July 2024

July 2024

Small caps are starting to shine, and we expect it will stay bright for a while.

Over time, smaller companies tend to outperform larger companies. They are under researched, under followed, and have better growth potential than their larger peers.

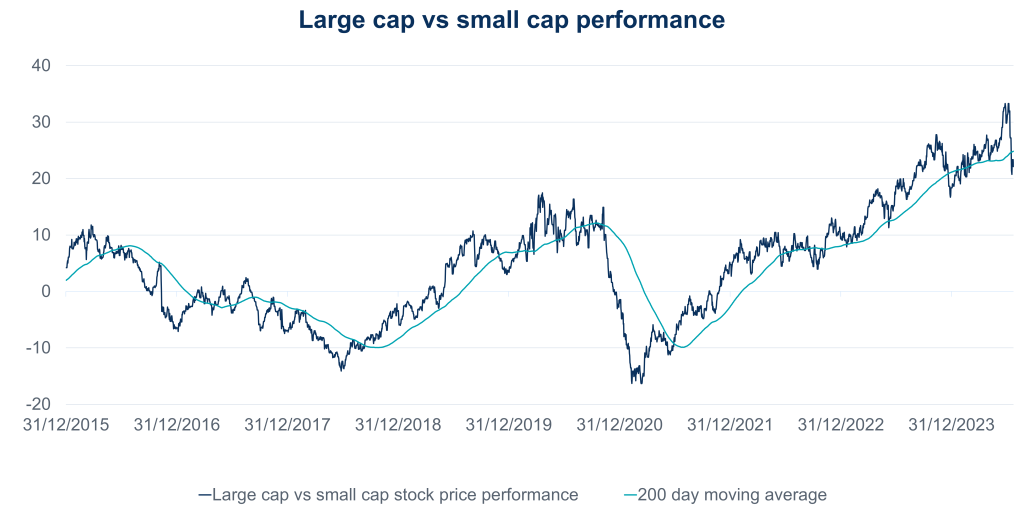

Recent history, which has seen mega-cap domination, has been the anomaly. Prior to the June CPI data, the S&P 500 was further ahead of the average stock than any time since 2003. The CPI print led to a drastic reversal with large-cap vs small-cap performance breaking below the 200-day moving average, an important psychological level.

Structurally, we maintain a preference for smaller companies over the coming quarters and years for three primary reasons:

1. Historical performance trendsThe share price underperformance of small and medium sized companies is at near all-time highs. History tells us these extreme periods of performance deviation reverse themselves over time.

|

|

|

2. Valuation discrepanciesThe valuation discount of small to large companies is near all-time highs. A reversion to mean of valuations will significantly help smaller companies.

|

3. Shifting macroeconomic windsThe macroeconomic headwinds that smaller companies have had to endure will become tailwinds. Higher interest rates hurt smaller companies to a greater degree than large companies as smaller companies have a higher percentage of floating-rate debt. Rates are now moving lower, and it is smaller companies that will get the benefit. Wage inflation also impacts smaller companies more than larger companies as they tend to be more labour intensive. Wage inflation is moderating, and this should continue as the labour market become looser. |

Smaller companies are stepping into the spotlight, ready to capitalise on the growth opportunities ahead. Their potential, previously overshadowed by larger peers, is now coming to the forefront.

Conclusion

The strengthening performance of small-cap stocks could signal a brighter forecast. As these companies gain momentum, their growth could lead to substantial returns. Might it be time for investors to consider the potential of smaller companies as they re-evaluate their portfolios?

Any views and opinions are those of the Fund Managers, this is not a personal recommendation and does not take into account whether any financial instrument referenced is suitable for any particular investor.

Capital at risk. If you invest in any Gresham House funds, you may lose some or all of the money you invest. The value of your investment may go down as well as up. This investment may be affected by changes in currency exchange rates. Past performance is not necessarily a guide to future performance.

The above disclaimer and limitations of liability are applicable to the fullest extent permitted by law, whether in Contract, Statute, Tort (including without limitation, negligence) or otherwise.

Gresham House

Specialist asset management

Gresham House

Specialist asset management