculation, others went out of business. Morningstar data indicates that only 5-10% of managed assets are value strategies. The last time value strategies were this out of favour it set up a five-year period of massive outperformance.

The declining number of value funds

Source: Morningstar, 31 December 2021

Conclusion

Being a value investor is inherently contrarian. The holding period for most institutional money managers sits well below one year. We are in an extreme minority. We are long-term, fundamental value investors willing to tolerate short-term relative pain in the pursuit of long-term returns.

Value investing is a dying art, and this creates the opportunity. Ignoring short termism and investor fads provides us with our edge.

We strongly believe that over the long term our sound process will deliver superior results. We believe that today is one of the best points in history to invest in a value strategy.

A value strategy will not outperform every week, every month, every quarter or even every year. But we believe that over multi-year periods value investing will triumph.

1. In their 2001 paper, Chan et. al. looked at growth rates across US firms over years and found that while some firms have grown at high rates historically, they are relatively rare instances. There is no persistence in long-term earnings growth beyond chance.

2. Bear flattening is when short-term interest rates rise faster than long-term interest rates. Bear steepening is when long-term interest rates rise faster than short-term interest rates.

Gresham House

Specialist asset management

Gresham House

Specialist asset management