Monthly Monitor - August 2023

Monthly Monitor - August 2023

The consensus view of the investment world on the UK appears troubled.

The negative narrative in the UK is well-worn: Brexit, followed by political turmoil within the governing Tory party; a cost-of-living crisis due to high inflation; and steep rises in borrowing costs and mortgage repayments have been regular contenders for the headlines.

However, there are areas of positivity within the UK economy too.

It remains a wealthy country with a good infrastructure and education, employment levels remain high, wages are growing (somewhat mitigating the cost-of-living crisis), and it continues to offer a pro-business, entrepreneur-friendly environment.

Moreover, Brexit is done. It’s seven years since the referendum and the bulk of the adjustment process is complete.

There has also been a sea change on the political front. The next UK general election will be Sunak versus Starmer and not Johnson versus Corbyn. The debates will be more about policy and less about ideology – bread-and-butter issues rather than passion projects.

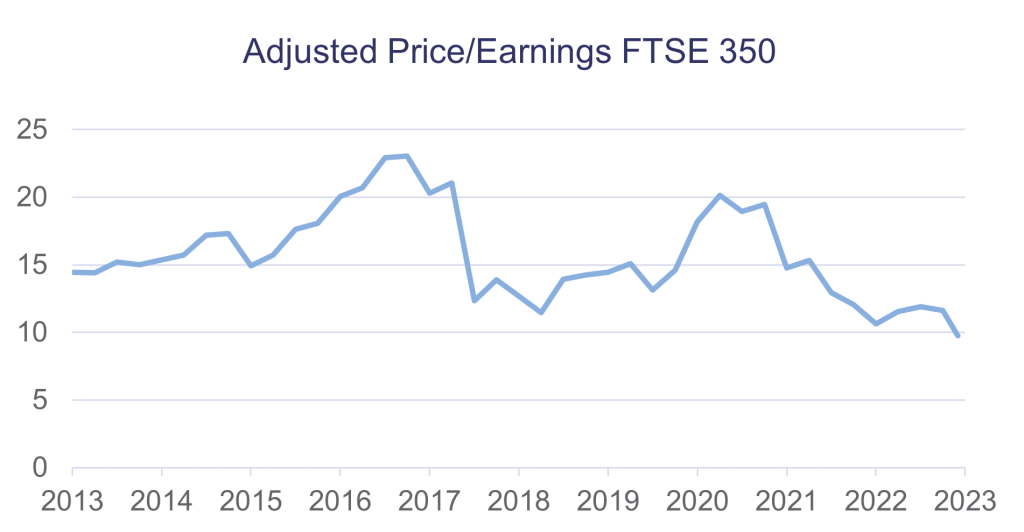

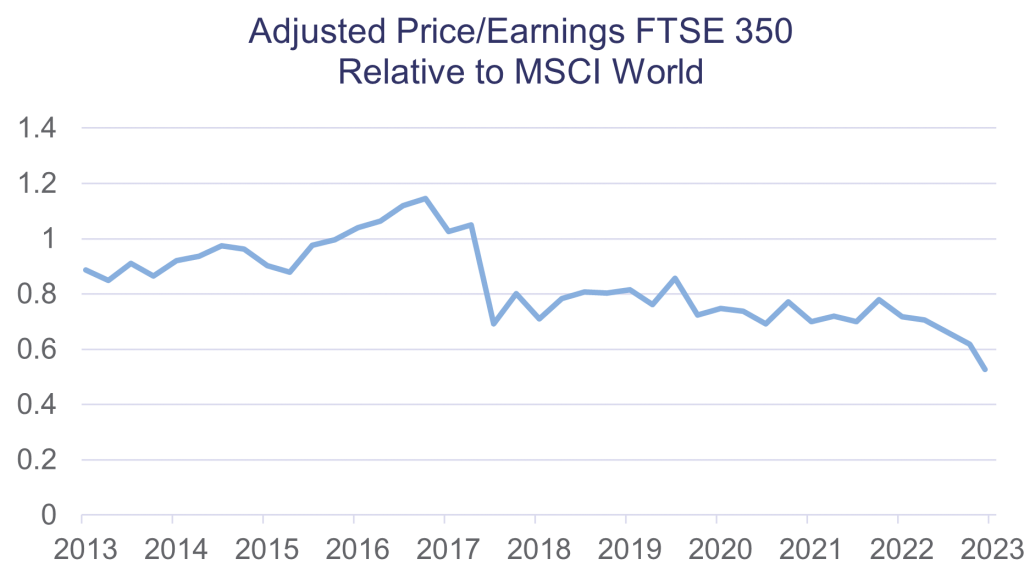

Yet investor expectations remain very low, despite UK equity valuations being at very attractive levels – both relative to their historic range and compared to global equities.

|

|

Data sourced from Bloomberg, August 2023

Among developed economies in this cycle, the UK has experienced one of the steepest increases in interest rates, which are expected to peak out higher than most peers and are projected to stay elevated for longer than most others.

This has fed recession concerns. But intuitively, fear of a steeper recession than elsewhere doesn’t seem consistent with forecasts of higher rates for longer. The implication is that stagflation has become the real concern.

While the rise in inflation in the UK has been amongst the steepest, the pace has been moderating in recent months but not as much as in other western economies, driving the hawkish interest rate expectations.

But there is a school of thought which argues that the moderation in UK inflation will be greater than expected due to: lower energy bills kicking in over the coming winter; easing inflation trends externally; easier prior year comparators starting to be lapped; and these factors in turn will reduce pressure on second order effects such as wage inflation.

If that school of thought is vindicated, then investor expectations on UK inflation and recession risk would be shown to have been overly pessimistic.

A key aspect to what might unfold in such a scenario is the starting point of low valuations combined with low expectations. When positive surprises meet with undervalued assets it is often a recipe for outsized returns.

Any views and opinions are those of the Fund Managers, this is not a personal recommendation and does not take into account whether any financial instrument referenced is suitable for any particular investor.

Capital at risk. If you invest in any Gresham House funds, you may lose some or all of the money you invest. The value of your investment may go down as well as up. This investment may be affected by changes in currency exchange rates. Past performance is not necessarily a guide to future performance.

The above disclaimer and limitations of liability are applicable to the fullest extent permitted by law, whether in Contract, Statute, Tort (including without limitation, negligence) or otherwise.

Gresham House

Specialist asset management

Gresham House

Specialist asset management