Outlining our sustainable investment commitments and achievements

Outlining our sustainable investment commitments and achievements

Gresham House is committed to operating responsibly and sustainably, building long-term value for clients

We strive to achieve the highest standards across all our operations and are committed to integrating responsible business practices.

Our purpose is to deliver effective and alternative investment solutions to help clients achieve their financial objectives whilst contributing towards the transition to a more sustainable economy.

What this means is that ESG is integrated as a consideration of our investment cycle, as well as in our day-to-day dealings as a business.

Key documents

Our aim is to become a recognised leader in sustainable investment by 2025.

To achieve this, we have implemented a Corporate Sustainability Strategy with targets related to Gresham House as a:

- Sustainable investor

- Sustainable business and employer

- Sustainable corporate citizen

This strategy ensures we take responsibility for our actions as an investor and custodian of our clients assets.

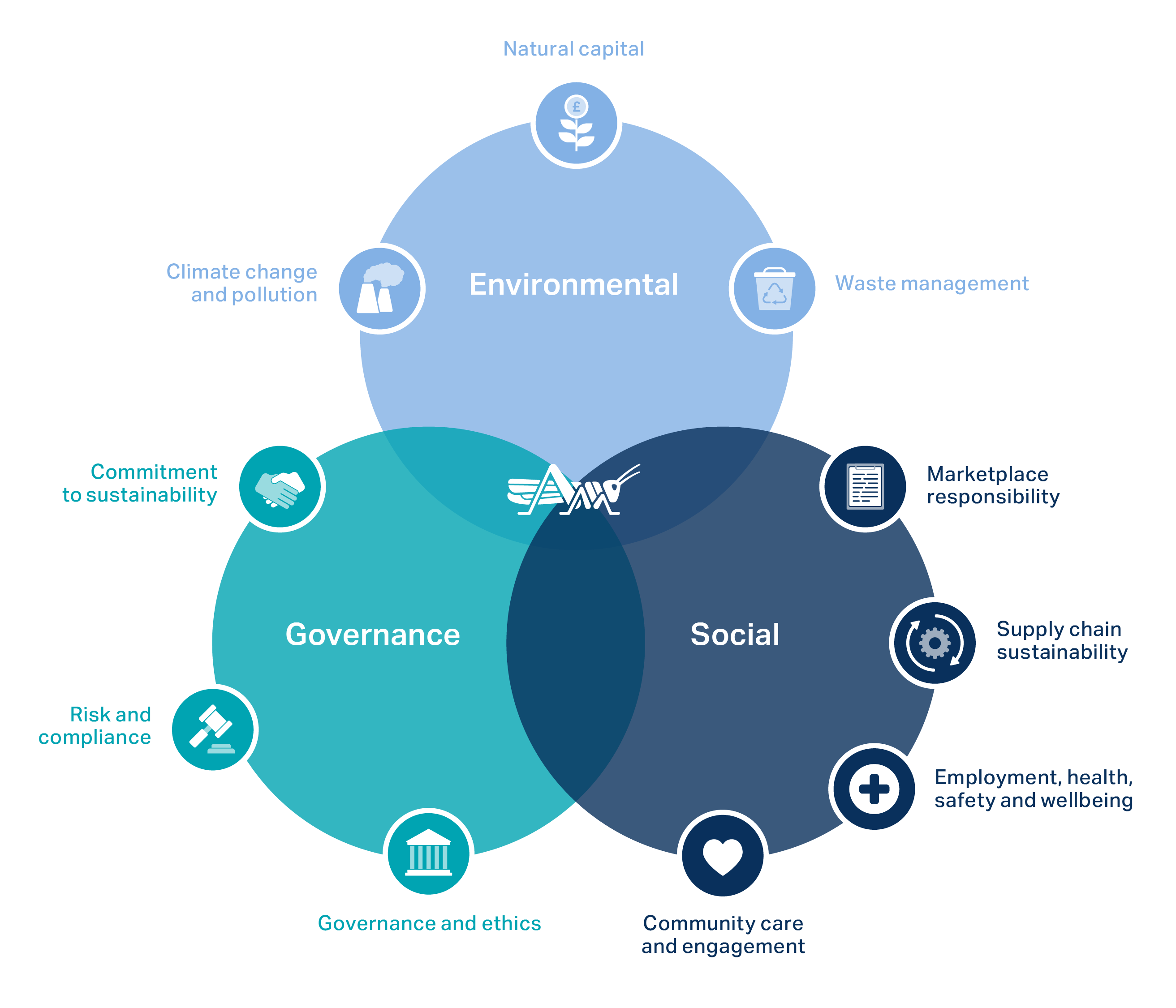

Sustainable investment framework

Our Sustainable Investment Framework is based on ten ESG themes.

These themes are considered to be the most material factors for our asset divisions.

Used by our investment teams, it identifies the broad range of ESG risks which may materially impact proposed transactions, as well as directing our focus towards more sustainable outcomes.

The ten ESG themes are used to structure analysis, monitor and report on ESG risks and opportunities within the lifecycle of our investments as an aid to more consistent integration across our asset divisions.

Why sustainable investment?

Asset management has a critical role to play in the world’s transition to a more sustainable economy and this creates compelling alternative investment opportunities.

Incorporating sustainability factors into investment decision-making protects value and drives resilience for all stakeholders.

Investors are increasingly seeking out opportunities with the potential for both financial and sustainability returns.

Sustainable Investment Report

We released our fifth annual Sustainable Investment Report in June 2025, where we detail how we remained committed to driving forward the sustainable investment agenda, alongside generating attractive financial returns for clients.

Read more

Task Force on Climate-related Financial Disclosures (TCFD) Report

We have prepared this report in line with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and the Transition Plan Taskforce (TPT), frameworks that help public companies more effectively disclose their climate-related risks and opportunities.

This report aims to provide our clients, shareholders and other key stakeholders with a better understanding of our exposure to climate-related risks and the climate-related opportunities that we are pursuing.

It outlines how we consider climate-related matters in our business operations, and how these map to the four TCFD thematic areas of Governance, Strategy, Risk Management and Metrics & Targets.

Read moreEngagement & voting

Gresham House is an active investor and acts as a long-term steward of the assets across our portfolio.

We believe that active ownership, including engagement and voting, are effective mechanisms designed to minimise risk and maximise returns.

Our engagement and voting activities are integrated into our business practices and investment processes. Both activities are viewed as a key part of our investment approach and not considered stand-alone objectives.

Engagement and voting policySignatories & support

We believe in playing an industry leadership role in supporting and promoting sustainable investment. This includes participating in a number of industry bodies and supporting sustainable initiatives.

We are a signatory to the UN-supported Principles of Responsible Investment and have aligned our sustainable investment commitments with them. We are a member of UKSIF and a signatory to the UK Stewardship Code. Gresham House Energy Storage Fund plc has also been awarded the LSE Green Economy Mark.

We support the ambitions of the Paris Agreement to manage the effects of climate change by limiting global temperature increases to well below 2˚C, preferably to 1.5˚C, compared to pre-industrial levels. We acknowledge the goals of this agreement and believe that many of our investments contribute positively to the transition to a low carbon economy.

We also support the recommendations of the Task Force on Climate-Related Disclosures (TCFD) for disclosing clear, comparable and consistent information about the risks and opportunities presented by climate change alongside existing financial disclosures. We will be working towards our own TCFD disclosures to provide our clients and investors with the required information to understand the climate risk and opportunities across our business operations and investment decisions.

The LSE Green Economy Mark has been awarded to Gresham House Energy Storage Fund plc.

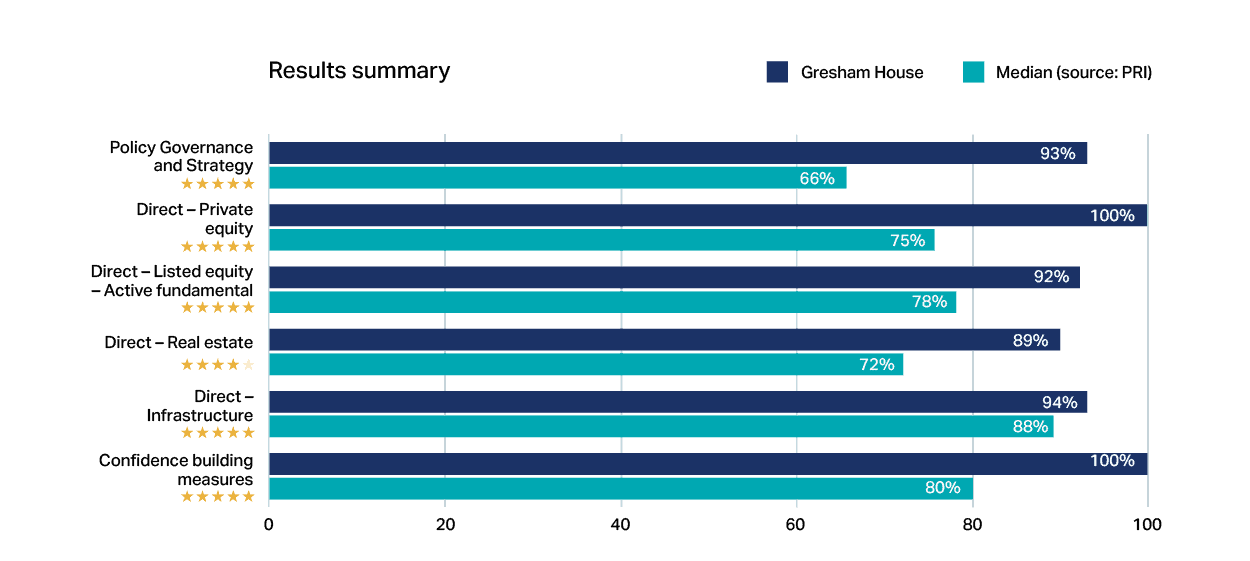

PRI

Gresham House has been a signatory to the UN-supported Principles for Responsible Investment (PRI) since February 2018.

For our 2024 PRI Report, we were awarded 4 or 5 stars, out of a maximum of 5 stars, for all modules relevant to Gresham House.

Source: Gresham House (collated from PRI report), November 2025

In line with the PRI publication guidance, please click the link to view our Assessment Report and Full Transparency Report.

Latest news

An inexhaustive list of terms and jargon you may encounter when looking into sustainable investing.

| Term | Definition |

| Article 9 fund | Under the EU Sustainable Finance Disclosure Regulation (SFDR), “Article 9” products have a sustainable investment objective, and ensure that none of the investments do significant harm to other environmental or social objectives at the same time. |

| Biodiversity credit | A transferable financial instrument used to finance actions that result in measurable positive outcomes for biodiversity (e.g. species, ecosystems, natural habitats) through the creation and sale of biodiversity units. Biodiversity credits are certified by governments or independent verification bodies. |

| Biodiversity net gain | An approach to development, land and marine management that leaves biodiversity in a measurably better state than before a development took place. |

| Carbon credit | A transferrable financial instrument (i.e. a derivative of an underlying commodity) certified by governments or independent certification bodies to represent an emission reduction that can then be bought or sold. United Nations UNFCCC |

| Carbon footprint | A measure of a group, individual or a company’s total greenhouse gas emissions, usually reported in carbon dioxide equivalent (CO2e) |

| Carbon offset | A carbon offset is a reduction or removal of emissions of carbon dioxide or other greenhouse gases made in order to compensate for emissions made elsewhere. World Resources Institute |

| Circular economy | A systematic approach to economic development with the goal of eliminating waste by focusing on a regenerative design and attempting to promote growth while reducing consumption of finite resources. |

| Decarbonisation | The term used for removal or reduction of carbon dioxide (CO2) output into the atmosphere. Decarbonisation is achieved by switching to usage of low carbon energy sources or through transitioning to alternative products or production methods that do not emit carbon into the atmosphere. |

| Diversity, equity and inclusion (DEI) | Diversity refers to the differences people may have in terms of their gender, age, race, sexual orientation, disability, religion, beliefs or other characteristics. Equity is the act of ensuring that processes and programs are impartial, fair and provide equal possible outcomes for every individual. Inclusion is about welcoming and celebrating diversity, calling out inequality and ensuring people feeling valued and respected. |

| Emissions trading scheme (ETS) | Emissions trading, also known as ‘cap and trade’, is a cost-effective way of reducing greenhouse gas emissions. To incentivise firms to reduce their emissions, a government sets a cap on the maximum level of emissions and creates permits, or allowances, for each unit of emissions allowed under the cap. Emitting firms must obtain and surrender a permit for each unit of their emissions. They can obtain permits from the government or through trading with other firms. The government may choose to give the permits away for free or to auction them. |

| Engagement | A purposeful dialogue between a company and its shareholders that aims to enhance and protect the value of investments. This might take place to encourage improvements in performance and processes, including ESG related activities, or to encourage change in strategy, board members etc. |

| ESG | Environmental, Social and Governance. Three key factors required to measure and evaluate the sustainable impact of an organisation. The integration of ESG factors is used to enhance traditional financial analysis by identifying potential risks and opportunities beyond technical valuations. |

| Greenhouse gas emissions (GHG) | The gaseous by-products of a company’s operations and industrial processes that are considered to be the principle cause of global warming. GHG emissions include carbon dioxide, methane, nitrous oxide, and fluorinated gases (F gases). |

| Greenwashing | The gaseous by-products of a company’s operations and industrial processes that are considered to be the principle cause of global warming. GHG emissions include carbon dioxide, methane, nitrous oxide, and fluorinated gases (F gases). |

| Habitat bank | Conservation or restoration initiative where natural habitats are preserved, restored, or created to offset or compensate for the negative environmental impacts of development or other human activities. |

| Impact investing | Investments that are made with the primary goal of achieving specific, positive social and/or environmental benefits while also delivering a financial return. Impact investments create a direct link between portfolio investment and socially/environmentally beneficial activities. Historically most impact investing has occurred in unlisted markets. |

| Just transition | While the shift to a low carbon economy will likely boost prosperity and create jobs, there will be transitional challenges (particularly social ones), which responsible investors can help to address. A ‘just transition’ means moving to a more sustainable economy in a way that is fair to everyone – including people working in polluting industries. |

| Materiality | A measure of the importance of specific ESG topics and information for a particular sector, asset or company. The greater effect an ESG factor can have on the success of a sector, asset or company, the more material it is, and vice versa. |

| Modern slavery | The exploitation of people who are coerced into an activity by someone who “controls” them, often with violence. It can take many forms including forced or bonded labour, early or forced marriage or human and organ trafficking. |

| Natural capital | The stock of renewable and non-renewable natural resources that combine to yield a flow of benefits to people. It includes soil, air, water, and all living things, which can be categorised into four core ecosystem services (see definition of Ecosystem services for more detail). Natural Capital Protocol |

| Natural forest | A forest that is a natural ecosystem, possessing many or most of the characteristics of a forest native to the given site, including species composition, structure, and ecological function. Accountability Framework initiative |

| Nature-based solutions | Actions to protect, sustainably manage and restore natural or modified ecosystems that address societal challenges effectively and adaptively, simultaneously providing human well-being and biodiversity benefits. IUCN (2020) The IUCN Global Standard for Nature-based Solutions |

| Net zero emissions | Occurs when a country, region, company, other entity, or even the world, has reduced greenhouse gas emissions to the maximum possible level so that the residual emissions can be neutralised by carbon removal. |

| Pensions for Purpose | A collaborative initiative that exists as a bridge between asset managers, pension funds and their professional advisers to encourage the flow of capital towards impact investment. |

| Principles for Responsible Investment (PRI) | A United Nations-supported international network of investors which aims to understand the implications of sustainability for investors and support signatories to facilitate incorporating these issues into their investment decision-making and ownership practices. |

| Responsible investing | An investment approach that considers ESG factors as part of risk analysis and may involve excluding some harmful products. It includes engagement and voting in order to protect long-term value. |

| Science-Based Targets Initiative (SBTi) | The SBTi is an organisation that defines and promotes best practices in emissions reductions and net-zero targets for corporates in line with climate science. It also provides target setting methods and guidance to companies to set science-based targets in line with the latest climate science. |

| Spectrum of Capital | A Gresham House approach to defining how we think about the extent to which sustainability risks and outcomes are integrated into our investment strategies. The spectrum of capital ranges from ‘Traditional’ (focused on financial returns) to ‘Philanthropy’ (focused on only non-financial returns, to the extent that investors accept full loss of capital). |

| Stewardship codes | A set of standards that help set stewardship expectations for asset managers and asset owners. These codes are established by local regulators on a country by country basis. In the UK there is the 2020 Stewardship Code. |

| Sustainability Disclosure Regulation (SDR) | Designed to ensure that sustainability information flows into the real economy in order to empower investors and consumers to make financial decisions which align with their values. It is intended to provide disclosure requirements at product (fund) and investee company (corporate) level. |

| Sustainability Risk | An environmental, social or governance event or condition that, if it occurs, could cause an actual or a potential material negative impact on the value of the investment. |

| Sustainable Finance Disclosure Regulation (SFDR) | A set of EU rules which aim to make the sustainability profile of funds more comparable and better understood by end-investors. This will focus on pre-defined metrics for assessing the environmental, social and governance (ESG) outcomes of the investment process. As its name suggests, emphasis is placed on disclosure, including new rules that must identify any harmful impact made by the investee companies. |

| Sustainable investing | ESG factors are considered as part of risk analysis and are used to identify investment opportunities aligned with environmental or social themes or sustainability outcomes, without compromising on market returns.Sustainable investments may include targeted engagement and voting in order to protect long-term value and to meet sustainability criteria. |

| Task Force on Climate-related Financial Disclosures (TCFD) | Provides recommendations for more effective climate-related disclosures that promote more informed investment, credit, and insurance underwriting decisions, which in turn would enable stakeholders to understand better the concentrations of carbon-related assets in the financial sector and the financial system’s exposures to climate-related risks. It is categorised into four sections: 1. Governance – The organization’s governance around climate-related risks and opportunities 2. Strategy – The actual and potential impacts of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning 3. Risk Management – The processes used by the organization to identify, assess, and manage climate-related risks 4. Metrics and Targets – The metrics and targets used to assess and manage relevant climate-related risks and opportunities. |

| Taskforce for Nature-related Financial Disclosures (TNFD) | Market-led, science-based and government-endorsed taskforce. It aims to develop and deliver a risk management and disclosure framework for organisations to report and act on evolving nature-related risks, with the ultimate aim of supporting a shift in global financial flows away from nature-negative outcomes and toward nature-positive outcomes. It is aligned to the TCFD’s strucutre using four categories: Governance, Strategy, Risk Management and Metrics & Targets. |

| UN Sustainable Development Goals (SDG) | Collection of 17 interlinked global goals designed to be a “blueprint to achieve a better and more sustainable future for all”. The SDGs were set up in 2015 by the United Nations General Assembly as a list of actionable goals intended to be achieved by governments globally by 2030. Each goal includes underlying sub-targets and indicators to track progress towards achieving them. |

| Voting rights | Equity investors typically have the right to vote at annual and extraordinary general meetings (AGMs and EGMs) on issues such as an individual director’s appointment, remuneration or mergers and acquisitions (depending on a country’s legal framework). |

View the full glossary

Gresham House

Specialist asset management

Gresham House

Specialist asset management