January 2024

January 2024

We analyse every investment we make through a ‘survive then thrive’ framework. This involves looking at risk before potential reward.

When examining if a company is worthy of inclusion in our funds, we look at our three downside risks:

- valuation risk

- earnings power risk

- balance sheet risk

We then seek to eliminate, or mitigate them. Looking at US equity markets through this prism, we see that two of these three risks are currently flashing red.

Red flag one – Valuation risk

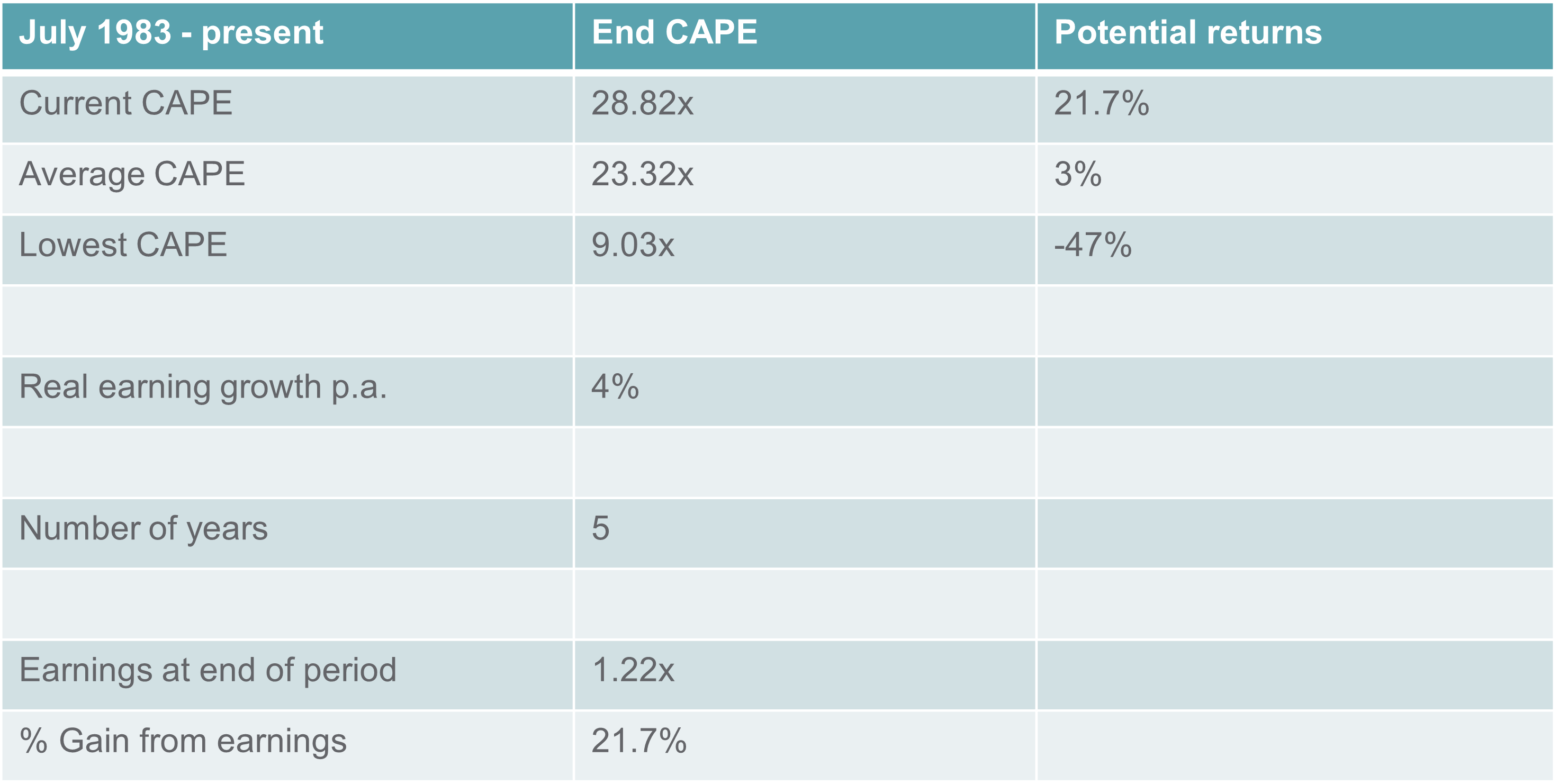

The US Market (Thomson DataStream) currently trades on a Cyclically Adjusted Price to Earnings (CAPE) Ratio of 28.83x.1 The average CAPE, back to 1983, is 23.3x. If we use Professor Robert Shiller’s very long-term data, the 150-year CAPE is 17.2x.

Over the last twenty years the increase in cyclically adjusted earnings has been 4% per annum, however dividends have not kept pace. Using Professor Robert Shiller’s data, the 150-year cyclically adjusted earnings growth is 2.2% per annum.

If we assume the period from 1983 is more reflective of the current situation, which is fair given the rise of intangible assets and improvements in Return on Capital Employed, we can make a realistic forecast for how we see the next five years.

In summary, the only way the US is going to generate acceptable returns is if valuations stay significantly above historic average levels, or if earnings grow at a much faster rate than they have done previously. These scenarios could happen but the lack of a margin of safety means it is a red flag on our framework.

1. The technology heavy indices are much higher

Source: Datastream, Gresham House, Ireland

Red flag two – Earnings power risk

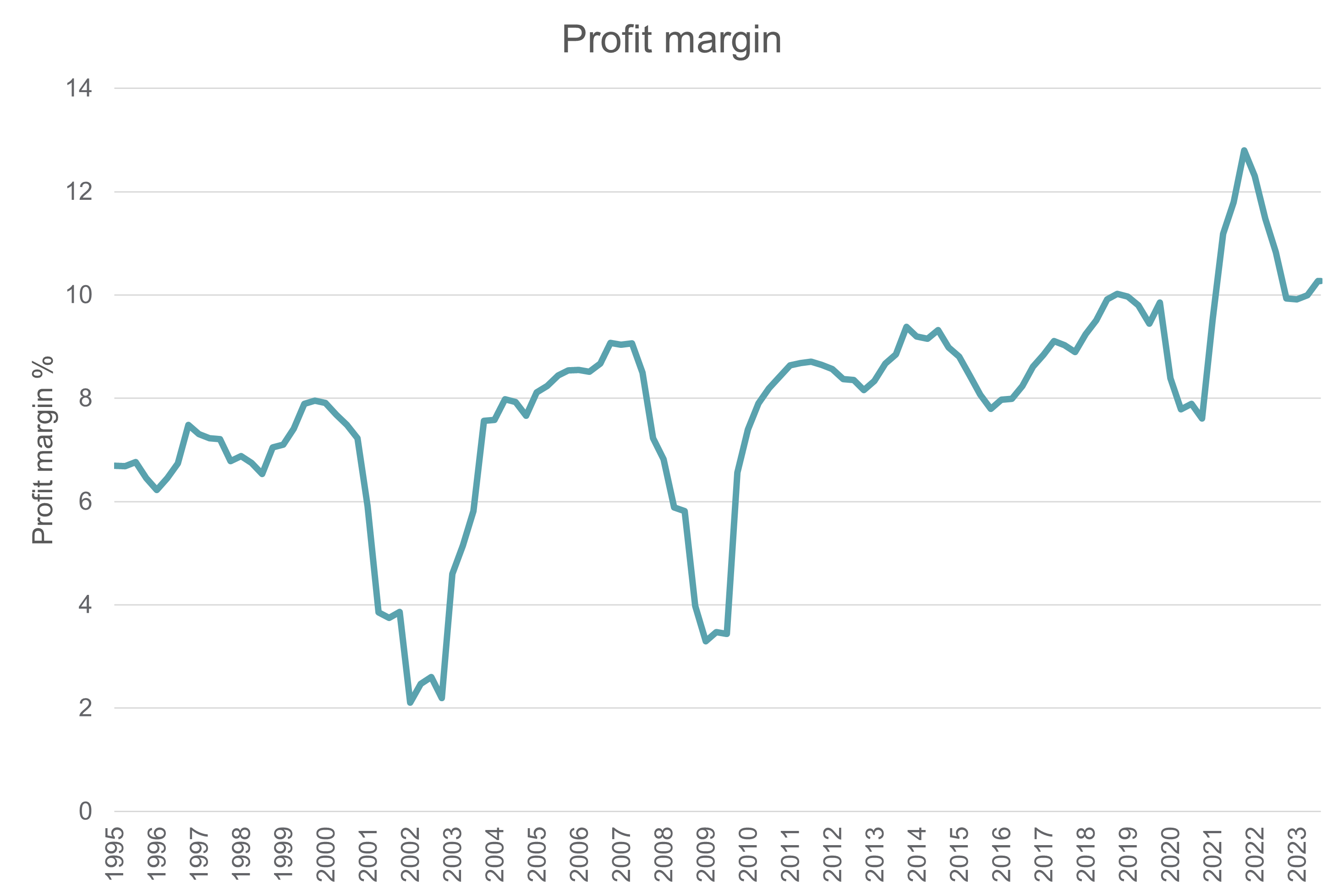

While US margins have come down, they remain elevated in a historic context. With financing costs increasing and wage growth running high we see potential margin vulnerability. Therefore we find it difficult to see margins expand in the current environment.

Source: Datastream, Gresham House, Ireland

Conclusion

To believe that US equities will provide a commensurate return over the next five years one has to believe that already high valuations will stay high, and that margins will stay elevated. History suggests that this is a risky premise. It is certainly not one that we are ready to accept.

Any views and opinions are those of the Fund Managers, this is not a personal recommendation and does not take into account whether any financial instrument referenced is suitable for any particular investor.

Capital at risk. If you invest in any Gresham House funds, you may lose some or all of the money you invest. The value of your investment may go down as well as up. This investment may be affected by changes in currency exchange rates. Past performance is not necessarily a guide to future performance.

The above disclaimer and limitations of liability are applicable to the fullest extent permitted by law, whether in Contract, Statute, Tort (including without limitation, negligence) or otherwise.

Gresham House

Specialist asset management

Gresham House

Specialist asset management