Peter Bolton - July 2023

Peter Bolton - July 2023

Collocation and net zero

As a market leader in battery energy storage systems1 (BESS) and a long-standing manager of renewable energy assets, we see huge potential in the ‘collocating’ of renewable generating assets with BESS assets to support the ‘net zero’ agenda.

What is collocation?

Collocation – sometimes referred to as ‘co-location’ – is broadly defined as two technologies sharing the same utility-scale grid connection point, often within the same site. Most commonly, solar generation is collocated with BESS, although the collocation of wind turbines and BESS is also possible. In the UK, there are currently seven operational collocated projects2.

Collocation to support net zero

Collocated projects are particularly important because both new renewable generation and new BESS capacity are essential to support the UK’s 2050 net zero targets3.

Renewable generation: renewable energy capacity needs to at least quadruple to meet net zero targets by 2050.4 This is linked to the need for low carbon generation and the expected increase in electricity demand from the transport and heating sectors. Rapid deployment is necessary to meet the UK Government’s ambition for all electricity to be generated from clean sources by 2035.5

BESS: Battery energy storage system development must keep pace with, or exceed, the rate of renewable roll-out.

GRIDSERVE’s York project (34.7MW solar, 30MWh collocated BESS). Photo credit: GRIDSERVE

BESS can prevent clean renewable generation from being wasted during periods of abundant supply, storing it for use when needed. Without this storage, the grid system may have to curtail intermittent generators such as solar and wind, favouring less clean baseload generators including gas.6 National Grid is looking for c.20GW of BESS by 2030 to support net zero7, representing over eight times current capacity.8

We are already observing extreme power price volatility partly driven by increased renewable generation, and BESS can profit from volatility, whilst also solving a market supply-demand issue.

The challenges of connecting to the UK grid system further highlight the importance of collocating renewables and BESS. Collocated projects sharing a grid connection point allow the grid to support more new infrastructure than would be possible under separate development, avoiding duplication.

This is a helpful tool to help alleviate pressure on the National Grid, as many market correspondents see grid connection issues as a potential bottleneck to reaching net zero. The Times9 reported that the UK is in “gridlock over its green growth” and that the queuing system for new projects is “not fit for purpose”. The Financial Times10 also recently highlighted constraints both in the physical grid infrastructure and staff availability to support new projects.

Sharing grid connections therefore makes most efficient use of available grid connections and provides two technology types both essential to support net zero objectives.

Operating model and revenue benefits

Collocated projects share a grid connection and this is feasible because the renewable asset and BESS would typically export power to the grid at different times of day (they rarely interfere with one another).

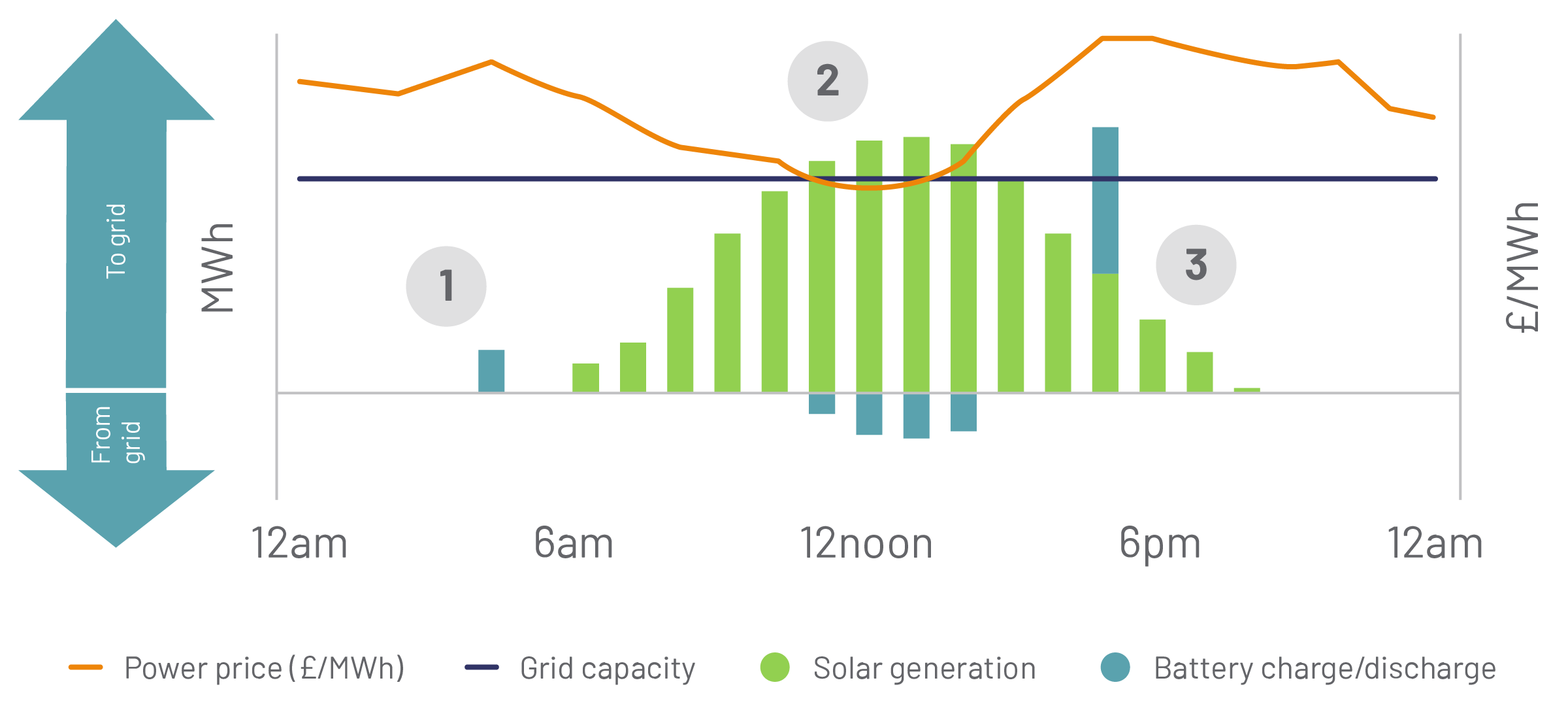

The illustration below demonstrates how solar and BESS can work together in harmony at a shared grid connection point, dispatching electricity “to grid” or importing “from grid” (in the case of the BESS) at different times over a 24-hour period.

The chart highlights that the power price (in £/MWh) varies over the 24-hour period. This is typical, with power pricing driven by a combination of available power supply and consumer demand.

The BESS will respond to these power price signals throughout the day. The following phases are identified within the chart:

1. BESS dispatches to the grid at a high-power price period before solar generation is available (not yet being daylight).

2. Solar dispatches to the grid during day, contributing to low power prices (linked to increased supply on the system). BESS charges during this low power price period. This could be from the grid, or (depending on site design) by using any solar generation which exceeds the grid capacity and would otherwise be wasted (or “spilled”).

3. BESS dispatches at a period of peak power price and high demand, as solar generation falls in the evening.

Figure 1: battery cycle and solar generation profile for a collocated project in the UK11

Market experts Modo Energy point out that solar generation is particularly attractive for collocation because it is “highly predictable based on location and time of year, with a daily cycle well suited to giving storage two opportunities a day to discharge”.12

Wind assets can also be collocated, depending on site-specific factors. On average, in 2022 UK onshore wind projects used approximately 30% of their grid connection capacity, which suggests that a collocated battery could theoretically operate for the remaining 70%. This “load factor” is higher for wind than for UK solar, which was c.10% in 202213.

Revenue benefits

Some of the obvious revenue benefits are:

- Larger revenues compared with a single-technology site

- Increased number of potential revenue streams (with various durations and predictability)

- Uncorrelated revenues, acting as a natural “hedge”, as BESS can pursue profit even if the renewable asset is achieving lower prices for its power sales

Revenues are captured through “route-to-market” offtake agreements. A reminder of the principal revenue streams for each component is shown below:

Renewable assets sell their power and associated “green certificates”14 (issued by Ofgem on behalf the Government) via a power purchase agreement (PPA). PPAs can be 1-15 years in duration;

BESS assets typically have optimisation contracts with expert trading entities, who will pursue various revenue streams associated with the charging and discharging of the battery. In the UK, this is increasingly expected to be focussed on energy trading via the wholesale market (arbitrage), though revenues can also be secured by offering several flexibility support services to the National Grid. Most of these revenue streams are on a short contract duration, with the exception of Government backed Capacity Market contracts of up to 15 years.

PPA counterparties are typically large utility, corporate or Government entities with good covenant strength.

Optimisation contracts can be agreed with many of the same utilities offering PPAs (e.g. Centrica, Statkraft, EDF) or with independent traders who look to partner with suppliers holding larger balance sheets.

Having the same counterparty delivering the renewable and BESS revenues can facilitate further efficiencies, such as the direct charging of the BESS from the adjacent renewable asset (depending on site configuration).

Collocation: cost savings

There are clear cost efficiencies of collocation, both during construction and operations. This supports an attractive economic case for collocation when combined with the revenue benefits.

Development and construction phase

Collocated projects benefit from sharing up-front costs between the renewable generator and the BESS.

This is important for the project’s development phase, reducing the cost per MW of capacity when making planning permission and grid connection applications.

Grid experts Power Systems point out that setting up a new site is a “long and often costly process” and that collocation can make this “both cheaper and faster”.15

When making payments to secure a grid connection, and to later install physical grid-related equipment at a site, the costs can also be shared between the two technologies. These costs are based on the project’s required capacity, not on how much power travels through it. Therefore, combining two technologies to more thoroughly utilise a connection doesn’t require additional cost.

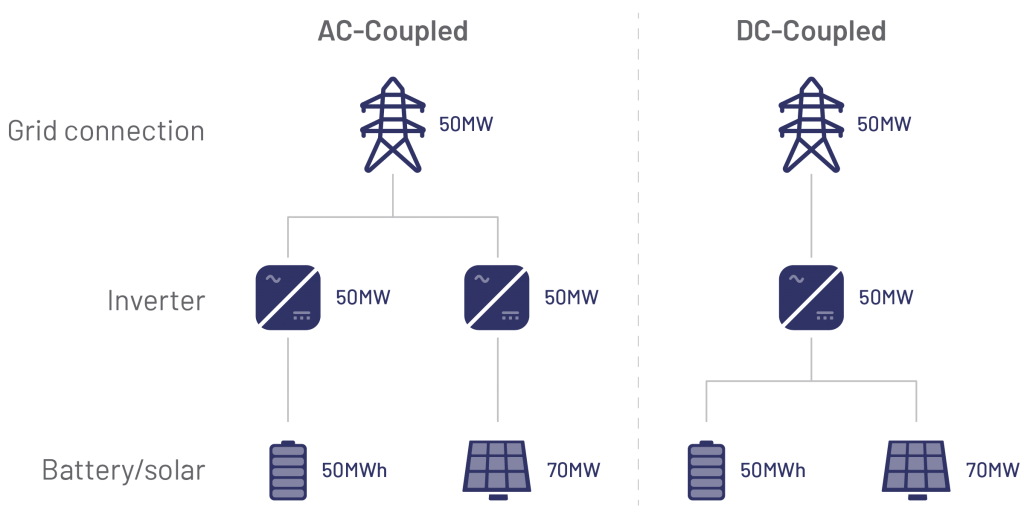

Finally, if designed in a particular way, collocated projects can reduce capital costs by minimising the physical equipment needed on the site. This is achieved by reducing the number of inverters required if the renewable and BESS elements can be ‘DC-coupled’ (i.e. they are connected “behind the meter” and before the inverter, without the Direct Current being converted into Alternating Current).

The majority of UK collocated projects operating today are ‘AC-coupled’, though ‘DC-coupling’ design is becoming more popular for future projects in development.

The diagram below shows the reduced number of inverters required for ‘DC-coupled’ design.

Figure 2: Illustration of the reduced inverter equipment required for a theoretical solar + BESS collocated site when DC-coupled16

Operational phase

Once operational, it is possible for collocated projects to pursue incremental cost efficiencies.

These efficiencies arise from the two technologies typically co-habiting the same site. Relative to standalone projects, this results in reduced lease costs negotiated with the landlord. There are also potential savings resulting from the operations and maintenance contractors combining their site visits and activities across the technologies, rather than duplicating efforts.

Collocation: pipeline and structuring for investors

The team at Gresham House are seeing an increasing number of collocated projects which lend themselves to a variety of investment structures.

Pipeline of potential projects

The collocation of BESS and renewables is relatively nascent, but becoming increasingly prevalent as asset owners optimise site design to pursue incremental revenue and cost efficiencies.

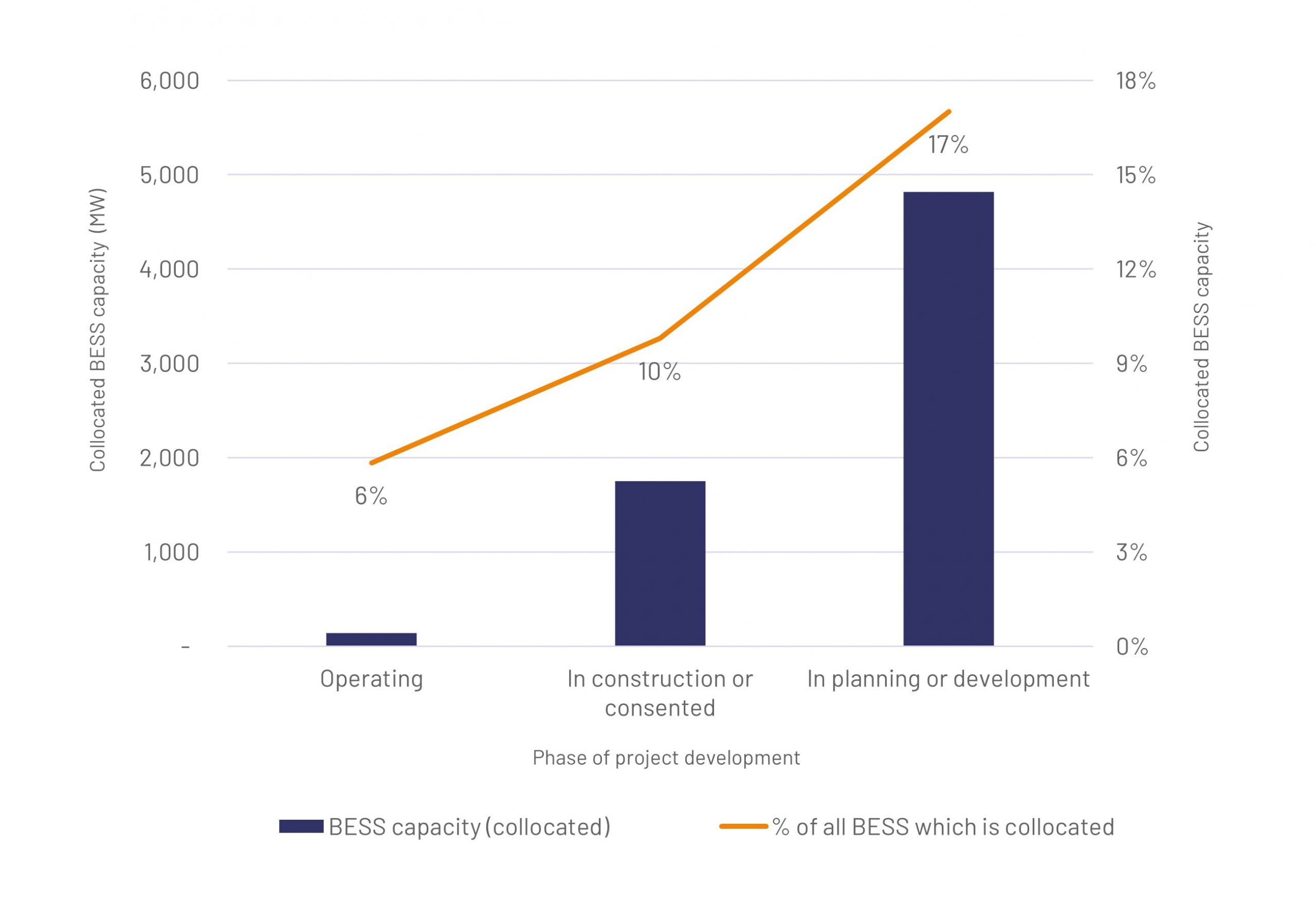

There are currently seven operational collocated projects in Great Britain, with a combined BESS capacity of c.140MW17. This represents c.6% of total current operating BESS capacity.18

The chart adjacent highlights that an increasing proportion of pre-operational UK BESS projects are expected to be collocated (from 6% of today’s operating capacity to up to 17% of BESS capacity currently in planning and development).

If all projects that are currently in planning or development are built out, they represent a c.35-fold increase in the BESS capacity which is collocated versus today’s operational collocated levels.

Figure 3: Proportion of BESS capacity which is collocated18

Structuring collocated projects for investors

It is possible to apply established contracting principles from the renewables and BESS sectors to reduce risk and enhance the attractiveness of collocated projects for investors.

From a construction and operations perspective, despite collocation projects being less common, it is possible to work with experienced contract counterparties under robust and “bankable” structures.

This is because both the renewable and BESS elements are well established technical solutions, with collocation not adding meaningful complexity. These contracts can offer guaranteed pricing and performance levels for the benefit of the investor, typically underpinned by parent company guarantees or other bank security.19

Collocated projects can be further de-risked by introducing long-term contracts to guarantee a proportion of their revenues.

This can be achieved in the following ways:20

- Power Purchase Agreement (PPA): can offer long-term (10-year plus) security of income by fixing a guaranteed price per MWh of power generated by the renewable element (with potential for inflation-linkage in some cases). For collocated projects, this represents the simplest of the revenue streams generated and can reassure investors and lenders who may not have otherwise financed standalone BESS projects (which can be seen as newer or more ‘merchant’ in nature)

- BESS optimisation floor: long-term (up to 10-year) minimum profit ‘floor’ guaranteed by the optimiser trading the BESS (£/MW capacity/ per annum). The optimiser will pursue revenues via both energy trading arbitrage and flexibility support services to the National Grid as mentioned previously. The asset owner and trader will share the financial benefit of overperformance above this “floor”

- Capacity market: 15-year contracted revenues for the BESS element available from National Grid (subject to auction). A relatively small proportion of total BESS revenues, but helpful in demonstrating cashflow certainty to equity investors and lenders

Conclusion

We are excited by the fact that collocated projects are becoming more common and popular among developers and investors.

There is a sizeable opportunity for investors to finance collocated projects in the UK. This paper highlights the benefit of collocated projects to support the transition to net zero, and their potential to deliver enhanced revenues whilst reducing costs.

In March 2023, Gresham House announced its venture into a new strategy which focuses heavily on collocated projects in the UK.

As investors in this space, Gresham House has acquired its first collocated project in England, planned to be 50MWp of solar capacity, with 75MWh of BESS.

Get in touch

Heather Fleming

Managing Director, Institutional Business

h.fleming@greshamhouse.com

Past performance is not a reliable indicator of future performance. Capital at risk.

References

1. Gresham House manages operating capacity of 0.59GW as at February 2023 (Gresham House Energy Storage Fund plc 2022 Annual Report) vs. 2.4GW of operating capacity in Great Britain as at March 2023 (Modo Energy, Battery energy storage buildout report, March 2023)

2. Renewable UK, EnergyPulse database, as at June 2023 (based on BESS capacity above 5MW connected to solar or wind projects) and Gresham House

3. UK Government gov.uk/government/news/uk-becomes-first-major-economy-to-pass-net-zero-emissions-law

4. Aurora Energy Research, net zero case according to the Aurora EOS Database, April 2023

5. UK Government gov.uk/government/news/plans-unveiled-to-decarbonise-uk-power-system-by-2035

6. Reports have suggested that National Grid spent as much as £215mn in 2022 to curtail wind generation according to Sky News, February 2023

7. National Grid, Future Energy Scenarios 2022, July 2022

8. 2.4GW according to Modo Energy, Battery Energy Storage Buildout Report, March 2023

9. The Times, How our power grid is choking UK green growth, March 2023

10. Financial Times, Renewables groups sound alarm over UK grid connection delays, February 2023

11. Aurora Energy Research, “It takes two: Opportunities for renewable co-located business models”, October 2022

12. Modo Energy, Co-location explained, 27 October 2022

13. Aurora Energy Research, GB Power & Renewable Market Forecast, April 2023

14. For example the Renewable Energy Guarantees of Origin (“REGO”), which acts to incentivise renewable generation

15. Power Systems UK

16. Modo Energy, Co-location of battery energy storage: AC/DC coupling, 08 November 2022

17. Renewable UK, EnergyPulse database, as at January 2023 (based on BESS capacity above 5MW connected to solar or wind projects) and Gresham House

18. 2.4GW according to Modo Energy, Battery Energy Storage Buildout Report, March 2023

19. For example bonding or letters of credit

20. Availability and pricing of contracted revenues is not guaranteed and is dependent on market conditions and later discussions with relevant suppliers

About the author

Peter Bolton Investment Director, Renewable Energy

Peter joined Gresham House in January 2021 and is responsible for the unsubsidised renewables and collocation strategy within our New Energy team. Peter has 15 years’ energy investment experience, having previously spent time at Foresight Group, Gazprom Marketing & Trading, and PwC’s Deals Strategy team.

Peter is passionate about the need for further renewable energy deployment and has a track-record working with developers on complex greenfield projects.

Gresham House

Specialist asset management

Gresham House

Specialist asset management