Monthly Monitor - April 2022

Monthly Monitor - April 2022

The investment story of 2022 so far has been rising bond yields, due to inflation returning with a vengeance. Inflation across the world is at levels not seen in 40 years and in response Central Banks are hiking interest rates.

However, bond yields are still running significantly below inflation rates, meaning there is considerable scope for them to rise further as the year progresses, if central bankers are serious about reining in inflation.

The most obvious implication of rising bond yields is falling bond prices and losses across bond portfolios have been quite stark, with the Bloomberg aggregate bond fund index falling 9.5% this year as of 19 April.

However, there are further implications for other asset classes. Numerous asset classes have seen their valuations rise due to low bond yields. Low bond yields translate into a low discount rate for valuing assets, which leads to higher valuations.

This is particularly true within the equity market, where many investors have adopted an investment strategy of buying companies that are perceived to be good quality, if the free cash flow yield on that security is above the 10-year bond yield.

This strategy relies on the idea that in a low bond yield world, there is no alternative to equities irrespective of valuations. We wonder if the concept of fundamental analysis of companies has gone out the window in large parts of the market over the last decade and what will happen when bond yields rise.

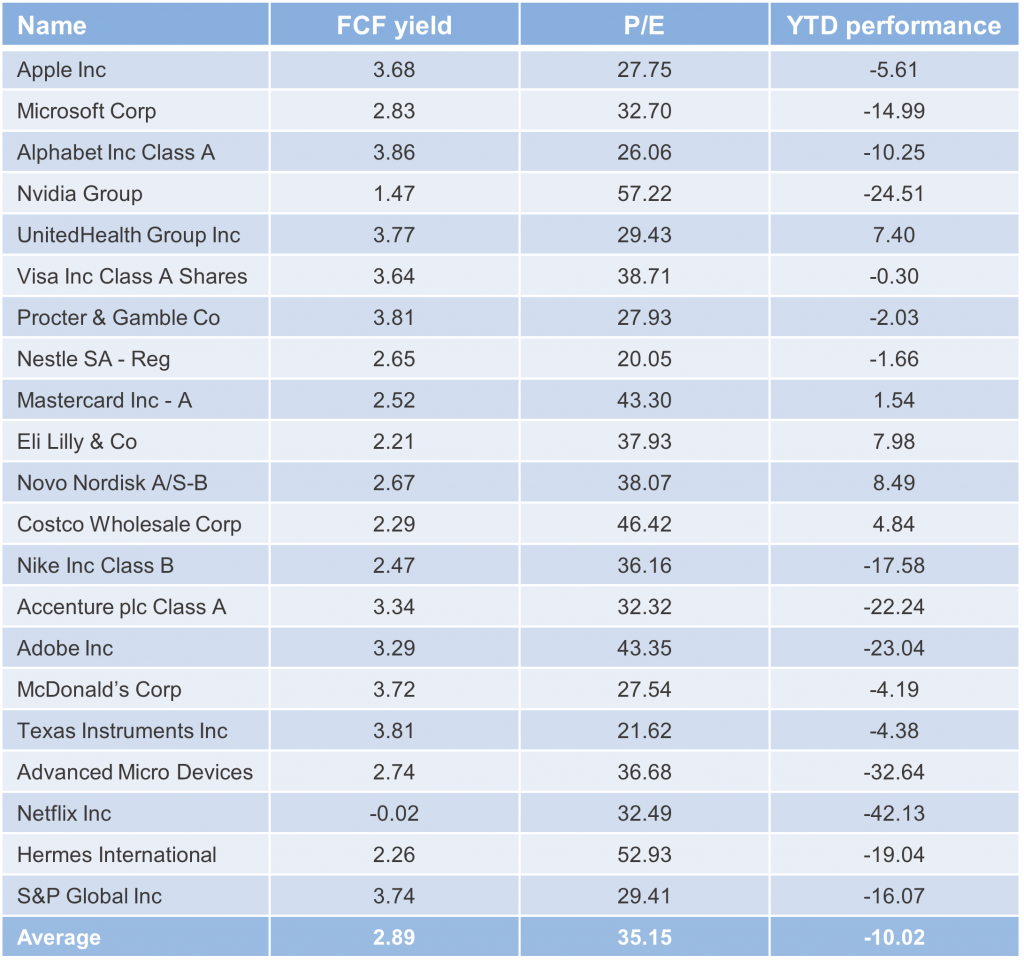

The largest stocks globally with Free Cash Flow (FCF) yields below 4% are listed in the table below along with their price to earnings ratio and their performance year to date.

We believe there is a considerable risk that this group of stocks will de-rate significantly in the face of higher bond yields.

With the average free cash flow yield of the group below the bond yield, investors will have to ask themselves if the fundamentals of the companies are strong enough to support the hefty valuations. We think the strength of the fundamentals of many of these companies is dubious. We are not surprised to see the average stock in this group down 10% this year.

We take comfort from the fact we do not own any of these equities across our portfolios. Not many can make this claim today.

Largest stocks globally with FCF yields below 4%

Source: Bloomberg, 20 April 2022

Gresham House

Specialist asset management

Gresham House

Specialist asset management