Monthly monitor - February 2022

Monthly monitor - February 2022

2022 is already proving to be a rude awakening for investors that believed the benign environment of 2021 was set to continue. As we outlined in our last monitor Is 2022 going to be the same as 2021?, we expected a change in market sentiment as central banks and the wider investment community realise we are in a more inflationary environment and interest rates will be on an upward trajectory.

This change caused pain in the equity market with falls of 4%, led by the Nasdaq, which fell 9%. Our equity funds held up, with the Appian Global Dividend Growth Fund rising 2.5%, although the Appian Global Smaller Companies Fund did suffer some weakness, falling in line with global markets. This change also negatively effected multi-asset funds as the value of bonds fell as well as equities. The Appian Multi Asset Fund really stood out against this negative backdrop, rising 0.9% during January 2022.

Global equity markets have suffered an horrific start to the year, initially falling 7%, before rallying in the last couple of days of the month to finish down 4%. The Nasdaq is the epicentre of the pain in equity markets. It initially fell 15% before the relief rally towards the end of the month brought its losses to 9% for the month. The malcontent throughout January was not limited to the equity market as bond investors also suffered. Bond yields rose in response to signs that inflation is set to be more persistent. Central banks react to the inflationary threat by laying out the path to higher interest rates.

Equity prices falling in conjunction with bond prices make this sell-off different to the previous sell-offs since the Global Financial Crisis. Equity market sell-offs, driven by poor economic data, have normally resulted in rising bond prices (falling bond yields).

This idea of negative correlation between equities and bonds is the cornerstone of the 60/40 portfolio. January 2022 has been a disaster for these types of portfolios. The Bloomberg 60/40 index lost 5.4% in January, reflecting a decline of 6.75% for large-cap equities and a loss of 2.1% for the Bloomberg U.S. Aggregate Bond Index.

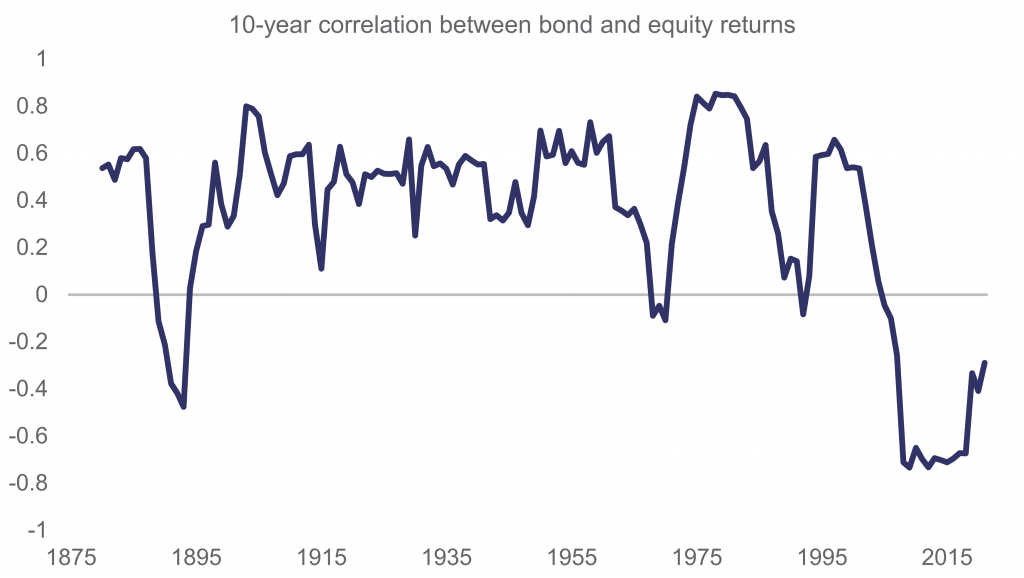

Our belief is that the 60/40 model is broken. The negative correlation between bonds and equities on which the strategy is predicated is a relatively new phenomenon. Over the longer term, equities and bonds have been positively correlated most of the time. We believe investors need a different approach to multi-asset investing.

A positive correlation between equities and bonds is not unusual

Source: MacroHistory, Datastream, 31 December 2021

Our multi-asset funds take a different approach and seek diversification through investing in assets such as Forestry, Infrastructure and Property as opposed to just Equities and Bonds, which have become highly correlated. In January, the Appian Multi Asset Fund was in positive territory, +0.9%, whilst the Appian Impact Fund was down 1.5%. The most relevant difference between the two, being the former’s exposure to Energy stocks which were the best performing sector over the month.

This type of market behaviour we have seen in January brings forward the question as to whether we are in a bear market. With central banks continuing to tighten and valuations high across equity and bond markets, the conditions are in place for a bear market across both asset classes. However, it doesn’t have to be a bear market for everyone.

The Mark Twain saying “History doesn’t repeat itself, but it often rhymes” comes to mind and when we look at the last major valuation crash in markets – the TMT crash of 2000. Over that period, value as a style did not suffer as the valuation unwind of the Nasdaq occurred. Large value companies didn’t even see their share prices wobble as the tech-laden Nasdaq crashed over 50%. Smaller cap value shares initially fell on fears that the tech collapse may spark an economic downturn. By the end of the year, they overcame these fears to finish in positive territory along with larger cap value stocks.

We are seeing similar behaviour today, as the Nasdaq corrects, the Appian Dividend Growth Fund is in positive territory for the year, +2.5% whilst the Appian Global Smaller Companies Fund has experienced some weakness, down 4.5%.

It doesn’t have to be a bear market for everyone

2000 was not a bear market for everyone – value investors did just fine

Source: Refinitiv Datastream, 1 March 2001

Is it different this time?

Is it fair to draw the parallels between the equity markets of today and the equity market of 1999 / 2000?

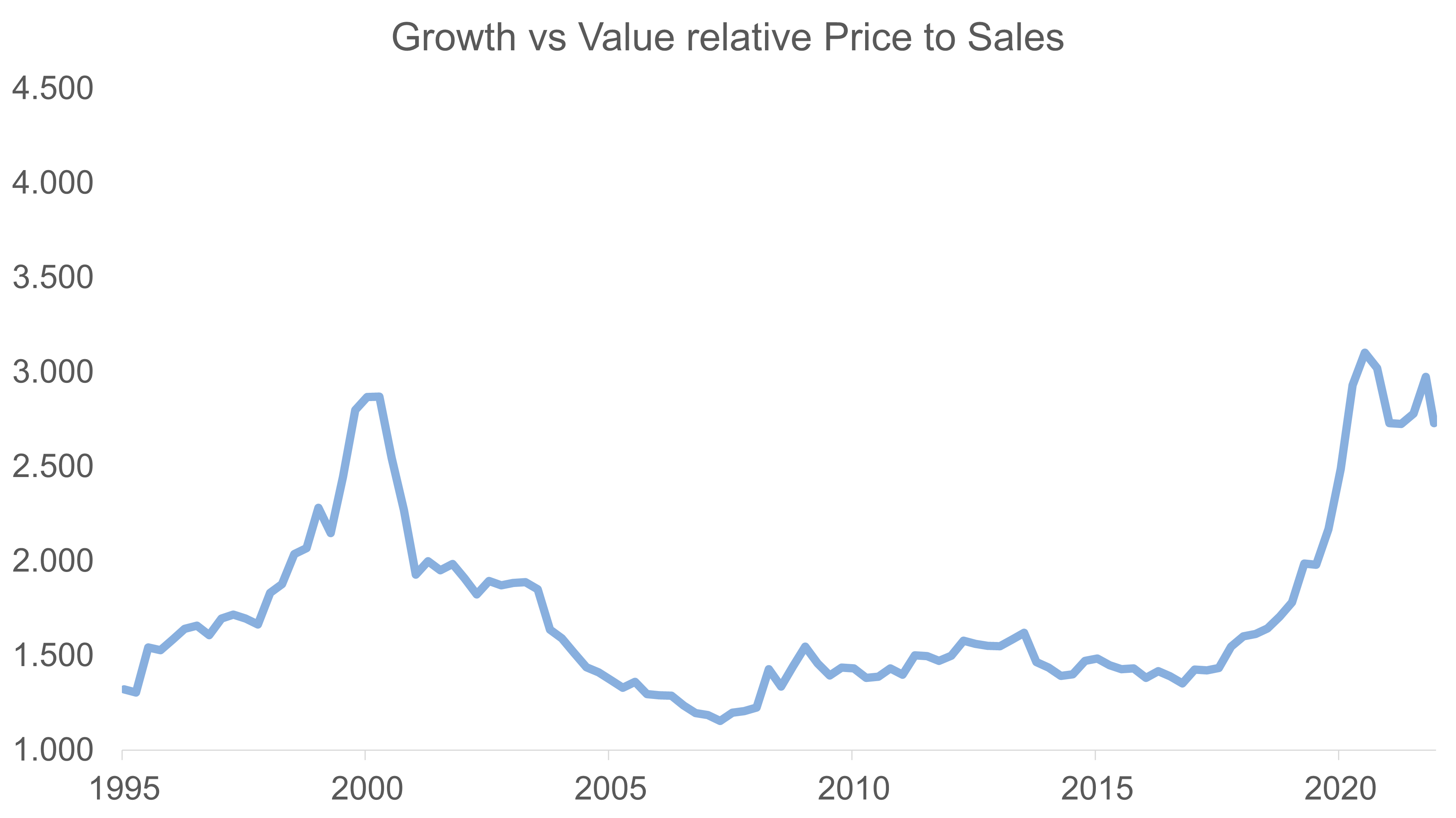

There are many differences, most notably that the headline growth stocks today are more profitable than the ones 20 years ago, but two similarities stick out. Firstly, the performance of growth stocks went parabolic in 1999 due to internet mania – the same occurred in 2020 / 2021 on the back of the low interest rate environment, induced by Covid.

Growth mania similar to 1999 / 2000

Source: Refinitiv Datastream, 31 January 2022

Valuation differentials between the 2 styles reached the 1999/2000 extremes in 2020.

Source: Gresham House Ireland, 1 February 2022

Source: Gresham House Ireland, 1 February 2022

The big difference this time versus 2000 is that the rush of money from investors into growth stocks has left the performance of value stocks significantly below their long-term trend line whilst growth stocks are trading well above their long-term trend line.

For mean reversion to occur, value stocks would need to rise circa 40% and growth stocks would need to fall circa 50%. This lends credence to the idea that this is not the start of a bear market but the beginning of a rotation from the parts of the market that have become expensive to the more sensible valued areas of the market.

The rotation may have begun already as the Appian equity funds have been out-performing broader equity markets since October 2020, when the discovery of vaccines marked the beginning of the end of the pandemic.

The set-up is for a rotation

Source: Gresham House Ireland, 28 January 2022

Whilst the first month of 2022 has been eventful, it hasn’t changed how we are approaching markets. We’re continuing to avoid fixed interest bonds and expensive stocks as these are at high risk of suffering a significant correction in the face of rising inflation and rising interest rates. Whilst recognising this risk to markets in general we continue to invest in assets we think can give positive returns, predominately solid equities with strong value characteristics and alternative assets that provide us with diversification, income yield and inflation protection.

Gresham House

Specialist asset management

Gresham House

Specialist asset management