The European Union’s Sustainable Finance Disclosure Regulation (SFDR) has come into force requiring, amongst other things, asset managers to make certain sustainability-related disclosures on their websites with respect to in-scope products.

Gresham House Asset Management Limited

Below are links to the website disclosures of all in-scope products under the management of Gresham House Asset Management Limited. Note that the website disclosures of one in-scope product will differ from those of another in-scope product.

Publication date: 23 December 2022

No consideration of adverse impacts of investment decisions on sustainability factors

Adverse impacts of investment decisions on sustainability factors are not considered by Gresham House (the Manager) and the Manager does not intend to consider adverse impacts for its investment strategies as it is not required to do so under the SFDR Article 4.

At product level, the Portfolio Manager has elected to exercise its discretion under Article 4(1)(b) of SFDR not to commit to considering the adverse impacts of investment decisions of the financial products on sustainability factors in the manner specifically contemplated by Article 4(1)(a) of the SFDR but will continue to consider and manage these impacts in line with its Sustainable Investment Policy.

Important notice

The website disclosures (the “Disclosures”) are being made pursuant to Articles 4(1) and 10(1) of Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector (as amended) (“SFDR”) in respect of the Irish Strategic Forestry Fund (the “Partnership”).

The Disclosures do not constitute (a) an offer of securities or interests, (b) an offer or invitation to the public, or (c) an invitation to apply for securities or interests. The Disclosures are being made to enable Gresham House Asset Management Limited, in its capacity as portfolio manager of the Partnership (the “Portfolio Manager”) to comply with its obligations under applicable law.

Sustainability-related disclosures

Publication date: 23 December 2022

Summary

The Partnership invests in a diversified portfolio of forestry assets which includes bare land for productive woodland creation, mid-rotation forestry and mature forestry plantations.

All planting land and existing forests acquired by the Partnership will be managed by Coillte and will either be: (i) land and/or forests that is/are certified under the FSC® (Forest Stewardship Council®) or PEFC® (Programme for the Endorsement of Forest Certification®) and will continue to be independently certified as 100% sustainable pursuant to the relevant certification during the period that the Partnership owns it/them; or (ii) newly acquired land and/or forests which is/are not yet certified under the FSC® or PEFC® but which will be managed with a view to ensuring that they will achieve such certification within a reasonable timeframe of being purchased by the Partnership.

This financial product promotes environmental or social characteristics but does not have as its objective a sustainable investment.

At least 97% of the Partnership’s NAV (including, for the avoidance of doubt, such development capital allocated to land and forestry investment as may temporarily be held from time to time) is aligned with the environmental and/or social characteristics of the Partnership.

The Partnership does not commit to making sustainable investments within the meaning of SFDR.

The sustainability indicators used to measure the attainment of the environmental or social characteristics promoted by the Partnership are:

(i) continued FSC® or PEFC® certification of planting land and/or existing forests which are already so-certified at the time of their acquisition by the Partnership; and

(ii) attainment of FSC® or PEFC® certification of such planting land and/or existing forests as are not at the time of being acquired by the Partnership so-certified, within a reasonable timeframe of being purchased by the Partnership.

Certification will be assessed by third party auditors on a regular basis as well as by the Portfolio Manager on an ad hoc basis. Both the FSC® and PEFC® have well-established and internationally recognised pre-defined criteria. The criteria and methodology can be found on the following websites:

- FSC® – fsc.org/en/fsc-standards

- PEFC® – pefc.ie

Data is collated by the Portfolio Manager from a variety of sources including woodland managers, third-party consultants, public databases. Data will be checked by various members of the Portfolio Manager’s Investment and Asset Management team.

A survey is sent to woodland managers annually for receipt of forest data include sustainability-related data. The data is dependent on the disclosure of accurate and relevant data and information by the woodland managers. The Portfolio Manager will work closely with woodland managers to monitor data received and to support in collation and measurement of required data.

Given the scale of forests under management as well as challenges in measuring certain data relevant to the attainment of FSC® or PEFC® certification (for example in relation to biodiversity and carbon sequestration), assumptions are made to ensure that data collation and measurement is done in a way that is appropriate to the Partnership’s mandate and objectives. All data is calculated using science-based and reputed approaches however these often apply estimates and assumptions to account for the scale of the forests in which the Partnership is invested.

In addition to internal audits and independent audits by relevant certification bodies, the Portfolio Manager has a dedicated Sustainable Investment Team that will also carry out annual auditing of ESG processes to ensure they meet the sustainability-related commitments of the Partnership.

The Partnership will engage with relevant stakeholders (including suppliers and local communities) as necessary, in order to ensure that FSC® or PEFC® certification of planting land and/or existing forests invested in by the Partnership is achieved and/or retained. The Portfolio Manager may also engage with relevant regulatory, industry or government entities with regard to certain aspects of sustainable forest management.

No sustainable investment objective

This financial product promotes environmental or social characteristics but does not have as its objective sustainable investment.

Environmental or social characteristics of the financial product

All planting land and existing forests acquired by the Partnership will be managed by Coillte and will either be:

(i) land and/or forests that is/are certified under the FSC® (Forest Stewardship Council®) or PEFC® (Programme for the Endorsement of Forest Certification®) and will continue to be independently certified as 100% sustainable pursuant to the relevant certification during the period that the Partnership owns it/them; or

(ii) newly acquired land and/or forests which is/are not yet certified under the FSC® or PEFC® but which will be managed with a view to ensuring that they will achieve such certification within a reasonable timeframe of being purchased by the Partnership.

Investment strategy

The Partnership invests in a diversified portfolio of forestry assets which includes bare land for productive woodland creation, mid-rotation forestry and mature forestry plantations.

All forests acquired or created will ultimately be certified and managed to international forestry management standards (FSC® or PEFC®) to ensure that the forests are managed in accordance with strict standards (incorporating prescribed social, economic and environmental criteria). All assets acquired by the Partnership require investment committee (“IC”) approval prior to acquisition.

An ESG report is provided to the IC for approval ahead of all investments. Once assets are acquired, they move into the asset management stage. At this point, assets will be managed to mitigate ESG-related risks and to meet (or continue to meet) the standards required in order to obtain (or retain) FSC® or PEFC® certification.

All forestry assets will be assessed at pre-investment stage and managed in line with the Charter unless any legal, regulatory, or natural obstacles outside the control of the Portfolio Manager prevent this.

The Charter sets out the Portfolio Manager’s commitments and targets in relation to sustainable forest management, based on international forestry standards, and the key performance indicators against which performance can be measured.

The Charter includes commitments and targets relating to the following categories. All commitments are at least aligned with forest certification standards:

- Forest Products & Services

- Climate Change

- Biodiversity & Woodland Ecology

- Forest Protection

- Income & Employment

- Communities & People

- Forest Certification and Standards

The Charter also reflects the Portfolio Manager’s commitment to apply the International Finance Corporation (IFC) exclusion policy as relevant to forestry assets(see ifc.org/exclusionlist) (the “Exclusion Policy“) to all forestry investments of the Partnership. This means that the Partnership will not be invested in:

- production or activities involving harmful or exploitative forms of forced labour/harmful child labour;

- commercial logging operations for use in primary tropical moist forest;

- production or trade in wood or other forestry products other than from sustainably managed forests; or

- production or activities that impinge on the lands owned, or claimed under adjudication, by Indigenous Peoples (as defined by the IFC for the purposes of its exclusion policy), without full documented consent of such people.

These exclusions are explicitly built into the Portfolio Manager’s proprietary ESG Decision Tool and require the Portfolio Manager to ensure that no new acquisition is in breach of the exclusions at due diligence stage.

All investments are screened using the Portfolio Manager’s Forestry ESG Decision Tool to ensure that ESG risks and opportunities are considered and the Exclusion Policy is applied, as part of sourcing, due diligence, acquisition, and ongoing management of assets. The ESG Decision Tool and KPIs set out in the Charter, as developed by the Portfolio Manager, will assist it to identify potential sustainability risks and opportunities pertaining to investments in a consistent manner, in line with the Portfolio Manager’s sustainability-related commitments. Further details relating to the ESG Decision Tool can be found in the section of the Information Memorandum entitled The Portfolio Manager’s ESG Decision Tool.

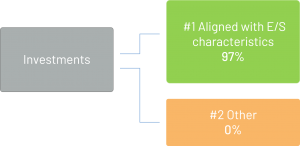

Proportion of investments

At least 97% of the Partnership’s NAV (including, for the avoidance of doubt, such development capital allocated to land and forestry investment as may temporarily be held from time to time) is aligned with the environmental and/or social characteristics of the Partnership. The Partnership does not commit to making sustainable investments within the meaning of SFDR.

Investments in the “#2 Other” category include investments and other instruments of the Partnership that cannot be aligned with the environmental and/or social characteristics of the Partnership. These can include, for example, portfolio management tools such as derivatives and cash (other than development capital allocated to land and forestry investment, as referred to above).

The Partnership does not make a minimum commitment to making investments that fall within the “#2 Other” category and therefore 0% is included for that category in the graphic below. This means that between 0% and 3% of the Partnership’s NAV might at any point in time qualify as “#2 Other” investments.

#1 Aligned with E/S characteristics includes the investments of the financial product used to attain the environmental or social characteristics promoted by the financial product.

#2 Other includes the remaining investments of the financial product which are neither aligned with the environmental or social characteristics, nor are qualified as sustainable investments.

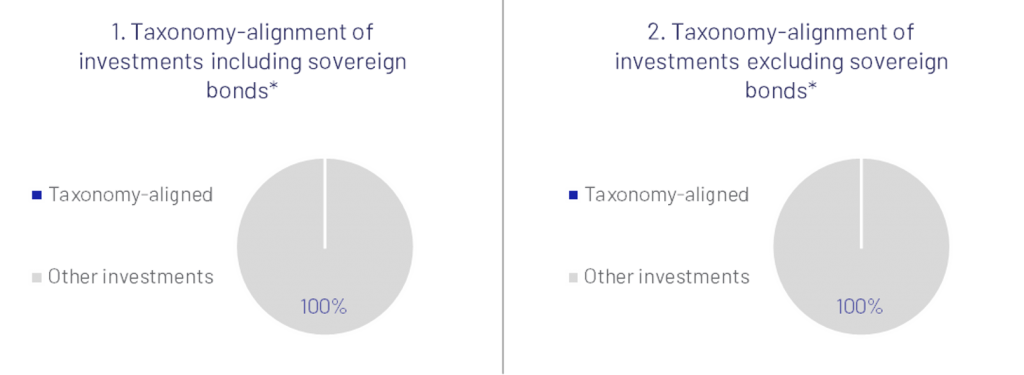

The two graphs below show the minimum percentage of investments that are aligned with the EU Taxonomy. As there is no appropriate methodology to determine the Taxonomy-alignment of sovereign bonds*, the first graph shows the Taxonomy alignment in relation to all the investments of the financial product including sovereign bonds, while the second graph shows the Taxonomy alignment only in relation to the investments of the financial product other than sovereign bonds.

*For the purpose of these graphs, ‘sovereign bonds’ consist of all sovereign exposures.

Monitoring of environmental or social characteristics

The sustainability indicators used to measure the attainment of the environmental or social characteristics promoted by the Partnership are:

- continued FSC® or PEFC® certification of planting land and/or existing forests which are already so-certified at the time of their acquisition by the Partnership; and

- attainment of FSC® or PEFC® certification of such planting land and/or existing forests as are not at the time of being acquired by the Partnership so-certified, within a reasonable timeframe of being purchased by the Partnership.

The certification status of said land and forests will be assessed by third party auditors on a regular basis as well as by the Portfolio Manager on an ad hoc basis.

Methodologies for environmental or social characteristics

Both the FSC® and PEFC® have well-established and internationally recognised pre-defined criteria which must be met in order to obtain FSC® or PEFC® certification. The relevant criteria and methodology can be found on the following websites:

- FSC® – fsc.org/en/fsc-standards

- PEFC® – pefc.ie

Data sources and processing

Data is collated by the Portfolio Manager from a variety of sources including woodland managers, third-party consultants, public databases in order to assess whether land and forests are being managed in line with FSC®/ PEFC® requirements. Data will be checked by various members of the Portfolio Manager’s Investment and Asset Management team.

A survey is sent to woodland managers annually for receipt of forest-related data including sustainability-related data. The data is dependent on the disclosure of accurate and relevant data and information by the woodland managers. The Portfolio Manager will work closely with woodland managers to monitor data received and to support in collation and measurement of required data.

Given the scale of forests under management as well as challenges in measuring certain data relevant to the attainment of FSC® or PEFC® certification (for example in relation to biodiversity and carbon sequestration), assumptions are made to ensure that data collation and measurement is done in a way that is appropriate to the Partnership’s mandate and objectives.

All data is calculated using science-based and reputed approaches however these often apply estimates (the proportion of which estimates will vary) and assumptions to account for the scale of the forests in which the Partnership is invested.

Limitations to methodologies and data

This section will be updated to include relevant limitations if and when these become apparent (on the basis of the understanding that this disclosure is required to include such limitations as relate to the scope of methodologies and data coverage, rather than limitations pertaining to the accuracy of data (which is addressed in the section immediately above).

Due diligence

All forests are inspected by the Portfolio Manager on a regular basis to ensure the requisite quality of woodland management. These internal audits will assess for adherence to the criteria relevant to achievement of the Partnership’s environmental and social characteristic, and associated forest management plans.

Forests will be independently audited by the relevant certification bodies (FSC® and/or PEFC®) to assess for compliance with their certification standards on a regular basis.

The Portfolio Manager also has a dedicated Sustainable Investment Team. This team will, inter alia, carry out annual auditing of the Portfolio Manager’s ESG-related due diligence processes to ensure they remain appropriate to attaining the environmental and social characteristic promoted by the Partnership.

The Portfolio Manager makes use of its proprietary ESG Tool to assist in evaluating the ESG impact of proposed investments as part of its due diligence process and to support the determination of the ESG KPIs as part of the initial investment process, which feeds into the ongoing monitoring of the Partnership’s incorporation of ESG considerations in its investment strategy. As part of this strategy, the Portfolio Manager conducts a detailed analysis of positive and negative factors affecting the investment, including any ESG event or condition that, if it occurs, could cause an actual or a potential material negative impact on the value of the investment (“ESG Risk”). The assessment of ESG Risks is conducted by the Portfolio Manager using data and information derived from a variety of sources and the Portfolio Manager’s own research, including the use of the ESG Tool.

Engagement policies

The Partnership (in line with the Charter) will engage with relevant stakeholders (including suppliers and local communities) as necessary, in order to ensure that FSC® or PEFC® certification of planting land and/or existing forests invested in by the Partnership is achieved and/or retained. The Portfolio Manager may also engage with relevant regulatory, industry or government entities with regard to certain aspects of sustainable forest management.

No consideration of adverse impacts of investment decisions on sustainability factors

The Manager has elected to exercise its discretion under Article 4(1)(b) of SFDR not to commit to considering the adverse impacts of investment decisions of the Company on sustainability factors in the manner specifically contemplated by Article 4(1)(a) of the SFDR but will continue to consider and manage these impacts in line with its Sustainable Investment Policy.

The manner in which sustainability risks are integrated into the investment decisions of Gresham House Asset Management Limited (the “Manager”) in relation to the Company

As detailed in the New Energy Sustainable Investment Policy, specific to the Manager’s investment division, the Manager integrates ESG (“sustainability”) risks and opportunities into the investment process.

The Manager integrates sustainability risks and opportunities through the completion of the ESG Decision Tool prior to investment. The Tool supports the identification of potential material ESG risks that need to be managed and mitigated during the investment period of the asset. The Tool also determines if there are any reasons why the asset may not be invested in at this stage for ESG reasons.

Post-investment, material sustainability risks identified through the ESG Decision Tool or as part of the division’s assessment of material sustainability risks to its assets, are monitored and managed on an ongoing basis. The Manager will also monitor ESG related data, where available, to support the ongoing management of sustainability risks for assets.

The likely impacts of sustainability risks on the returns of the Company

The Manager has determined that the sustainability risk (being the risk that the value of the Company could be materially negatively impacted by an environmental, social or governance event or condition) faced by the Company is low to medium.

The Manager has put in place processes and checks to minimise ESG-related risks associated with the manufacturing and sourcing of the components used in energy storage plants, as well as the construction and operation of these plants.

Sustainability-related disclosures

Publication date: 23 December 2022

Environmental and social characteristics

The Company is committed to investing in and increasing battery energy storage system (BESS) capacity to support the decarbonisation and electrification of energy systems. Battery energy storage systems (BESS) play an essential role in supporting the decarbonisation of energy systems and consequently the broader economy. The Company, in this way, aims to contribute positively to climate change mitigation and net zero strategies.

The Manager will assess adherence to the characteristic through measuring and monitoring:

- total operational battery energy storage capacity (megawatts (MW) and megawatt hours (MWh))

- total battery energy storage capacity under construction (megawatts (MW) and megawatt hours (MWh))

The Manager also intends to measure, monitor, and report on carbon emissions avoided (tCO2e) as a result of the operation of BESS and increase in BESS capacity. The Manager is in the process of finalising a robust methodology to estimate the carbon emissions avoided through the increased adoption of BESS in energy systems.

Summary

The Company is committed to investing in and increasing battery energy storage system (BESS) capacity to support the decarbonisation and electrification of energy systems. Battery energy storage systems (BESS) play an essential role in supporting the decarbonisation of energy systems and consequently the broader economy. The Company, in this way, aims to contribute positively to climate change mitigation and net zero policies.

The Company promotes environmental or social characteristics but does not have sustainable investment as its objective.

As detailed in the Gresham House New Energy Sustainable Investment Policy, the Manager integrates sustainability risks and opportunities into the pre-investment process for all assets through the completion of the ESG Decision Tool prior to investment. Post-investment, material sustainability risks identified through the ESG Decision Tool or as part of the division’s assessment of material sustainability risks are monitored and managed on an ongoing basis.

In line with the Company’s focus on supporting decarbonisation of the economy, the Manager will consider any climate-related risks and opportunities within the acquisition and construction phase and aim to mitigate or minimise risks.

At least 96% of the Company’s investments are aligned with the environmental and/or social characteristics of the Company. The Company does not commit to making sustainable investments as defined under the SFDR.

The Manager will measure and monitor the MWs and MWhs of operational BESS capacity and BESS capacity under construction on a regular basis. This is a central objective and outcome of the Company and remains core focus for the Manager.

MW and MWh operational and in-construction capacities are taken from the as built site diagrams and connection agreements, with in-construction assets driven from the site specifications as approved within the EPC agreement.

The parent entity of the Manager has a dedicated Sustainable Investment Team. This team provides support in relation to the evolution of processes around sustainable investing applied by the Manager. The Sustainable Investment Team carries out annual auditing of ESG processes to ensure they meet the sustainability-related commitments of the Manager. This includes an assessment of ESG metrics, ESG Decision Tools and investment processes.

As detailed in the Gresham House New Energy Sustainable Investment Policy, the Manager commits to engaging with relevant stakeholders as part of its ongoing investment and management of BESS assets. Engagement is focused to maximise the efficient operation of BESS that help balance the UK electricity grid, allowing it to make optimal use of intermittent renewable energy generation in the UK electricity generation system.

The fund does not designate a reference benchmark.

No sustainable investment objective

The Company promotes environmental or social characteristics but does not have sustainable investment as its objective.

Environmental or social characteristics promoted by the Company

The Company is committed to investing in and increasing battery energy storage system (BESS) capacity to support the decarbonisation and electrification of energy systems.

Battery energy storage systems (BESS) play an essential role in supporting the decarbonisation of energy systems and consequently the broader economy.

The Company, in this way, aims to contribute positively to climate change mitigation and net zero policies.

Investment strategy

The Company seeks to provide investors with an attractive and sustainable dividend over the long term by investing in a diversified portfolio of utility scale energy storage systems, which utilise batteries, located in Great Britain, and the Overseas Jurisdictions.

The Company aims to do this through the construction, development, acquisition, management, and operation of battery energy storage system (BESS). BESS assets are managed to provide several integral functions to energy systems that will enable the decarbonisation of the grid through increased renewable energy generation and generate varied revenue streams.

Functions include “Trading”, providing “Balancing Mechanisms” to the grid, and “Ancillary Services” (such as ” Frequency Response”, which maintains electrical stability by responding to deviation in frequency flowing through a network).

As detailed in the Gresham House New Energy Sustainable Investment Policy, the Manager integrates sustainability risks and opportunities into the pre-investment process for all assets through the completion of the ESG Decision Tool prior to investment. Post-investment, material sustainability risks identified through the ESG Decision Tool or as part of the division’s assessment of material sustainability risks are monitored and managed on an ongoing basis. In line with the Company’s focus on supporting decarbonisation of the economy, the Manager will consider any climate-related risks and opportunities within the acquisition and construction phase and aim to mitigate or minimise risks.

The Company invests in individual battery energy storage projects. All projects are companies that sit within special purpose vehicles invested in by the Company. Projects may either be operational or under construction at time of acquisition. Due diligence is carried out prior to acquisition for all projects. As noted above, this includes completion of the ESG Decision Tool to assess potential sustainability risks and opportunities. In addition, all projects will be assessed to ensure the project compliance to all relevant legal and regulatory requirements. The projects do not have management structures, employees, or tax policies in the way “investee companies”, as understood by the SFDR, might have.

Proportion of investments

At least 96% of the Company’s investments are aligned with the environmental and/or social characteristics of the Company. The Company does not commit to making sustainable investments as defined under the SFDR.

“Other” category investments include a legacy asset that uses mostly gas engine technology to provide power to the grid although does have a small amount of BESS (used as primary energy source before gas takes over) and a small amount Diesel generator capacity (primarily used as back up for Capacity Market Obligations). Under the investment policy, only energy storage systems (primarily BESS assets) will be invested in and as such the Company will not invest in equivalent assets going forward.

Monitoring of environmental or social characteristics

The Manager will measure and monitor the MWs and MWhs of operational BESS capacity and BESS capacity under construction on a regular basis. This is a central objective and outcome of the Company and remains core focus for the Manager.

The Manager is working to develop a credible carbon avoided methodology and will monitor this as a key metric to measure the attainment of the environmental characteristic to support climate change mitigation through the Company’s contribution to the decarbonisation of the energy system over time. The Manager is seeking input from a third-party carbon consultant to support the development of this methodology and the parent entity’s Sustainable Investment Team will also provide oversight.

Methodologies

MW and MWh operational and in-construction capacities are taken from the as built site diagrams and connection agreements, with in-construction assets driven from the site specifications as approved within the EPC agreement.

The methodology for carbon emissions avoided is currently under development and will be made available once ready.

Data sources and processing

MW and MWh operational and in-construction capacities are taken from the as built site diagrams and connection agreements, with in-construction assets driven from the site specifications as approved within the EPC agreement.

This disclosure will be updated when the Company adopts new metrics to assess carbon emissions avoided.

Limitations to methodologies and data

This disclosure will be updated when the Company adopts new metrics to assess carbon emissions avoided.

Due diligence

The Manager integrates sustainability risks and opportunities through the completion of the ESG Decision Tool prior to investment. The Tool supports the identification of potential, material ESG risks that need to be managed and mitigated during the investment period of the asset. The Tool also determines if there are any reasons why the asset may not be invested in at this stage for ESG reasons.

Post-investment, material sustainability risks identified through the ESG Decision Tool or as part of the division’s assessment of material sustainability risks to its wind, solar and battery energy storage system (BESS) assets, are monitored and managed on an ongoing basis. The Manager will also monitor ESG related data, where available, to support the ongoing management of sustainability risks for assets.

The parent entity of the Manager has a dedicated Sustainable Investment Team. This team provides support in relation to the evolution of processes around sustainable investing applied by the Manager. The Sustainable Investment Team carries out annual auditing of ESG processes to ensure they meet the sustainability-related commitments of the Manager. This includes an assessment of ESG metrics, ESG Decision Tools and investment processes.

Engagement policies

As detailed in the Gresham House New Energy Sustainable Investment Policy, the Manager commits to engaging with relevant stakeholders as part of its ongoing investment and management of BESS assets. Relevant stakeholders include developers, landowners, planning authorities, contractors and equipment suppliers during the development and contracting/procurement/construction process, as well as investors.

During the operational phase of the project, the Manager will engage with several stakeholders including local communities, insurers, operations & maintenance contractors, asset optimisers, the Environment Agency, and local fire services. Engagement is focused to maximise the efficient operation of BESS that help balance the UK electricity grid, allowing it to make optimal use of intermittent renewable energy generation in the UK electricity generation system.

Designated reference benchmark

The fund does not designate a reference benchmark.

Gresham House Asset Management Ireland Limited

Entity-level SFDR Disclosures

Under the EU Sustainable Finance Disclosure Regulation (SFDR), Financial Market Participants (FMPs) are required to make sustainability-related disclosures on their websites. This section provides disclosures required under the SFDR.

Publication date: 23 December 2022

No consideration of adverse impacts of investment decisions on sustainability factors

Adverse impacts of investment decisions on sustainability factors are not considered by Gresham House, Ireland (the Manager) and the Manager does not intend to consider adverse impacts for its investment strategies as it is not required to do so under the SFDR Article 4.

At a product level, it is our belief that the consideration of sustainability risks through ESG integration, as defined in the relevant Sustainable Investment Policy, is sufficient to demonstrate a consideration of sustainability risks and impacts for funds which do not have sustainable investment as their objective.

Sustainability risk policies

At Gresham House, we have developed a clear sustainable investment policy and are working hard to embed our approach consistently and effectively in line with our commitments, aiming to always be best in class.

Group Sustainable Investment Policy

The Gresham House Group Sustainable Investment Policy is applicable to Gresham House Asset Management Ireland Limited (Gresham House Ireland).

Across all our asset classes, we believe that understanding and, wherever possible, improving on environmental, social, economic and governance (ESG) performance drives long-term value, and we aim to work proactively with management teams and key stakeholders to make a positive change over time.

Our asset class policies

The Gresham House, Ireland Sustainable Investment Policy describes the sustainable investment commitments of the Manager1 for all unit trusts2.

1. The Manager refers to Gresham House Asset Management Ireland Limited (Gresham House Ireland), the Alternatives Investment Fund Manager (AIFM)

2. A Unit Trust is an arrangement made for the purpose of providing facilities for the participation by the public, as beneficiaries under a trust, in profits or income arising from the acquisition, holding, management or disposal of securities or any other property.

The Gresham House Commercial Real Estate Sustainable Investment Policy describes the sustainable investment commitments of the Manager1 for the Gresham House Commercial Property Fund.

1. The Manager refers to Gresham House Asset Management Ireland Limited (Gresham House, Ireland), the Alternatives Investment Fund Manager (AIFM)

Gresham House, Ireland Sustainable Investment Policy

Gresham House, Ireland Commercial Real Estate Sustainable Investment Policy

Sustainability risk integration

The Manager integrates sustainability risks as part of its investment decision-making process for all funds.3 The Manager believes that incorporating sustainability factors into investment decision making protects value and drives resilience of investments and can create compelling investment opportunities.

3. A sustainability risk integration model is currently being developed in respect of the Gresham House Commercial property fund.

A sustainability risk is an ESG event or condition that, if it occurs, could cause an actual or a potential material negative impact on the value of an investment. The likely impacts of sustainability risks on the returns of the fund will depend on the fund’s exposure to investments that are vulnerable to sustainability risks and the materiality of the sustainability risks.

The integration of sustainability risk throughout the investment lifecycle is key to the overall success of the funds under management. Sustainability risk assessment is part of the pre-investment due diligence process carried out by Investment Teams. Investment Teams are required to analyse how certain ESG factors may impact the investment case and the fund Net Asset Value. This is done through the application of the ESG Decision Tool (‘the Tool’).

The Tool is a key component of Gresham House’s approach to ESG integration and is applied by all investment divisions. The Tool aims to support the identification of a broad range of ESG risks which may materially impact on a proposed transaction. It does so by prompting a consideration of various aspects underlying ten core ESG themes laid out in the Sustainable Investment Framework. These themes include but are not limited to Governance & Ethics, Marketplace Responsibility, Climate Change and Pollution, Supply Chain Management and Employment, Health, Safety & Wellbeing.

The Tool will not tell the investment teams whether to invest or not, instead it aims to provide a rational and replicable assessment of key ESG risks which should be considered prior to investment, and to help rank the significance of each risk. The Tool also provides a way of summarising material ESG issues, which can then be tracked and monitored over time, and include actions that can be taken to mitigate those risks throughout the holding period.

The findings from the tool can be used to identify topics to engage investments , with the aim of increasing shareholder value over time and reducing downside risk. The findings may also drive voting decisions as a means of managing risk identified, if relevant to the investment strategy.

Remuneration policies

Sustainable investment-related objectives form part of employee variable remuneration review as detailed in Gresham House Asset Management Ireland Limited’s (Gresham House, Ireland) Remuneration Policy.

This extract is a carve out of the Gresham House, Ireland’s Remuneration Policy for the purpose of investor awareness and SFDR compliance.

Gresham House, Ireland is authorised by the Central Bank of Ireland as an Alternative Investment Fund Manager pursuant to the European Union (Alternative Investment Fund Managers) Regulations, 2013.

Variable remuneration

Performance management is measured by senior management on both a quantitative and qualitative basis with performance evaluations taking place on a mid-year and an annual basis. Employees may be eligible for a discretionary annual bonus payment. The level of bonus will depend on the performance of the individual, the Investment Team as a whole and the overall firm performance and takes into account financial as well as non-financial criteria. Gresham House, Ireland gives appropriate consideration to financial and non-financial criteria, including performance against sustainable investment-related objectives.

The annual bonus payment is at the total discretion of the firm. To reinforce the emphasis on sustainability, the firm not only considers what was achieved, but how the results were achieved when deciding on variable remuneration.

The Gresham House, Ireland remuneration principles are designed to attract a diverse and talented workforce, align reward with consideration of risk factors and support appropriate and controlled risk taking in line with fund objectives and strategies.

Product-level Sustainability-related disclosures

Publication date: 23 December 2022

Under the SFDR, Financial Market Participants (FMPs) are required to make certain sustainability-related disclosures on their websites with respect to investment products. Below are links to the website disclosures of all in-scope products under the management of Gresham House, Ireland. Note that the website disclosures of one in-scope product will differ from those of another in-scope product.

Adverse sustainability impacts

Pursuant to Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector (“SFDR”), the Fund is not classified as an Article 8 or Article 9 fund, however, disclosure in accordance with the requirements of Article 6 of SFDR in relation to the integration of sustainability risks, which is applicable to the Fund, is set out in the Prospectus.

The Fund does not consider adverse impacts of investment decisions on sustainability factors, as defined under SFDR, as it is not required to do so under Article 4(3).

EU Taxonomy

The investments underlying this financial product do not take into account the EU criteria for environmentally sustainable economic activities.

Adverse sustainability impacts

Pursuant to Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector (“SFDR”), the Fund is not classified as an Article 8 or Article 9 fund, however, disclosure in accordance with the requirements of Article 6 of SFDR in relation to the integration of sustainability risks, which is applicable to the Fund, is set out in the Prospectus. The Fund does not consider adverse impacts of investment decisions on sustainability factors, as defined under SFDR, as it is not required to do so under Article 4(3).

EU Taxonomy

The investments underlying this financial product do not take into account the EU criteria for environmentally sustainable economic activities.

Adverse sustainability impacts

Pursuant to Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector (“SFDR”), the Fund is not classified as an Article 8 or Article 9 fund, however, disclosure in accordance with the requirements of Article 6 of SFDR in relation to the integration of sustainability risks, which is applicable to the Fund, is set out in the Prospectus. The Fund does not consider adverse impacts of investment decisions on sustainability factors, as defined under SFDR, as it is not required to do so under Article 4(3).

EU Taxonomy

The investments underlying this financial product do not take into account the EU criteria for environmentally sustainable economic activities.

Adverse sustainability impacts

Pursuant to Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector (“SFDR”), the Fund is not classified as an Article 8 or Article 9 fund, however, disclosure in accordance with the requirements of Article 6 of SFDR in relation to the integration of sustainability risks, which is applicable to the Fund, is set out in the Prospectus. The Fund does not consider adverse impacts of investment decisions on sustainability factors, as defined under SFDR, as it is not required to do so under Article 4(3).

EU Taxonomy

The investments underlying this financial product do not take into account the EU criteria for environmentally sustainable economic activities.

Sustainability-related disclosures

Summary

The Gresham House Thematic Multi Asset Fund is managed through a top-down asset allocation framework which involves the formation of a house view on financial markets that drives the asset allocation. Individual asset allocation decisions are based on bottom-up fundamental analysis and application of a sustainable investment process.

The fund promotes environmental and social characteristics by investing at least 70% of its value in “sustainable assets”, as well as not investing in companies which do not adhere to global norms on environmental protection, human rights, labour standards and anti-corruption, and excluding companies which have significant involvement in certain industries. “Sustainable assets” are defined as those which meet the fund’s sustainable thematic alignment and exclusion criteria. Thematic alignment will be determined by the percentage revenue, or equivalent metric relevant to the business model, which demonstrates contribution to a sustainable theme. Investments must demonstrate that more than 20% of revenue, or equivalent metric, contributes to a sustainable theme to be included in the fund. The fund will report on the percentage of holdings aligned to each theme on a periodic basis.

In order to ensure the securities in the fund adhere to global norms and do not invest in excluded industries, an external ESG data provider is employed to monitor the portfolio. The internal investment team is responsible for compiling a sustainable investment thesis for each asset. The thesis includes a summary of findings from the ESG Decision Tool, employed to assess material ESG risks and opportunities, and an assessment of the thematic alignment of the underlying security.

No sustainable investment objective

This financial product promotes environmental or social characteristics but does not have as its objective a sustainable investment.

Environmental or social characteristics

The fund promotes environmental and social characteristics by investing at least 70% of its value in sustainable assets. “Sustainable assets” are defined as those which align to sustainable themes, including but not limited to Climate & Energy, Waste, Circular Economy and Food & Agriculture, and meet the fund’s exclusion criteria restricting investment in certain activities. The fund will also not invest in companies which do not adhere to global norms on environmental protection, human rights, labour standards and anticorruption.

Investment strategy

The Gresham House Thematic Multi Asset Fund seeks to achieve long-term capital appreciation with moderate risk exposure by investing on a diversified basis in transferable securities, such as equity securities and debt securities, and in collective investment schemes. The Fund may invest across asset classes, sectors, geographies, and market capitalisations without limitation save in respect of the restriction on investment that do not meet the fund’s thematic and exclusion criteria described below.

The Gresham House Thematic Multi Asset Fund is managed through a top-down asset allocation framework which involves the formation of a house view on financial markets that drives the asset allocation. Individual asset selection decisions are based on bottom-up fundamental analysis, including a consideration of valuation and business quality, as well as alignment to sustainable themes and adherence to exclusion criteria.

Exclusion criteria

All investments must pass a screening process carried out by a third-party data provider to ensure they meet the fund’s exclusionary criteria. Exclusionary criteria are twofold:

First, the fund precludes investment in companies which do not adhere to global norms on environment protection, human rights, labour standards and anti-corruption. Global norms include:

- OECD Guidelines for Multinational Enterprises

- ILO Tripartite Declaration of Principles concerning Multinational Enterprises and Social Policy

- UN Global Compact

- Guiding Principles on Business and Human Rights

The third-party data provider will produce a red flag for investments considered to violate these Norms. Investments receiving a red flag cannot be invested in or will be sold within three months if already invested.

Secondly, the fund excludes investments with significant involvement in certain industries and activities. The industries or activities and exclusion thresholds are listed below:

- Military Equipment Services and Production >10% revenue

- Gambling >10% revenue

- Pornography > 5% revenue

- Tobacco > 10% revenue

- Nuclear Power >10% revenue

- Abortifacients – any involvement in Production, Distribution, Services

- Abortion Services/Planned Parenthood – any involvement

- Contraceptives – any involvement in Production, Distribution, Services

- Stem Cell Research – any involvement

- Alcohol Production – > 10% Revenue

- Fossil Fuels Production and/or Exploration >10% Revenue

Any investment that is determined by the third-party data provider to breach the thresholds will be sold from the portfolio within three months.

Thematic alignment

For all new investments made by the fund (except for cash or cash equivalents, or sovereign bonds), a company note including an investment and sustainability thesis must be produced prior to investment. This includes an analysis of the thematic alignment of the security and includes detail such as the theme targeted and a description of how the asset aligns to the theme.

All investments made by the fund must also be assessed using the ESG Decision Tool (“the Tool”) prior to investment. This tool is used to assess material sustainability risks and opportunities to the investment case and to identify any areas to be monitored and addressed through engagement and/or voting, as and when relevant, through the holding period. A summary of material findings from the Tool will be included in the company note.

Good governance

Good governance is assessed through application of the Tool which prompts an assessment of sustainability risks and opportunities to the investment case under the headings noted below:

- Board structure, composition and protocols

- Board skills and engagement, including in ESG risk

- Delivering change and success

- Anti-competitive behaviour

- Anti-bribery & corruption

- Ethical risk profiling and management

It is also considered that the exclusion of investments in breach of global norms contributes to the avoidance of investments that do not demonstrate good governance.

Sovereign bonds

Investment in sovereign bonds does not apply the fund’s exclusion or thematic alignment criteria. Investments in sovereign bonds that are intended to be held for more than 12 months (i.e. those that are not considered cash or cash equivalents) will be required to have a prime ESG rating (B- or above), as defined by a third party ESG data provider.

Proportion of investments

The fund invests across a variety of asset classes including equities, cash, bonds, property and alternative assets such as infrastructure and forestry. The fund will invest at least 70% of fund value in assets that promote environmental and social characteristics as determined by their alignment to sustainable themes and compliance with the fund’s exclusion criteria.

Up to 30% of the fund asset value is classified as “other”. This mainly consists of investments in cash and/or bonds. This allocation is necessary from an asset allocation perspective

The fund does not intend to make any sustainable investments.

Monitoring or environmental or social characteristics.

1. Continuous monitoring is carried by an external ESG data provider to ensure investments are not in breach of global norms in relation to environmental protection, human rights, labour standards and anti-corruption and to ensure that investments continue to meet exclusionary criteria.

2. Meetings with representatives of investments will be carried out regularly by the Gresham House Ireland Investment Team in order to:

- Assess the underlying investment thesis including alignment to sustainable themes

- Monitor any ESG specific risks identified

- Assess additional ESG risks

- Encourage improvements in ESG shortcomings

3. The Fund is overseen by the Gresham House Ireland Investment Committee on a regular basis who provide oversight of the fund’s adherence to the investment process detailed above.

Methodologies

To ensure an alignment of investments to sustainable themes, a sustainable investment thesis is compiled by the Investment Team which includes an analysis of thematic alignment as well as an assessment of ESG risks. The assessment of thematic alignment is based on bottom-up fundamental research.

An external provider is employed to ensure the global norms, exclusionary criteria and country ESG ratings of the fund are met. Please see here links to the:

- Methodology applied to assess adherence to global norms

- Methodology applied to determine revenue associated with exclusion criteria

- Methodology applied to assess country ESG rating

Data sources and processing

An external provider, currently ISS (Institutional Shareholder Services), is employed to provide data relating to compliance with global norms, breach of exclusion criteria, principal adverse impact indicators and country ESG ratings.

Internal analysis of all investments is conducted by the Gresham House Ireland Investment Team to determine thematic alignment. This is based on publicly available information and includes a review of documents including annual reports and sustainable investment reports, or equivalent.

Limitations to methodologies and data

Data relating to exclusions and global norms violations is provided by third party providers. The Manager is dependent on the external provider to provide accurate data. This data is also dependent on companies disclosing relevant data and accurate data.

The subjective nature of ESG data and sustainability topics means that third parties may not agree with the Investment Team or external provider in relation to thematic alignment or global norms violations.

Not all investments of the fund are covered by the third-party data provider. In circumstances where the investment is not covered, the Investment Team will endeavour, to an extent which is fair and reasonable, to follow the investment process laid out above using publicly available information. The Investment Team may also aim to improve on gaps in data by engaging with investments to encourage improved disclosure of required information.

Due diligence

To assess ESG risks associated with an investment, an internal ESG tool is applied by the investment team. In order to ascertain the sustainability characteristics of the underlying assets, a sustainability investment thesis is compiled by the investment team.

The Gresham house Ireland Investment Committee provides oversight of the fund’s investment process. The Sustainable Investment Team also carries an annual audit to assess adherence of the Investment Team to sustainable investment related commitments including the completion of ESG Decision Tools.

Engagement policies

Engagement is part of the Manager’s sustainable investment approach, as detailed in the Engagement & Voting Policy. The Investment Team will engage with non-cash and non-government securities. The purpose of engagement can vary but includes to:

- Monitor any ESG risks identified, including controversies

- Encourage improvements in ESG shortcomings to enhance value of investments

- Assess alignment with fund themes and alignment thresholds

- Encourage greater disclosure of ESG-related information

In addition, the fund will vote all resolutions where possible. Voting for holdings in the fund are undertaken by ISS based on the ISS Sustainability Policy guidelines.

Designated reference benchmark

The fund does not designate a reference benchmark.

Adverse sustainability impacts

Pursuant to Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector (“SFDR”), the Fund is not classified as an Article 8 or Article 9 fund, however, disclosure in accordance with the requirements of Article 6 of SFDR in relation to the integration of sustainability risks, which is applicable to the Fund, is set out in the Prospectus. The Fund does not consider adverse impacts of investment decisions on sustainability factors, as defined under SFDR, as it is not required to do so under Article 4(3).

EU Taxonomy

The investments underlying this financial product do not take into account the EU criteria for environmentally sustainable economic activities.

Gresham House Investment Management (Guernsey) Limited

Entity-level SFDR Disclosures

Under the EU Sustainable Finance Disclosure Regulation (“SFDR”), Financial Market Participants (FMPs) are required to make sustainability-related disclosures on their websites. This section provides disclosures required under the SFDR.

Publication date: 1 July 2024

No consideration of adverse impacts of investment decisions on sustainability factors

Adverse impacts of investment decisions on sustainability factors are not considered by Gresham House Investment Management (Guernsey) Limited (the AIFM) and the AIFM does not intend to consider adverse impacts for its investment strategies as it is not required to do so under the SFDR Article 4.

The AIFM has elected to exercise its discretion under Article 4(1)(b) of SFDR not to commit to considering the adverse impacts of investment decisions of the financial products on sustainability factors in the manner specifically contemplated by Article 4(1)(a) of the SFDR but will continue to consider and manage these impacts in line with its Sustainable Investment Policy.

Sustainability risk policies

At Gresham House, we have developed a clear sustainable investment policy and are working hard to embed our approach consistently and effectively in line with our commitments, aiming to always be best in class.

Group Sustainable Investment Policy

The Gresham House Group Sustainable Investment Policy is applicable to Gresham House Investment Management (Guernsey) Limited.

Important notice

The website disclosures (the “Disclosures”) are being made pursuant to Articles 4(1) and 10(1) of Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector (as amended) (“SFDR”) in respect of Gresham House British Sustainable Infrastructure Fund III LP (the “Partnership”).

The Disclosures do not constitute (a) an offer of securities or interests, (b) an offer or invitation to the public, or (c) an invitation to apply for securities or interests. The Disclosures are being made to enable Gresham House Investment Management (Guernsey) Limited, in its capacity as Alternative Investment Fund Manager of the Partnership to comply with its obligations under applicable law.

Sustainability-related disclosures

Publication date: 1 July 2024

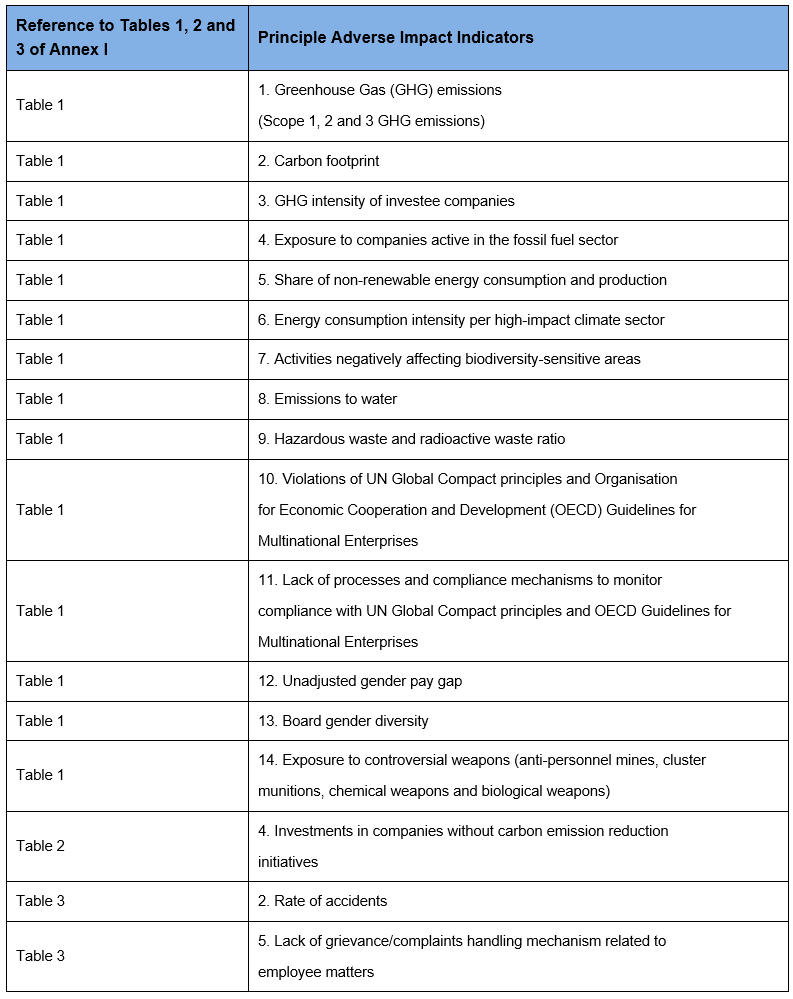

Consideration of principal adverse impacts of investment decisions on sustainability factors

Adverse impacts of investment decisions on sustainability factors are considered by Gresham House Asset Manager (the “Manager“) at product level.

In relation to Tables 1, 2 and 3 of Annex I of Commission Delegated Regulation (EU) 2022/1288 of 6 April 2022, the Partnership takes into account the following principal adverse indicators (PAIs) and will calculate, monitor and report against these on an annual basis. The Manager has not set any specific thresholds in relation to the PAIs but will use these indicators to contribute to investment decisions and with a view to consistent improvement.

Summary

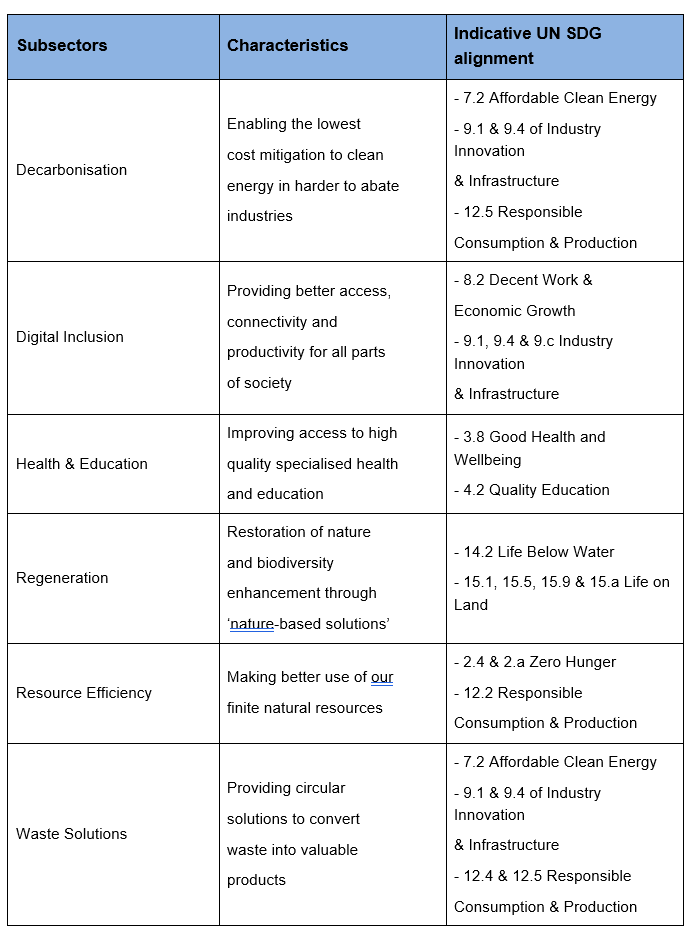

The Partnership’s primary goal is to generate strong financial returns from investments in Sustainable Infrastructure aiming to provide profitable, real asset-based solutions intended to directly address key environmental and/or societal challenges.

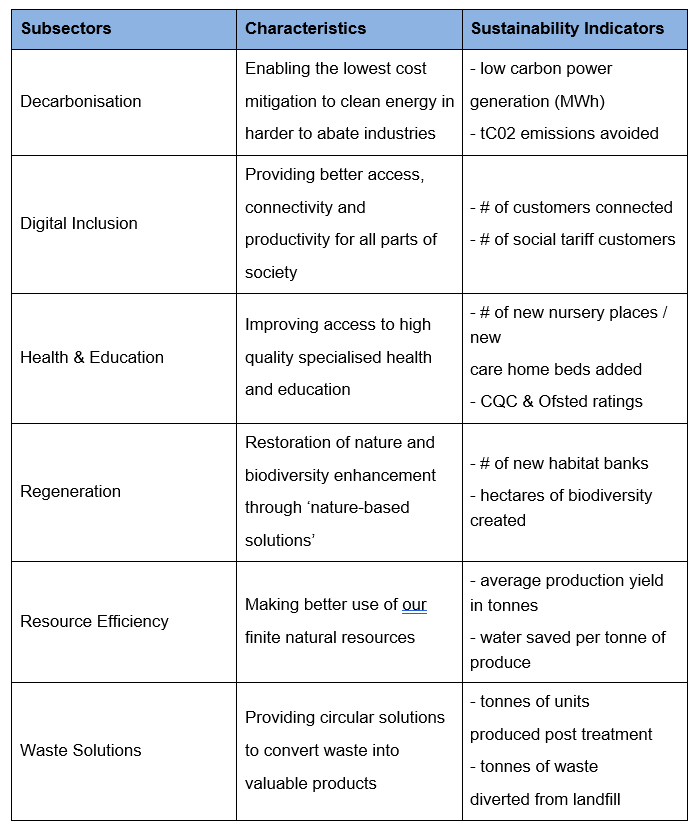

The Partnership will target investments across six sub-sectors targeting real asset-based solutions intended to directly address key environmental and/or societal challenges. Partnership’s overall investment approach aims to achieve a portfolio of investments that are aligned to the United Nations’ Sustainable Development Goals (“UN SDGs”). The following table indicates the characteristics that BSIF III will be seeking to promote across each of the subsectors and their alignment with UN SDGs.

This financial product promotes environmental or social characteristics and, while it does not have as its objective a sustainable investment, it will have a minimum proportion of 75% of sustainable investments as defined in Article 2(17) of SFDR.

The sustainability indicators used to measure the attainment of the environmental or social characteristics promoted by the Partnership are set out in the table below:

In summary, the Fund actively monitors these indicators, beginning with due diligence and continuing through portfolio monitoring, portfolio engagement, and thorough reporting on ESG metrics on a periodic basis.

No sustainable investment objective

This financial product promotes environmental or social characteristics and, while it but does not have as its objective a sustainable investment, it will have a minimum proportion of 75% of sustainable investments as defined in Article 2(17) of SFDR.

Environmental or social characteristics of the financial product

At every stage of the investment process, consideration is given to the social and environmental impacts of the investment and underlying asset.

The Partnership will target investments across six subsectors targeting real asset-based solutions intended to directly address key environmental and/or societal challenges. The Partnership’s overall investment approach aims to achieve a portfolio of investments that are aligned to the UN SDGs (as outlined in the Summary section above).

Investment strategy

The Partnership is the third flagship fund of the successful British Sustainable Infrastructure strategy (the “BSIF Strategy”), with the primary goal of generating strong financial returns from investments in Sustainable Infrastructure; profitable, real asset-based solutions intended to directly address key environmental and/or societal challenges. The BSIF Strategy has a thematic approach to investing, allocating to the following six sub-sectors in a diversified yet holistic way to take advantage of the most attractive opportunities from a return and impact perspective.

-

-

- Decarbonisation

- Digital Inclusion

- Health & Education

- Regeneration

- Resource Efficiency

- Waste Solutions

-

The Partnership will only make investments that are aligned with the Partnership’s strategy and investment objective. As outlined in prior sections, the Partnership’s Investment Process has been built to ensure a robust and thorough diligence of each opportunity is carried out prior to making an investment to ensure the investment aligns to the Partnership’s strategy and investment objective.

The Partnership’s investment objective is to seek to achieve long-term yield with capital growth by making investments to build and operate Sustainable Infrastructure that seek to achieve financial, environmental and societal returns by linking the positive impact of investments to the UN SDGs. The Partnership targets a minimum proportion of 75% of sustainable investments, as defined in Article 2(17) of SFDR, which promote environmental and societal characteristics within the scope of Article 8.

The Partnership’s investment policy will operate to target investments that:

-

-

- fall within one of the six subsectors listed in the table above;

- promote the environmental and/or social characteristics outlined above;

- are aligned to at least one of the UN SDG subgoals relevant to the business activity and jurisdiction of the investment; and

- can be measured and monitored against sustainability indicators as outlined in the table above.

-

Proportion of investments

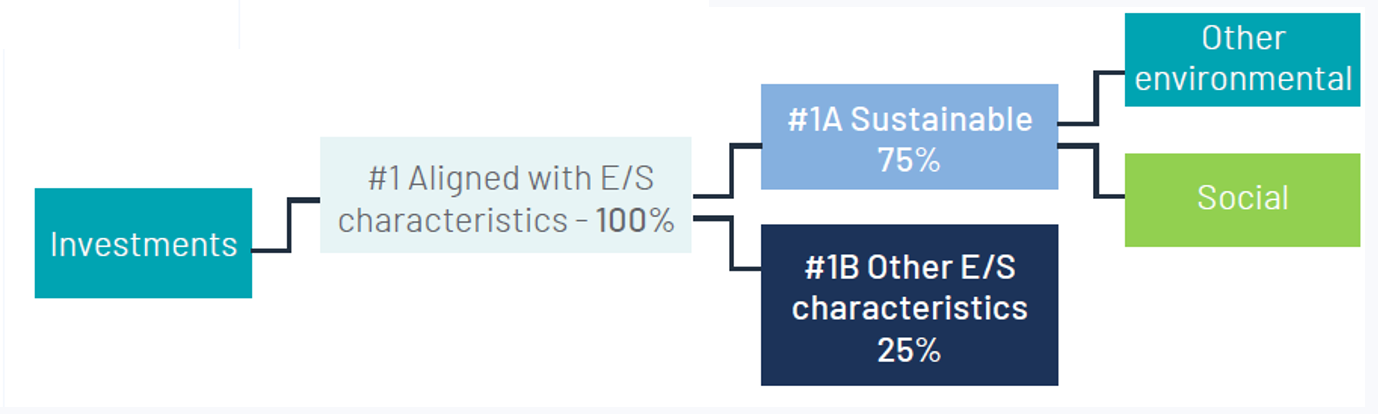

100% of the Partnership’s investments are aligned with the environmental and social characteristics promoted by the Partnership. The Partnership’s investment policy will operate to target investments that (i) fall within one of the six subsectors listed above, (ii) promote the environmental and/or social characteristics outlined above and (iii) are aligned to at least one of the UN SDG subgoals relevant to the business activity and jurisdiction of the investment. Where the Partnership has raised capital, upon receipt of such capital and prior to its deployment into investment projects in accordance with the Partnership’s investment strategy, such new capital will comprise cash and cash equivalents.

The category #1 Aligned with E/S characteristics covers:

– The sub-category #1A Sustainable covers sustainable investments with environmental or social objectives.

– The sub-category #1B Other E/S characteristics covers investments aligned with the environmental or social characteristics that do not qualify as sustainable investments.

The two graphs below show the minimum percentage of investments that are aligned with the EU Taxonomy. As there is no appropriate methodology to determine the Taxonomy-alignment of sovereign bonds*, the first graph shows the Taxonomy alignment in relation to all the investments of the financial product including sovereign bonds, while the second graph shows the Taxonomy alignment only in relation to the investments of the financial product other than sovereign bonds.

*For the purpose of these graphs, ‘sovereign bonds’ consist of all sovereign exposures.

Monitoring of environmental or social characteristics

The Manager makes use of its proprietary ESG Decision Tool to assist in evaluating the ESG impact of proposed investments as part of its due diligence process and to support the determination of the ESG KPIs as part of the initial investment process, which feeds into the ongoing monitoring of the Partnership’s promotion of ESG considerations in its investment strategy and the reporting on these to the investors. As part this strategy, the Manager conducts a detailed analysis of positive and negative factors affecting the investment, including any ESG event or condition that, if it occurs, could cause an actual or a potential material negative impact on the value of the investment (“ESG Risk“). The Manager considers the ESG Risks in its investment decision making process and risk monitoring process as well as during the lifecycle of the investment. ESG Risks may include, but are not limited to:

-

-

- Environmental – environmental risks and associated costs, policy or management related to factors such as sustainability of use of natural resources, waste management, water or air pollution, climate change, protected environments, protecting water supplies, greenhouse gas emissions;

- Social – social factors such as human rights, discriminatory policies, community consent or impacts on communities, worker health and safety, public health issues, relations with unions and employees, managing product safety issues, child and forced labour, protection of consumer rights, competitive wages and benefits, implementation of antibribery policies; and

- Governance – governance issues such as the composition and independence of the board of directors of a Portfolio Company, determination of executive compensation, shareholder rights, audit and accounting quality and controls, conflicts of interest

-

The potential impact of ESG Risks on the performance of the Partnership will depend on the exposure of the investment to, and the materiality of, such ESG Risks and the extent to which such risks have been mitigated by the Manager’s approach to integrating and monitoring of ESG Risks in its investment strategy. However, there is no guarantee that these measures will mitigate or prevent ESG risks arising in respect of the Partnership.

The potential impact on the value of Interests from an actual or potential material decline in the value of the investment due to an ESG Risk or condition will vary and depend on several factors including, but not limited to, the type, extent, complexity and duration of the event or condition, prevailing market conditions and the existence of any mitigating factors.

Methodologies for environmental or social characteristics

The assessment of the ESG Risks is conducted by the Manager using a number of different methodologies, with the relevant data deriving from a variety of sources and the Manager’s own research, including the use of the ESG Decision Tool. The ESG Decision Tool is a proprietary tool underpinned by Gresham House’s overall ESG framework, which identifies the ESG considerations of each investment. The use of varying methodologies and the subjective nature of non-financial criteria means a wide variety of outcomes are possible and the data may not adequately address material sustainability factors, nor identify the relevant ESG Risks. The analysis is also dependent on the disclosure of accurate relevant data and the availability of such data can be limited and so there can be no assurance that all material issues will be uncovered. Any failure by the Manager to identify relevant ESG Risks through the analysis process may lead to inappropriate investment decisions, which could have a material adverse effect on the value of Interests.

Data sources and processing

Data is collated by the Manager from a variety of sources including directly from portfolio companies. Data will be checked by various members of the Manager’s Sustainable Infrastructure Team (“Sustainable Infrastructure Team”).

Limitations to methodologies and data

This section will be updated to include relevant limitations if and when these become apparent (on the basis of the understanding that this disclosure is required to include such limitations as relate to the scope of methodologies and data coverage, rather than limitations pertaining to the accuracy of data (which is addressed in the section immediately above).

Due diligence

Prior to investing the governance of each investee company will be assessed as part of the due diligence process. Any changes required to meet good governance standards will be implemented prior to or shortly after investing. Following first investment, representatives of the Fund will sit on the board of each investee company to ensure good governance is being practised and will work with the investee company to update policies and procedures as required to promote good governance at every level within the investee company. Additionally, at the point of investment investee companies will be required to adopt certain governance policies, such as:

-

-

- the Investee Company Diversity, Equity and Inclusion Policy; and

- the Investee Company Sustainability Policy.

-

These policies require investee companies to commit to the active promotion of equal opportunity, diversity and inclusion, and that concern for the environment and broader sustainability agenda is integral to their activities, amongst other commitments. The Manager will consider the environmental and social characteristics of each investment, including considering its alignment with the UN SDGs, and assess the investment against the Gresham House developed Impact Framework. At this stage the investment will be screened against the mandatory and selected voluntary principle adverse impact indicators (“PAIs”) as listed above. The Impact Framework also informs the proprietary ESG Decision Tool which is used to screen for material risks that are considered prior to and throughout the life of the investment. At this stage, the team may also seek to commission third party environmental and/or social due diligence, as deemed relevant, based on the outputs of their internal due diligence including the outputs of the ESG Decision Tool ahead of deciding to invest.

Engagement policies and adherence to responsible business conduct codes and internationally recognised standards

The Partnership’s sustainable investments are aligned with the OECD Guidelines for Multinational Enterprises and the United Nations Guiding Principles on Business and Human Rights, including the principles and rights set forth in the 8 fundamental conventions identified in the International Labor Organization’s (ILO) Declaration on Fundamental Principles (covering subjects that were considered to be fundamental principles and rights at work, e.g. freedom of association and the effective recognition of the right to collective bargaining, the elimination of all forms of forced or compulsory labour, the effective abolition of child labour, and the elimination of discrimination in respect of employment and occupation) and Rights at Work and the International Bill of Human Rights. Alignment is ensured through the implementation and monitoring of formal commitments by portfolio companies.

In addition, portfolio companies are required to implement a business-wide Sustainability Policy and Diversity & Inclusion Policy as part of the BSIF Funds investment documentation.

Gresham House

Specialist asset management

Gresham House

Specialist asset management