November 2024

November 2024

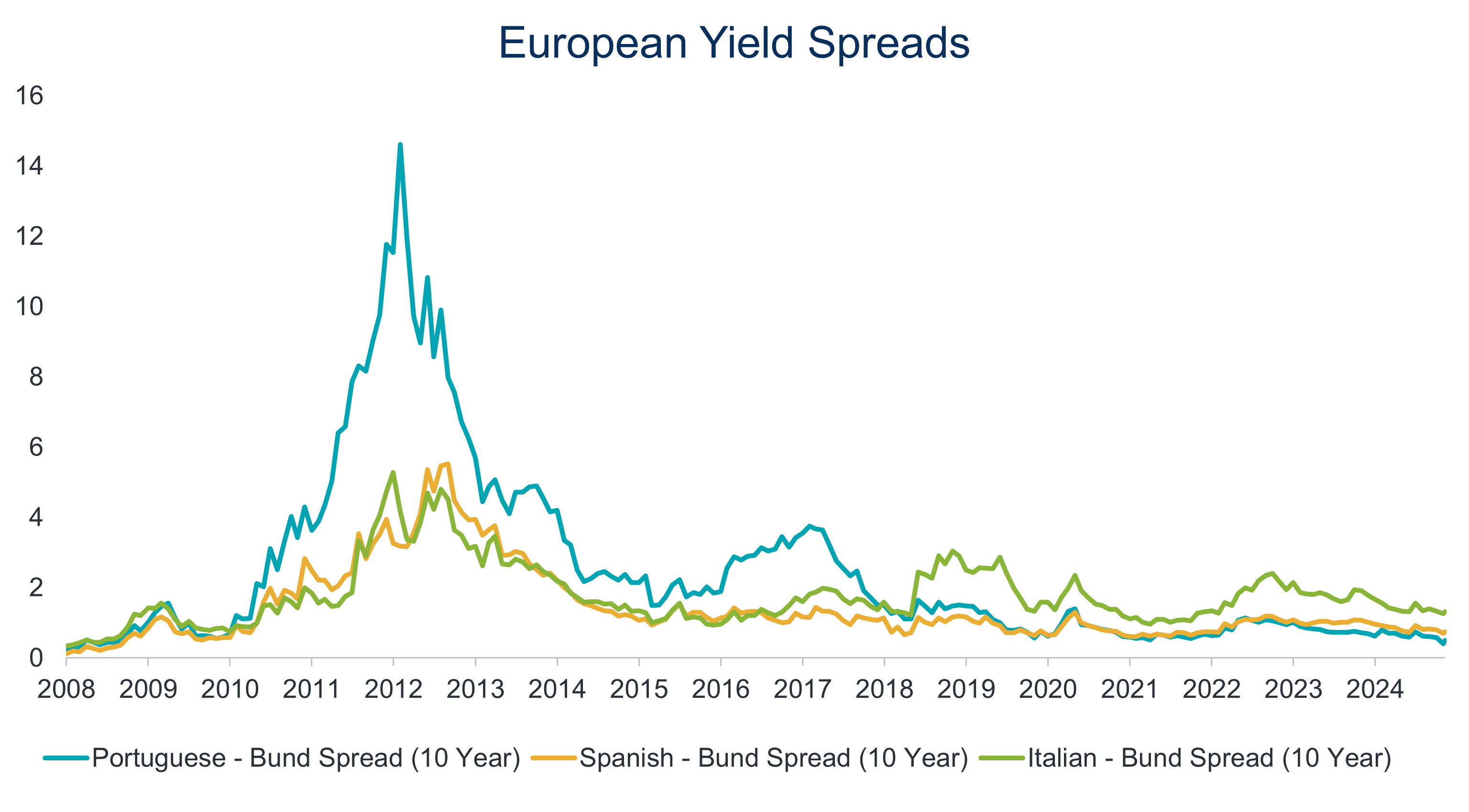

During the Eurozone crisis of 2009-2014, the term PIIGS, used to refer to five European countries: Portugal, Italy, Ireland, Greece and Spain, facing a severe economic crisis.

This crisis was caused by a range of factors. In Ireland and Greece, excessive debt accumulated with the advent of the Euro, in Italy lacklustre economic growth prevailed, while Portugal and Spain experienced a combination of these issues.

The number of countries under economic strain caused concern that the stability of the European Union could be affected. Ten years on, the PIIGS have gone from being un-investable to growing at a fast rate and attracting investor inflows, as sovereign spreads tighten compared to German bonds.

Source: Bloomberg, November 2024

On the other side of the ledge, Europe’s core (France and Germany) is struggling. In France’s case, unsustainable Government budget deficits and political upheaval have led to spreads widening.

Source: Bloomberg, November 2024

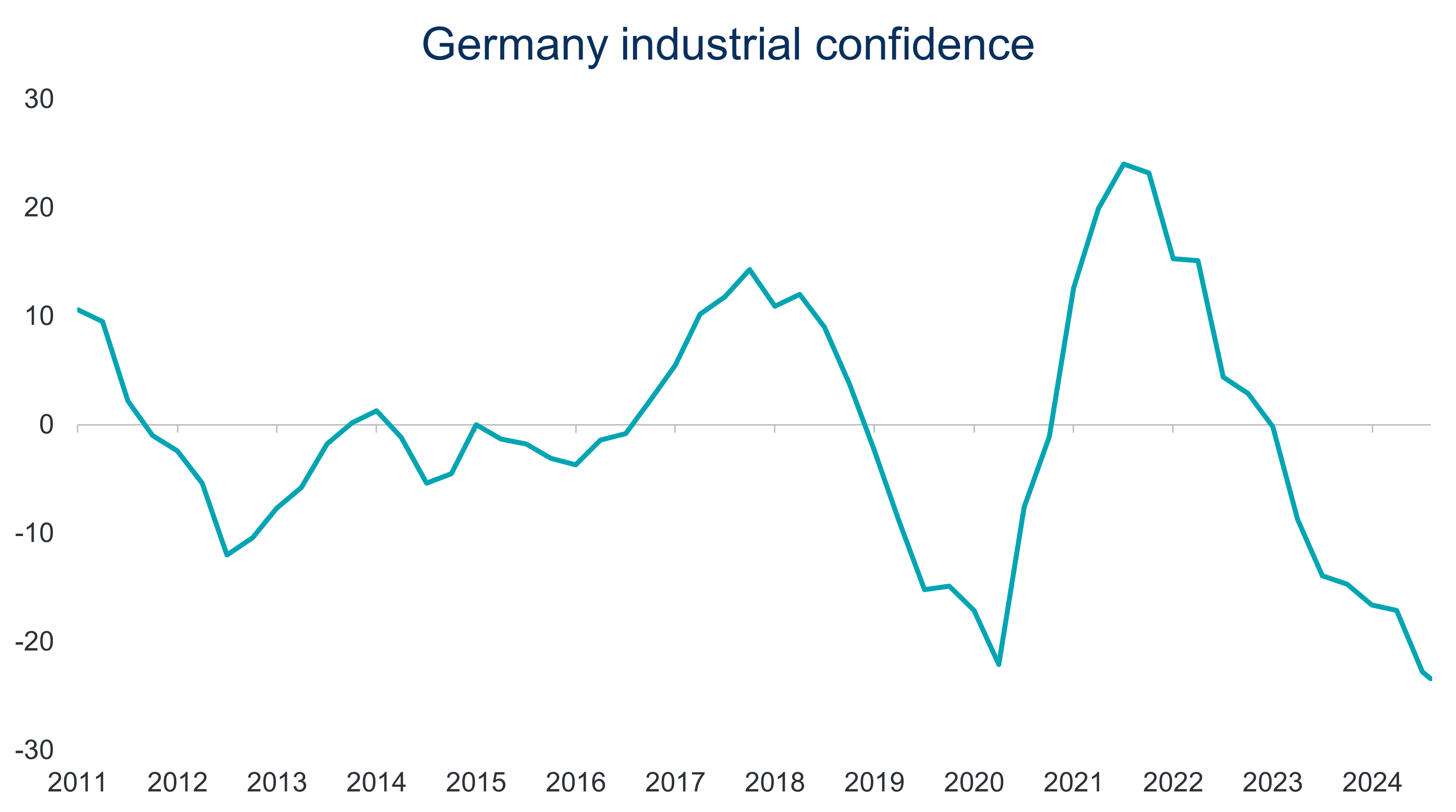

All is not rosy in Germany either. Manufacturing volumes have collapsed, and confidence has completely evaporated. The once industrial powerhouse continues to de-industrialise as both demand and supply has faced increased competition from China, alongside labour rigidity and higher energy costs as a result of the war in Ukraine.

Source: Bloomberg, November 2024

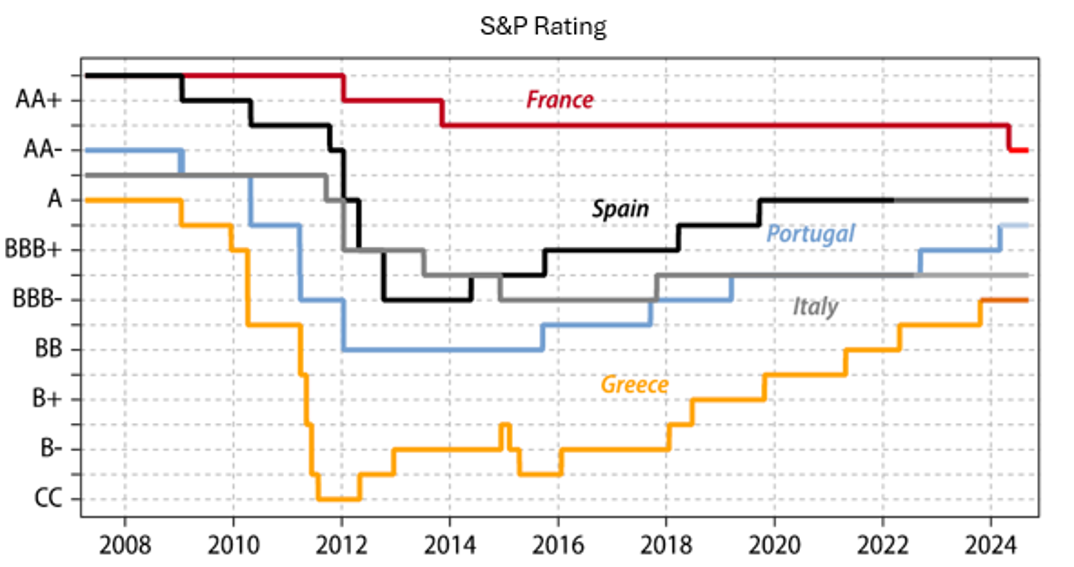

We see no reason why the PIIGS won’t continue to fly for the following reasons:

- Public finances are in poor health compared to the rest of the developed world. Since 2016, we have seen consistent ratings upgrades for the PIIGS, whereas France has gone the other way

Source: Gavekal Research, November 2024

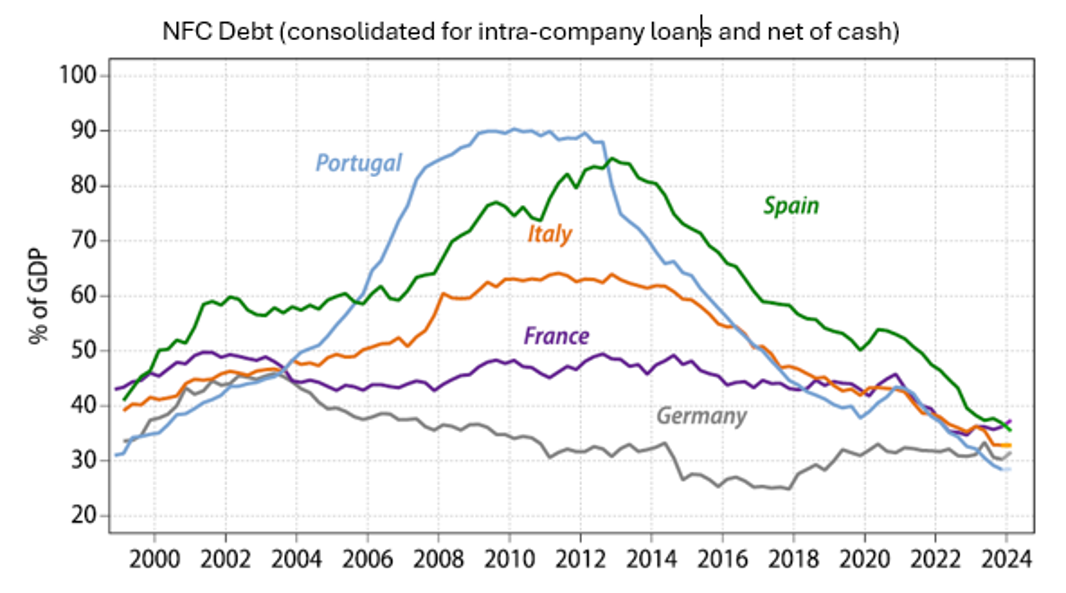

2. Deleveraging is now complete, balance sheets are clean and there is room to add leverage

Source: Gavekal Research, November 2024

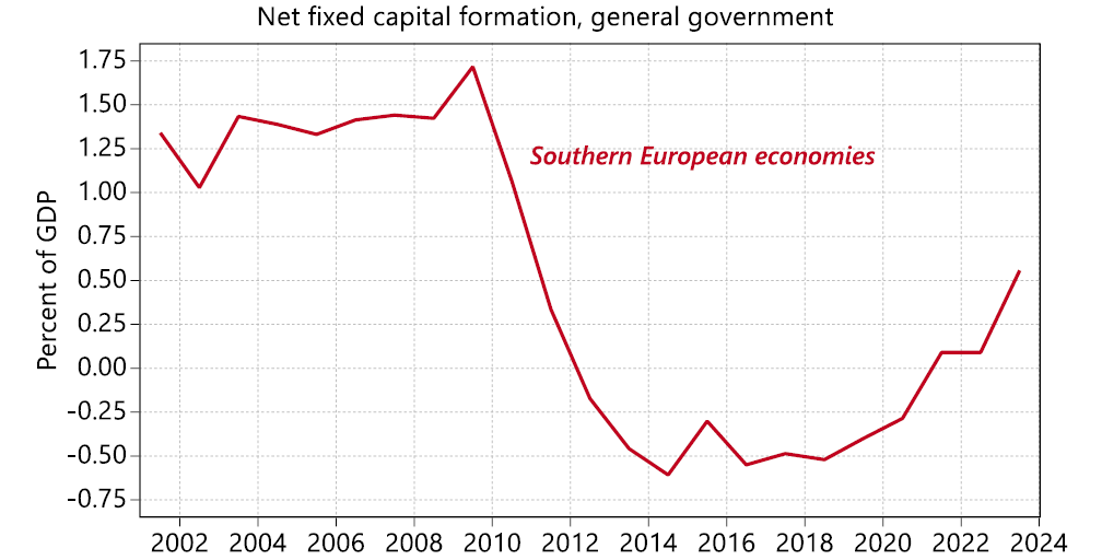

3. Much needed infrastructure is on its way

Source: Gavekal Research, November 2024

4. Valuations are reflecting the old heavily indebted PIIGS and not the new reality

In our view, we don’t expect these trends to reverse and we are increasingly optimistic on the outlook for the periphery.

Any views and opinions are those of the Fund Managers, this is not a personal recommendation and does not take into account whether any financial instrument referenced is suitable for any particular investor.

Capital at risk. If you invest in any Gresham House funds, you may lose some or all of the money you invest. The value of your investment may go down as well as up. This investment may be affected by changes in currency exchange rates. Past performance is not necessarily a guide to future performance.

The above disclaimer and limitations of liability are applicable to the fullest extent permitted by law, whether in Contract, Statute, Tort (including without limitation, negligence) or otherwise.

Gresham House

Specialist asset management

Gresham House

Specialist asset management