May 2024

May 2024

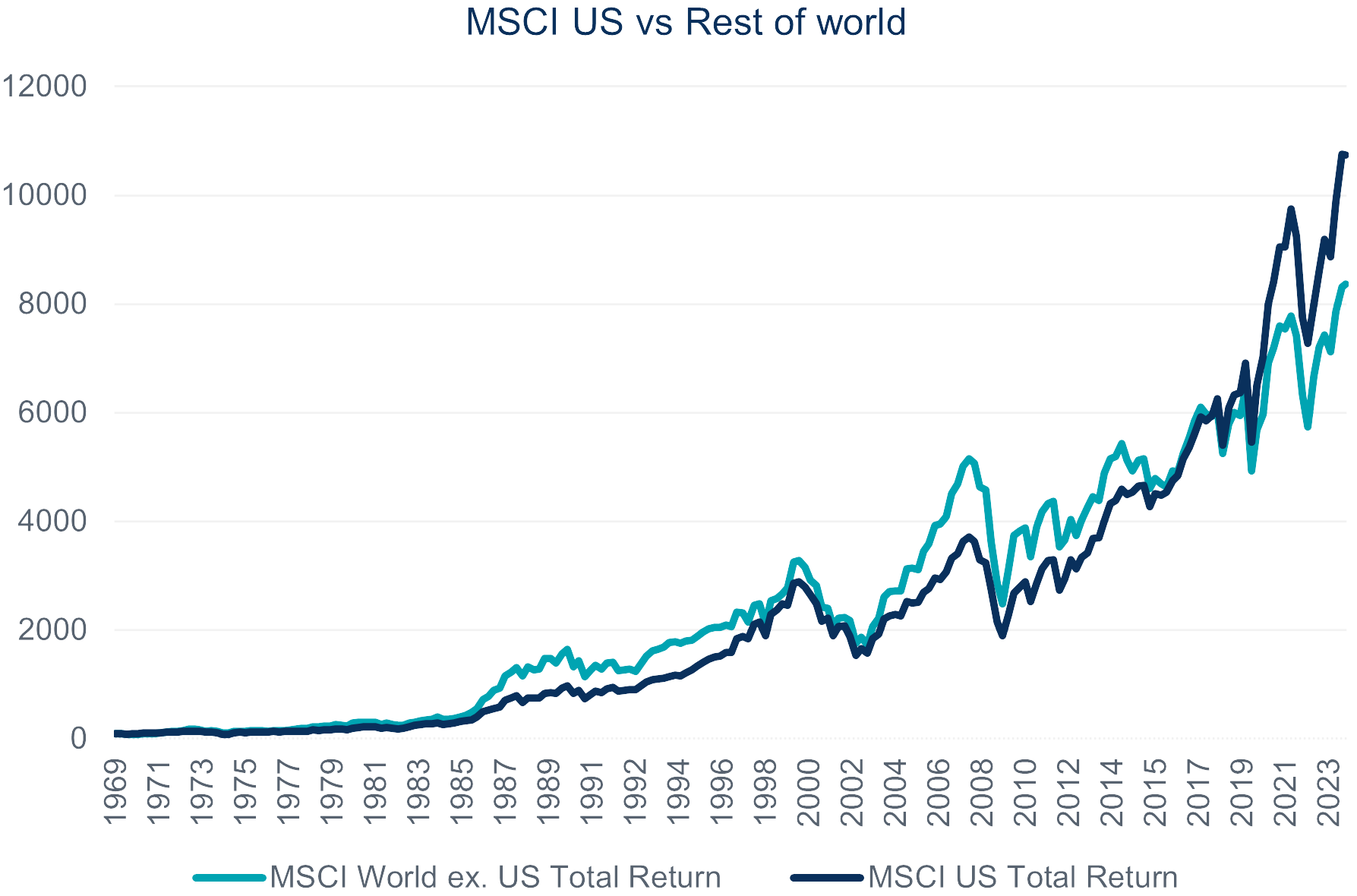

After a decade of US outperformance, it may be time for investors to rebalance away from the region and into areas that have been capital starved, and are now primed for the coming bull market.

Source: Bloomberg, Gresham House, Ireland, May 2024

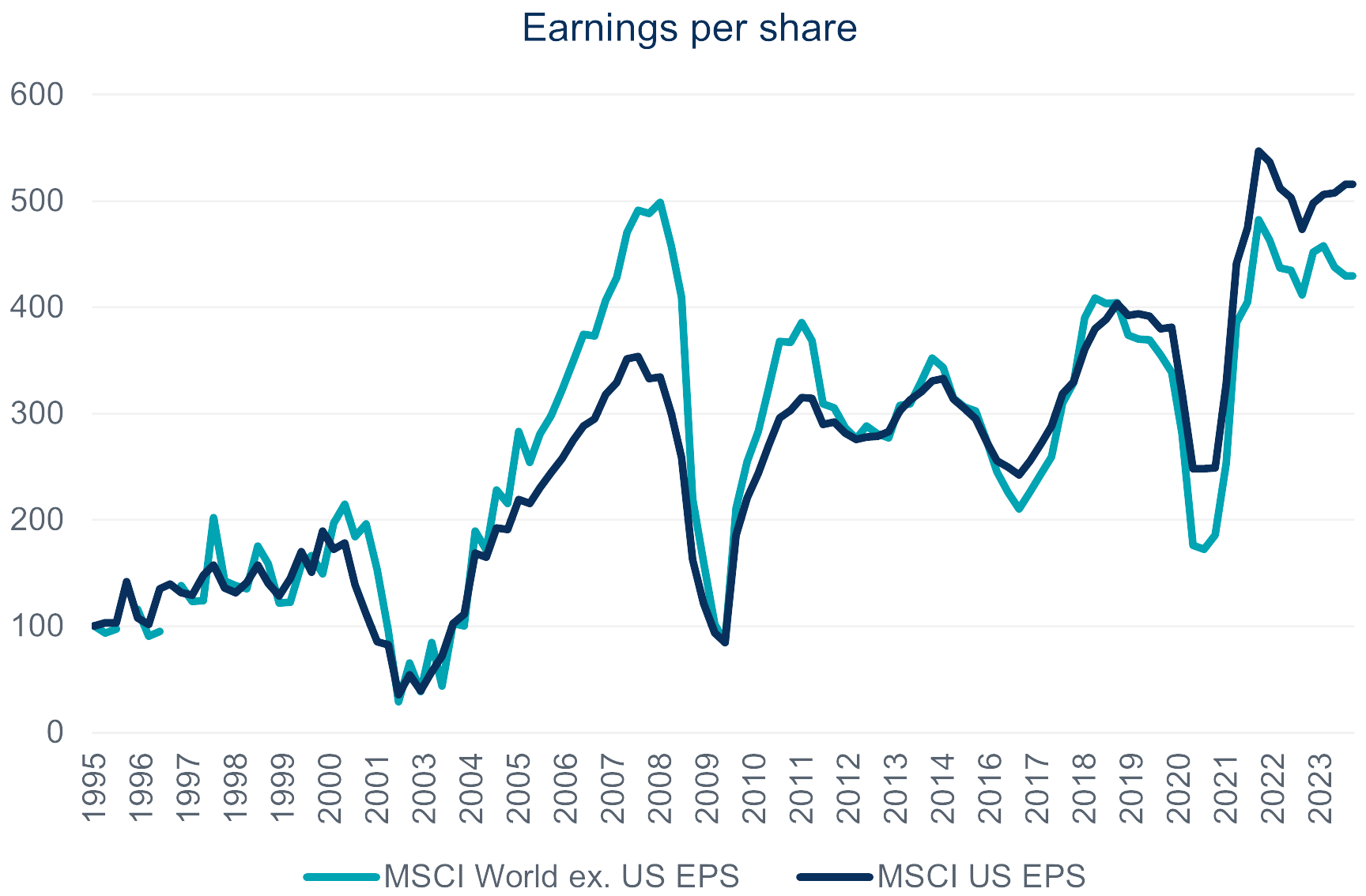

The US outperformance has been largely justified by superior earnings versus the rest of the world over the last six years.

Source: Bloomberg, Gresham House, Ireland, May 2024

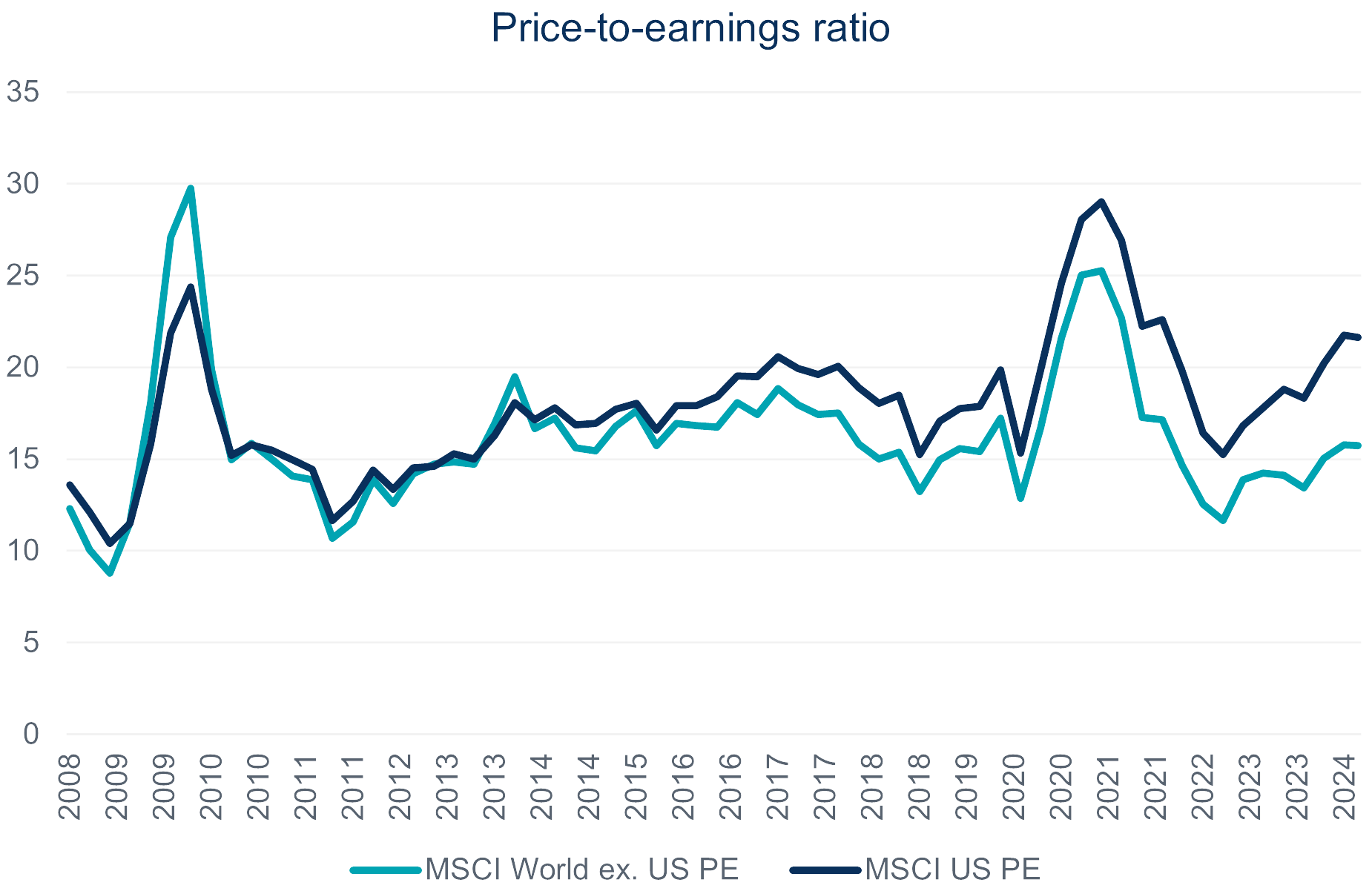

However, the market took the superior earnings narrative to its extreme and valuations now look very stretched.

Source: Bloomberg, Gresham House, Ireland, May 2024

The higher valuation reflects the view that US earnings will be superior to the rest of the world going forward. But there are few things in markets that are permanent. The US now accounts for 70% of global equity market capitalisation. Contrast this with US GDP which is only 18% of Global GDP. The US also only accounts for 4% of the global population. It seems implausible to us that the US, with only 4% of the world’s population and 18% of the worlds GDP will account for 70% of global profits over the decade ahead. The opportunities for the decade ahead lie elsewhere, in Europe, the UK, Japan and Emerging Markets.

The rest of the world has three advantages over the US in our view as we consider the next cycle:

- Valuations

- Margin convergence

- Real economy exposure

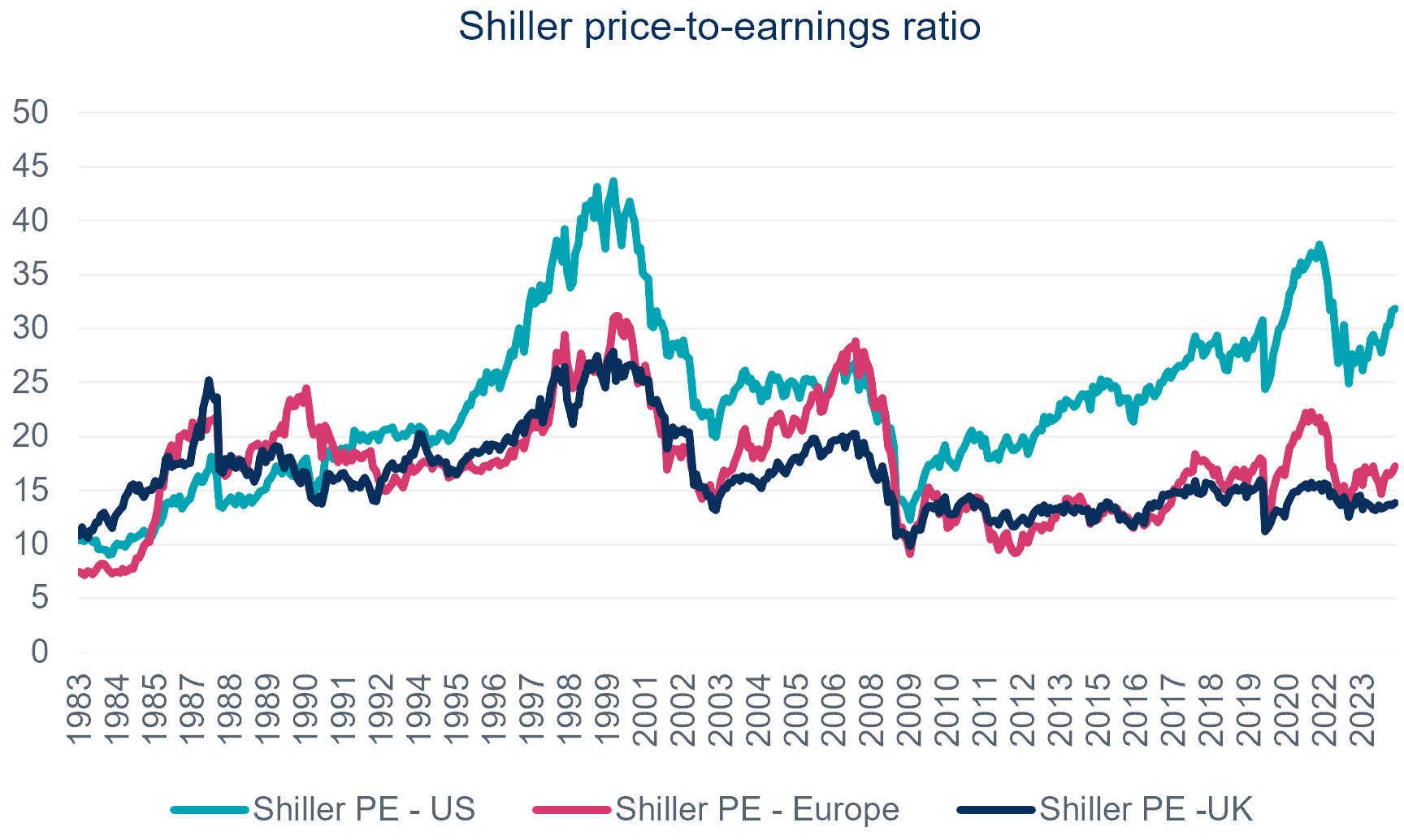

Valuations

The Shiller P/E ratio (an indicator of whether the stock market as a whole is overvalued or undervalued), which is strongly correlated to future returns, paints an optimistic picture for equities outside the US, particularly in Europe and the UK.

Source: Thomson Datastream, Gresham House, Ireland, May 2024

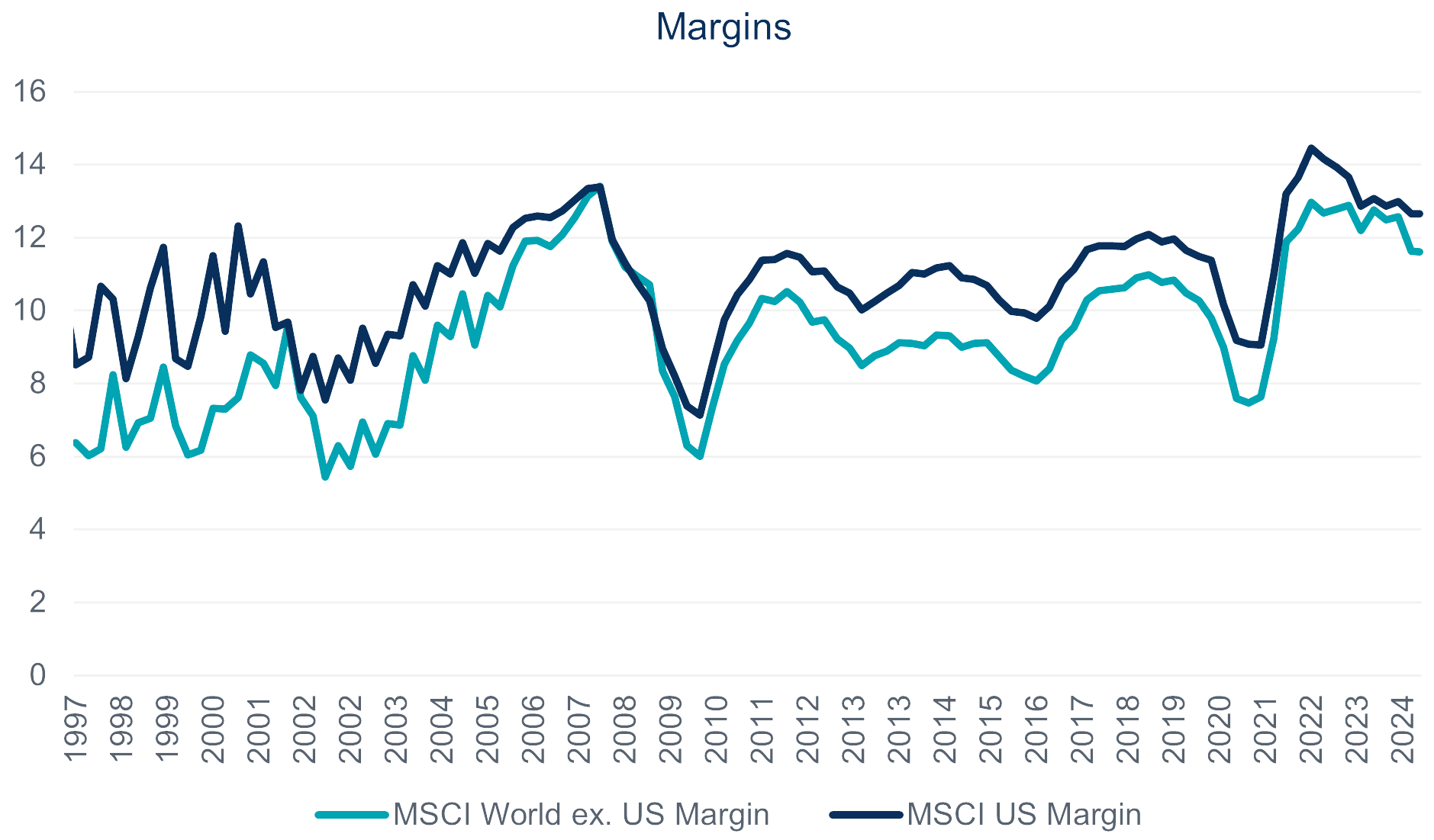

Margin convergence

The era of companies in the US trading at superior price-to-earnings margins to those outside of the US is ending. US margins have been higher than those in the rest of the world, for several reasons, the main one being that wage costs have collapsed in proportion to output. Wage share of GDP has collapsed as bargaining power has diminished. Corporate America has gained greater flexibility in terms of its workforce with a greater proportion of wages being variable and based on performance metrics.

We see the onshoring and labour shortages that we are experiencing in the US as a catalyst for labour gaining back some of the lost share of GDP. This will support margin convergence between the regions.

Source: Thomson Datastream, Gresham House, Ireland, May 2024

Real economy exposure

Several macroeconomic factors as well as valuations have us favouring exposure to the real economy for the coming cycle. There is clearly no appetite for returning to the fiscal austerity of the 2010s. Governments are under pressure to inject even more money into their economies. These more flexible fiscal policies will find their way into the real economy. Just as secular stagnation and zero interest rates favoured intangibles and glamour stocks, secular reflation should favour tangible stocks.

Any views and opinions are those of the Fund Managers, this is not a personal recommendation and does not take into account whether any financial instrument referenced is suitable for any particular investor.

Capital at risk. If you invest in any Gresham House funds, you may lose some or all of the money you invest. The value of your investment may go down as well as up. This investment may be affected by changes in currency exchange rates. Past performance is not necessarily a guide to future performance.

The above disclaimer and limitations of liability are applicable to the fullest extent permitted by law, whether in Contract, Statute, Tort (including without limitation, negligence) or otherwise.

Gresham House

Specialist asset management

Gresham House

Specialist asset management