Country profile - April 2023

Country profile - April 2023

Exploring Ireland’s characteristics as a destination for forestry investment

📑 The first in a series of articles from our specialist team exploring global forestry markets.

Background

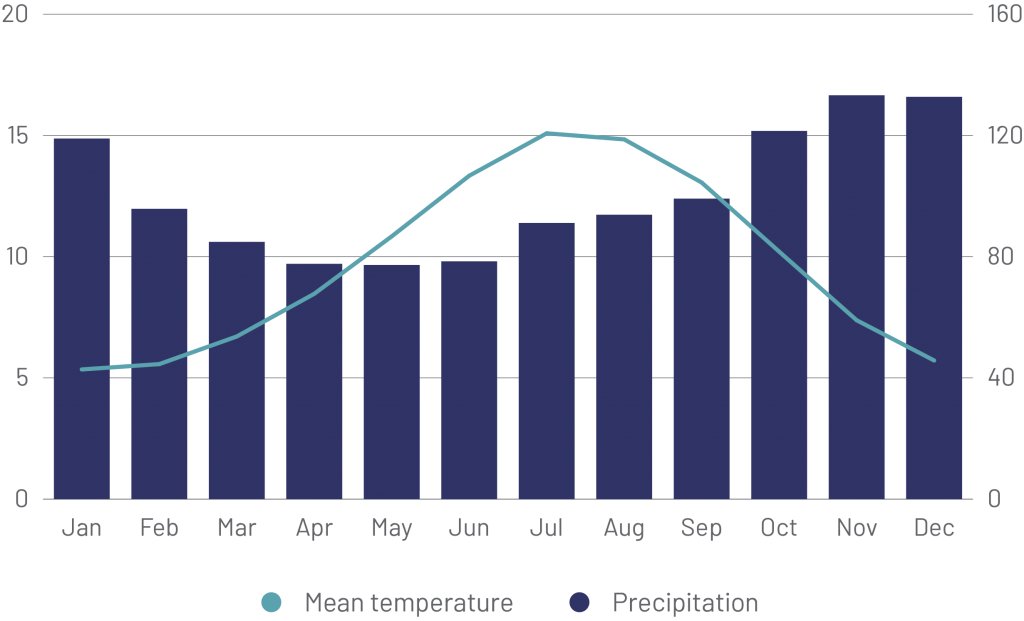

Ireland’s maritime climate and nutrient rich soils are well suited to commercial forestry.

Despite having the fastest growth rates for commercial conifers in Europe, it has one of the lowest forest cover levels in the EU. It has a highly developed processing sector and enjoys strong domestic demand as well as access to the UK, the second largest importer of timber products in the world.

Future demand is underpinned by a growing population and the demand for housing, with significant state support for expanding forest coverage in Ireland’s Forest Strategy. Increased afforestation is a cornerstone of the country’s Climate Action Plan, which targets Net Zero by 2050.

As the forest cover grows and the timber market matures, there are opportunities for investors to add value to a forestry portfolio.

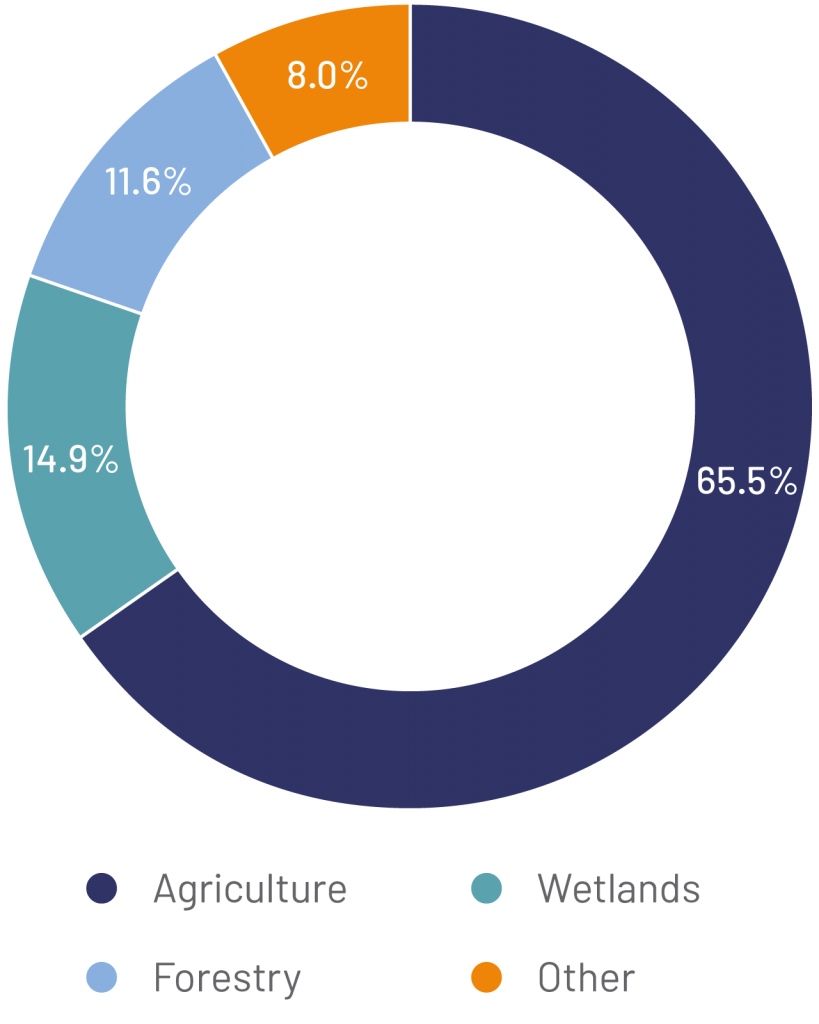

Land use

|

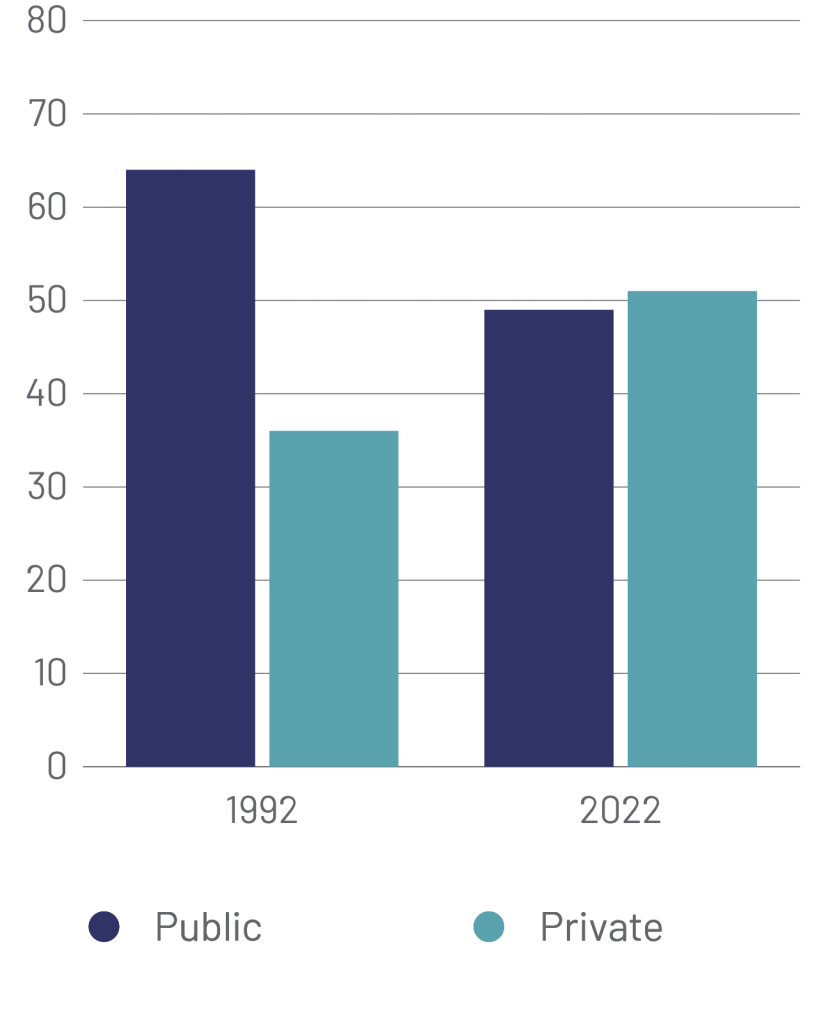

Forest ownership (%)

|

Source: CSO (Land use); DAFM Forest Statistics Ireland 2022 (Forest Ownership)

Irish climate (°C vs. mm)

|

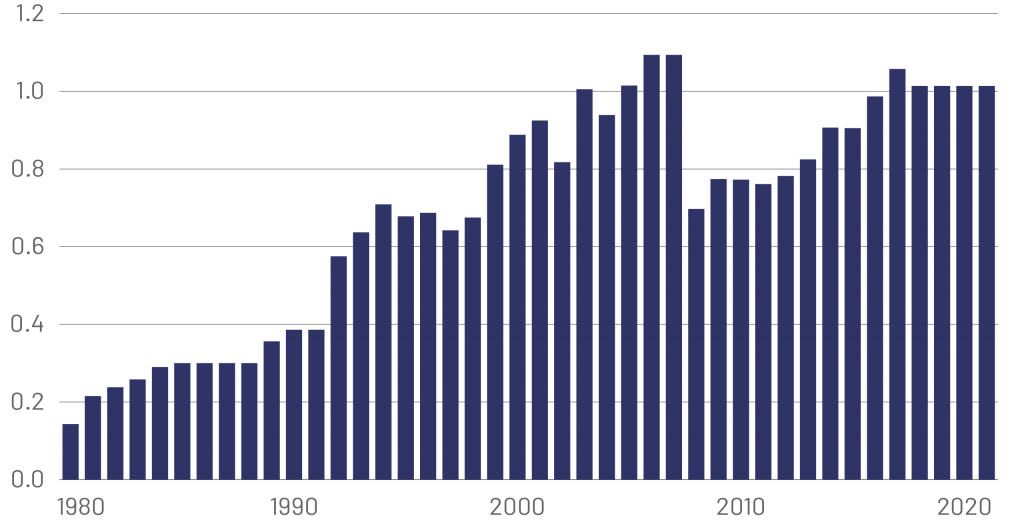

Value of wood and paper products (€mn)

|

Source: World Bank; FAOSTAT

Forest estate

11.6%of land use |

810,000hatotal area |

+10.5%ten-year change |

69%conifer |

Ireland’s forest estate has followed a similar trajectory to many European countries, with a high natural level of woodland cover reduced through clearance for agriculture, settlement, and demand for timber.

This reached a low of 1.2% forest cover in the early twentieth century but has recovered significantly since, through control of deforestation and widespread planting. Total forested area now stands at 11.6%. The Irish Government’s forestry strategy targets 18% coverage, with an annual afforestation goal of 8,000ha.

A significant portion of the overall estate has been established since the 1980s (367,000ha) and this has driven available wood volumes upward in recent years as these forests reach maturity.

This has supported growth in the forest and wood products sector, which is estimated by Ireland’s Council for Forest Research and Development (Coford) to employ the equivalent of 9,000 full time employees and to contribute €2bn to the Irish economy.

Historic production of sawnwood products in Ireland (million m3)

Source: FAOSTAT

Public and private ownership

Roughly half of Irish forestry is in the public sector, primarily under the management of Coillte, a semi state-owned company. Historically this has been higher, though recent private sector afforestation has brought the sectors into more even balance.

To date, privately owned Irish forestry has been highly fragmented, having been predominantly planted by farmers with the support of EU and state grants. The average plot size is 8.6ha and significantly larger forests are rare.

This combined model of agriculture and forestry allows the landowner to diversify incomes.

However, managing individually smaller forests can result in lost economies of scale, and small isolated plot sizes may drive sub-optimal harvesting decisions.

Individual small forest owners are also exposed to the buyer-power of the larger timber processing entities.

Certification

Certification with a stewardship body, such as the FSC or PEFC, helps demonstrate that forests are sustainably managed, however, this does require relatively frequent investment in systems and administration. Only 6% of the private forest sector is certified under the aforementioned main bodies

As it stands today, however, a large proportion (64%) of the timber sold to mills in Ireland is from Coillte’s state-owned forests, which are certified. Mills are only required to ensure a certain proportion of their input is from certified sources, which allows the mills to buy a portion of their intake from uncertified private forests.

As the proportion of wood coming from private forests grows, certification will constrain the opportunities for marketing wood from the private sector. Larger scale ownership can invest in PEFC or FSC certification and will likely add value, particularly if a tiering of timber pricing occurs.

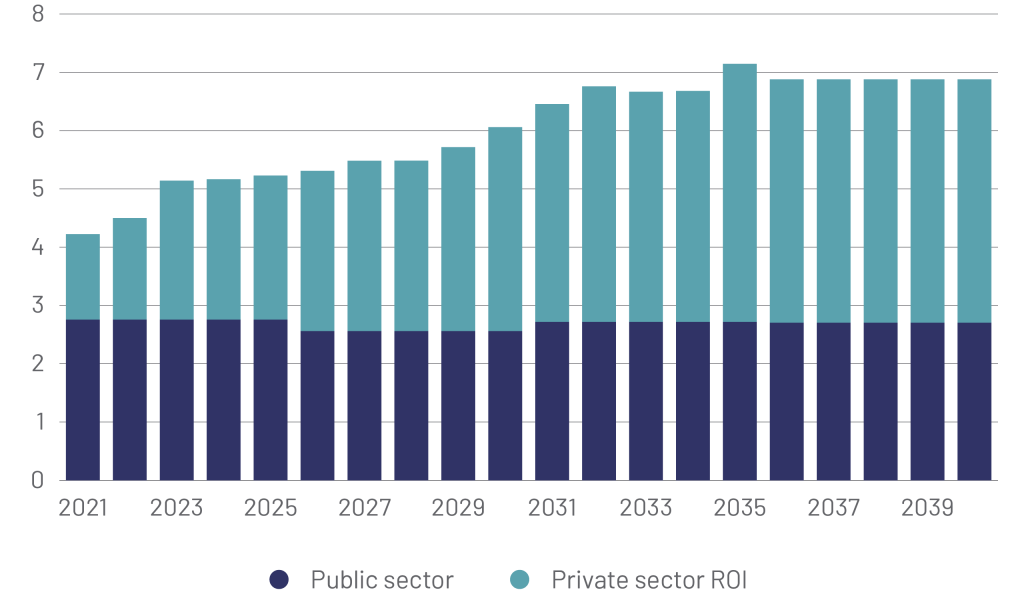

Forecast net realisable roundwood production (million m3)

Source: DAFM Forest Statistics Ireland 2022

Domestic demand

In line with global timber demand trends, Ireland is forecast to see an increase in construction activity as new houses are built.

This is a function of a growing population, changes in housing preference, and a historic lack of housing supply.

There is political consensus on addressing the housing shortage, with the €4bn ‘Housing for All’ plan pledging to build 300,000 new homes over the next ten years.

Timber demand will be further supported by efforts to decarbonise construction, and the trend towards offsite construction.

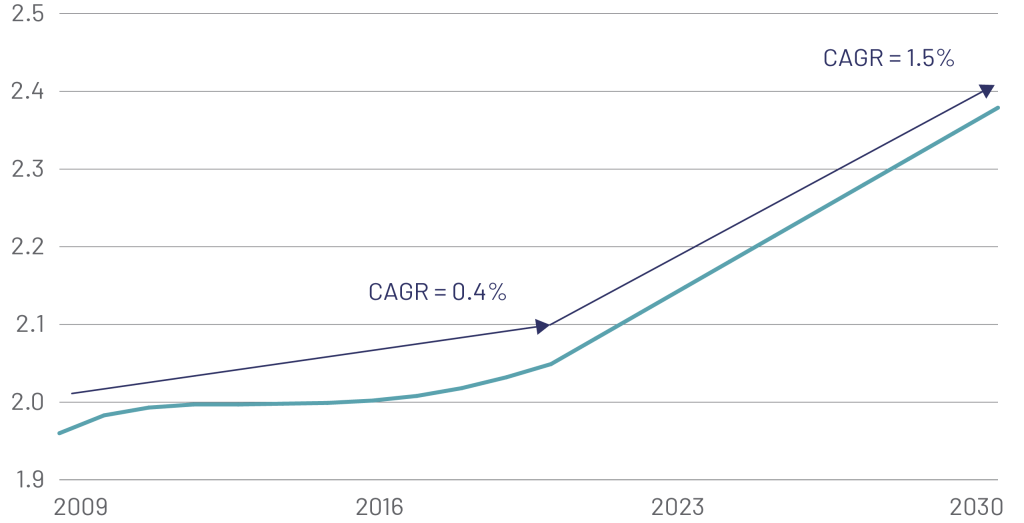

Irish housing stock (million)

Source: Statista

Export demand

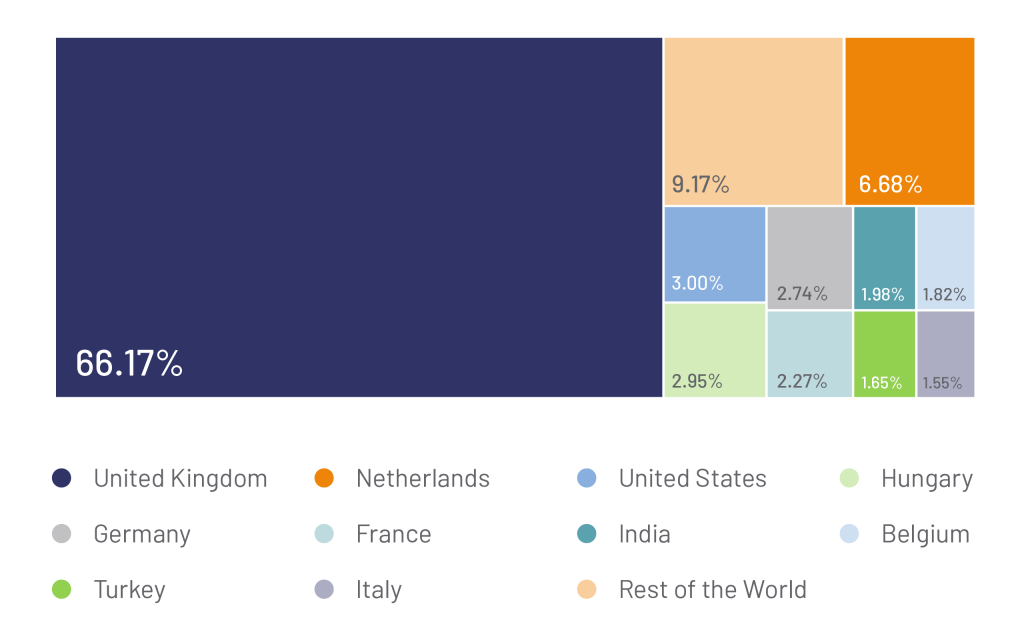

Exports of wood products from Ireland reached €1,033mn in 2021, with the lion’s share of this going to the UK. The UK is the second largest importer of wood products globally, relying on its trading partners to meet c.80% of its demand.

Ireland’s other key trading partners are experiencing similar timber demand and are expected to keep export opportunities open for high-quality Irish grown timber.

Ireland export partners for wood-based products

Source: World Bank

A potential investment opportunity?

Ireland is well-positioned both to grow high-quality timber and to deliver this into receptive markets.

In terms of afforestation, there is clear political support and a tried and tested route to developing bare land into forest.

We believe these two factors, together with the aforementioned current demand drivers, provide strong potential for Ireland as a location for forestry investment.

Get in touch

|

|

| Anthony Crosbie Dawson Director, Forestry & Private Clientsa.crosbiedawson@greshamhouse.com |

Important information

Opinions expressed within this article are the author’s own and not necessarily those of Gresham House. This does not, and should not be construed to, constitute investment advice. Past performance is not a reliable indicator of future performance.

Your capital is at risk.

Forestry investment is not for everyone. Please read more about the investment class and read up on the risks involved before considering investing.

Gresham House

Specialist asset management

Gresham House

Specialist asset management