March 2024

March 2024

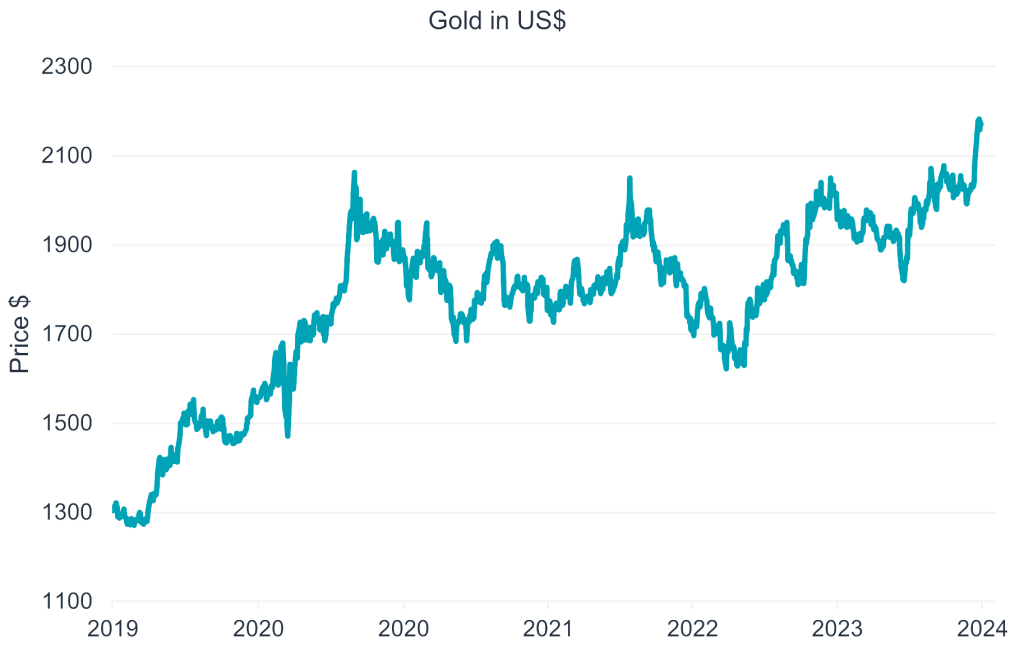

Gold, which Keynes defined as a ‘barbarous relic’, has finally broken out from its four-year sideways trend.

The current bull run in gold is occurring at a time when equity markets are also strong. Usually, gold investors are left behind in this climate, as gold is generally seen as an insurance policy against major negative events, however that is not the case this time.

Source: Bloomberg, Gresham House, Ireland

Why is gold rallying and is it sustainable?

Generally, rising interest rates on the back of a strong economy negatively impact the price of gold. Higher interest rates mean higher opportunity costs of holding non-productive assets like precious metals, making them relatively less attractive.

Gold doesn’t provide a cash flow, so is expensive to hold when there are attractive cash flows available from relatively risk-free bonds. The current bull market we are witnessing has been driven by emerging markets as opposed to real interest rates.

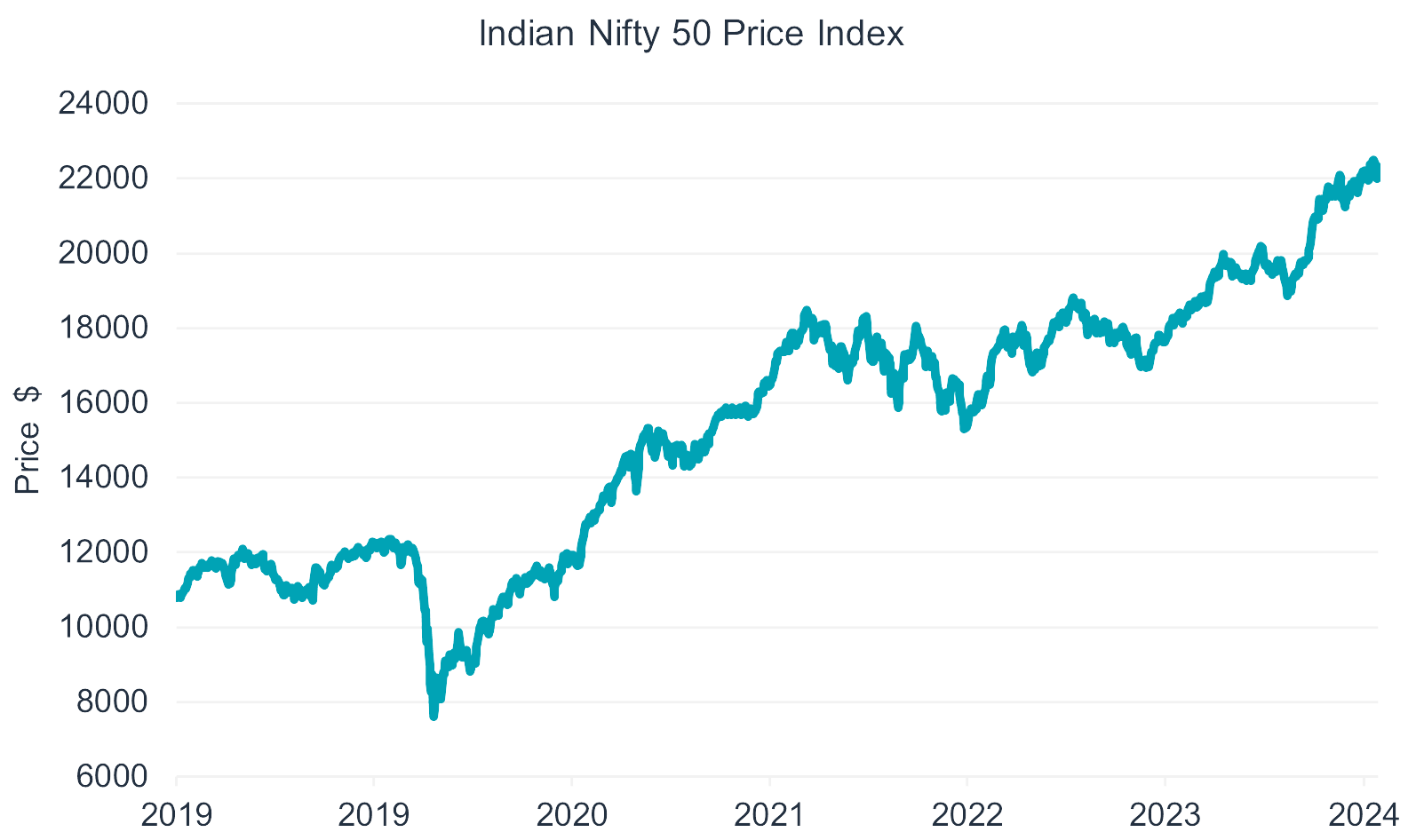

Indian markets

Indian markets are booming, and current valuations are very high. Economic and asset booms in India go hand-in-hand with an increase in jewellery purchases. India is the third-largest jewellery market in the world1 and there are no signs of the correlation between increased wealth and jewellery consumption slowing down.

Source: Bloomberg, Gresham House, Ireland

Chinese markets

In China, the implosion of the property bubble and gold consumption during the longer than typical Chinese New Year holiday is driving demand. According to the World Gold Council, gold jewellery sales increased 24% year-over-year during the Chinese New Year holiday.2 Policy makers have also lowered interest rates to reignite the economy. Both catalysts have led to inflows into gold, reflected in the premium Shanghai gold is trading at versus other exchanges.

In addition to emerging market retail activity, emerging market central banks continue to add to their gold reserves with January seeing the Central Bank of Turkey, People’s Bank of China and the Reserve Bank of India adding more than 30 tonnes to their gold reserves.3

Given the potential for a positive upside juxtaposed against gold’s inherent insurance properties, the opportunity set is positive. With the gold price being less a function of real interest rates and more a function of momentum in China and other emerging markets, in our view it looks as if this bull market will continue to grow.

Conclusion

We continue to maintain the allocation to gold within our multi-asset portfolio, as we believe the relationship between gold and real rates has weakened substantially and gold is now more of an emerging markets story.

1. statista.com

2. World Gold Council, 29 February 2024

3. World Gold Council, 5 March 2024

Any views and opinions are those of the Fund Managers, this is not a personal recommendation and does not take into account whether any financial instrument referenced is suitable for any particular investor.

Capital at risk. If you invest in any Gresham House funds, you may lose some or all of the money you invest. The value of your investment may go down as well as up. This investment may be affected by changes in currency exchange rates. Past performance is not necessarily a guide to future performance.

The above disclaimer and limitations of liability are applicable to the fullest extent permitted by law, whether in Contract, Statute, Tort (including without limitation, negligence) or otherwise.

Gresham House

Specialist asset management

Gresham House

Specialist asset management